Warren Buffet has a famous quote: “Be fearful when others are greedy. Be greedy when others are fearful.”

And what he’s saying is, I’m gonna take my $100 billion and dip buy when everyone’s scared. Then I’m gonna sell when everybody’s greedy.

But Warren doesn’t trade penny stocks … And you can’t do what Warren Buffet does — unless you have billions of dollars.

Think of trading penny stocks as the opposite of investing…

While investors are looking for fear, I prefer to look for greed.

There’s a specific way I spot it in the market and individual stocks.

This can help you gauge when it’s time to jump in a trade and when to get out before emotions shift…

Click here to find out how you can learn how to trade fear and greed from multiple millionaire traders!

How to Gauge Fear and Greed in the Market

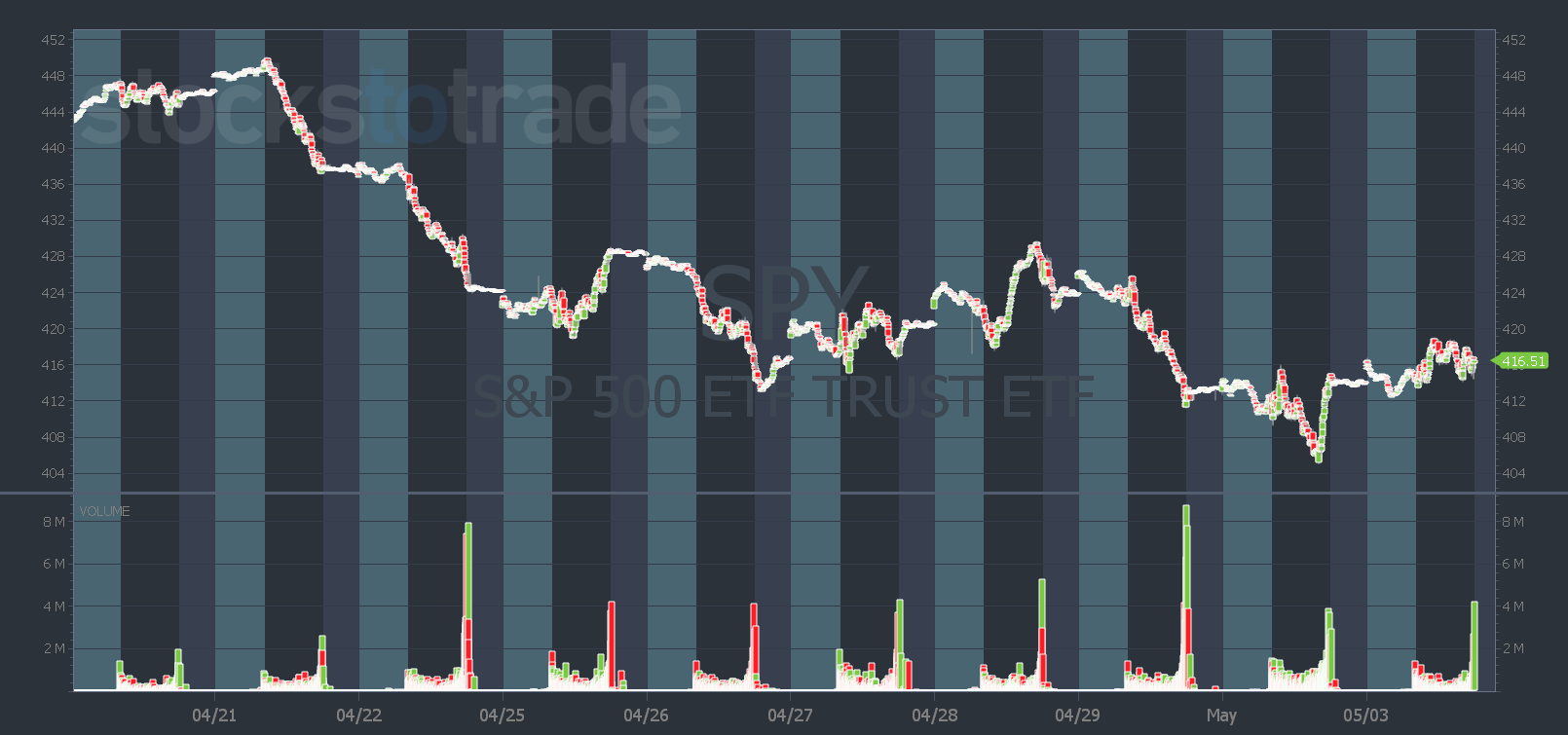

Yesterday a SteadyTrade Team member asked why I look at the SPDR S&P 500 ETF Trust (NYSE: SPY) chart.

Basically, it gives me an idea of where we are on the fear and greed index. I picture something like this…

I want to gauge whether everybody’s fearful or if everybody’s greedy…

When the SPY looks like it has the last couple of weeks, people are fearful. This is when I like to be a little more cautious, less aggressive, and focused on afternoon trades.

When the market’s ripping, that’s when people get greedy. They feel FOMO and worry they’ll miss the next big runner.

That causes stocks to go higher than anyone anticipates…

That’s why most of my trading patterns focus on buying strength.

Buy when others are greedy and ride the hype and momentum…

How to Take Advantage of Fear and Greed

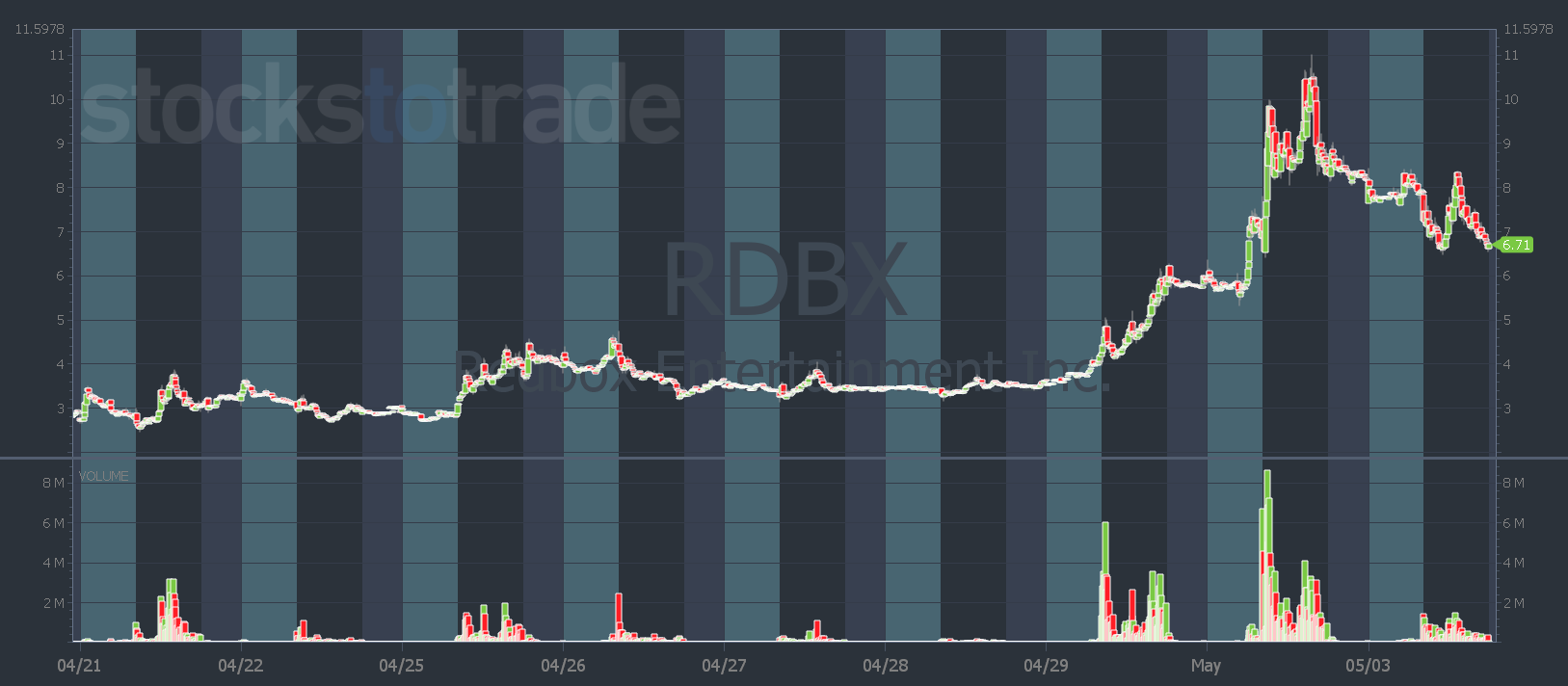

In the SteadyTrade Team, we don’t aim to buy stocks like Redbox Entertainment Inc. (NASDAQ: RDBX) at $2 on April 20 and sell on May 2 at $11.

Our philosophy is to take 50 cents a day along the way. (Remember that rhyme — it’s gold!)

If you follow our philosophy it means day trading RDBX multiple times … Aim to take 50 cents per share on April 21 … Another 50 cents on April 25 and 29 … And maybe $2 per share on May 2…

Recognize when traders are greedy and are willing to hammer in their market orders and chase the stock higher. That’s when you can get big moves like RDBX.

Yesterday, Blue Apron Holdings, Inc. (NYSE: APRN) was another example…

That morning run-up was due to longs being greedy. Anyone who missed the move on day one wanted in.

But it was also caused by fearful short sellers. Once it was over $4.30, all the shorts from day one were in the red. That’s what makes short squeezes so powerful — they’re a combination of intense emotions.

So even though I don’t care which direction the overall markets go, knowing which emotions are at play in the market can help you…

- Gauge overall market sentiment.

- Know when to trade and when not to.

- Adjust your expectations for any trade.

When greed is high and you’re experienced, you can be more aggressive. When fear is high, be conservative. Take smaller positions, be selective, and take profits quickly.

With experience, you’ll be able to recognize fear and greed on the chart and in the price action.

But while you grow your knowledge account and experience, why not learn from multiple millionaires — in person?!

That’s right … In-person learning is back!

Join millionaire traders Tim Sykes, Roland Wolf, and surprise guests in person at two upcoming events…

Have a great day everyone. See you all back here tomorrow!

Tim Bohen

Lead Trainer, StocksToTrade