If you’ve ever traded a stock, you’ve seen bid and ask prices. They’re the two stock quote numbers that usually show up in green and red.

But have you ever stopped to ask what they really are and where they come from?

Why are the two prices different?

Is there a way to pay a better price on a stock?

Today we’ll take a deeper look into bid and ask prices and answer some of these questions. Plus we’ll look at some examples and why this matters in your trading.

This may seem like a super basic concept … but read on to learn how this can affect your bottom line.

Let’s get to it!

Table of Contents

What Is the Bid and Ask Price?

The bid and ask price (aka bid and offer) is basically a two-way price quote. It indicates the best potential price for which a stock can be bought or sold at a given time. Stocks are unique in that their prices are determined by both buyers and sellers.

Ever notice how the bid and ask are never the same? Let’s break down each piece to find out why.

What Is a Bid Price?

The bid is the maximum price that a buyer is willing to pay for a particular stock. If you want to sell a stock, you’ll have to sell it at this price.

What Is an Ask Price?

The ask is the minimum price that a seller is willing to take in exchange for a stock. If you want to buy a stock, you’ll have to pay this price.

What Is the Bid-Ask Spread?

The bid-ask spread is the price difference between the bid and ask.

The spread varies depending on the stock and the market. But smaller spreads indicate that the stock is very liquid because buyers are willing to pay close to what sellers are offering.

Larger spreads indicate that the stock isn’t in high demand so there aren’t many buyers to push the price higher.

Examples of the Bid and Ask

Let’s take a look at a few examples of bid and ask prices from the StocksToTrade platform. This will also give you examples of different bid-ask spreads.

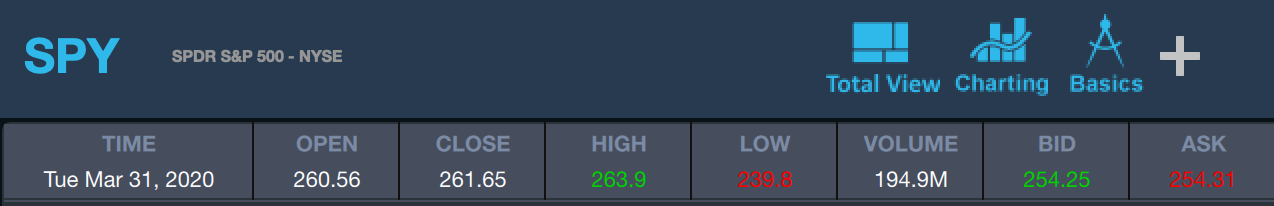

On March 31, 2020, the SPDR S&P 500 (NYSE: SPY) had a bid price of $254.25 and an ask price of $254.31…

At this particular time on that day, the most a buyer was willing to pay was the lower of the two. And the higher price was the lowest a seller was willing to accept. SPY is a very liquid stock — notice how close the two prices are.

SPDR S&P 500 (NYSE: SPY) March 31 bid and ask prices (Source: StocksToTrade)

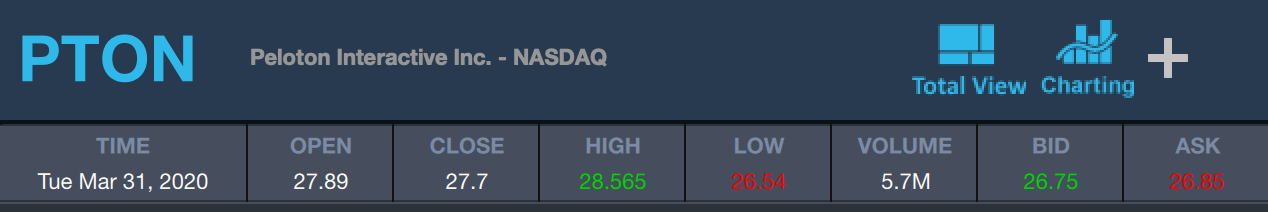

On that same day, Peloton Interactive Inc. (NASDAQ: PTON) had a bid price of $26.75 and an ask price of $26.85.

Peloton Interactive Inc. (NASDAQ: PTON) March 31 bid and ask (Source: StocksToTrade)

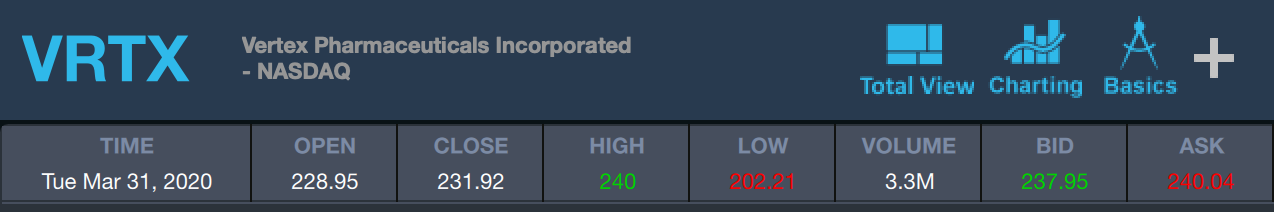

Vertex Pharmaceuticals Incorporated (NASDAQ: VRTX) had a bid price of $237.95 and an ask price of $240.04. See the difference in spread compared to the SPY? VRTX doesn’t have near the volume as the SPY. That indicates a lower demand for the stock. Fewer buyers are willing to pay the asking price, hence the wider bid-ask spread.

Vertex Pharmaceuticals Incorporated (NASDAQ: VRTX) March 31 bid and ask (Source: StocksToTrade)

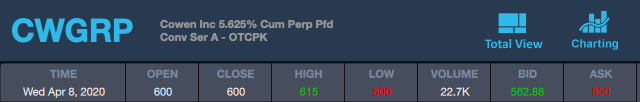

Cowen Inc (OTCPK: CWGRP) is a good example of a large bid-ask spread. The bid of $562.88 and ask of $850 is a difference of $287.12 and shows that the buyer and seller are in major disagreement about the value of the stock.

Also notice the light volume of 22.7K. The big spread leads to a lack of movement.

Cowen Inc. (OTCPK: CWGRP) April 8 bid and ask (Source: StocksToTrade)

Who Benefits From the Bid-Ask Spread?

The bid-ask spread generally benefits the market makers. These large firms quote the bid and ask prices and then keep the spread as a profit. It’s the money they receive for efficiently and quickly matching up buyers with sellers.

In the VRTX stock example above, the market maker quotes a price of $237.95 (Bid price) / $240.04 (Ask price). In this case, the market maker’s profit would be $2.09.

If a buyer isn’t willing to pay a price beyond a certain threshold and sellers aren’t willing to lower their offer, spreads can widen dramatically. So pay attention to the spread before you enter a trade. If you’re not careful, you may end up spending more than you realize.

Types of Orders

If you’re going to trade stocks, you have to place an order.

The challenge is that prices are moving constantly, especially if you’re day trading. It’s impossible for buyers or sellers to know what price they’ll get in a trade unless they’re using specific types of orders.

Let’s take a look at two of the most common types of orders that every trader will deal with.

Market Order

A market order, also called an unrestricted order, is an order that fills at a stock’s current price. It executes immediately which can be a great thing if you need to get in or out of a stock as fast as possible.

Limit Order

A limit order, also known as a take-profit order, is an order that only fills at a specific price or better, within a certain time frame.

How to Choose The Right Type of Order

Like I said earlier, a market order executes immediately.

The danger with a market order is that you won’t know what price you’ll actually get until your order is filled. If the bid-ask spread is large, you could end up paying much more than you bargained for.

Market orders should be used when certainty of execution is more important than the price of the execution.

Limit orders, on the other hand, won’t fill until you get a desirable price.

For example, a buy limit order will only be executed at the limit price or lower. Conversely, a sell limit order will only be executed at the limit price or higher.

Limit orders aren’t guaranteed to be executed, but they can give traders much more control to help protect themselves from losses due to slippage, especially if the bid-ask spread is wide.

Best Bid-Ask Spread Trading Strategy

Getting a better understanding of how the bid and ask works can make you a better trader because you can then leverage your knowledge to get a better price execution.

Buying at the ask price (or selling at the bid price) is known as “paying the spread.” Basically, you’re paying the market maker fee that we talked about earlier.

The market can move fast … So you may need to pay the spread if you need to get in and out of a position quickly. It isn’t, however, always the best option on every trade. Why? It could significantly affect your profits over time.

If the price is dropping — and it’s likely you’ll get filled on the bid side — then it would be better to buy at the lower quoted price instead of paying the ask price unnecessarily.

Conversely, if you want to sell a stock and the price is rising, it would be better for you to sell at the higher price instead of paying the spread.

See how this knowledge can save you money?

You can take things even further … You can combine your understanding of the bid and ask price with the knowledge of reading level 2 quotes to get even better entries. But we’ll save that for another post.

StocksToTrade

StocksToTrade is our research, scanning, and trading platform. It’s designed by traders for traders — with built-in tools for watchlists, charting, indicators, news feeds, and more.

You can check it out for yourself with a 14-day trial for just $7.

But here at StocksToTrade, we’re about so much more than our platform. We’re all about education. We love to see traders find their strides in the markets. And to help you do that we have plenty of free and no-cost resources. Here are just a few…

The Weekly Watchlist: Sign up to get the list of stocks I’m watching for the week ahead. It lands right in your inbox every Sunday and is a great way to start prepping for the week.

Weekly Stock Watchlist and Live Trading Recap on YouTube: Tune in every Monday for a live session with me. I’ll answer your trading question, show you my trading screens, discuss the overall markets, and much more. All you gotta do is subscribe to our YouTube channel to be notified when the session’s starting.

Weekly Stock Watchlist and Live Trading Recap on YouTube: Tune in every Monday for a live session with me. I’ll answer your trading question, show you my trading screens, discuss the overall markets, and much more. All you gotta do is subscribe to our YouTube channel to be notified when the session’s starting.

The StocksToTrade Blog: Yep, that’s where you are right now. We cover a ton of information from chart patterns, trading psychology, technical analysis, and so much more. Hit the home page and start researching!

StocksToTrade on YouTube: Every week I share a few new videos about all things trading. I feature seasoned traders, break down trading basics, share smart strategies, and beyond. Subscribe to get notifications and be sure to check out our archives to round out your trading knowledge.

The SteadyTrade Podcast: Not gonna lie — I love our podcast. Along with Kim Ann Curtin and Stephen Johnson, I get to interview amazing finance icons, authors, and traders. We get into all things trading … We even have the SteadyTrade book club.

StocksToTrade Pro

When the market’s crazy like it right now, you gotta keep your trading skills on point. At StocksToTrade Pro, that’s exactly what we do.

Our trading community is all about trading smarter every day in any kind of market. You get mentorship with me, plus access to our chat room with traders who are committed to trading smarter every single day.

You also have access to twice-daily webinars, cutting-edge training, and tons of educational resources. Ready to meet a team of awesome traders? Join us a StocksToTrade Pro today!

Conclusion

Conclusion

There you have it! Now you know the basics of the bid and ask price.

If you want to be successful at trading, you’ll have to protect your accounts. One way to do that is to limit the fees that you pay so that you can keep more of your hard-earned capital.

By understanding how the bid and ask work, you can strive for better entries and exits for your trades.

And if you’re ready to boost your trading education, come check out the StocksToTrade Pro program. It’s your opportunity to join a network and community of like-minded traders, get mentorship, webinars twice a day, and so much more.

Wanna see how StocksToTrade’s scanners work? Take them for a spin. You can get a 14-day trial for only $7. Come see why some of the best traders start each day with StocksToTrade!

Have you been “paying the spread” unnecessarily in your trading? Leave a comment…