90% of traders lose.

That statistic gets thrown around a lot — probably because it’s true…

If trading was easy, everyone would do it.

The truth is — trading’s hard.

And most traders fall victim to crucial mistakes.

But once you know what the 90% of traders who lose are doing wrong — you can avoid it.

So today I’m sharing what I think is the biggest mistake losing traders make. Plus, I’ll give you my rules and tips to help you avoid the same fate in the future…

Learn all my lessons in real time — join the SteadyTrade Team today!

Why 90% of Traders Lose

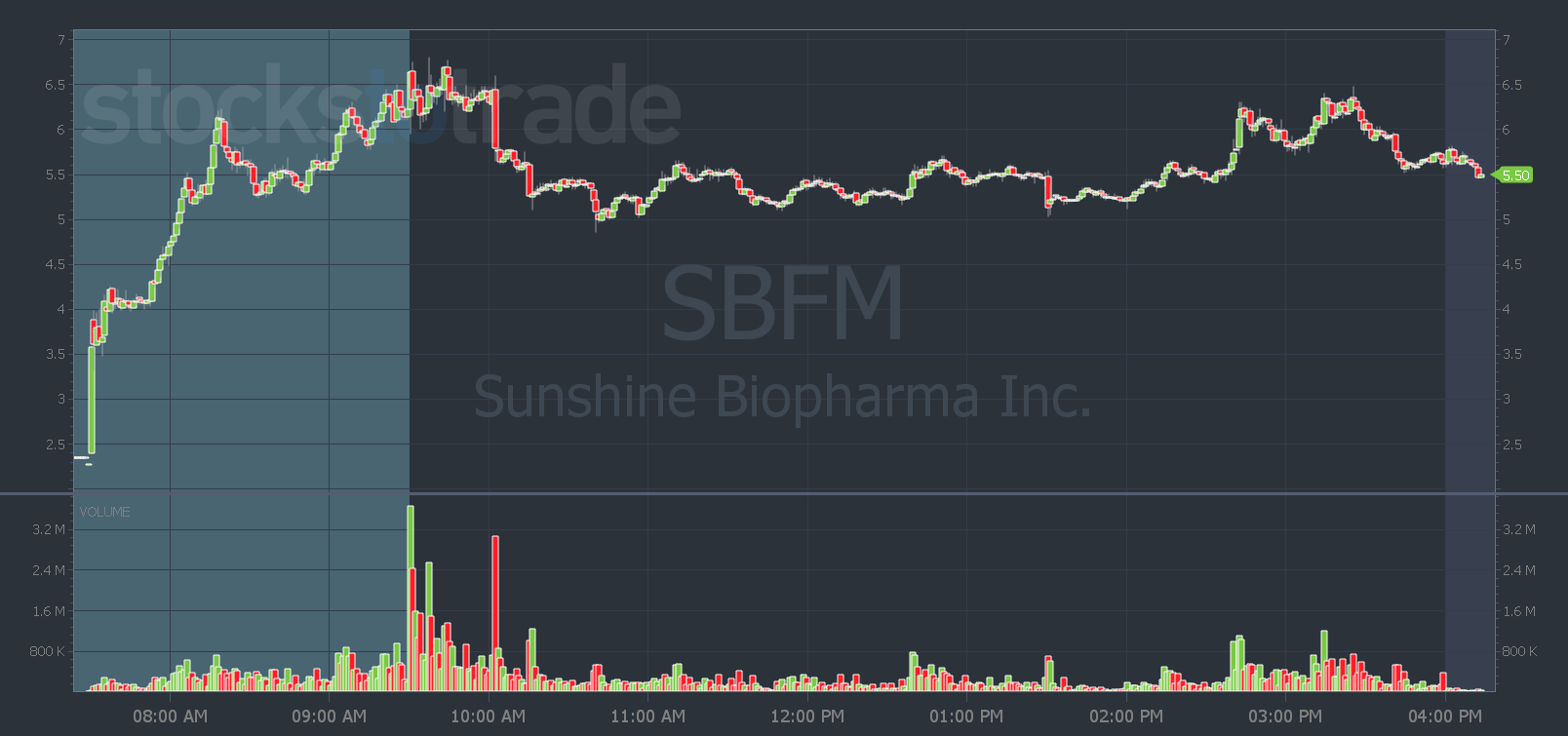

Yesterday in the SteadyTrade Team morning webinar Sunshine Biopharma, Inc. (NASDAQ: SBFM) was one of our top watches in premarket…

It’s a sketchy low float biotech stock that announced cancer news. It was also the chat pump du jour.

At the open, it was up roughly 150%!

You might wonder, with those kinds of big percent gains in penny stocks, how can 90% of traders lose?

Because they trade stocks like SBFM like this…

They buy in premarket, at the open, or whenever a chat room ‘guru’ sends out the alert…

And they hold.

That’s it.

They have no strategy. They have no exit plan…

They see these crazy big percent gainers and they think, what if it goes to $8? Or what if it goes to $10?!

They don’t want to miss out.

In short, small gains aren’t good enough for them.

They want to buy a sketchy low float biotech like SBFM for $2 and have it turn into the next Moderna, Inc. (NASDAQ: MRNA) overnight.

That’s not reality, folks.

And that’s why this is an important lesson…

How to Be In The Top 10%

As I was explaining the rules that apply to trading SBFM, a SteadyTrade Team member asked, “What If I’m already in SBFM from $4.60?”

Here’s what I had to say…

First, that was an aggressive buy, but congrats.

Second, take your profits and look to reenter if it holds up.

And that was exactly the right way to trade SBFM…

When you’re up roughly $1.50 per share in premarket…

in a sketchy low float biotech that was trading around $2 on Monday…

… and it’s a chat pump…

You’ve gotta take profits.

I can almost guarantee that 90% of losing traders and chat sheep didn’t take profits. They won’t sell until they’re breakeven or red…

You don’t have to make the same mistake. You can take safe trades if you follow some simple rules.

Some of the rules I follow are:

- Buy in premarket, sell in premarket.

- When you see profit, take profits.

- Nine out of 10 chat pumps fail at the open.

Those are my rules. You don’t have to follow them. But they work.

And if my rules and lessons can keep one trader safe from losses — or help them lock in profits — it’s worth it.

But I can only help you if you put in the work. Show up every day. Watch webinars and ask questions in the chat room.

I give traders my safest plans and top mentoring tips and lessons every trading day in the SteadyTrade Team. Join today, and I’ll see you in chat!

Stay steady. See you back here tomorrow.

Tim Bohen

Lead Trainer, StocksToTrade