The goal of this post is to show you you can determine not only the best altcoins, but where to buy them, and even how to trade them.

The explosive rise of Bitcoin has spurred another unprecedented phenomenon—the creation of an army of altcoins that now compete with Bitcoin.

There are now a total of 2,112 (and growing) cryptocurrencies listed on CoinMarketCap, and Bitcoin’s dominance has fallen to below 40 percent from more than 90 percent a couple of years ago. So, how to pick the best altcoins to trade?

This is not to say that Bitcoin is any danger of being eclipsed by other coins; rather it means that traders and investors have a much bigger basket to choose from that was the case two or three years ago.

That’s hardly a bad thing, considering that altcoins have sometimes been known to outperform Bitcoin by a country mile.

Had you invested $1,000 in Bitcoin in 2017, investing just $100 for each of the top 10 altcoins and holding onto them for a year, the gains on your altcoin basket would have been more than double.

Download a PDF version of this post as PDF.

Individual performance by altcoins such as NEM and DASH were even more impressive, with the former netting more than five times the return of Bitcoin.

Not everybody is interested in holding cryptos for months or years.

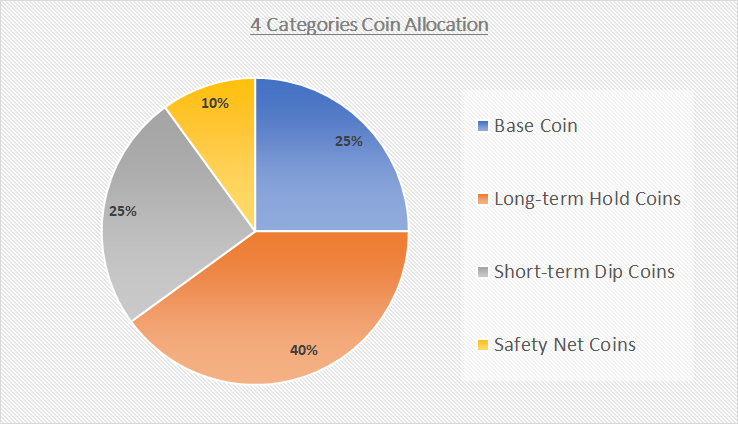

After all, many people still do not view BTC and other cryptos as a real store of value. Swing/position traders, though, might find this guy’s diversified portfolio on Hackernoon worthy of consideration.

Are altcoins generally more profitable to trade than Bitcoin?

The short answer is, no, at least not for day traders. Understanding chart patterns and good timing are more important factors for day traders. Day traders are mostly interested in two aspects when choosing good stocks/assets/commodities to trade:

- High volatility

- Good liquidity

Nearly all cryptocurrencies typically exhibit very high absolute volatilities compared to your average stock, including penny stocks.

Bitcoin is by far the most expensive cryptocurrency, but still exhibits much higher volatility than many lower-priced altcoins.

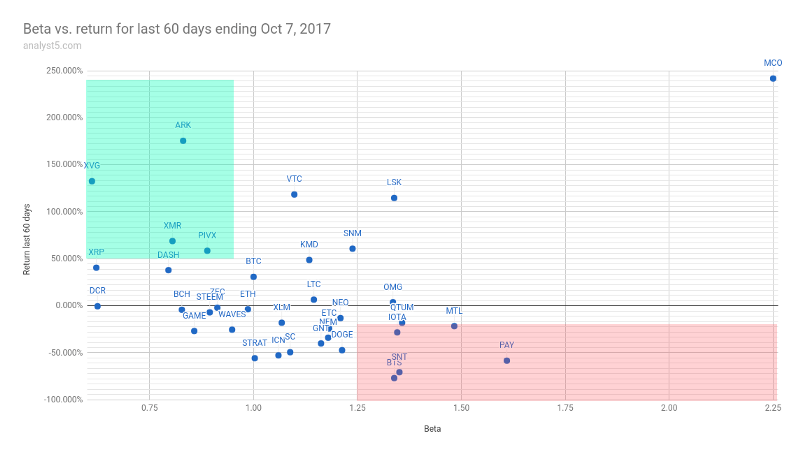

Medium.com, a popular tech site, conducted a study to assess the beta values of Bitcoin and leading altcoins over a period of 60 days ending October 7, 2017.

Bitcoin was assigned a beta value of 1, since most altcoins are sold or bought using Bitcoin (in any case, many exchanges only allow cryptocurrency trading and not USD or another fiat).

You can see from the chart below that many altcoins had lower volatility than Bitcoin while two-month returns seem to bear little correlation with volatility.

Those juicy returns are great for any position trader, but it might not mean much to a day trader. Nevertheless, here is some advice for both camps of traders.

A few house rules

Knowing the right coins to trade is half of the battle when it comes to profiting from the market. This is even more critical for position/swing traders who plan to hold for months or even years (a lot of top 100 coins are little more than vaporware).

Here’s how to go about it:

1.) Invest in solid technologies

Whether you are a day trader or a long-term investor, you will need to select several crypto coins for your portfolio.

Although you can add or remove individual coins from your portfolio according to your strategy, you are not likely to be doing this on a daily basis.

You therefore need to pick coins that have a strong technology backing them, so as to be sure that they will not go up in smoke.

There are literally hundreds of deceased coins listed on the deadcoins.com website (I bet you are not aware that a coin by the name boring coin ever existed).

Also bear in mind that a few coins disappeared into thin air during the Jan/Feb 2018 market crash, so that’s a very real risk right there. Altcoins that have been invented to disrupt industries are a good pick, though by no means foolproof. Examples include:

- VeChain (VEN) — based on an RFID offering that detects counterfeit goods

- Icon (ICX) — provides blockchain solutions to hospitals, banks, and universities

- Genesis Vision (GVT) — a decentralized platform that is designed to bring traders, brokers, and exchanges together

- Ox (ZRX) — a protocol that facilitates exchange of token that run on the Ethereum blockchain.

2.) Carefully vet the vendor

- Check out the website and look out for the red flags

- How strong is the team behind the coin? A strong technical team is more likely to create a robust code than a weak one.

- Are you impressed with the whitepaper? The whitepaper tells you what problem(s) the technology aims to solve and how it goes about it. DO NOT skip this step.

- Get to know the founders. Comb through their social media feeds to get a feel for their individual mindsets.

- Check out the community of existing users on Reddit, Telegram, Instagram, GitHub, and 4Chan. How do they feel about the coin and its future potential? Wisdom of the masses still works.

3.) Check trade volumes

You can check out a coin’s trade volumes on CoinMarketCap. Trade volume tells you how much has been transacted over the past 24 hours and gives plenty of clues about demand and future direction.

Some smaller altcoins such as MonaCoin sometimes have larger trade volumes than larger coins such as Neo and Dash.

You don’t want to buy a coin that no one will want to buy when you need to sell.

4.) Learn your chart patterns

If you start with a $1,000 investment, trade every day and make a 1 percent gain consistently PER DAY, your investment will be worth $37,783 at the end of the first year and a cool $1,427,587 by the end of year two!

In fact, a 1 percent gain every hour is achievable with your average coin if you master the right patterns and indicators.

5.) Consider past trends

Always investigate the historical trends and expert reviews of the altcoin before buying. This is especially critical for coins that do not have tons of followers or where useful information is hard to come by.

6.) Set an exit price

Many traders spend hours on end fine-tuning their entry strategies, but then end up messing everything by taking bad exits.

Others lack any effective exit plan and end up getting shaken out at a terrible price.

All cryptocoins have a market cap and a finite coin supply of which a certain percentage has already been mined. Use those to set up a realistic exit.

7.) Learn how to manage risk

Consider your individual risk profile when setting your trade strategies, entry, and exit points.

Never trade more than you can afford to lose is an overused maxim in trading, yet it remains one of the wisest.

Learn when to trade and when not to.

With the right strategies in place, it’s possible to put in just a few hours’ work every day and still make good money trading Bitcoin and alt coins.

You just have to know how to pick the best altcoins to trade .

Have realistic expectations, stick to the basics and remember to pay your taxes just in case the IRS one day decides to look at your past trading activities!