There’s a theme I see working in the market right now…

But there’s a difference between themes and repeatable patterns.

While themes come and go, patterns tend to show themselves across the entire market and in many different stocks.

So does a theme mean there’s a trading opportunity?

Maybe. That depends on you…

Your experience, skill level, risk tolerance…

What works for one trader might not work for another.

So today I’ll share a theme I see in the market right now, then you can decide if there’s a trading opportunity for you…

Learn the patterns you can trade in any market here.

Let’s start at the beginning…

What’s a Company REALLY Worth?

An Initial Public Offering or IPO is how a company becomes publicly traded.

How does a company determine its stock’s worth?

It’s similar to selling your house…

If you bought your house years ago and added some improvements … you know what you spent, but you don’t know what it’s worth. How do you find out? You hire an appraiser who evaluates the house and gives you an estimated value.

In business, an investment bank determines a company’s value…

The bank reviews the company’s revenues, profits, liabilities, and future projections. Then it comes up with a number — the estimated value of the company, or market cap.

From there, the company can determine how they want to divide their market cap … If a company has a market cap of $100 million and wants to price shares at $20, then they’ll have 5 million shares outstanding.

A higher or lower share price means fewer or more shares outstanding, respectively.

But in the case of house appraisers and investment banks, they don’t consider the market value of the house or company…

The free market decides that.

And sometimes there are big discrepancies between price and value…

Let’s look at how it can play out and whether there are trading opportunities in recent IPOs right now…

Trashy IPOs Make a Comeback?

The theme I’m seeing lately is recent IPOs with absolutely disgusting charts having volatile moves…

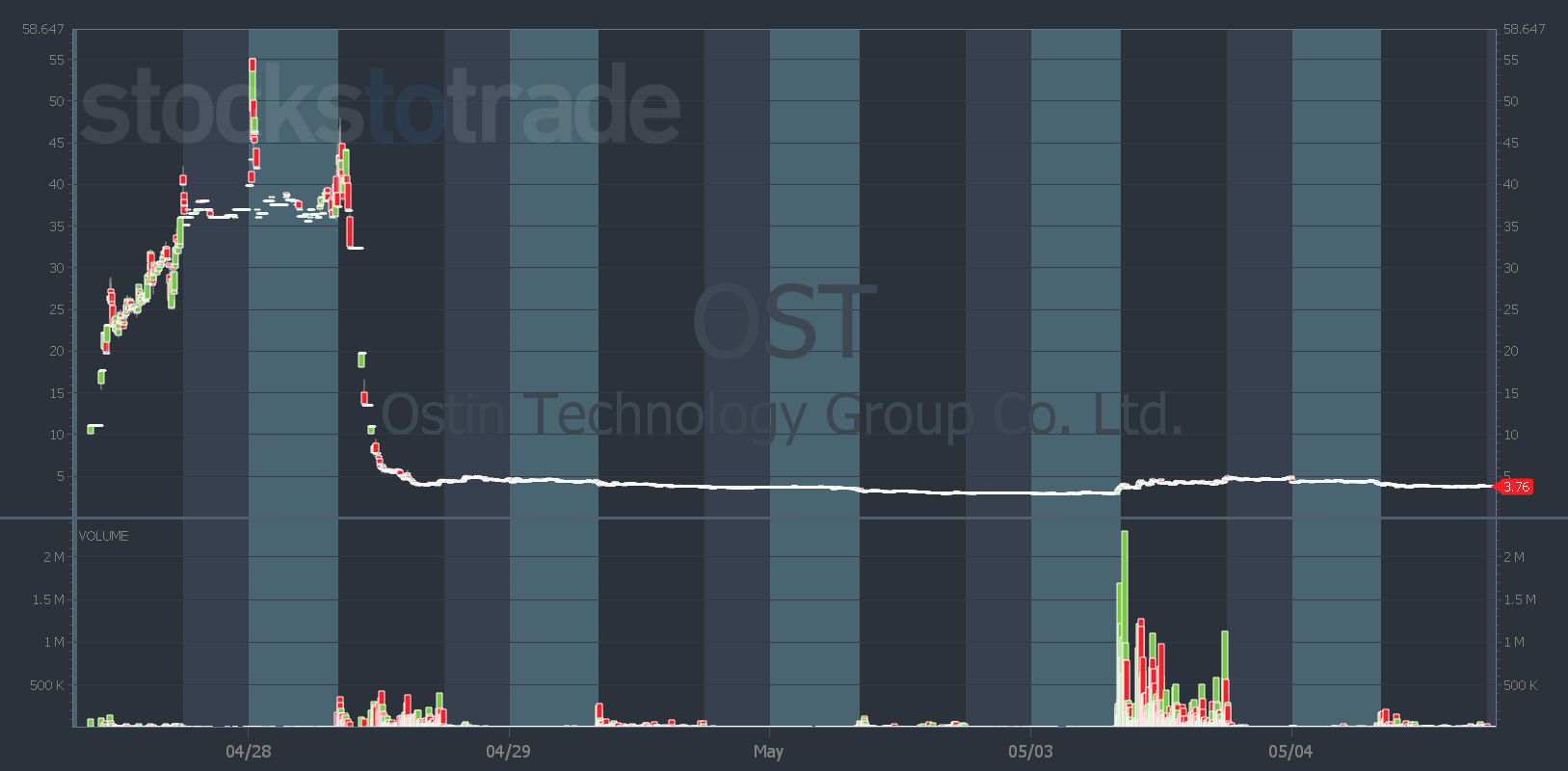

Last week, Ostin Technology Group Co., Ltd. (NASDAQ: OST) opened for trading at around $10.10 and shot to $40 on the same trading day. But the next day everyone got absolutely clobbered as it sank from $48 to $4.

Then on Tuesday, it attempted a comeback and spiked from roughly $3 to $5.

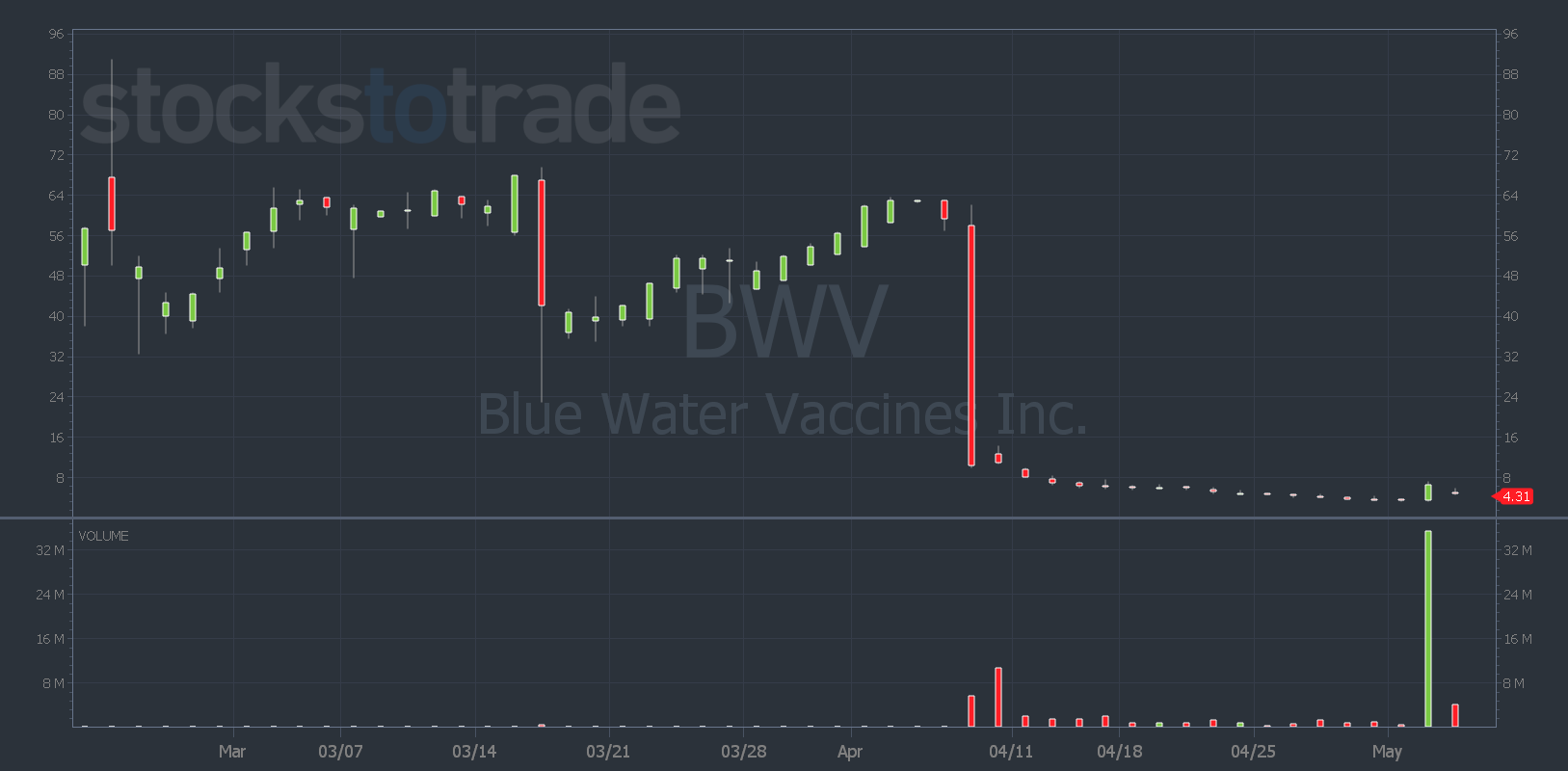

In the SteadyTrade Team webinar on Tuesday afternoon, members were distracted by Blue Water Vaccines, Inc. (NASDAQ: BWV). The stock climbed from $3.50 to $7!

But I didn’t like it…

First, it’s a sketchy biotech. Second, it had no news. Third, it’s way off its highs around $90.

Recently it tanked from roughly $60 to $10 in one day!

I mean, just look at the chart since its February IPO — it’s brutal.

Aclarion, Inc. (NASDAQ: ACON) is another example. This stock IPO’d last month and has been in a downtrend since. Then yesterday it had a green day with high volume.

But again, ACON had no news to justify the move.

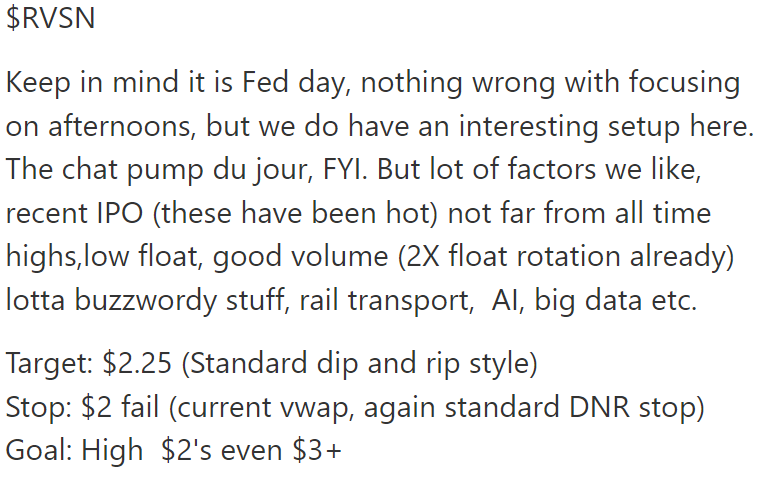

Rail Vision Ltd. (NASDAQ: RVSN) is another recent IPO that gapped up on record-high volume yesterday. It had news, and even though it was Fed announcement day, there was a lot to like about it…

RVSN offered a trade opportunity in the morning — but you had to be quick!

All of these recent IPOs are extremely volatile.

If you’re experienced and you see an opportunity — take it.

But if you’re new, wait until the afternoon and focus on trading patterns. Especially in this uncertain market.

And if you don’t see a trade opportunity, it’s okay to sit on your hands.

Have a great day everyone. See you all back here tomorrow!

Tim Bohen

Lead Trainer, StocksToTrade