Once a stock has a big move, it often offers more than one opportunity to trade it.

But you don’t have to do it by randomly chasing spikes and hoping you don’t get caught in the rug pull…

There’s a methodical way to do it. But you need a process and patience…

Once you see my example, you’ll understand…

And after you see it enough times, you’ll see how easy it can be to repeat it when you’re focused on the process instead of profits.

You don’t have to over-complicate trading.

You can grow your account by trading the same stock over and over by applying the right patterns. (I give you all my favorite patterns in my ebook.)

Today I’ll show you how with the same example as yesterday…

This is why it’s not about trading more stocks — it’s about trading the right ones with the right patterns…

How To Trade Stocks Multiple Times

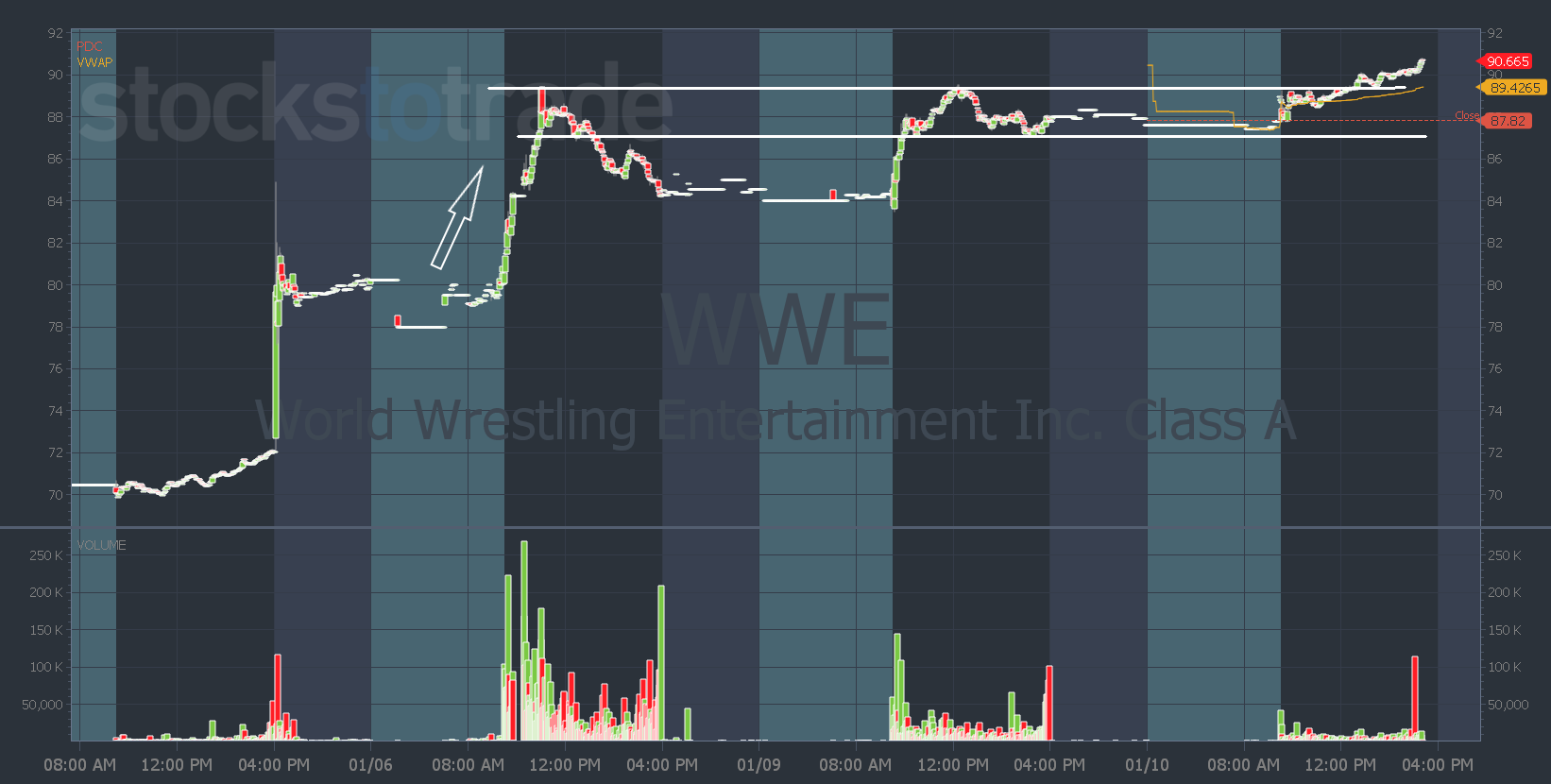

In yesterday’s Daily Accelerator, I showed you how and why the red-to-green pattern worked so well in World Wrestling Entertainment, Inc. (NYSE: WWE) on Monday morning.

And yesterday afternoon the stock had another repeating pattern…

After WWE had a red-to-green move on Monday and went from roughly $84 to $89, it consolidated and closed near its highs at $87.82.

And that’s what we like to see for a stock to have another breakout move above the day one high.

I go over what to look for and how to trade the day three surge here.

Check out the chart…

It’s not a perfect day three surge example, but no two stocks or charts will ever look the same. Instead of looking for the most perfect pattern, think about the reason behind the move.

Where buyers enter a stock and shorts exit.

WWE had a big day one move, then instead of picture-perfect consolidation into day two, it pulled back. But on Monday with the red-to-green move, it reclaimed that upper consolidation area.

Then it was poised for a day three surge breakout over the day one high.

It wasn’t a huge move — it needed more volume to get explosive. But this is just an example of how you can trade the same stock multiple times.

You can trade the patterns, get in and out, and take your potential profits to use for the next trade…

Or since this is a ‘real’ stock, you can swing trade it as long as it’s in an uptrend and you have the right risk level.

I go over all these patterns and trade ideas daily in the SteadyTrade Team.

But if you want to learn a new way to trade these ‘real’ stocks and still catch some impressive percent gains — keep an eye on your inbox for some exciting news dropping this afternoon!

Have a great day everyone! See you back here tomorrow.

Tim Bohen

Lead Trainer, StocksToTrade