While the mainstream media is pitching doom and gloom…

And analysts are predicting that we haven’t seen a bottom in the market yet…

…the word ‘recession’ is being mentioned a lot more at dinner discussions and the crypto market has been anything but stable.

Luckily, you don’t have to make sense of that to make money in this market.

And you don’t have to be a bear to profit.

I even spoon-fed you a stock from my weekly watchlist … THAT JUST HIT A 52-WEEK HIGH!

More on that in just a moment…

Want to find the hottest plays daily? Get access to 40+ built-in scans with StocksToTrade!

Hot Opportunities in a Shaky Market

I’ve been saying for months that I think we’re far from done with the run in oil and gas stocks.

That’s why my first pick on this week’s watchlist was Occidental Petroleum Corporation (NYSE: OXY). But OXY isn’t some penny stock, only up because of hype or a short squeeze…

So, why do I like this setup?

It has:

- A catalyst

- Positive market sentiment

- A pattern

First, the catalyst comes from comments made at the Berkshire Hathaway Inc. (NYSE: BRKB) annual meeting on April 30. Warren Buffett’s conglomerate purchased OXY during Q1 and increased its Chevron Corporation (NYSE: CVX) holdings…

So, it looks like Buffett is bullish on oil.

Second, retail traders are jumping on board as people see increased oil prices every day…

Whether it’s at the pump or on our heating or grocery bill — we’re all paying more.

As more people recognize these higher prices aren’t going away overnight, they’re more likely to get on their phones and buy oil and gas stocks.

Lastly, OXY had a technical pattern.

Even if you ignore the catalyst and market sentiment — remember that technical patterns work!

A stock breaking out to new 52-week highs will show up on more traders’ scans. It’s a simple strategy and it’s easy to recognize the pattern.

More scans = more buyers.

Even with its roughly $60 billion market cap, OXY still had a $3 per share move. And there’s nothing but blue skies overhead!

So now that we’ve seen a big name break out, where’s the next opportunity?

There are a few options…

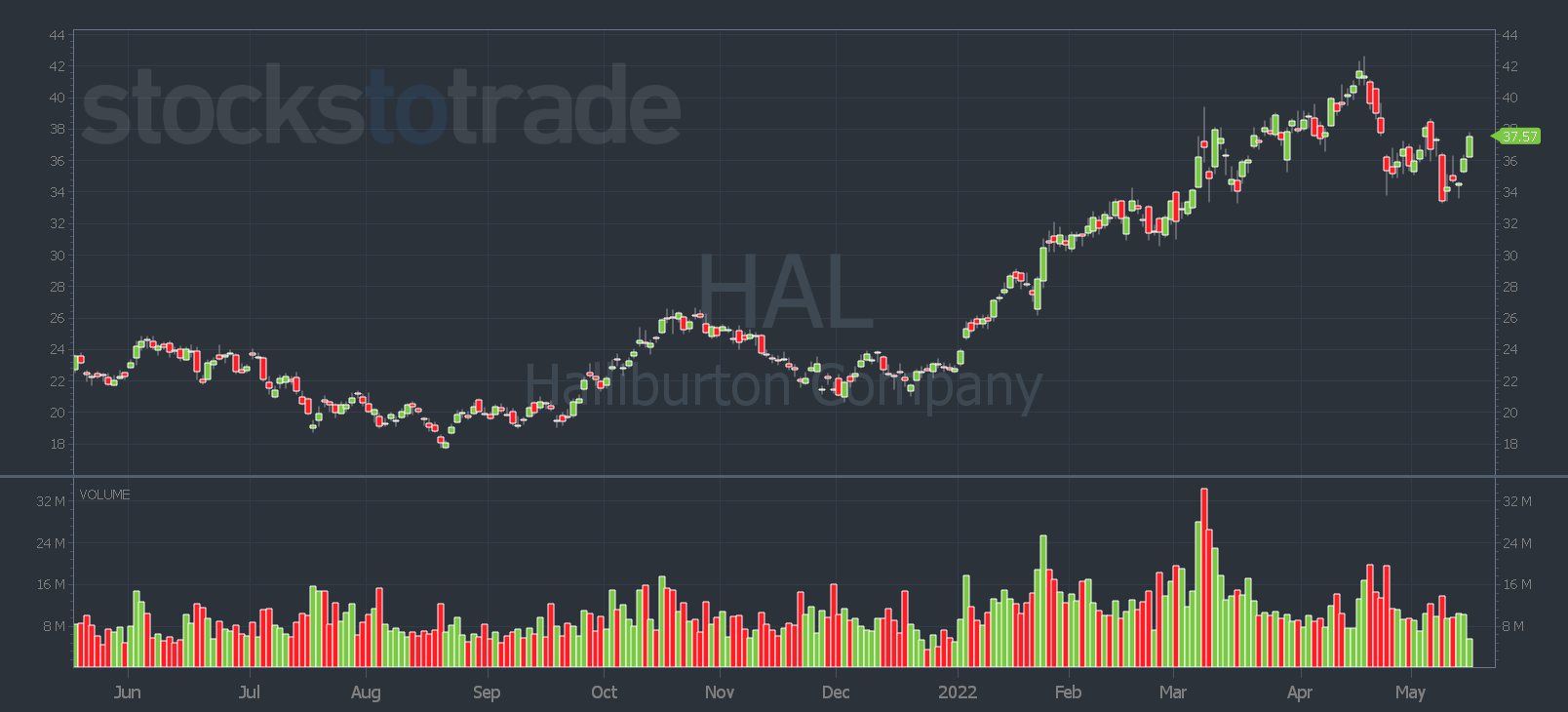

If you like trading ‘real’ stocks, Halliburton Company (NYSE: HAL) is a slow-mover with a massive market cap. It pulled back recently from its highs, but it’s still in an uptrend…

Like OXY, Exxon Mobil Corporation (NYSE: XOM) also broke out to new 52-week highs yesterday. I told students to watch for the breakout on my May 8 watchlist…

But if you want to trade volatile oil and gas penny stocks, look for sympathy plays. There are already a few perking up…

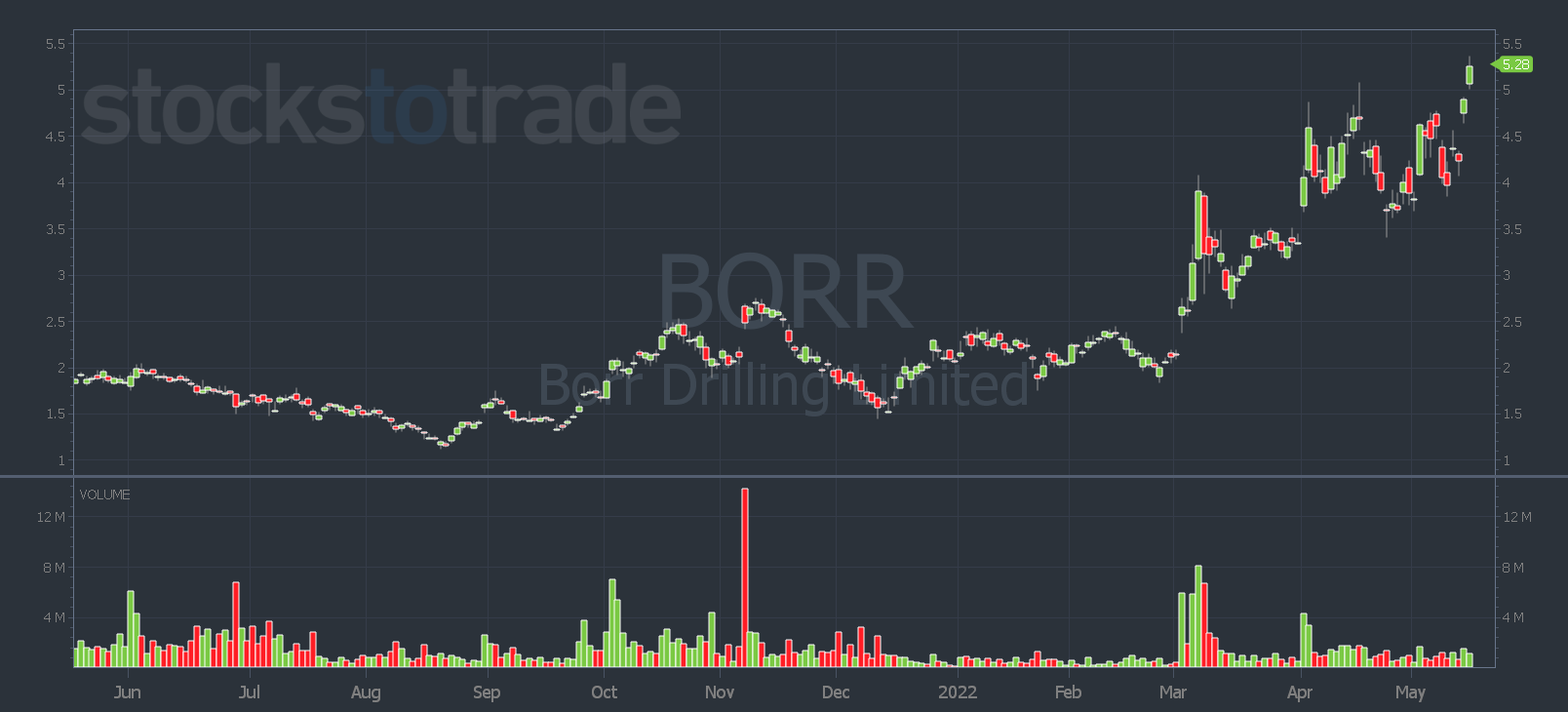

Borr Drilling Limited (NYSE: BORR) also hit new 52-week highs yesterday. It has a large market cap so it’s a slow-mover. But it’s a lower-priced stock, which can be better for traders with a small account.

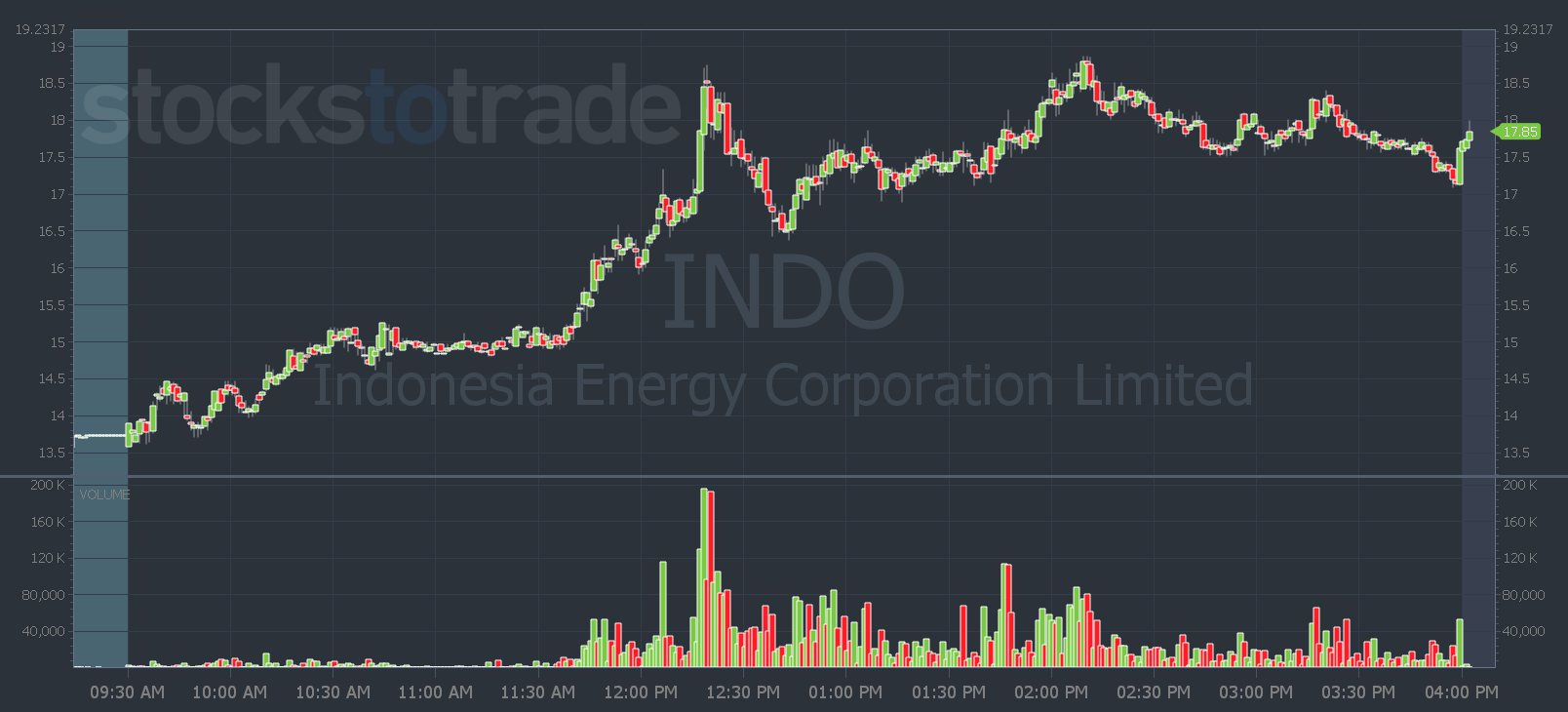

Indonesia Energy Corporation Limited (NYSE: INDO) spiked 30% intraday. It has a ton of resistance on the chart. But if high volume comes in, this one could get interesting…

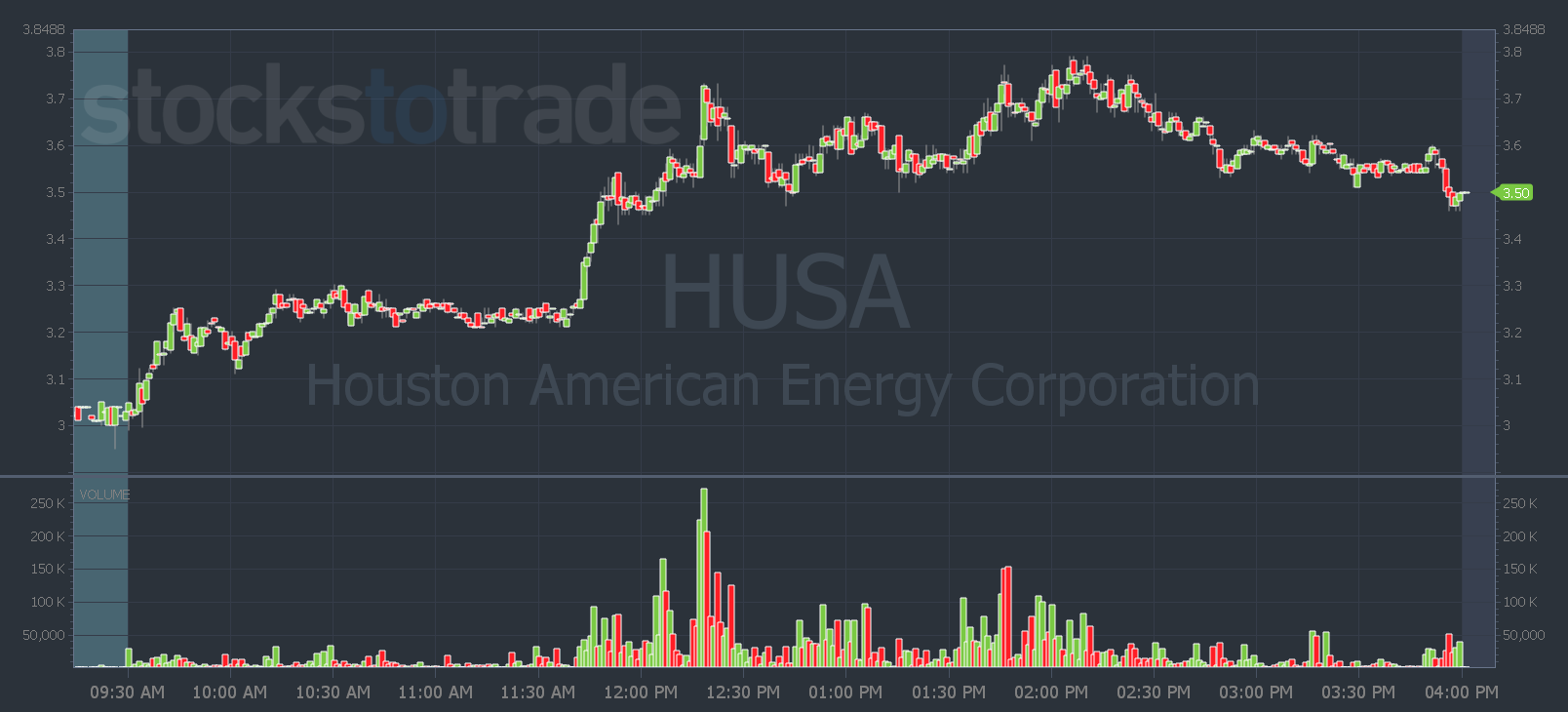

Trashy, low-float stock Houston American Energy Corp. (NYSE: HUSA) climbed over 20%. There was a great mid-day trade opportunity that offered roughly 50 cents per share in gains…

So, while the market might be bearish on tech and other overvalued stocks, that’s not the story with commodities…

If you want to trade these oil and gas opportunities, keep your eyes on crude oil prices as the sector leader. Then, run your StocksToTrade scans throughout the day, find the top movers, and look for one of our patterns.

Have a great day, everyone. See you back here tomorrow.

Tim Bohen

Lead Trainer, StocksToTrade