Yesterday morning was what I call a frothy market day…

There were a ton of stocks to watch, the market was gapping up, and there was lots of volume in stocks…

But early morning action doesn’t depict how the rest of the day will go.

And having a lot of stocks on your watchlist doesn’t mean there will be a ton of trades.

I talk a lot about quality over quantity when it comes to your watchlist…

I’d rather watch a few quality stocks and trade one than try to chase many rabbits and catch none.

So today I’ll show you how you can narrow down your list into a manageable watchlist and catch some of the best trades, and ignore the rest.

How to Find the Hottest Stocks + Four Winners

Focusing on a smaller watchlist can prevent you from getting overwhelmed…

It’s easy to see a lot of stocks running and get excited and eager to trade.

But controlling that FOMO is crucial for becoming a consistently profitable trader. Stay focused on trading the best setups — not making money.

That can help you avoid emotional mistakes.

You can run scans to find big % gainers and make your trade plan. But on a day like yesterday, you could have hundreds of stocks to sift through before the open…

I use a rollover watchlist to keep my eye on the multi-day runners. And I do things the easy way…

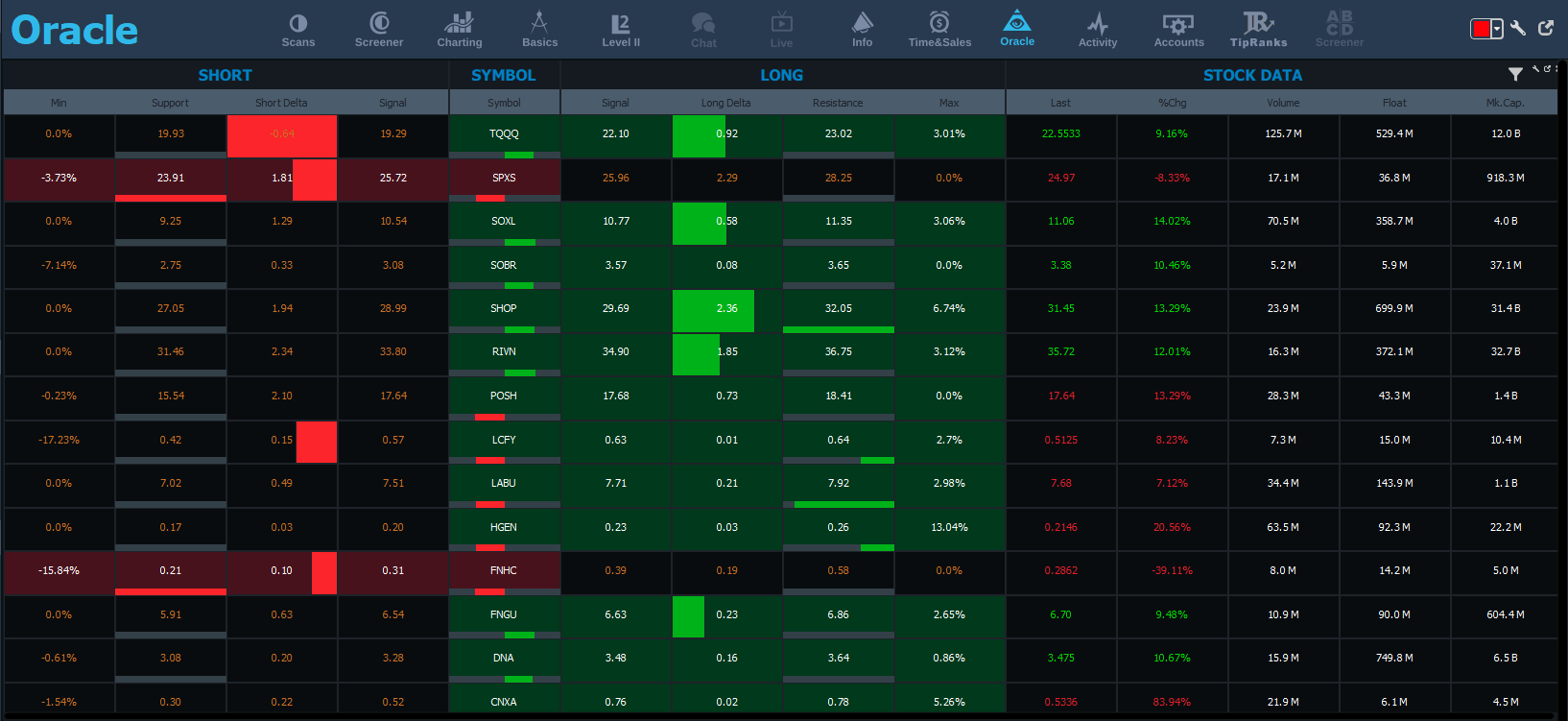

I use Oracle to show me stocks that may not be on my radar.

The algorithm finds 20 of the hottest stocks in premarket that have the potential to explode.

Then a few minutes after the open, it gives me a signal price to enter and a resistance level where I can take profits.

And yesterday it had multiple winners while a lot of stocks on my watchlist had a consolidation day…

This is what the algorithm shows traders right after the open…

The full list of Oracle winners from yesterday is too much to cover here. But here are just a few trades you could’ve taken with this list of stocks and the levels handed out…

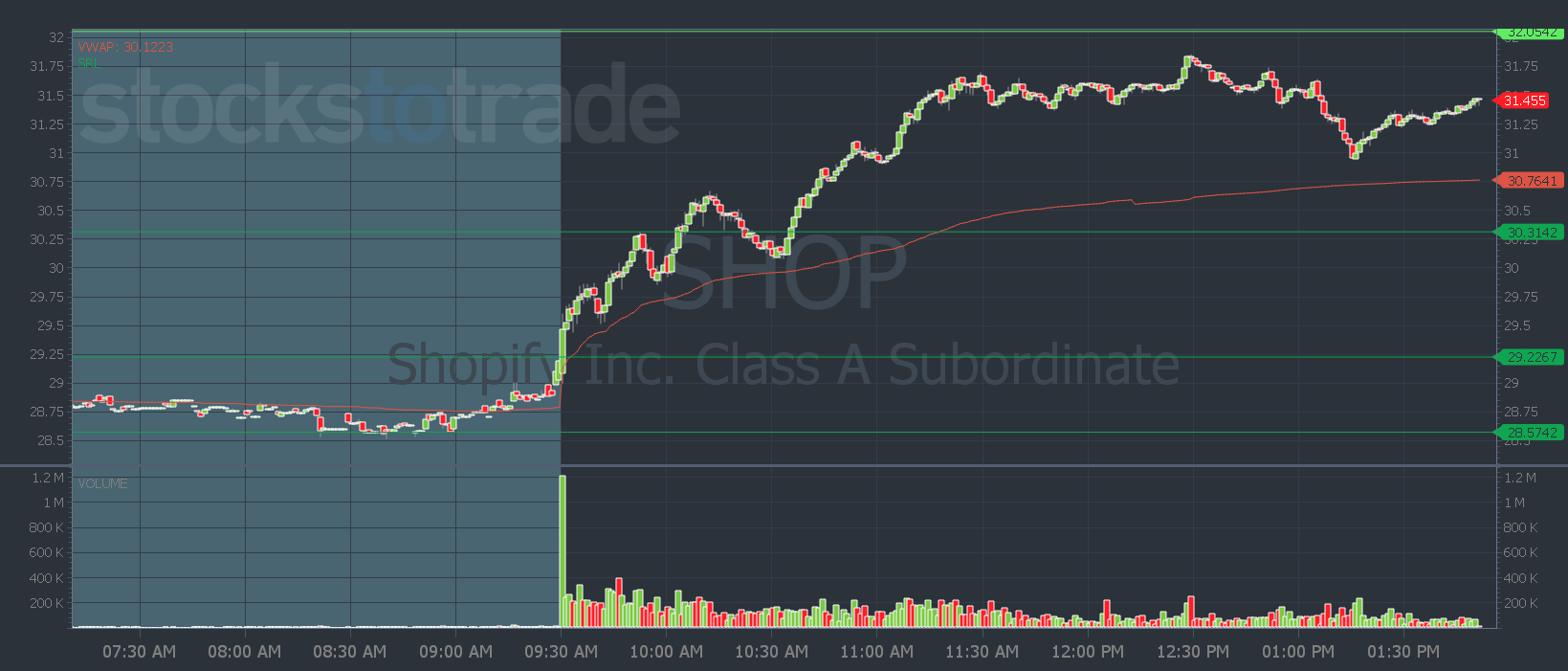

Oracle had a signal price for Shopify Inc. (NYSE: SHOP) of $29.69. And showed resistance at $32.05.

![]()

The stock hit the signal price a few minutes after the open and made a high of $31.85. So the stock failed near resistance just below a whole dollar level.

That’s why I like to use the algorithm and then use my years of experience and knowledge to adjust the trade plan using my own lessons.

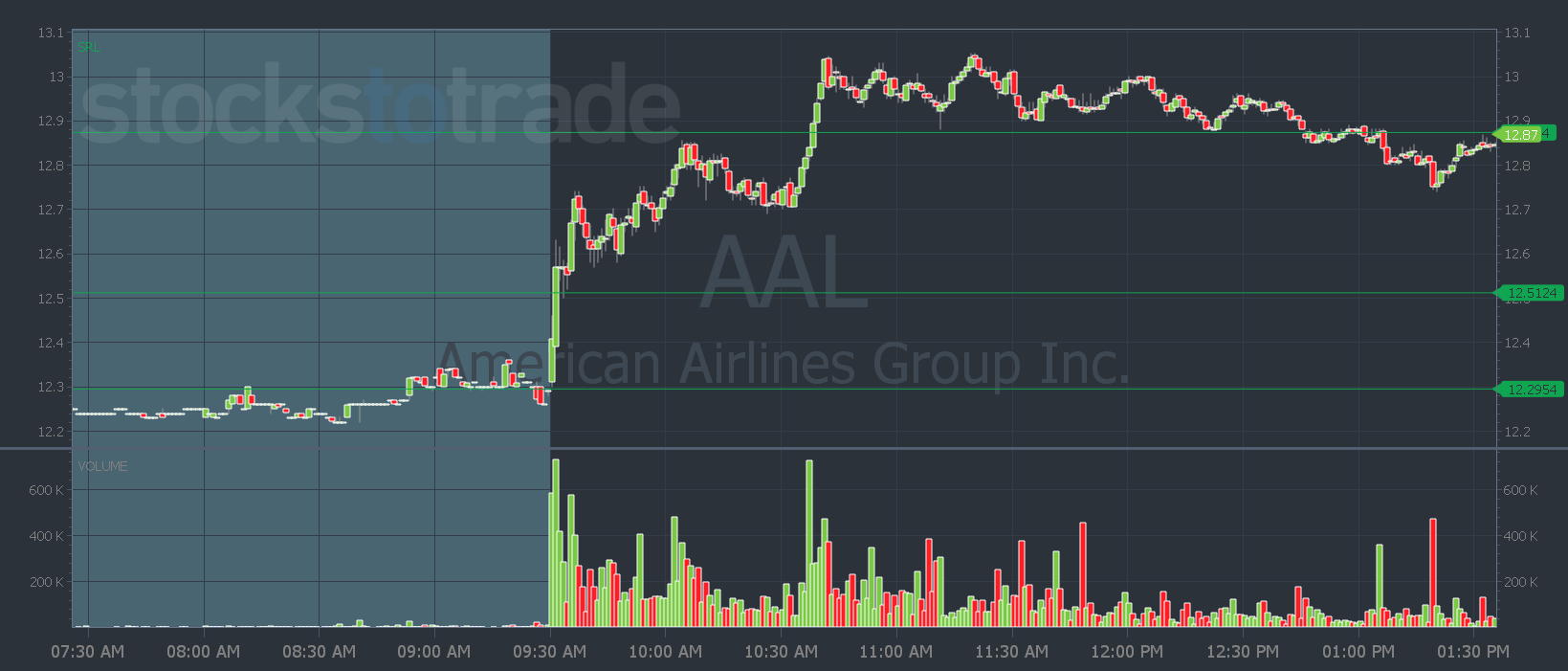

American Airlines Group Inc. (NASDAQ: AAL) was another winning Oracle pick.

![]()

The stock spiked straight up to Oracle’s proposed entry level right after the open. It hit the resistance level about 20 minutes later. But then it consolidated and continued higher.

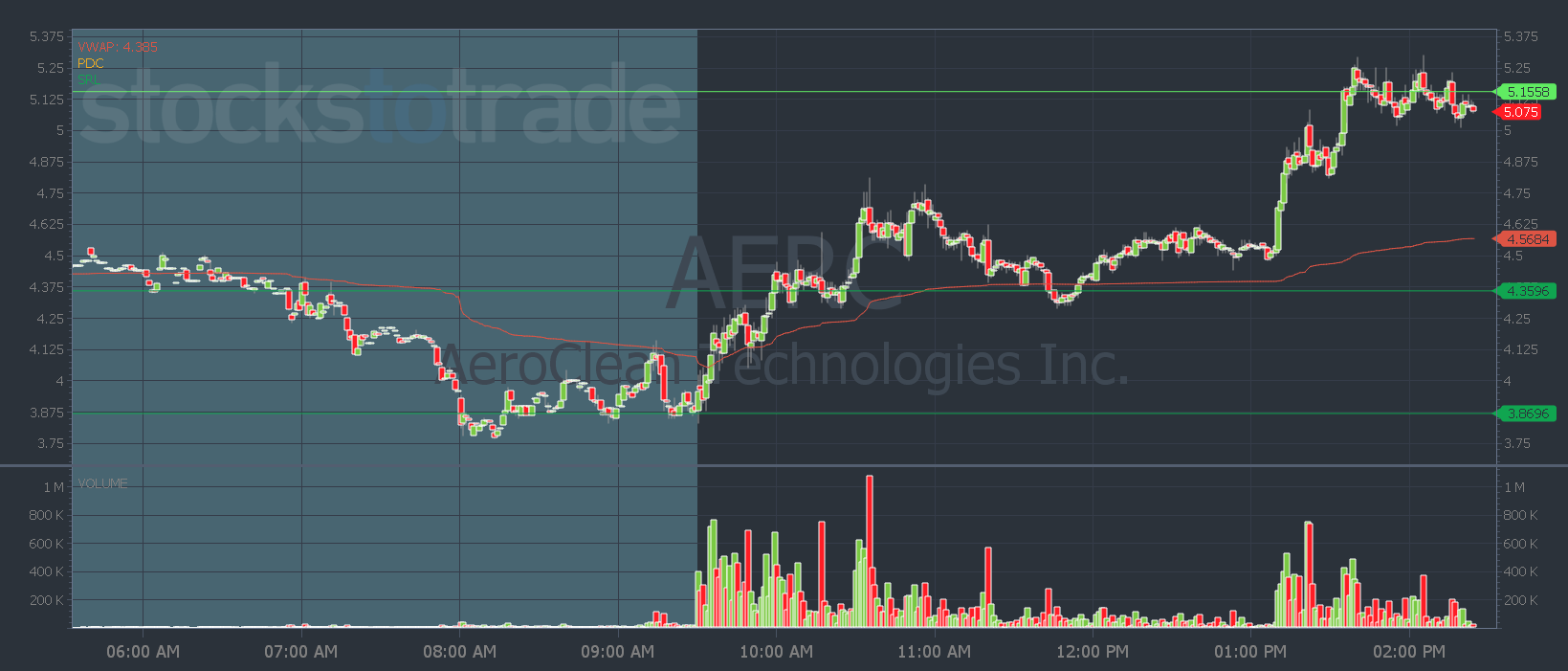

AeroClean Technologies, Inc. (NASDAQ: AERC) was one of our favorite stocks to trade in June when it went on a wild run from $2.50 to almost $24.

Yesterday it was another Oracle pick that soared higher than its resistance level.

![]()

It hit the Oracle entry signal a few minutes after the open. Then it slowly climbed higher…

You could’ve traded it for a 30-cent move, but you also could’ve got back in for another winning trade…

It broke resistance in the morning. And it had a nice VWAP hold high of day break in the afternoon, making highs over $1 per share from Oracle’s entry target.

And if you like the true penny stocks, Oracle picks up momentum in those stocks too. It picked Bit Brother Limited (NASDAQ: BTB) to potentially gain 27% yesterday…

![]()

Crypto stocks had a nice pop yesterday and BTB went from 30 cents to a high of 43 cents — a 43% gain!

How YOU Can Benefit From Oracle

You can see that Oracle doesn’t have a bias … it picks large cap, pricier stocks, mid-cap, and true penny stocks. And stock that has the potential to explode.

And you can use the Oracle support and resistance lines to guide your trade.

You don’t have to hold and hope a stock breaks resistance … Trade the conservative, safe trade idea, and if it breaks resistance, you can always get back in.

Oracle resistance can become support and offer another way to trade if you like dip buys…

You get to choose how you trade.

But Oracle makes sure you’re looking at stocks with the most potential, AND you’re looking at important key levels.

If you’re struggling with consistency in your watchlist, trade plans, or execution — try it today and see how it can change your trading!

Have a great day everyone. See you back here tomorrow.

Tim Bohen

Lead Trainer, StocksToTrade