Last week we saw moves of 100%+, 334%, and 80% gains. These were all one-day moves that traders could’ve capitalized on by trading stocks…

But for struggling traders, it doesn’t matter how many opportunities there are if you don’t know how to find and trade them.

You might hear about these incredible runners after the fact, get FOMO, and trade something dumb instead…

Hey, I’ve been there … I know how frustrating it can be.

That’s why today I’m sharing three ways you can improve your trading technique. I want to help you start nailing these opportunities…

But like I wrote here on Friday…

Less Is More

Trading is about quantity over quantity.

The problem is, most new traders get so excited about trading and ‘making bank, bro,’ that they start trading anything and everything that’s moving.

Even if you cut losses quickly, if you’re taking a bunch of trades and losing more than you win — you’ll blow up.

It’s like death by a thousand paper cuts.

The better approach is to limit your trades to one or two a day.

This isn’t the 2020 market anymore. There just aren’t as many insane runners every day.

So adapt and be selective. That means…

Focus on The Highest Probability Setups

The highest probability setups will differ for everyone. What works for one trader, might not work for you.

That’s why you need to tinker and test different strategies and setups in the beginning.

Personally, I think afternoon trades are a good place for new traders to start.

That way you can avoid the mayhem of the market open. And you can see a pattern develop more clearly…

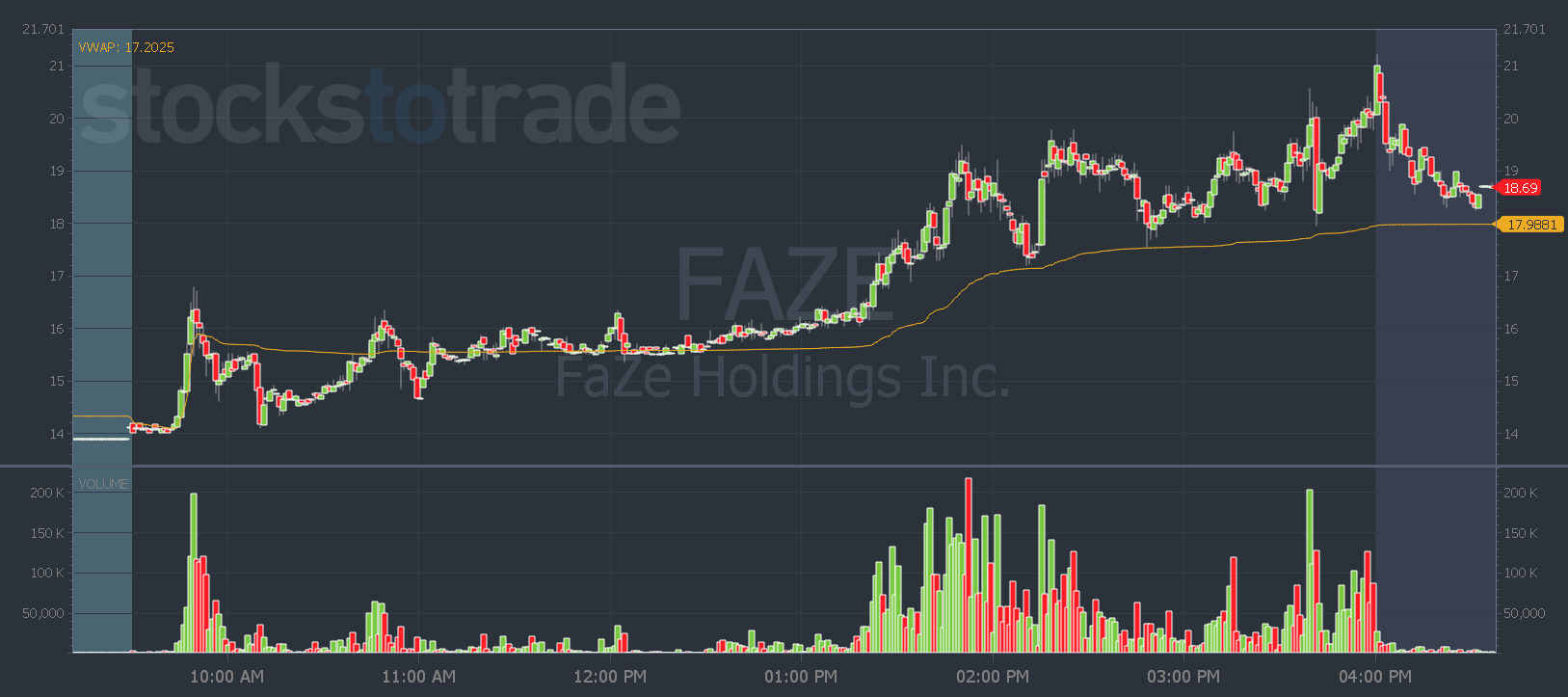

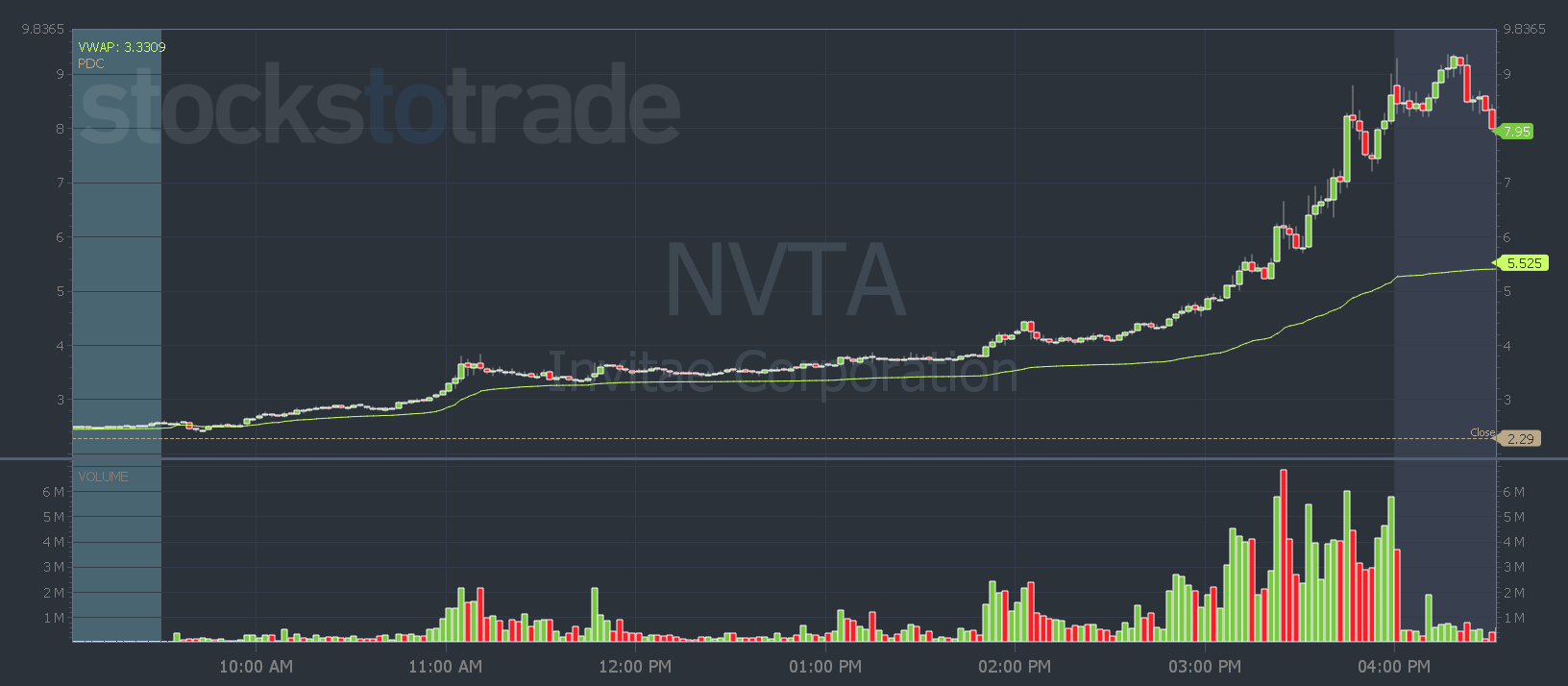

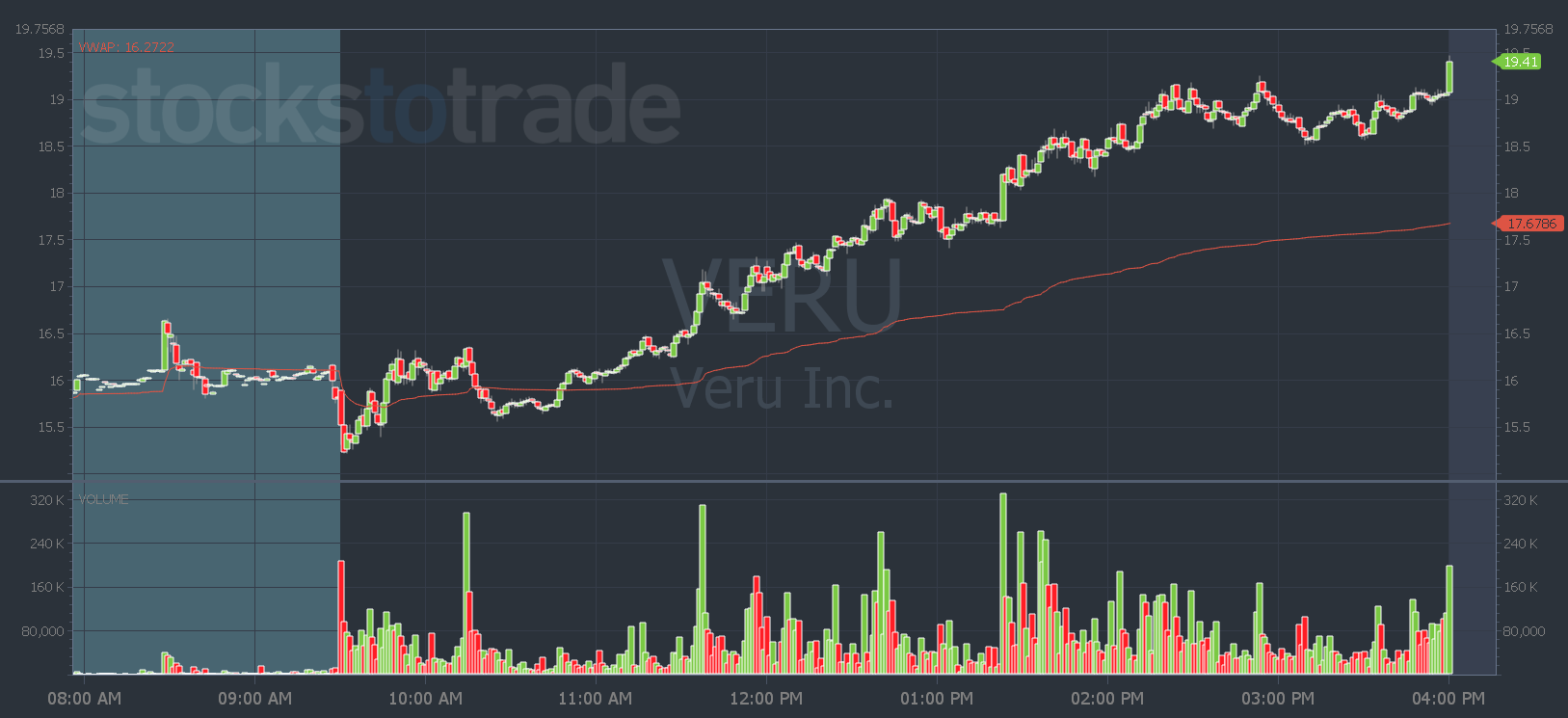

Just look at how similar these charts look…

Those are three examples of my VWAP hold high-of-day break pattern that played out in one week!

That’s why less is more. And perfecting one pattern is key in the beginning…

It’s also why you hear of experienced traders sizing down and going back to their bread and butter setups when they’re on a losing streak.

Stick to the basics in high probability setups. They give you clear levels for your entry and risk…

But it doesn’t matter how well you can identify a pattern … Because no two stocks will move the same. So always…

Be Flexible

Last week, Veru Inc. (NASDAQ: VERU) made its move a little too early for me two days in a row…

On Thursday, it dipped and ripped right near the open.

And on Friday, it broke the intraday high before noon and the $17 level I was watching right around noon.

I wanted it to make its move in the afternoon after it sucked in more shorts all day.

But remember that the market doesn’t care what we want. It doesn’t care how much money you want to make or what time you want stocks to move.

You just have to be ready to take your shot…

Have a trading plan and be ready to execute when a stock makes its move.

Just make sure you have a risk level you’re comfortable with. And be flexible when considering where to take profits…

Make adjustments based on how much you like the setup, and whether things have been clicking for you.

If you’re struggling, be more conservative and build confidence with small wins.

You can also adjust your expectations for each trade based on the individual stock…

Look at the chart examples above. FaZe Holdings Inc. (NASDAQ: FAZE) was super choppy. While Invitae Corporation (NYSE: NVTA) was smooth, and VERU was a slow grinder.

With choppy stocks, you take a smaller position size and use a wider risk. With smoother stocks, you can try to ride the momentum and be patient using a trailing stop loss.

Also, look at how far a stock has run in the past. And consider the float, the volume, and where resistance is on the chart…

Oracle can help you spot those key levels. And you can watch my video on support and resistance here.

You also need to track all your trades so you can review them and see what’s working and what’s not.

See if you can make adjustments to anything that’s not working, or if you just have to cut out certain trades completely.

Hopefully, this helps you get your Money Monday off on the right foot…

Have a great day everyone. I’ll see you back here tomorrow.

Tim Bohen

Lead Trainer, StocksToTrade