Real stocks are back in play, meme stonks are back, crypto and crypto stocks are in play, plus there are plenty of trash penny stock runners to throw into the mix…

That means there’s no lack of plays. For new traders, it might be overwhelming.

But here’s an easy tip to keep your FOMO in check and stay focused on the best setups…

Trading is about quality — not quantity.

If you have one really great setup and execute your plan, you don’t have to stare at your screens all day.

You don’t have to turn trading into a crappy 9-5 job where you’re chained to your desk.

And you don’t have to mess around trying to trade random spikers like BioAtla Inc. (NASDAQ: BCAB).

Or day one IPOs like Treasure Global Inc. (NASDAQ: TGL) that halted almost every minute…

If you focus on the setups that repeat, you can grow your account over time.

Today I’ll show you how you can trade simple setups in the morning so you can go about your day, and do your house projects or yard work…

A Gimme Setup In a Recent Runner

Yesterday, the very first Breaking News Chat alert for the day was Veru Inc. (NASDAQ: VERU).

The company announced earnings and provided an update on the potential approval of its COVID treatment.

VERU’s an old favorite that’s been hanging around for months…

It’s full of trapped shorts. It had news. I don’t love COVID news PRs, but it’s still a thing — heck, the President had it a few weeks ago…

So that said, it was my number one watch for a dip and rip.

And I sent out my alert to Daily Market Profit subscribers…

So whether you were in the Breaking News Chat room, Pre-Market Prep, the SteadyTrade Team, or if you subscribe to my alerts…

There were multiple ways to hear about this play…

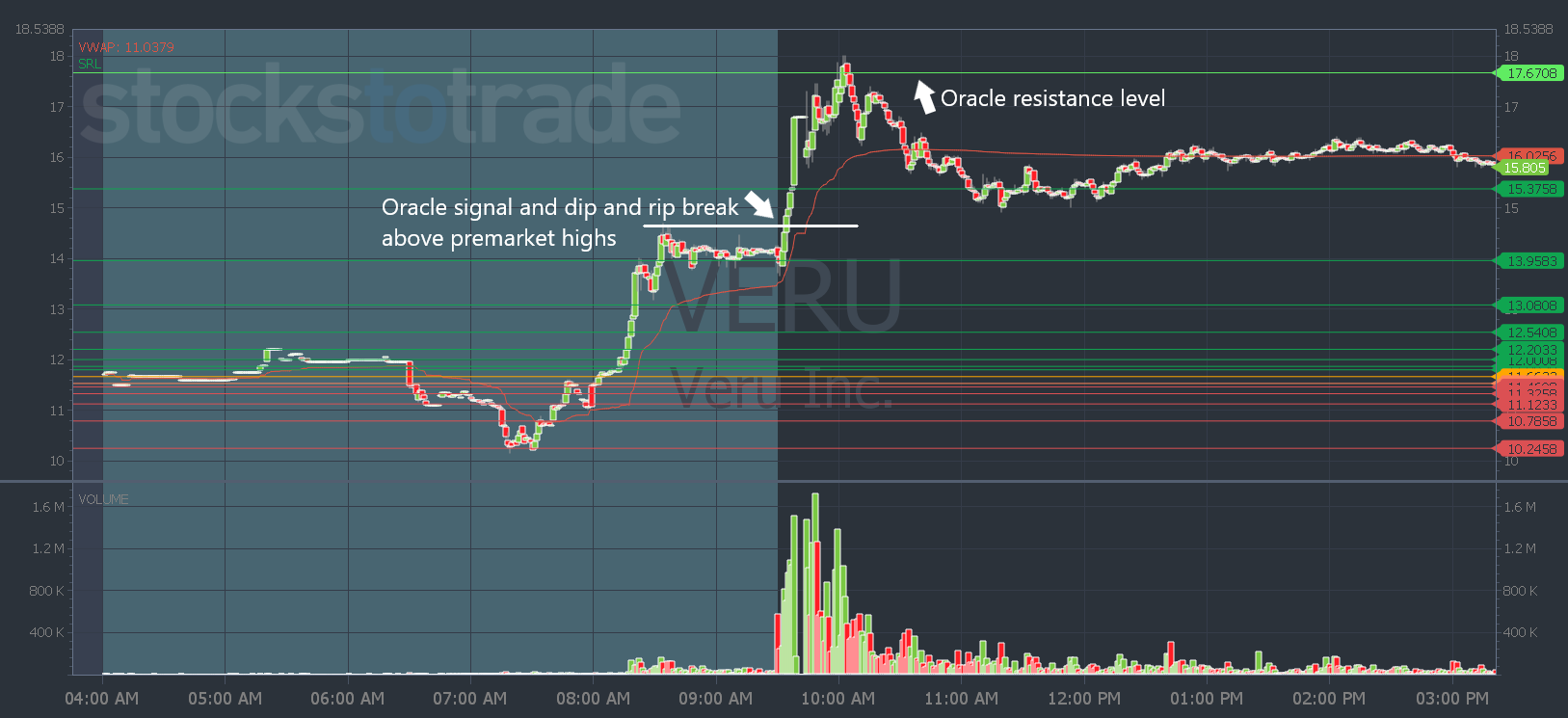

It was even on Oracle … And my trade plan included a target entry above the Oracle level of $14.67 with a stop loss in the low $14s. And my goal to sell was the Oracle resistance level of $17.67.

Look how it played out. It was beautiful!

VERU offered the potential to catch a $3 per share move. If you bought 100 shares with $1,467 of capital, you could’ve made $300. That’s a 20% gain for your account. And you could’ve walked away for the day.

But chances are, you won’t catch the bottom and top of the move…

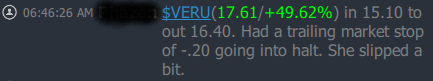

So look at some of the trades SteadyTrade Team members took to nail and bail this setup…

![]() Some traders took small gains. And others held for a dollar per share moves. There were even more in the chat room that took it early and sold near the top.

Some traders took small gains. And others held for a dollar per share moves. There were even more in the chat room that took it early and sold near the top.

Now, I want everyone to be healthy, wealthy, and wise … So if you’re missing out on these types of plays — StocksToTrade can help.

Get Breaking News Chat alerts and try the Oracle algorithm here.

If you want my top picks and trade plans — subscribe here.

There’s more than one way to make money in the markets. You just have to find what works best for you!

Have a great day everyone. I’ll see you back here tomorrow.

Tim Bohen

Lead Trainer, StocksToTrade