One of the biggest struggles new traders face is trying to find the right stocks to trade…

And while I do my best to share with you my top ideas each week. I want to do you one better today and explain why these trades work.

After all, good trading boils down to pattern recognition.

If you can find a winning pattern, then all you have to do is stay patient, and wait for it to repeat itself.

That’s why I’m going to go over two of the free ideas I recently shared, and why they worked…

Sound like a deal?

Okay, then let’s get started…

Why These Two Trades Worked

Veru Inc. (NASDAQ: VERU) was a watch for a weak open red-to-green move and you had the opportunity to trade it twice.

If it went too early for you the first time, you could’ve waited until post 9:45 a.m. for the second move.

And it was actually the more significant move…

That’s why the 9:45 a.m. or later rule doesn’t just keep you safe from potential failed setups.

It can also make you wait for the stock to have more time to lure in shorts. And that can create even bigger moves later on.

And that’s exactly why waiting for the second VERU trade made it work so well…

The first move came within the first minute of the market open. Not an ideal time to enter a trade…

But the trade did offer a good risk level nearby at the lows of the premarket consolidation.

The second move was a better opportunity…

Now, you may have gotten caught in that fake-out green move around 10:15 a.m. Eastern. But if you were using the lows near $18.50 as your risk, you wouldn’t have gotten stopped out…

If you got in or added to your position on the second move, you could’ve moved up your stop and used the higher low around $18.80 as your risk.

Both were high probability setups with tight risk.

The next winning watchlist trade idea was SIGA Technologies, Inc. (NASDAQ: SIGA).

It also made a red to green move yesterday just like I outlined on the watchlist…

And it offered $2 per share of upside!

The red to green move in SIGA was beautiful…

It was trading low volume when it made a move near the open. But it held above VWAP. And we got a big push when high volume came in on the break above the previous day’s high.

So even if you were unsure about the red to green move … There was another chance to take your shot…

Today, watch it for a break above yesterday’s high of $27. It would also be new 52-week highs, so this could be on a lot of traders’ radars.

Now, not all my watchlist plans played out yesterday … But that could mean more opportunities today…

What to Watch For Today

When it comes to my watchlist feature stock, I had to make adjustments to my plan…

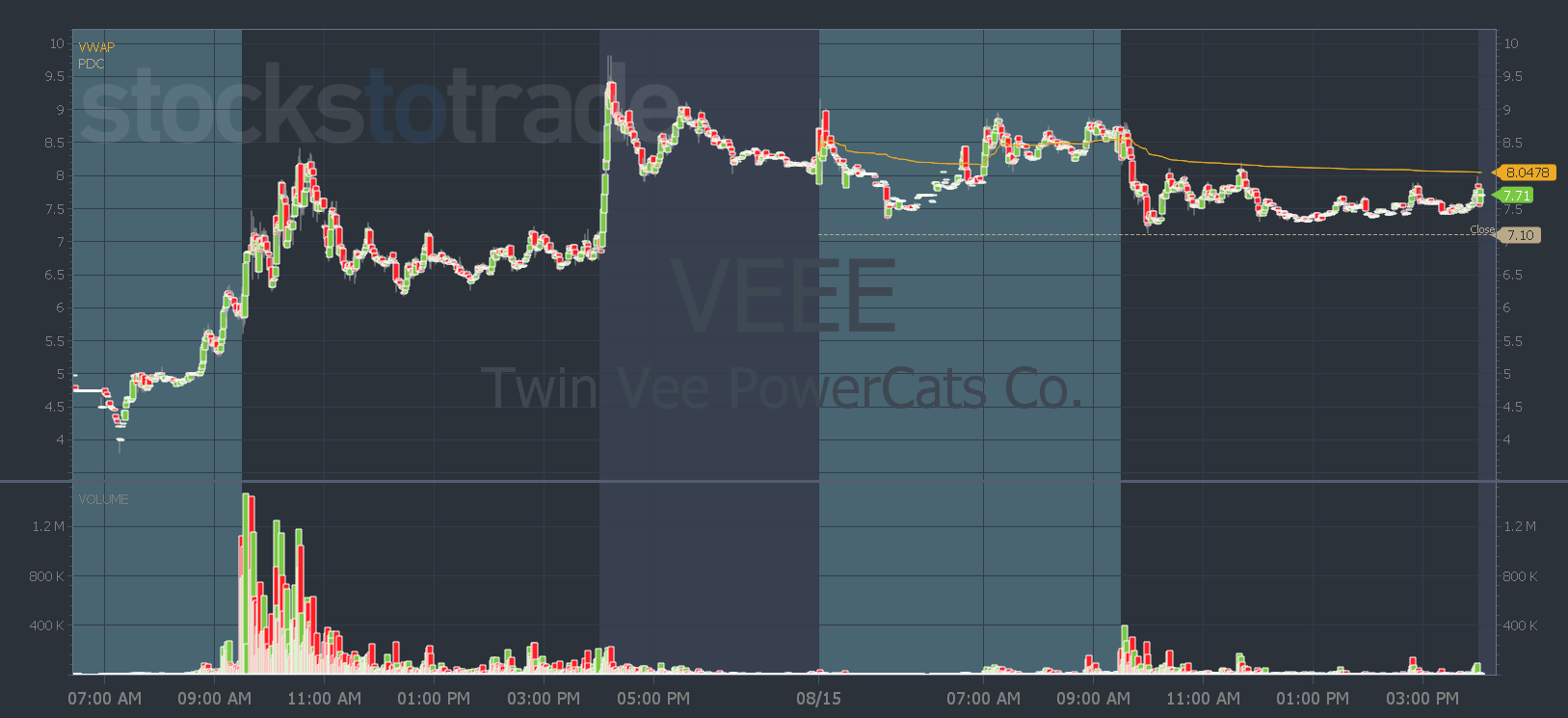

Yesterday morning in Pre-Market Prep and the SteadyTrade Team I had to adjust my plans for Twin Vee Powercats Co. (NASDAQ: VEEE).

I recorded the watchlist when VEEE was hanging around VWAP on Friday afternoon … I didn’t expect it to go from around $7 to almost $10 after hours.

So the new plan was a dip and rip over $9.

You can see we didn’t get that move. But the plan kept us safe. Plus, VEEE stayed green all day. That means it’s still a watch…

Today I’ll watch VEEE for a potential day-three surge — the $9 level is still key for more potential upside.

You could’ve gotten all these trade plans and updates for free…

So next week, make sure you open your weekend watchlist email. And tune in to Pre-Market Prep for free every Monday at 8:30 a.m. Eastern on YouTube for my updated plans.

Also, join me live for the rest of the week here.

Have a great day everyone. I’ll see you back here tomorrow.

Tim Bohen

Lead Trainer, StocksToTrade