We had a solid winning trade during the SteadyTrade Team webinar on Tuesday…

Now, typically I don’t like random afternoon spikers. But this one was different…

And I broke down what made it special, in real-time for SteadyTrade Team members.

It was a valuable lesson because it shows the power of low floaters and how they move on news…

I nailed the call again the following day with an interesting pattern I’ll explain later…

Meanwhile, the overall market was all over the place, trying to make sense of the Fed’s latest interest rate hike.

The reason why I want to dig into the play and explain why it worked so well, is because the news was special … And it created a 120% gain!

I want you to be prepared to take advantage of it next time it rolls around…

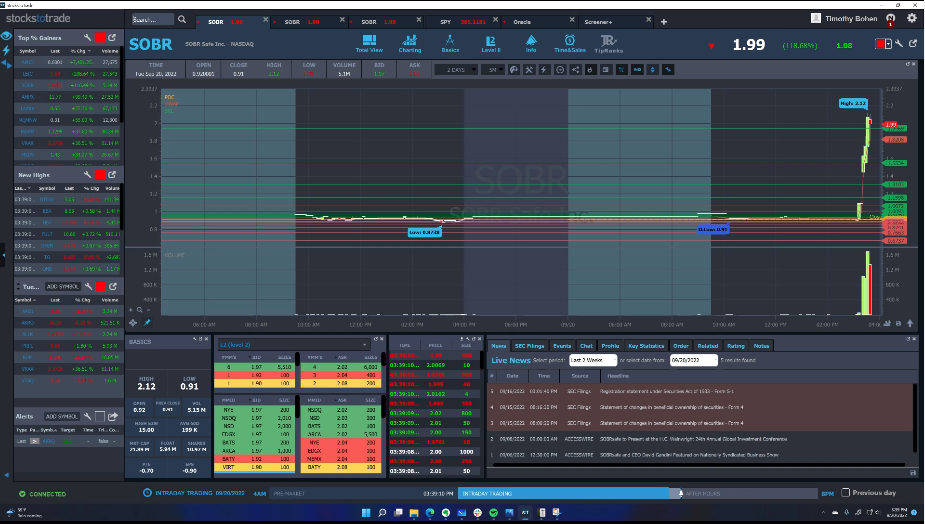

The News That Sent SOBR Soaring

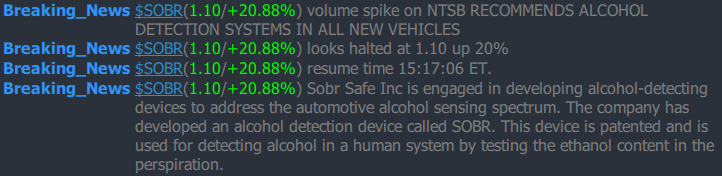

On Tuesday afternoon, the Breaking News Chat team alerted SOBR Safe, Inc. (NASDAQ: SOBR) after the NTSB recommended the installation of alcohol detection systems in all new vehicles.

The stock immediately halted at $1.10 after the news hit. And once it reopened it was trading at $1.45.

A few minutes later I went live in my afternoon SteadyTrade Team webinar and discussed the play…

The stock was spiking straight up and trading high volume. I said I liked it over the $1.94 Oracle resistance level on the chart.

It has a low float of 6 million shares and it traded roughly 2 million shares in 10 minutes.

And the news was interesting…

What Made This News Special

While some traders who know me might argue, “Tim, I thought you don’t like random afternoon spikers…?”

SOBR wasn’t random.

It wasn’t spiking due to a regular old penny stock press release … or a Twitter or chat room pump…

…And it wasn’t spiking on no news.

It had news. And not just any news — government news.

It reminded me of Digital Ally, Inc. (NASDAQ: DGLY) when it spiked after receiving a government contract for body cameras in 2015.

Now, I doubt the NTSB’s proposed requirement would ever pass. But whether you agree or disagree…

When government news pushes a stock — that makes it different.

I’m glad I was able to give this lesson live to SteadyTrade Team members.

Because as I was live in the webinar, SOBR gained volume and was coming up on float rotation … Then it blew through the Oracle level I said to watch.

I love to see members profit from the process…

![]()

![]()

![]()

![]()

![]()

![]()

But that wasn’t the end for SOBR…

Yesterday’s Trade Idea

In Pre-Market Prep I said to watch SOBR for a weak open red-to-green move over $3. I also sent my full trade plan to Daily Market Profit subscribers. (Get my number one pick and trade plan delivered to your inbox every morning here.)

A red-to-green move occurs when a stock opens lower than its previous closing price. Then it rips back upwards and crosses above the previous day’s close.

It can be a powerful move because the weak open draws in short sellers. And they typically use the previous close as their risk. So when it goes from red to green, shorts buy to get out, and that sends the stock higher.

With SOBR we got that move in the afternoon in the magic hour of trading. Just as the overall market dropped on the Fed interest rate announcement.

It gave traders an opportunity to catch a quick 30-cent per share move — that means you could’ve made $300 in profits on a 1,000-share position.

It doesn’t sound like a lot, but in this market, you can’t afford to get greedy. Take a lesson from SteadyTrade Team members’ trades in SOBR … Take a few cents a share, and you can always get back in.

We love penny stocks because they allow us to profit despite the doom and gloom the mainstream media pushes on us.

If you want to be in my next live webinar — join the SteadyTrade Team today! I’m sure we’ll be talking about our plan for SOBR today.

Have a great day everyone!

Tim Bohen

Lead Trainer, StocksToTrade