The penny stock action we’re seeing this week can be overwhelming…

There are just too many stocks to watch every morning. Even experienced traders can have a hard time focusing…

Of course, I love to see all the runners and potential trades. But the action can be a double-edged sword.

It almost creates anxiety…

What should I watch? Which stock will run? The FOMO can grip you hard…

And that can lead to chasing, revenge trading, or even paralysis and flat-out missing trades.

Nobody wants any of that. We want to find the best opportunities, trade a predictable pattern, and execute a successful trade…

So today I’ll show you three ways you can hone in and focus on wild market days…

1.) Pick Your Favorite

SteadyTrade Team members hear me say this a lot…

When there are a lot of runners — pick your favorite.

My number one doesn’t have to be your number one. You should have data on which setup works best for you…

So when you go through your process, focus on the best one or two stocks that have the potential for that pattern or setup.

If another stock goes and you miss it…

2.) Wait for The Afternoon

When I say wait for the afternoon, it doesn’t have to be the 2 p.m. window…

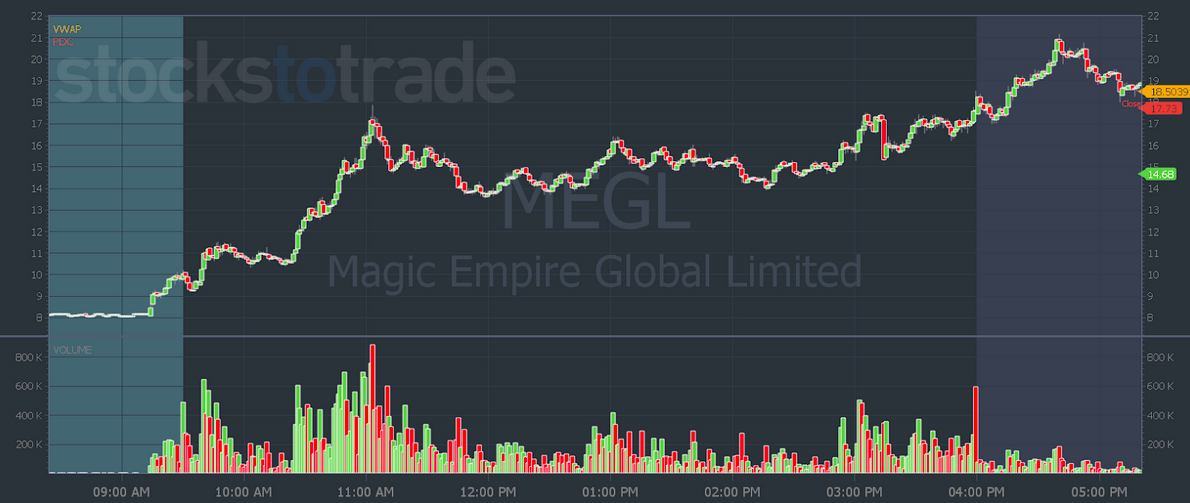

Look at Magic Empire Global Limited (NASDAQ: MEGL) … it was one of the biggest runners on Monday and it had its best move at 10:30 a.m. Eastern.

The same story was true yesterday…

In two of the biggest runners, you didn’t have to be first.

You could’ve played high of the day breaks and whole or half dollar levels all the way up…

But if you knew the news and the ‘why’ behind the moves, that could’ve added to your conviction to watch and trade these two stocks.

This is another way to hone in on the best potential stocks to trade…

3.) Focus on Story Stocks

I’m not here to spike the football — but I’m going to spike the football…

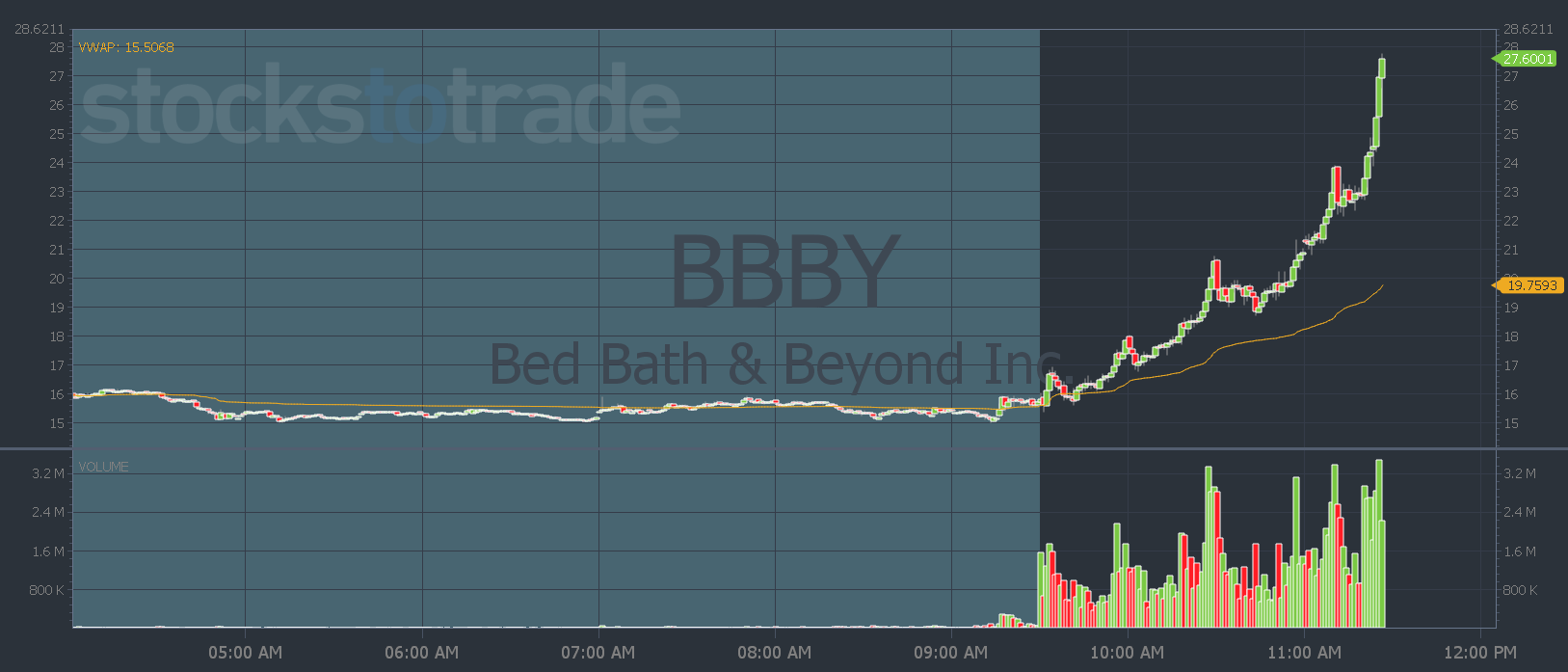

I outlined a beautifully detailed plan for Bed Bath & Beyond Inc. (NASDAQ: BBBY) on Pre-Market Prep yesterday morning.

Here’s why I liked it:

- Meme stocks are hot

- It’s heavily shorted

- Multi-day runner

- Closed at or around the high of the day on Monday

- Good Volume

So it had the potential for a sexy red-to-green move…

In premarket, it had a nice base around $15 and resistance at $16. That gave you a solid level to enter on the break above resistance with risk on support.

I even drew it all out on the whiteboard.

If you wanted to play it safe, you could’ve waited for the break above Monday’s high of $17. We didn’t see that move until 10 a.m. Eastern.

From there it just kept going…

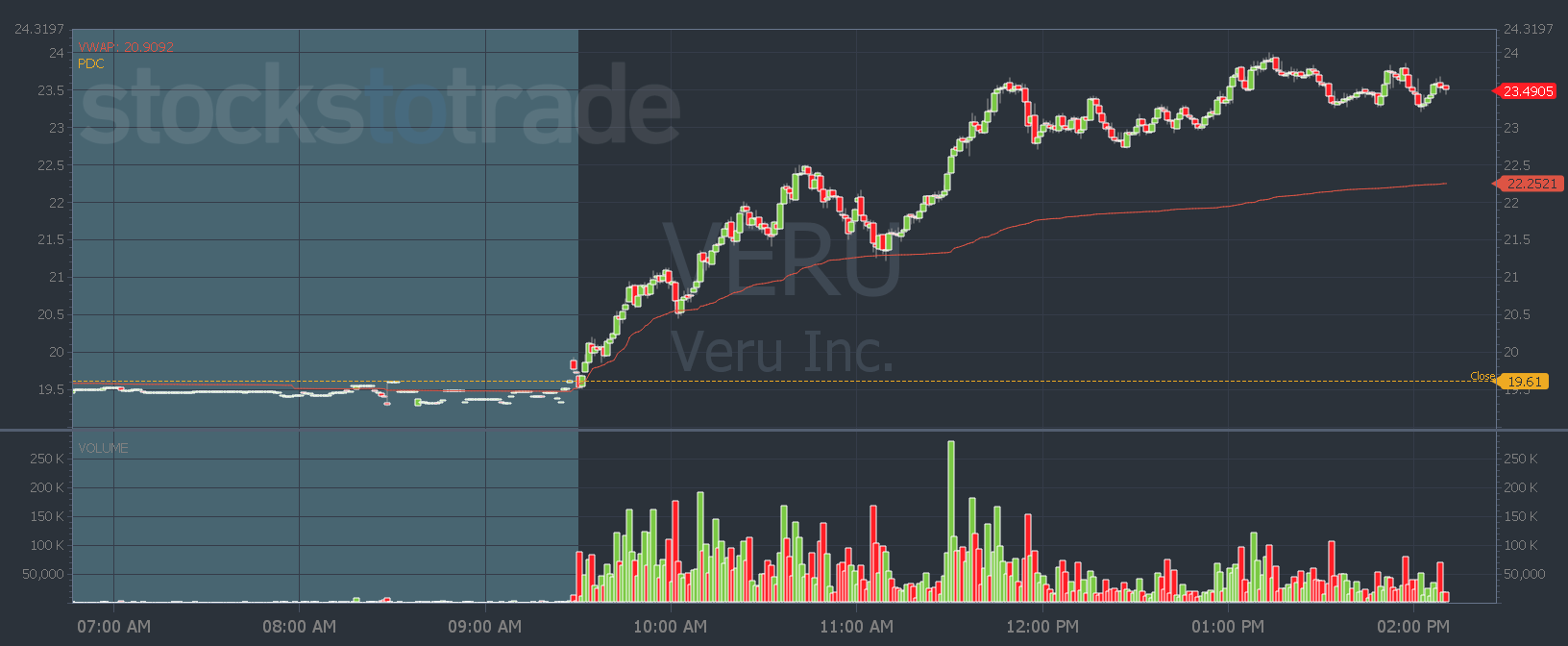

Veru Inc. (NASDAQ: VERU) was another top watch for a weak open red to green.

I didn’t go into as much detail on the webinar with this one, but it still had an incredible move…

So what made both of these stocks run?

They’re story stocks with momentum…

BBBY is a meme stonk and it’s been running for multiple days. Plus, it had news…

Right at the open, the Breaking News Chat team sent an alert that RC Ventures upped its stake in the company.

The Breaking News Chat also let traders know that the venture capitalist firm had previously upped its stake in GameStop Corp. (NYSE: GME) and moved that stock as well.

VERU is a COVID stock … And while you might think it’s old news, it’s still around…

And the news still spikes stocks…

Right near the market open yesterday, the Breaking News Chat team sent out an alert that the First Lady has COVID.

With that news, most traders are going to look at the biggest recent COVID stock that’s running.

Plus, both VERU and BBBY are heavily shorted. They’ve run for multiple days, and the higher they go, the more shorts try to guess the top.

God bless the short sellers!

Have a great day everyone. I’ll see you back here tomorrow.

Tim Bohen

Lead Trainer, StocksToTrade