What’s a current craze in the stock market? Meat that’s not meat, it’s actually vegetables … kinda … Hey, I won’t eat it, but I’ll trade the stock if it smells right.

I’ll tell you all about it in this post, but that’s not all. You’ll also find out about how the trading community came together to educate each other while raising funds for charity…

Plus you’ll hear about the crazy life of a hedge fund guy turned globe explorer on the back of his motorbike. ..

All that and more. Read on for the latest edition of Tim Bohen’s Take …

Table of Contents

What’s the Haps

My friends, let me tell you — I’m loving this summer weather! I know, I say that a lot lately, but it’s true.

I’m outdoors a ton these days: landscaping, laying concrete, building a wall, and doing some bass fishing. My son and I even competed in a bass fishing tournament. It was a great time!

On the trading front, I had the honor of being invited to speak at the Benzinga Trading Summit.

I was excited! The summit looked amazing, had a great line up and I was excited to catch up with a bunch of old trading friends…

The day before the event, I took the two-hour drive to Grand Rapids to get my flight. That’s when disaster struck.

I get to the airport, sit down, open up my laptop and BAM, there’s a notice from the airline that my flight was delayed.

Now, delays aren’t always the worst. It’s often just an awkward wait at the airport, but it meant that I’d miss my connecting flight from Chicago — disaster!

To make matters worse, I call up the airline and find out there’s a two-hour delay to speak to somebody. That’s when I started to realize I wasn’t going to make the summit…

So, all-in-all, I had a four-hour road trip from my house to the airport and back — all for nothing!

Pro travel tip: Never take the last flight out when you have an important meeting the next morning.

Either way, I heard the summit was amazing. Sorry to anyone who was excited to hear me speak — I hope to see you next time!

My Most Exciting Trade Setup

I have a super easy pick for the most exciting recent trade setup.

This is a stock that I and the StocksToTrade team consider to be quite possibly the best higher-priced stock to day or swing trade on the market today.

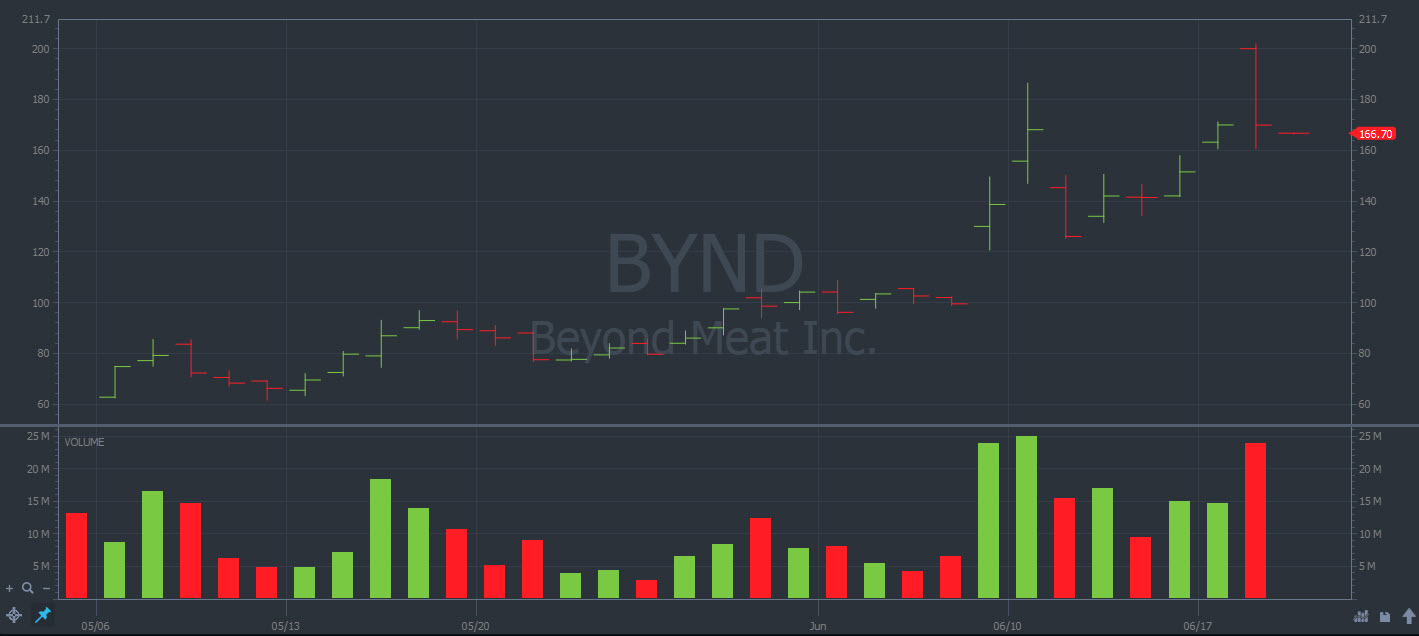

That stock is BYND on the Nasdaq — that’s the ticker for Beyond Meat Incorporated.

BYND has been on the StocksToTrade weekly watchlist for a few weeks now, and members in the StocksToTrade Pro chatroom mention it all the freakin’ time.

The particular setups we’ve been looking for are simple breakouts on high volume, and they’ve been working amazingly well.

So, why is BYND such a hot stock?

The simple answer: It’s in a blossoming industry that a lot of people think could boom in the coming years. The product is a vegan, plant-based meat substitute.

Now, don’t get me wrong … You won’t find any of this plant-based ‘food’ in the Bohen household. We’re a meat-eating family and proud of it…

But, you can still love a stock even if you’re not a fan of the product. What matters is that other traders and investors see exciting prospects for the company. And it looks like the market’s voting that way…

Already, BYND’s IPO is being touted as the most successful IPO in years.

The company IPO’d for $25. But when trading commenced in May, the very first price printed was $46. Hot stock is an understatement.

Since then, we’ve seen this thing go nuts. It seems like every minor pullback is met with a wave of massive buying pressure, pushing the stock to new highs. That’s why I think these simple breakout plays can work so well.

We even saw the stock gap up to open at $200 on June 18, before pummelling back to around $160 in a single trading session.

At the time I’m writing this, the stock’s headed higher. A truly wild ride. So, what are the lessons we can glean from BYND?

First, some traders like to short these supernova type stocks after they made a sudden massive up-move. But I’d never want to short a stock with the level of hype around BYND. Everyone’s talking about the stock, so who knows where the top could be…

Second, at StocksToTrade, we often focus on trading the lower-priced stocks. The stocks below $10 or so in price, FOR EXAMPLE, can have big, fast moves with great trading opportunities for a savvy retail trader.

But that doesn’t mean we never trade higher-priced stocks. BYND has been making huge, penny-stock-like moves, so it’s been a good play for some of us in that arena.

There’s a little trick I use in situations like this: The Rule of 10. This is where you take a higher-priced stock and move the decimal point one (or more) spot over … You’re effectively turning a $50 stock into a $5 stock in your mind.

It’s definitely NOT a trick you want to use with every stock. But if you want to get into with higher-priced trades, it can be a useful little mind hack.

StocksToTrade Feature of the Week

Do you want to hear about five stocks that I and the StocksToTrade team look at each week?

Do you want to hear about those stocks for the grand price of ZERO dollars?

If you just shouted YES, then I have to tell you about the StocksToTrade weekly watchlist.

This is our mailing list — you can sign up for free and each Sunday we’ll send you out a list of five stocks that we think show some potential.

We’ve had some great stocks listed on the weekly watchlist recently. Case in point: the BYND stock has been on the weekly watchlist for a few weeks now.

So, if you’re not already on it … Click this link to sign up and receive the StocksToTrade weekly watchlist.

What Am I Reading Right Now?

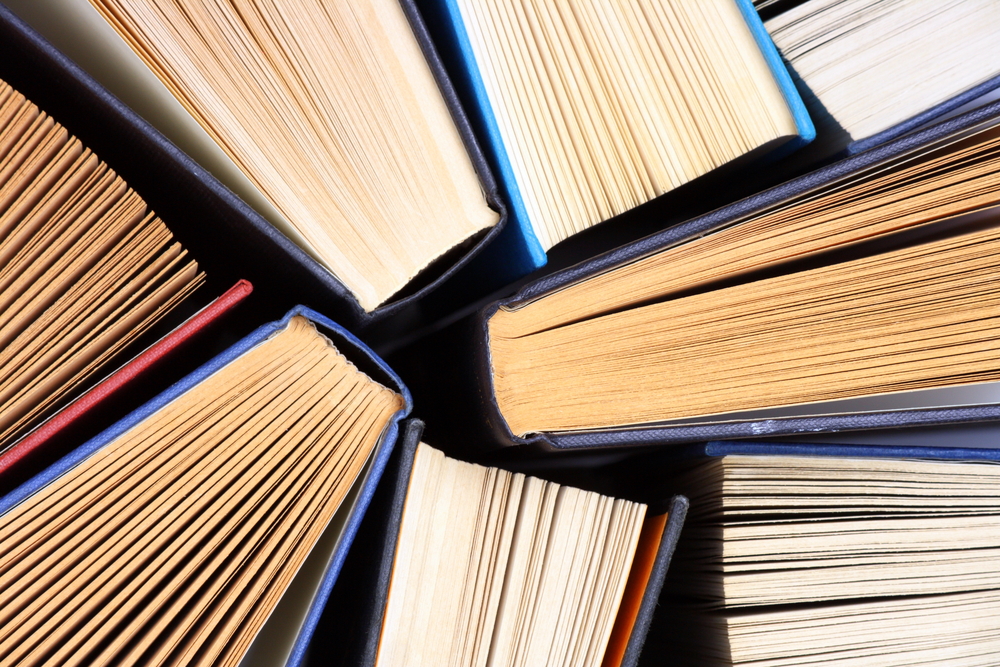

At the moment, I’m reading like a madman, studying up for an upcoming podcast guest who I’m nuts about.

That guest is none other than Jim Rogers, and I think he’s one of the most interesting men on the planet.

He’s famous in the finance world for working with George Soros at the start of his career, quickly making his fortune in the hedge fund business and retiring in his 30s.

Did he settle down and play golf after retiring at such a young age?

Hell no! He’s had all kinds of adventures instead.

Just to list a few, at one point he rode his motorcycle all around the world. He then outdid that adventure with a second trip around the world in a converted Mercedes.

He used these trips for fodder, writing a book for each adventure. He was even one of the earliest investors in the China boom … He was able to see what was happening on the ground before everyone else knew about it.

Cool guy, right? He’s written ten or so books and I’m trying to read as many as I can before we get him on the podcast.

At the moment, I’m deep into his book “Street Smarts: Adventures on the Road in the Markets.” I’m actually re-reading this one. I first read it six years ago or so and remember loving it.

In the book, Jim explains a ton of things, including his philosophy on life, thoughts on the global economy, the rise of China, and why he chose to relocate his family from NYC to Singapore.

This is a finance book that I recommend not just to traders but also to people who aren’t as interested in finance and stocks. It’s an amazing read.

Tim Bohen’s Take : The Wrap

That’s it, gang…

I hope you learned some great lessons from the BYND trade. Sometimes these ultra-simple breakout trades can work amazingly on a stock that has so much hype behind it.

Make sure you’re on our weekly watchlist to help you keep up with some of the hottest stocks, like BYND.

And if you’re craving more trading action AND education, join me at StocksToTrade Pro.

You can see which stocks I’m watching each day, participate in our chatroom, and attend educational webinars. Traders of all levels are always welcome!

Words can’t express how excited I am to have Jim Rogers on an upcoming podcast of SteadyTrade, make sure to go here and subscribe so you don’t miss out.

I don’t eat vegan meat — yuck! But I’ll happily trade the stock when it’s hot. Do you ever trade stocks even though you hate the product? Share your stories … I’d love to hear your experience! Thanks for reading another install of Tim Bohen’s Take!