Many traders are struggling to trade this choppy market…

They’re getting caught in false breakouts … Getting shaken out in big pullbacks… and missing entries on fast-moving stocks…

It may feel like weeks since you nailed a solid trade.

With all of that choppy action when the market is open, you may be thinking about trading in premarket when things seem a little calmer…

But before you take a trade, make sure you know what you’re getting into…

There are three things you must know before you trade in premarket … But if you can follow these guidelines and establish rules, you may find success. Plus, it doesn’t hurt to have some help with trade plans…

Three Things To Consider Before You Trade Premarket

There are winning trade opportunities in premarket (like the two I’ll show you shortly), but premarket can also be dangerous…

Premarket trading starts at 4 a.m. Eastern and lasts until the market opens at 9:30 am.

During that time you may see tons of premarket gainers and be tempted to jump in…

But wade into this strategy carefully with these tips…

Look For Volume

In premarket stocks can move on very little volume.

If you don’t take your time and look for a stock trading huge volume relative to its float — you could get yourself stuck in a position.

If you buy into a low-volume spiker, there may not be a buyer when you want to sell. You can get stuck having to reduce your ask price just to get out.

And that can end up in bigger losses than you expected.

Consider The News

Stocks can spike in premarket when a press release drops at 8 a.m. Eastern (the most common time for press releases).

Often the spikes are caused by algos, short sellers, and uneducated traders who buy any stock with a press release.

But those traders who jump in stocks with news don’t take enough time to digest the news.

It’s better to wait and give more traders the chance to interpret the news and let the chart set up.

Look for a stock that has the volume I mentioned earlier, and for the stock to hold up and consolidate in premarket.

That can give you a risk level for a potential trade before you consider entering.

Buy In Pre, Sell in Pre

If you do enter a trade in premarket, I always recommend traders take profits before the market opens. Because what happens in premarket doesn’t really matter once the market opens…

You get a ton more volume at the open…

Traders who were in the stock early take profits. And short sellers take positions…

In short, there’s a ton of volatility.

That’s why I say, if you buy in premarket, sell in premarket. Then let the market digest the news and let the stock establish a trend. You can always get back in after the open if a pattern presents itself.

My number one watches in the last two days both made their moves in premarket…

So let’s break them down and see if you could’ve traded them considering the three lessons I just gave you…

Two Premarket Trade Examples

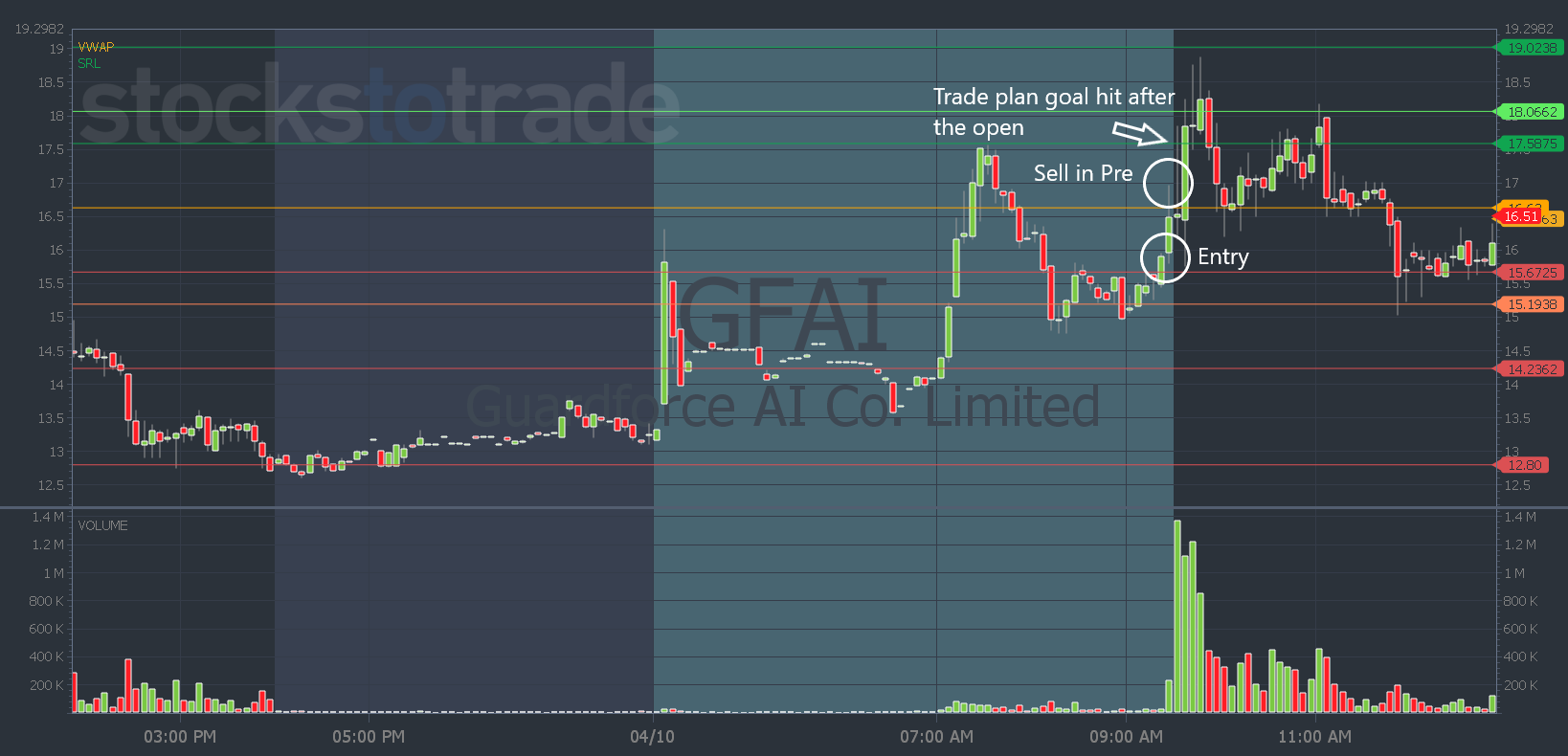

On Monday my top watch was Guardforce AI Co., Limited (NASDAQ: GFAI).

It was gapping up in premarket after a big selloff during the previous afternoon. And it spiked $4 per share at 7 a.m. Eastern with no news and with no other action in the artificial intelligence sector…

So that proved to me it was LOADED with shorts.

My plan included an entry at $16 risking a VWAP fail at $15.50 and a goal of $17.50 which was the premarket high.

You can see if you followed the plan, it played out perfectly. But if you follow the guidelines I just gave you and sold in premarket — you still had the chance to make $1 per share.

It had enough volume right before the open. It didn’t have news but it’s a multi-day runner in a hot sector … And short sellers can be enough of a catalyst sometimes, even without news.

Yesterday my number one watch moved in premarket again…

I was watching Innovative Eyewear, Inc. (NASDAQ: LUCY) after the company put out a pumpy artificial intelligence-related press release.

The stock is a low float and a former runner…

In my trade plan, I thought it ran too early so I wanted a pullback. But if we didn’t get a pullback and you missed the early move, I said it was also a watch for an afternoon VWAP hold.

Well, both plans played out…

LUCY made its move early, so if you didn’t want to trade premarket, you could’ve caught the afternoon move.

But in premarket, you could’ve bought my proposed entry at $3.25 with risk at $2.99 and you could’ve sold into the push to the goal of $4 before the market even opened.

The stock had volume, news, and you could’ve bought in pre and sold in pre…

I delivered both of these trade ideas to subscribers’ inboxes in premarket on both mornings.

If you would have taken these two trades using the guidelines above, you could’ve made combined profits of $1.75 per share or a 29% gain in just two days!

And you wouldn’t have had to sit in front of your screen all day.

👉 Watch this to see how I combine the power of our proprietary algorithm and my 15+ years of trading experience to deliver you trade ideas with a proposed entry, goal, and stop…

Get the power of man and machine working for you and I’ll deliver my top watch and game plan to you tomorrow morning!

Have a great day everyone. See you back here tomorrow.

Tim Bohen

Lead Trainer, StocksToTrade