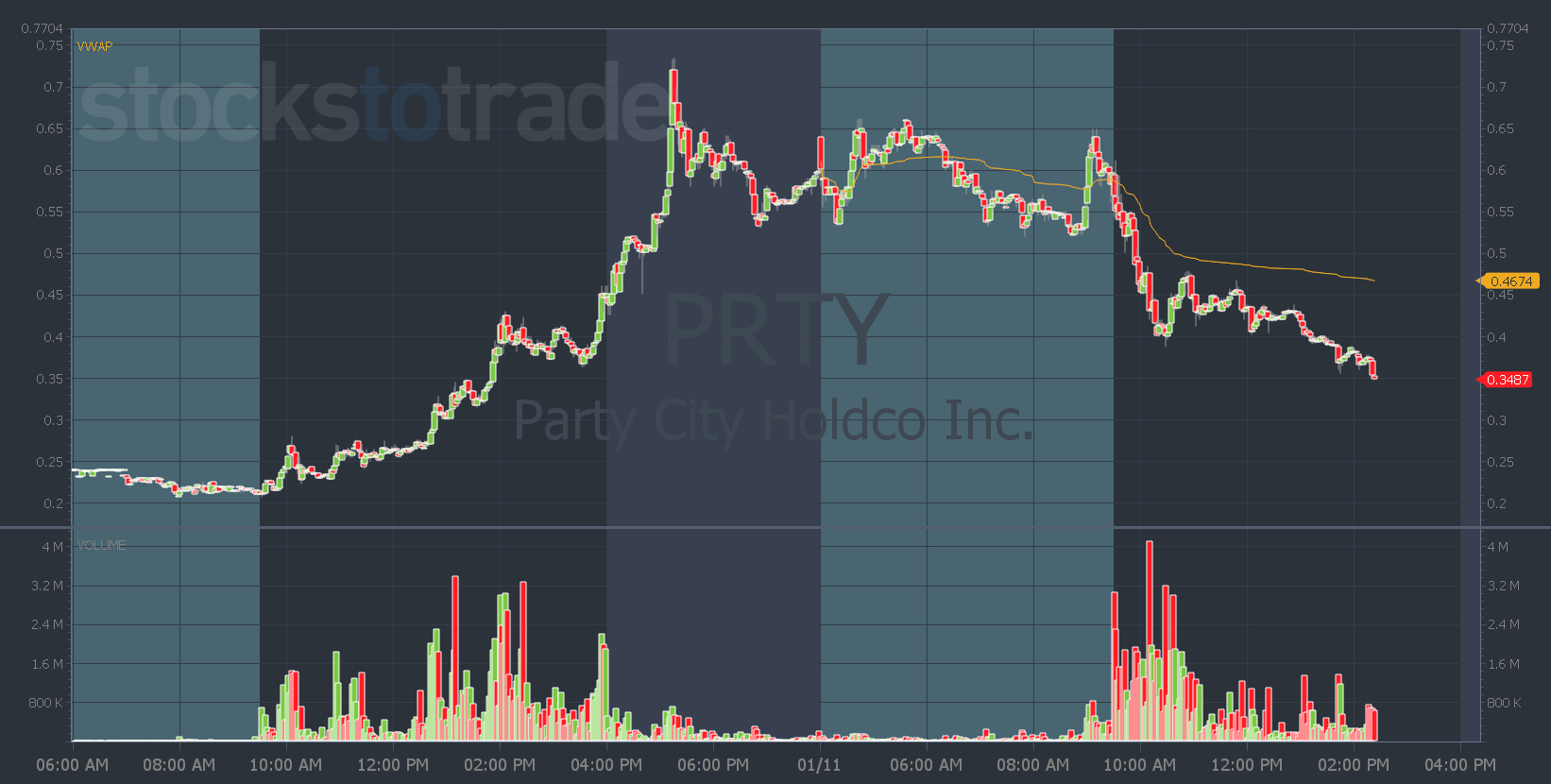

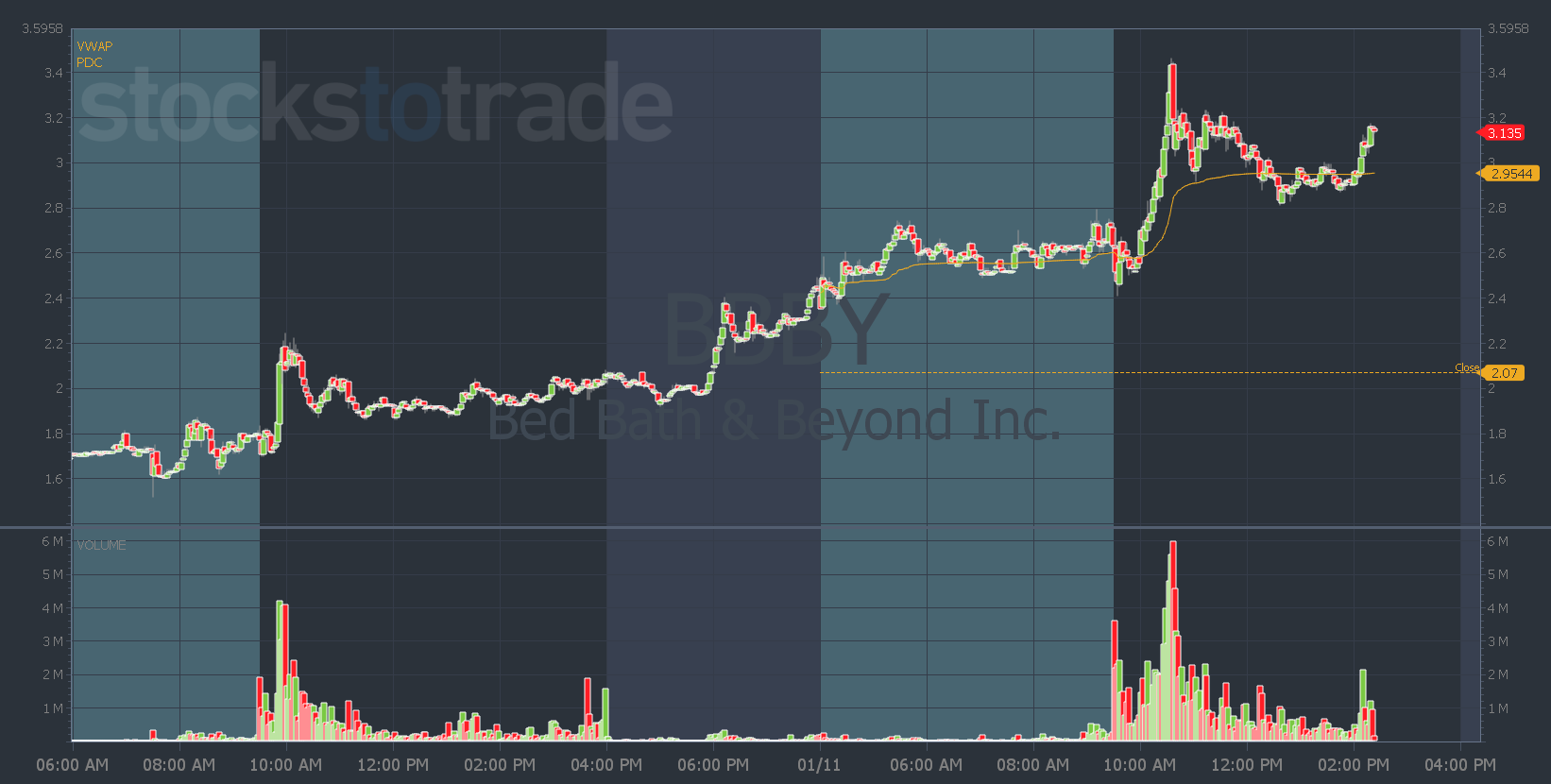

Over the last 3 days, Bed Bath & Beyond Inc. (NASDAQ: BBBY) and Party City Holdco Inc. (NYSE: PRTY) were up as much as 121% and 177% respectively.

But I don’t like them…

It might sound counterintuitive to not like two of the biggest trash stock runners. But hear me out…

Holding onto these stocks is like removing the pin from a grenade and holding it in your hand …

Yes, you can make money in the short term. But is the risk worth the reward?

These bankruptcy plays always end badly.

I said it on Pre-Market Prep yesterday…

They’re like the ticker RDBX from last summer. We knew how it was going to end… And now the stock isn’t even listed anymore.

So here are the rules if you can’t ignore these degenerate bankruptcy plays…

How To Trade Sketchy Bankruptcy Plays

BBBY and PRTY are some of the most liquid big gainers of the week, so I don’t expect you to ignore them completely.

There are ways to profit from the moves. But there’s one big caution I have for traders about these tickers…

Why I Don’t Like Them

The biggest thing I see people get tripped up with on these bankruptcy plays is they fall for the hype.

People see posts on Twitter that say PRTY is going to $1 and BBBY is going to $5…

And they believe it.

I’m not saying BBBY can’t go to $5. But the problem comes when traders take a position and the stock goes up — they see profits and think it’s great. So they hold it.

They think they’re going to catch some gap-up moves and shorts will get squeezed, but the next day news could hit and it gaps down 30% and it never bounces again…

Then they keep holding for a bounce that never comes, they hold until it’s delisted and literally lose everything.

The end game with all bankruptcy stocks is the same — they’re going to zero.

And I don’t like to see new traders lose everything.

How to Trade Bankruptcy Stocks Instead

The first rule for trading bankruptcy stocks is I don’t like them on the first day no matter what.

But once they continue and prove themself — that changes everything.

Tuesday was the second day of PRTY’s perk, and the best trade was in the afternoon. But it got destroyed yesterday…

On day one BBBY went sideways. Then on Tuesday, it had a quick spike after a dip and rip. And had another nice one yesterday…

This is why I only like these stocks after they prove themselves. It can just help you stack the odds in your favor.

The second rule for trading these stocks is to stick to day trades only.

Traders who stay agile can trade them with no problem … You can get in and out quickly, trade the patterns, and it can work out great.

Just don’t get caught up in the hype and think you’ll catch a gap up from holding overnight.

The risk is so much higher than the reward.

Either don’t trade them. Or know that you’re trading something that will eventually get destroyed, most likely get delisted, or go to the OTC markets.

Day trade them, take quick gains, and don’t aim for home runs.

Have a great day everyone! See you back here tomorrow.

Tim Bohen

Lead Trainer, StocksToTrade

P.S. I told you to watch your inbox for exciting news yesterday — did you see it? If you missed it, check it out here!