The markets took a dramatic turn over the last week.

I’m not kidding … just look at two of last week’s biggest movers…

They weren’t up on some macro headline news or a perfectly timed penny stock PR…

Nope.

Both were up because of idiot short sellers. So even though I talk a lot of smack about short sellers — I love them.

They create these powerful moves and repeatable patterns we can take advantage of.

Today I’ll break down two beautiful Friday squeezers, then I’ll tell you where to look for the next big move! These big gains are just the tip of the iceberg…

Looking for more potential short squeezes? Get top tech tools working for you!

Two Textbook Friday Short Squeezes

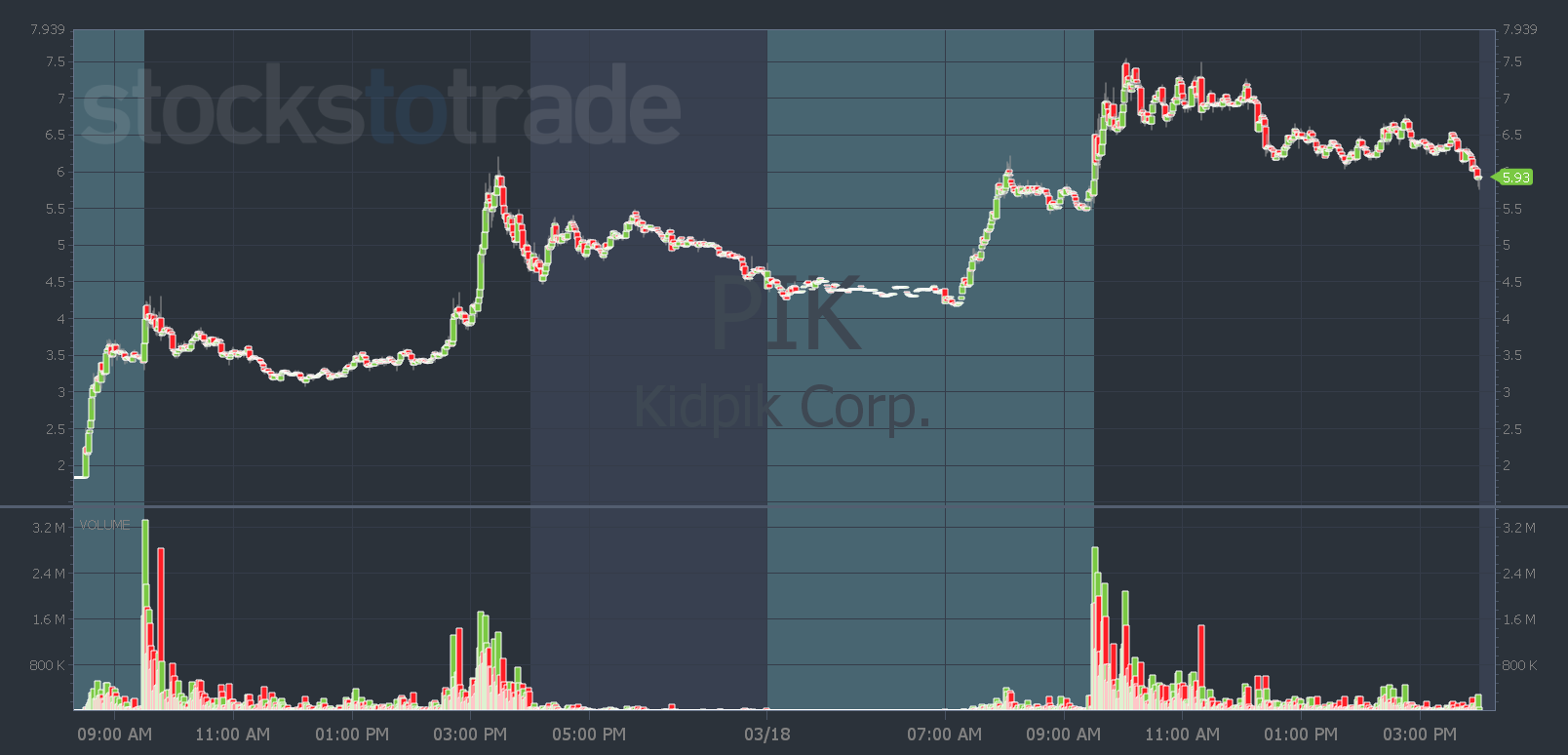

Let’s start with my number-one watch on Friday — Kidpik Corp. (NASDAQ: PIK)

It was the most liquid play on Oracle in premarket yesterday. It was as good as it gets for a potential Friday short squeeze:

- High volume

- Dubious sketchy news

- Low float

- Glorious afternoon squeeze the day before

- Ugly chart

It spiked in premarket and set a high around $6. Then it trended sideways. So my plan was to watch for a weak open, then a break above $6 risking the $5.50 level.

But it didn’t open weak. It spiked right at the open and gained over $1 per share — a 25% move!

But if you think PIK spiked from $3 to $6 on Thursday, and from $6 to $7.50 on Friday because of the Disney news — we have a problem.

Time for an intervention…

The reason behind PIK’s $4.50 per share gain in two days isn’t due to the news. It’s because of idiot short sellers.

And it was one of the best low float short squeezes we’ve seen in a while.

Learn how to recognize a low-float Friday short squeeze here.

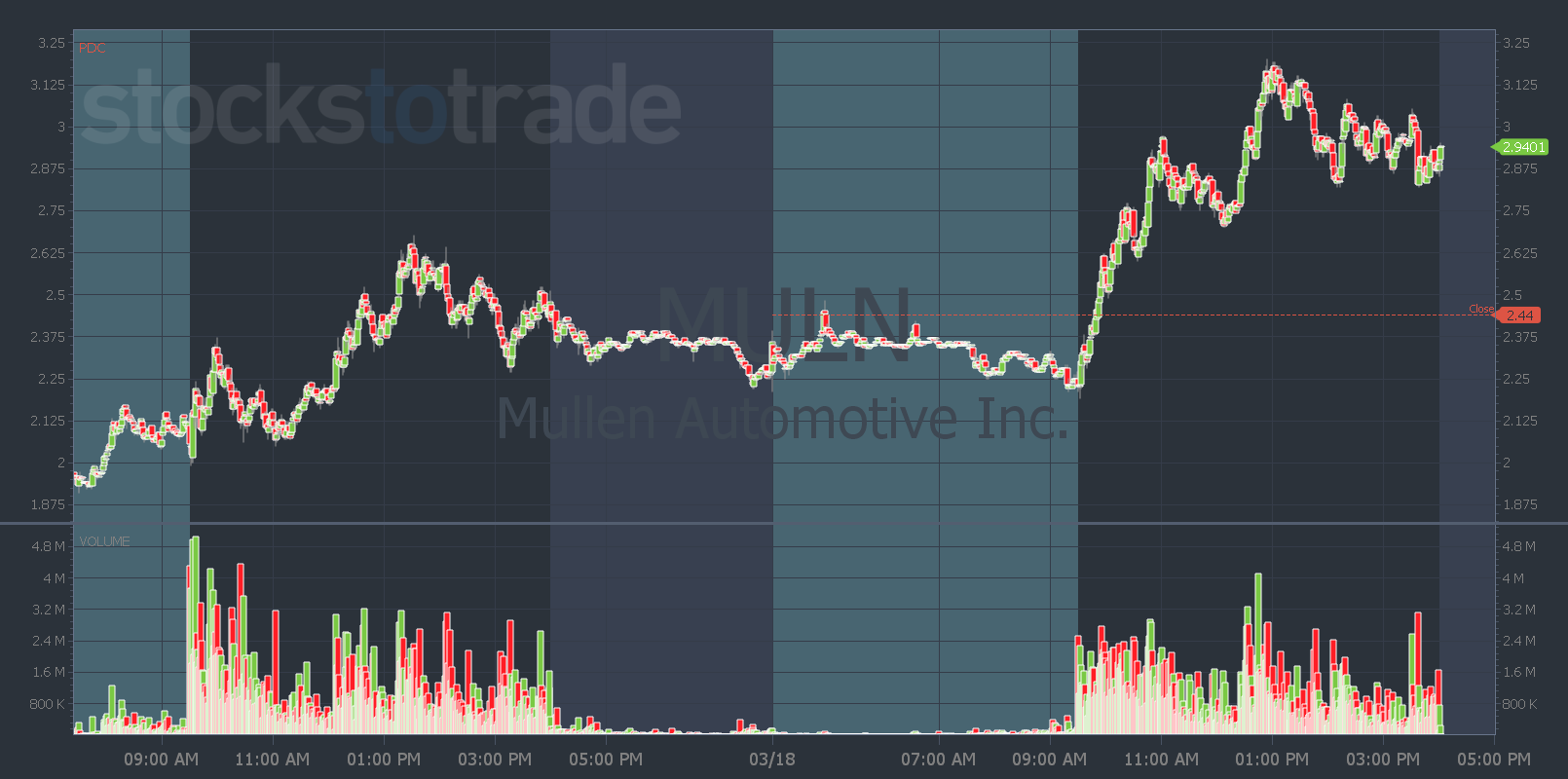

The next big Friday squeezer was Mullen Automotive, Inc. (NASDAQ: MULN).

Just like PIK, there’s only one reason it went from $2.20 to $2.60 on Thursday and didn’t gap down huge on Friday: trapped short sellers.

And when it went from red to green on Friday — boom!

It squeezed from roughly $2.40 to $3.20. That’s a 25% gain on a break above a key level and a textbook repeatable pattern.

Again, MULN isn’t up because of its EV (that will probably never get built) or because Yahoo Live and CarBuzz featured the company…

When a stock holds up for almost a month, there’s a high chance it’s because of trapped short sellers. There’s no other reason for it to still be up roughly 200% since it gapped up on February 28.

Watch this video to learn how to ride a short squeeze.

How can you use what you’ve learned about short squeezes going forward?

You have to find heavily shorted stocks…

And I think junky, low float oil and gas stocks could be next to have an epic short squeeze.

Recent low float runners like Indonesia Energy Corporation Limited (NYSE: INDO), Enservco Corporation (NYSE: ENSV) aren’t dead yet. They’re hanging around…

And just like we saw in PIK and MULN…

When key levels break — the squeeze could be HUGE.

Find all the biggest oil and gas runners NOW with StocksToTrade’s prebuilt oil and gas scans. They’re FREE for subscribers.

If you’re not a StocksToTrade user, there’s no better time to start than today! Get a limited-time monthly discount here.

But hurry!

Your StocksToTrade discount and your three free oil and gas scans disappear at midnight TONIGHT.

Have a great Money Monday. See you back here tomorrow!

Tim Bohen

Lead Trainer, StocksToTrade