The Fed raised interest rates by .75% yesterday — but as I said on Tuesday, it doesn’t affect the way we trade.

In fact, we had another huge penny stock gainer yesterday.

If you weren’t able to capitalize, don’t feel bad. Trading can be frustrating…

You’ll have losing trades, the wrong ideas, and bad timing…

But as frustrating as those are, they don’t make you a bad trader.

The key is to learn from your mistakes and adapt to what you see happening on the chart and with the price action.

It’s like having a baby…

The doctor gives you a due date for you to plan around … you think you have time to paint the nursery, get your bag packed for the hospital, and install the car seat…

But that baby can come anytime. And when it’s time — there’s no stopping it.

You gotta roll with it and adapt.

That’s what we did in the SteadyTrade Team yesterday…

I had the right trade idea, but I botched the timing. But it’s OK because the trade idea worked. Find out why and what you can learn from it below…

And see how you can uncover intel sources and utilize proprietary software and algorithms to find the best plays here.

The Key Level That Sparked a $10 Per Share Move

Yesterday in my morning SteadyTrade Team webinar, I said I didn’t like AeroClean Technologies, Inc. (NASDAQ: AERC).

At least not THAT DAY…

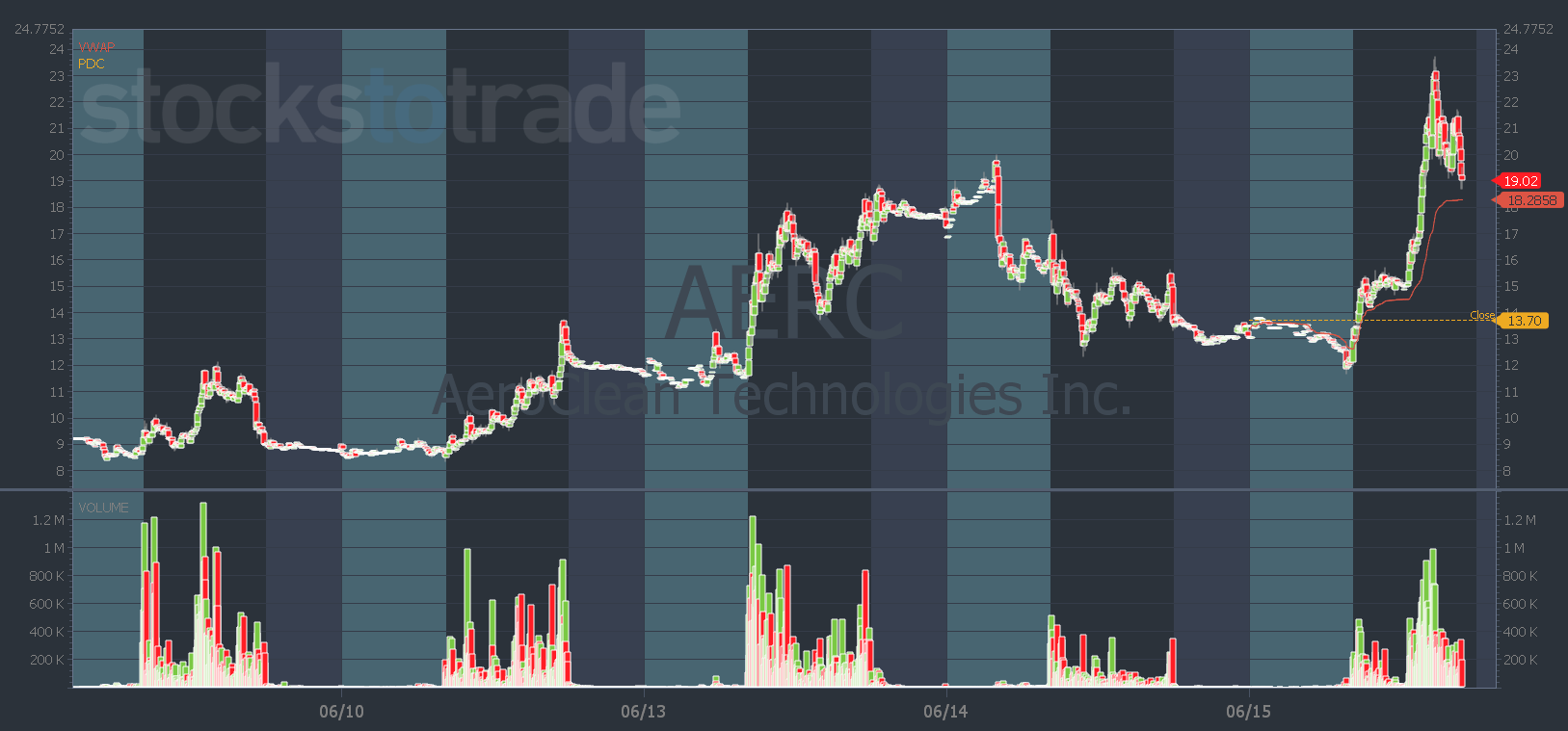

But, the stock was still up 600% on dubious news from a week and a half ago. And the shorts were still trying to guess the top.

So I liked it for a weak open red to green. But I wasn’t sure if it was the day for a big squeeze.

I know hope isn’t a strategy … But I was hoping that as we got closer to Friday AERC would slowly grind higher and squeeze through $20 on Friday…

But like the baby that’s ready to be born, AERC couldn’t wait…

It went from red to green, then squeezed through the high of the day, and Tuesday’s intraday and premarket highs. (Also, $20 is a whole dollar key psychological level.)

So there were multiple levels to trade off…

You could’ve bought the red to green move and held it as long as it was above VWAP. You could’ve bought the afternoon high of day break. Or any of the other levels it broke on the way up…

All in all, AERC soared a whopping $10 per share from the red-to-green level!

So while I might’ve been wrong about the timing of the move — AERC’s proof the patterns work.

It was an incredible red-to-green move. And it shows you the importance of how key levels come into play.

Discover all my patterns and when to trade them in my ebook. Better yet, sign up for Pre-Market Prep and it’s included!

Have a great day everyone. I’ll see you all back here tomorrow!

Tim Bohen

Lead Trainer, StocksToTrade