The easiest thing to do in this market is lose money…

A lot of stocks are running premarket and then fall flat down with no follow-through whatsoever.

So what can you do to avoid getting caught up in the chop fest and losing money?

You can try to trade premarket spikes — which I don’t recommend for new traders…

But I have a better idea that I’ll share with you shortly…

You see, there’s one key thing you can look for before jumping on a trade that can save you from a lot of frustration and heartache.

One Thing You Must Do In This Market

In my SteadyTrade Team webinars, I talk a lot about checking the boxes…

Make sure the stocks on your watchlist have a ‘why’ — reasons for considering the trade.

Things like:

- Volume

- News

- Low float

- Float rotation

But have you ever been in this situation…?

You see a big gapper in premarket…

It checks the boxes that indicate it could be a big runner … So you get in at the open thinking it will rip higher — but it falls off a cliff.

What went wrong?

First, you need to have a plan and pattern. So when you take a loss like that ask yourself which pattern you were trading…

Have a name for each setup you like to trade. If you can’t name the setup when you’re looking at the chart, then don’t take an entry. This can help you stay accountable for following those patterns and plans.

Because being a successful trader comes down to being selective and patient.

Not every premarket runner equals a trading opportunity. (Get help picking the best stocks and plans here.)

So the most important thing I want you to do in this market is to wait for confirmation.

What Is Confirmation?

Confirmation is waiting for that signal to hit before you enter a trade.

If you’re trading a dip and rip pattern, wait for the stock to break above its premarket highs. If you’re trading an afternoon VWAP hold, wait for the stock to break the high of the day.

Waiting for confirmation can cut out mistakes like:

- Guessing games

- Getting in too early

- Trading random setups

- Buying random spikes.

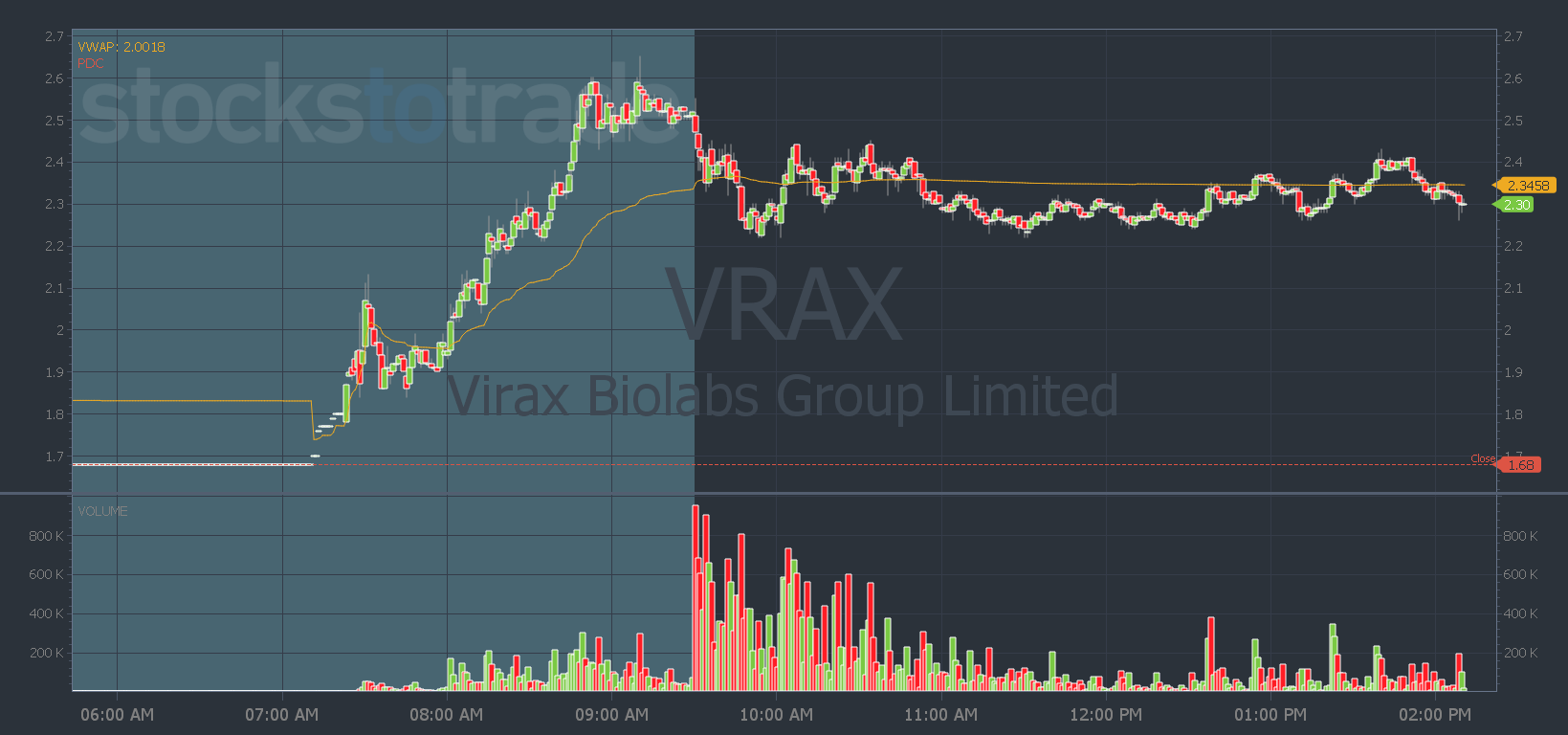

Yesterday, my number one watch was Virax Biolabs Group Limited (NASDAQ: VRAX).

It was moving on a COVID-related press release. It’s a former runner, it had good volume and a low float. And it rotated its float in premarket…

It had all the signs of being a potential runner.

My trading plan for SteadyTrade Team members included a signal entry at $2.73 … But the stock didn’t hit that level in the morning…

That means having a plan, being patient, and waiting for confirmation before entering keeps us safe from unnecessary losses.

Try to take a deep breath, control FOMO, and wait for that confirmation before you trade.

See how many losses this one simple step can cut out from your trading.

Want even more trading tips, insights, and lessons from me? Become a member of Stockstotrade’s FREE trading community today!

Don’t forget to answer all the questions to join. And engage with your fellow traders — that’s what makes this community so great!

Have a great day everyone. See you back here tomorrow.

Tim Bohen

Lead Trainer, StocksToTrade