Think about most people getting crushed in this market … They’re concerned about their long-term investments, their retirement … and are left wondering how much worse can it get…

They have all these questions…

Don’t you think it’s ironic that for years financial advisors and money managers have been trashing day trading, and preaching that key to financial freedom was buy-and-hold?

But how’s that advice working now?

Investors are getting crushed, and that includes the ones who parked their money in “safe” blue-chip companies.

While they’re having sleepless nights…it’s day traders who are the ones sleeping like babies.

They trade opportunities as they come, and they close out their positions by the end of the day and end the day in a cash position.

That doesn’t mean it’s smooth sailing in this market. But there are strategies working for day traders — I’ll share them today…

Plus, I’ll share some old-school Wall Street advice that day traders can ignore.

And don’t forget to claim your daily Hanukkah gift here!

Bad Advice To Ignore

Investors like Warren Buffet say things like “Invest in quality companies.”

Ok, Warren … What’s a quality company?

It’s subjective.

Most people don’t know what a quality company is until after they see the stock rise for years and the company starts to bring in cash.

By then, the stock is too expensive for everyday folks to buy a meaningful-sized position to see any gains.

Look at The Walt Disney Company (NYSE: DIS) … For years it was an investor favorite. Now it’s losing its luster. Will Warren Buffet tell you when to sell?

No.

They all push their picks on people through mainstream media … But you don’t know when they sell until after the filings come out. And the stock is already down from the massive amount of selling.

Who has the patience or stomach to hold through those large drawdowns?

Can you afford to lose money trying to chase investors who have billions of dollars?

Probably not.

That’s why day trading is great for the average Joe or Jane looking to get into the market.

Day traders trade what they see, then they go into cash.

And while the Dow Jones lost 500 points yesterday, day traders didn’t care.

They can take the day off and not place a trade. Or they can wait for the right opportunity to strike.

Right now, I think the best time to do that is to wait for mid-day or late-day moves.

Day Trading Strategies to Focus On Now

Morning moves right now are choppy. We’re not seeing clean follow through moves…

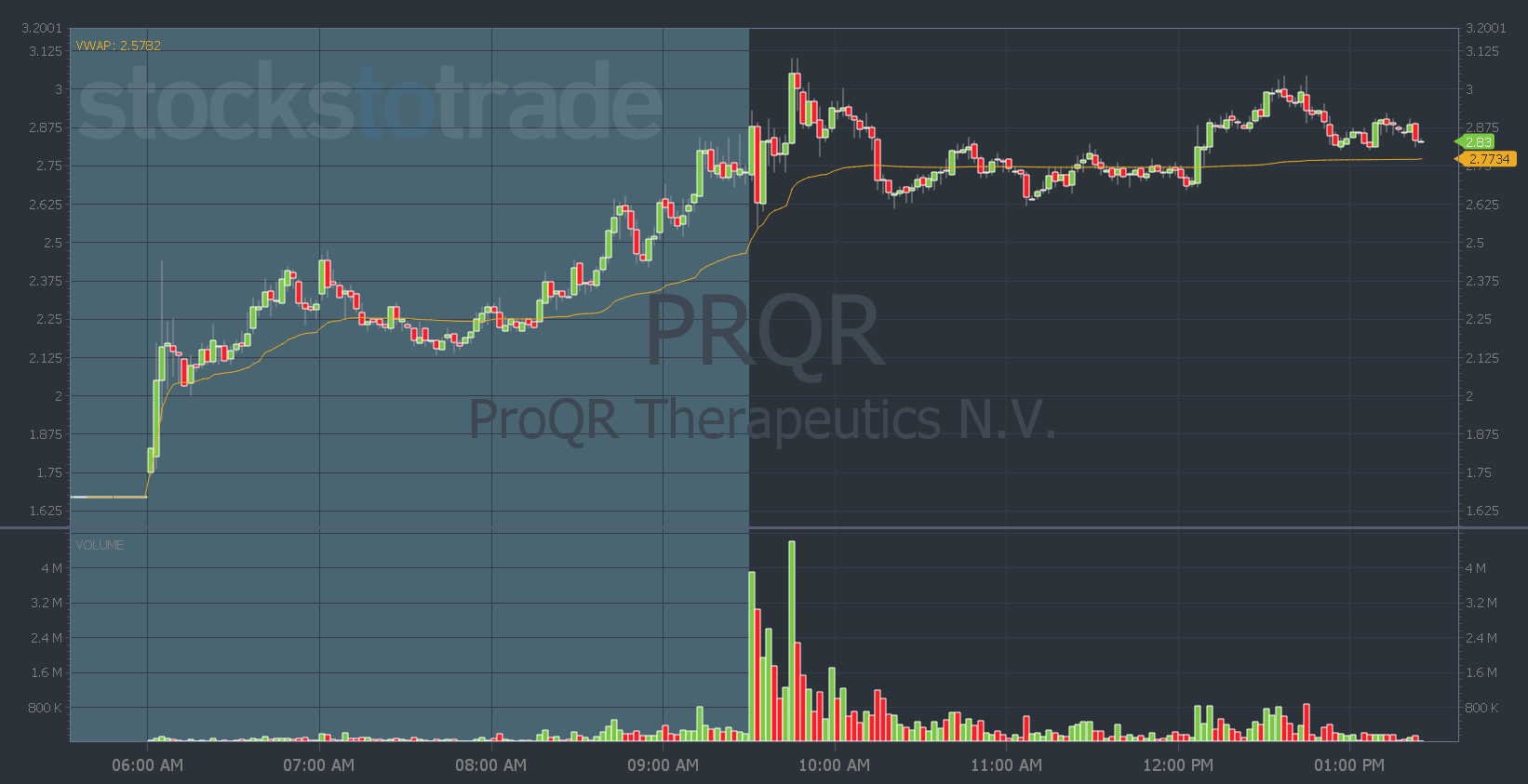

Yesterday ProQR Therapeutics N.V. (NASDAQ: PRQR) was my number one watch. But I said to wait for the afternoon.

This is why … Just at that choppy morning price action…

It chops traders up and scares them out of positions. That leaves them with small losses which can add up and lead to an account blow up by one thousand paper cuts…

But there are a few things working.

As I said, mid-day and late moves are better right now…

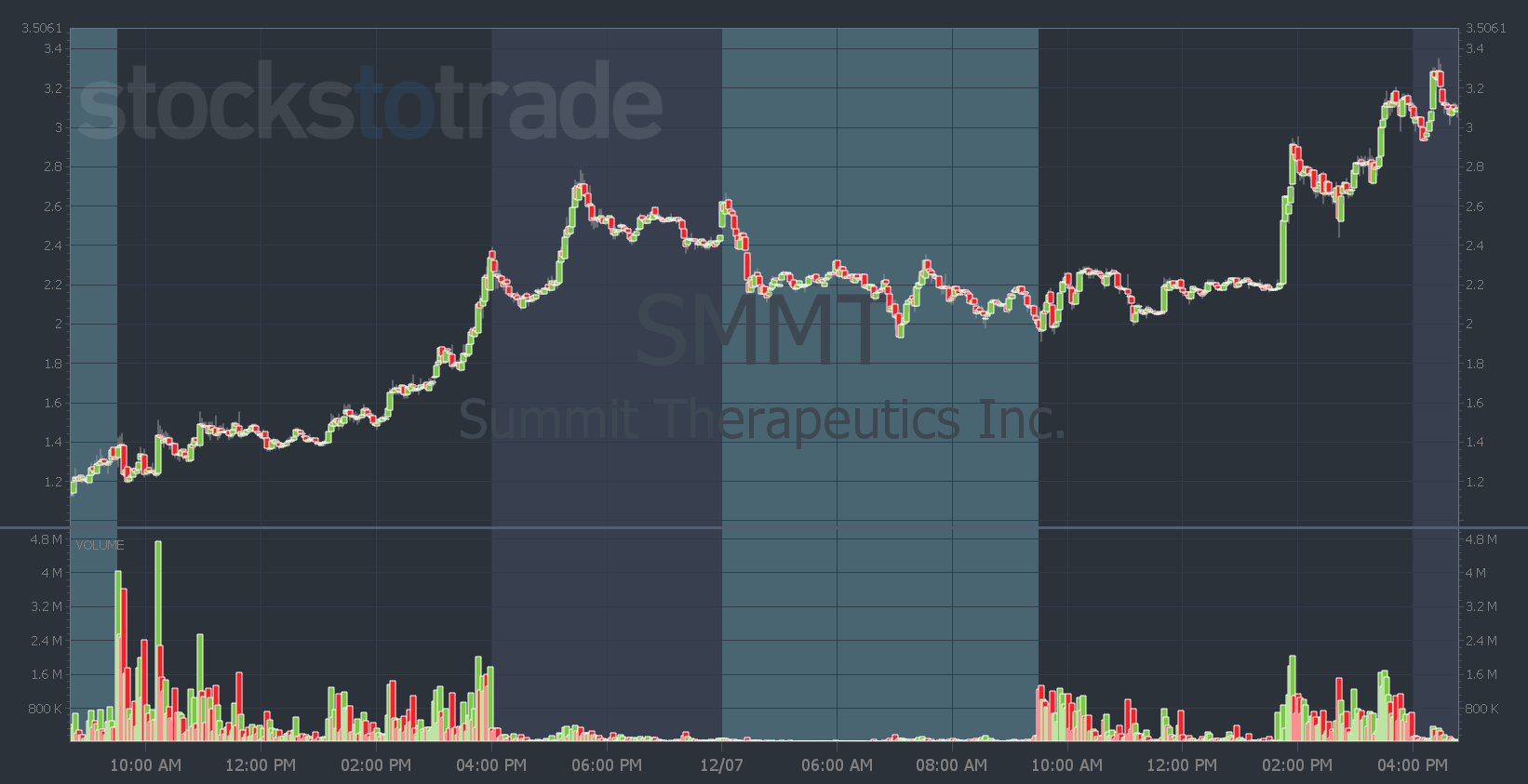

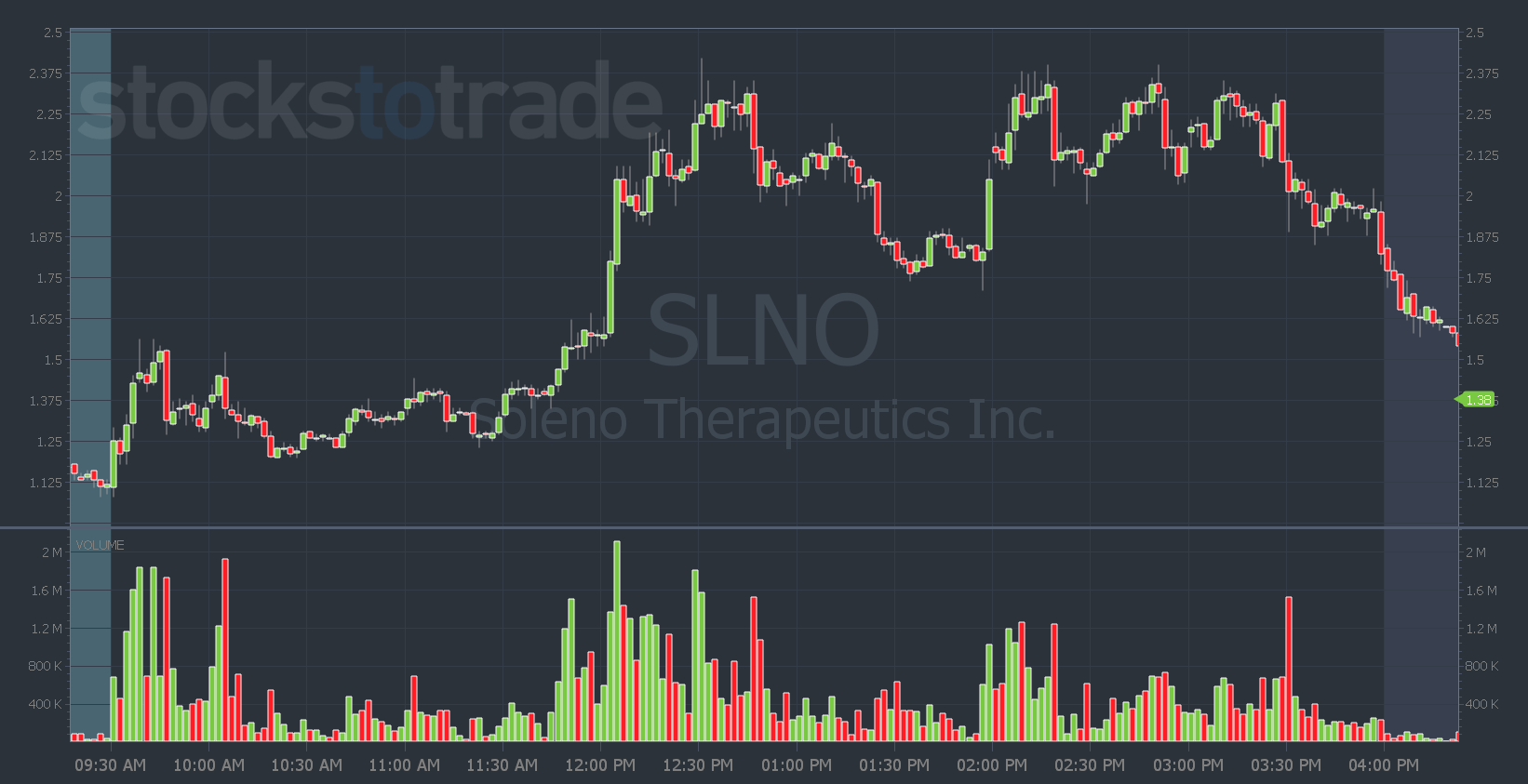

Look at recent moves in Summit Therapeutics Inc. (NASDAQ: SMMT) and Soleno Therapeutics, Inc. (NASDAQ: SLNO)…

SMMT had two days in a row with nice clean moves in the afternoon. And both days followed the repeating afternoon VWAP hold high of day break pattern.

SLNO followed the same pattern on Monday.

And it had a nice clean move without a bunch of choppy action to scare traders out.

So if you’re getting chopped up in the morning and turning winners into losers because of lack of follow through — stick with what’s working.

Now’s not the time to overcomplicate things. Follow the theme — don’t fight it…

We recently had two to three weeks of true penny stocks being hot. Now afternoon moves are working.

Eventually, it will shift again.

But unlike long-term investors — day traders are always ready to adapt to changing markets.

That’s why I show up every day for my Pre-Market Prep and SteadyTrade Team webinars…

When you’re in tune with the market every day, you can see these shifts happen.

Join me every morning to make your trade plan for the day…

And give yourself the chance to make 2023 your best trading year.

Happy holidays everyone! Enjoy your time with family and friends. And I’ll see you back here tomorrow.

Tim Bohen

Lead Trainer, StocksToTrade

P.S. Time is running out! Take advantage of our massive StocksToTrade sale now!