The market’s been pretty ugly in 2022. But I’ve noticed one pattern that’s working a LOT lately … In fact, it seems to thrive in choppy market conditions.

I call it the day-three surge pattern, and I want to share it with you now.

There’s a lot to like about this pattern. It’s easy to identify, it gives you time to react, and it has clearly defined risk levels.

Keep reading for a detailed explanation including an example of a recent day-three surge runner with charts. Study up and prepare for the next one!

Note: Want daily updates on potential day-three surges? I talk about this pattern ALL the time in my Pre-Market Prep sessions. Check out my NO-COST session every Monday at 8:30 a.m. Eastern on YouTube, then tune in the rest of the week through StocksToTrade Advisory.

Table of Contents

The Day-Three Surge Pattern

If you haven’t heard me talk about this pattern yet, I made this video to explain it:

As the name implies, the day-three surge is a pattern that plays out over three days.

- On day one, it’s a big gainer with substantial news…

- On day two, it draws in shorts, and then…

- On day three, it breaks its highs.

Simple, right? But not every big gainer with news will follow this pattern. You need the right conditions.

Recipe for a Surge

First, an important reminder. As a short-term trader, whether it’s day trading or trading short-lived patterns like the day-three surge, you’re primarily trading emotion.

It’s not so much about the ticker or the company. It’s about fear and greed, which drive supply and demand for a stock and create the biggest moves.

For this reason, a lot of my favorite patterns tend to work best with stocks that are disconnected from the overall market trend — sometimes I might even say they’re disconnected from reality.

We’re seeing a lot of fear and a lot of greed in the market right now, which is a big part of why we’re seeing this pattern so much.

I know. It might sound counterintuitive. So let’s walk through the pattern using a recent example…

Day-Three Surge Pattern: Hookipa Pharma Inc. (NASDAQ: HOOK)

© StocksToTrade

Recently, my weekly watchlist pick Hookipa Pharma Inc. (NASDAQ: HOOK) offered a great example of a day-three surge. But before we get into the day-three breakdown, a reminder…

Before Trading, Check the Boxes

I like to check the boxes on EVERY potential trade. I make sure to ask myself things like…

- Is it low float?

- Is there news?

- Does it have unusually high volume?

- Is it a past runner?

For the full list of my criteria, check out this post.

Additionally, in the current market, I’m making sure to check StocksToTrade resources like Oracle Daily Direction Alerts and Breaking News Chat to see what they have to say about the ticker in question. It can help me hone my plan of attack.

Once I’ve got my eye on a ticker, here’s what I want to see…

HOOK Day-Three Surge: How It Played Out

Here’s how the HOOK three-day surge played out…

Day One: Big Gainer

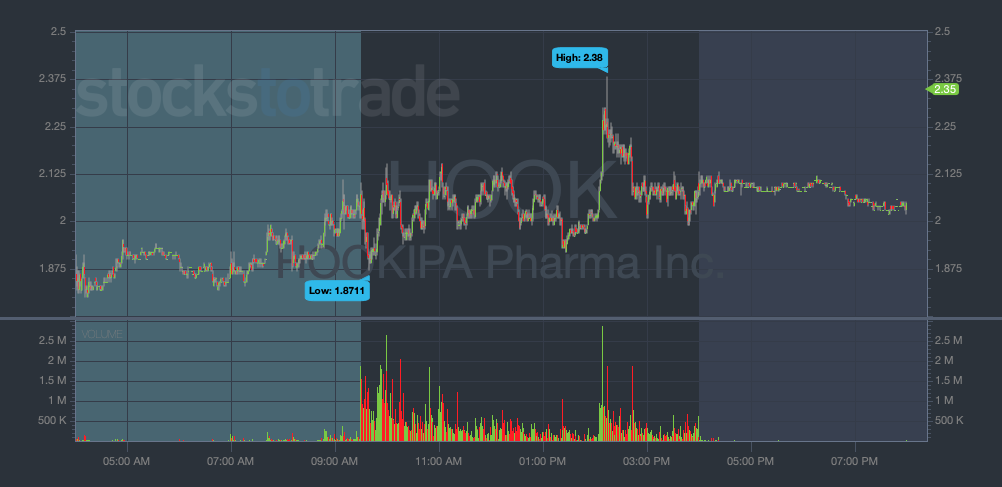

Technically, the three-day surge pattern on HOOK started on Tuesday night when the company announced news. But since it was after the 4 p.m. market close, I’m combining Tuesday night and Wednesday as day one of the pattern.

On Tuesday night, HOOK announced some attention-getting news about a partnership with Gilead Sciences, Inc. (NASDAQ: GILD). That’s HUGE for a small-cap stock like this. It’s not common for a low-priced stock to be tied up with a huge partner.

The stock reacted on Wednesday. It was a big gainer in the morning. It chopped around some but held all of its gains. Actually, it was a great afternoon VWAP-hold day trade on day one, too.

Day Two: Drawing in the Shorts

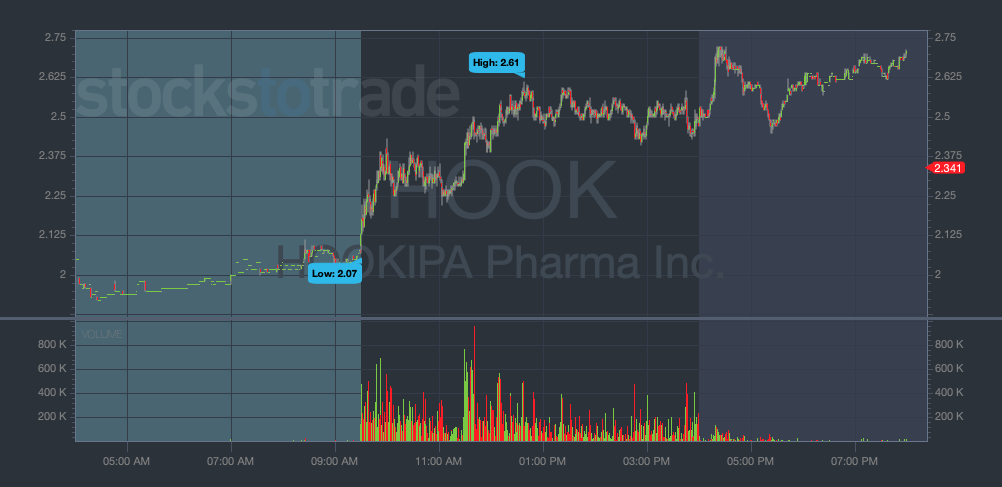

Something you must understand is that stocks like this usually spike then fail on news.

Short sellers count on that.

But in HOOK’s case, the catalyst really had legs. It’s rare for a huge biotech to invest in a little company like this.

Nonetheless, expecting the typical pattern to play out, shorts got lured in.

In terms of the day-three surge pattern, there’s no trade on day two. The stock should already be on your radar because of the previous day’s move. Maybe you have an alert set. Today’s the day you look for confirmation of the pattern.

On day two, HOOK uptrended in the late afternoon and even had a perk after hours. That tells me that shorts got stuck. They never had a place to cover, they couldn’t get out break-even because it ground up into the close.

Day Three: Breaking New Highs

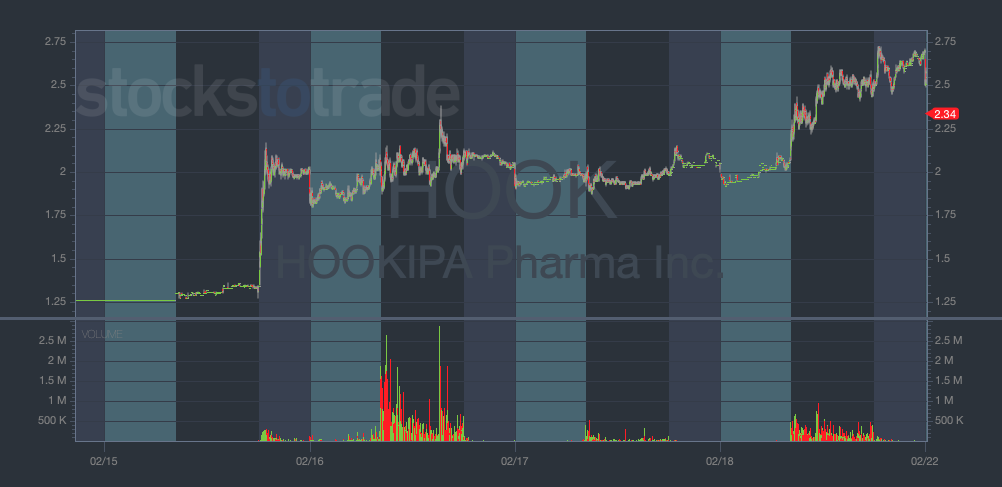

On day three of the three-day surge pattern, you look for a break of the highs. Once it does that, you’re off to the races.

When HOOK broke through $2.20, it was a panic point for shorts. Suddenly, everyone wanted to buy. The stock had an amazing afternoon … it even provided more opportunities the following week after the long holiday weekend.

Here’s the full arc of the day-three surge on HOOK…

The Day-Three Surge Pattern in Review

I’ve been seeing this pattern a LOT lately. I think we’re going to keep seeing it over and over in 2022, so get familiar with it!

As a recap:

- Day one: Look for a big gainer with substantial news that holds all of its gains.

- Day two: Today’s the day to look for short-baiting action. They think it’s gonna break down — but if it doesn’t, they’re stuck and don’t have a place to exit.

- Day three: If it breaks the highs, it could run!

Remember — there are no guarantees in the stock market. The pattern doesn’t always play out to the letter.

Plus, if you miss today’s day-three surge, there’s a good chance there will be another one tomorrow or the next day. Keep learning and keep watching out for them!

Note: This pattern is so new that it’s not in my e-book … but if it keeps working (and I think it will), I’ll definitely be adding it! Check it out to learn my other top patterns.

Did you already know about this pattern? Have you traded it? Leave a comment below — I love hearing from you!