I get asked this question a lot…

How do traders find hot sectors first and ride the momentum, while others are a day late and a dollar short?

The answer is simple…

Preparation and the right tools.

To catch the moves before they happen, you must be ready.

So to help you do that, today I’ll share ways you can prepare for hot sectors. And I’ll give you the top tech tools that can help you spot and trade them.

How to Prepare for Hot Sectors

I always say: History doesn’t repeat exactly, but it often rhymes.

The market and stocks move in patterns because they’re based on human emotion.

Humans make the decisions that move the markets…

Whether it’s to buy or sell at certain points. Or emotional reactions based on news.

I have 15 years of experience watching the markets. So I’ve learned how to spot hot sectors and market momentum.

But if you don’t have those years of experience, one of the best ways to prepare for the future is to find out what matters to traders now.

Ask yourself, what’s happening in the market, politics, and the world that impacts stocks or a sector?

What stocks are running? Is there a theme? Is there a big runner that everyone’s watching?

Once you have an idea of what could impact a sector, then you can use tech to help you hone in on the opportunity…

Build Scans and Watchlists

Like I wrote yesterday, getting ready for a hot sector starts with building your scans.

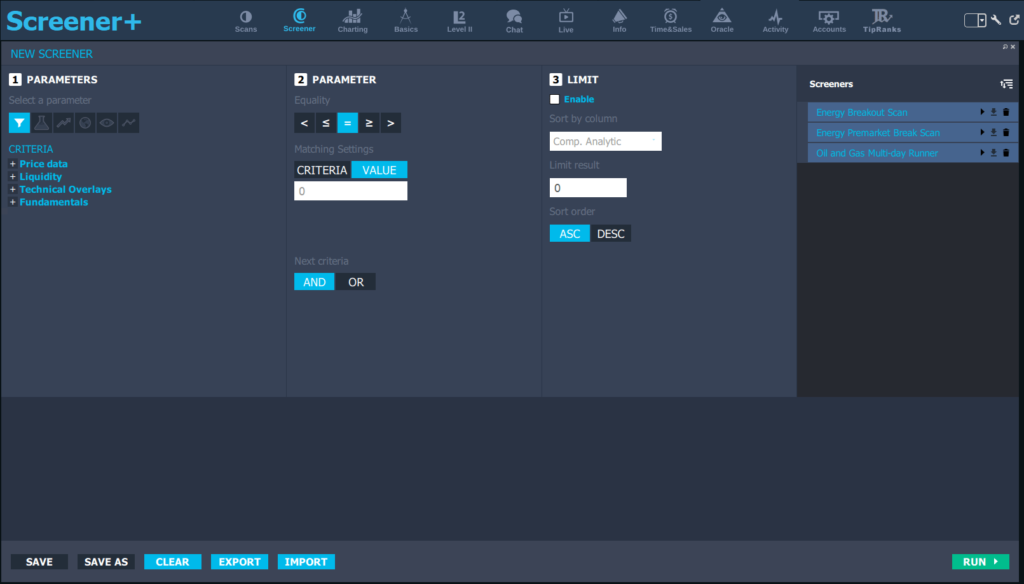

You can build sector scans on StocksToTrade even before there’s momentum in a sector…

If you want to cast a wide net and get all the stocks in a certain sector, you can use filters afterward to narrow down the list. That way you’ll only look at stocks with the right price point and float you want to trade.

Or you can customize your StocksToTrade screener to a narrow list based on sector, price, volume, and even fundamentals. It’s the most comprehensive scan tool out there…

Watch my full video lesson library here to learn how to use it. Be sure to watch all the lessons because I also cover day trading basics and the top patterns and strategies to look for.

And if you’re not a StockToTrade user yet, what are you waiting for? Get a limited-time discount offer here.

OK, enough of my rambling…

Now, once you build your custom screener, you can save it right on the platform. Your list of scans will save on the right of your screener tab. You can see my StocksToTrade oil and gas scans listed below…

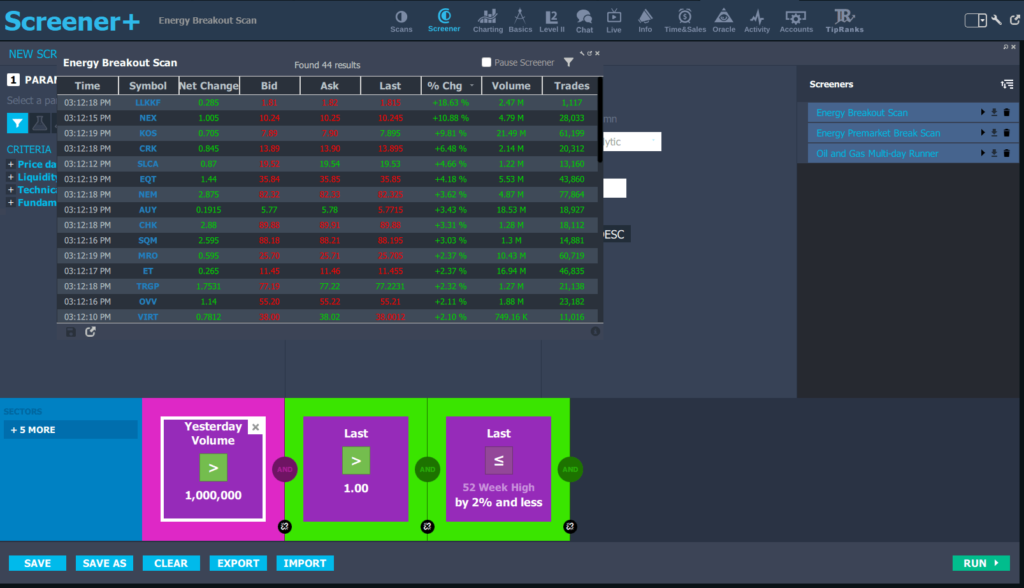

When you’re ready to run your scan, just hit the play button on the scan you want to run. And StocksToTrade instantly spits out a list of stocks that meet your criteria. (This is where you can filter the results if you cast a wide net to start with.)

I ran StocksToTrade’s prebuilt Oil and gas multi-day runner scan on Friday afternoon and here’s what it gave me…

45 results. And the second biggest percent gainer on the list was NexTier Oilfield Solutions Inc. (NYSE: NEX).

Check out Friday’s intraday chart:

Now, if you ran your own sector scan and got 45 results that were all big percent gainers, that might mean the sector’s hot. And you might want to pay close attention to it.

Listen, tech can’t do all the work…

You still have to show up every day and run the scans. You have to build your watchlist, make a plan, and execute trades.

But you’ve gotta start somewhere. And that somewhere is with your scans.

Run your scans every morning and afternoon. See what’s moving. Check what’s happening in the Breaking News Chat…

You’ve gotta put the puzzle pieces together.

Sure, there might be days when nothing is moving. But it only takes one…

You just need one big runner to make a trade. And that one big runner can kick start an entire sector.

If you’re not sure how to get started building your own scan, download StocksToTrade’s FREE oil and gas stocks scan here. Then use the criteria they’re built on to make your own sector scans.

But hurry!

They’re only available until MIDNIGHT TONIGHT — download them here now!

Have a great Money Monday. See you all back here tomorrow.

Tim Bohen

Lead Trainer, StocksToTrade