Money Monday started the week off with lots of penny stocks out there… (Which only solidifies why Tim Sykes thinks things are about to get wild in small-cap land.)

I had a ton of speculative low-float runners on the weekly watchlist this week.

But we woke up to more new runners to watch this week.

Plus, there’s big news that will hit today and tomorrow that traders need to keep an eye out for.

So let’s dig into what I’m watching and what you have to watch for in the markets today…

Stocks to Watch Today

There’s a lot to pay attention to today and the rest of the week … Let’s start with the stocks to watch…

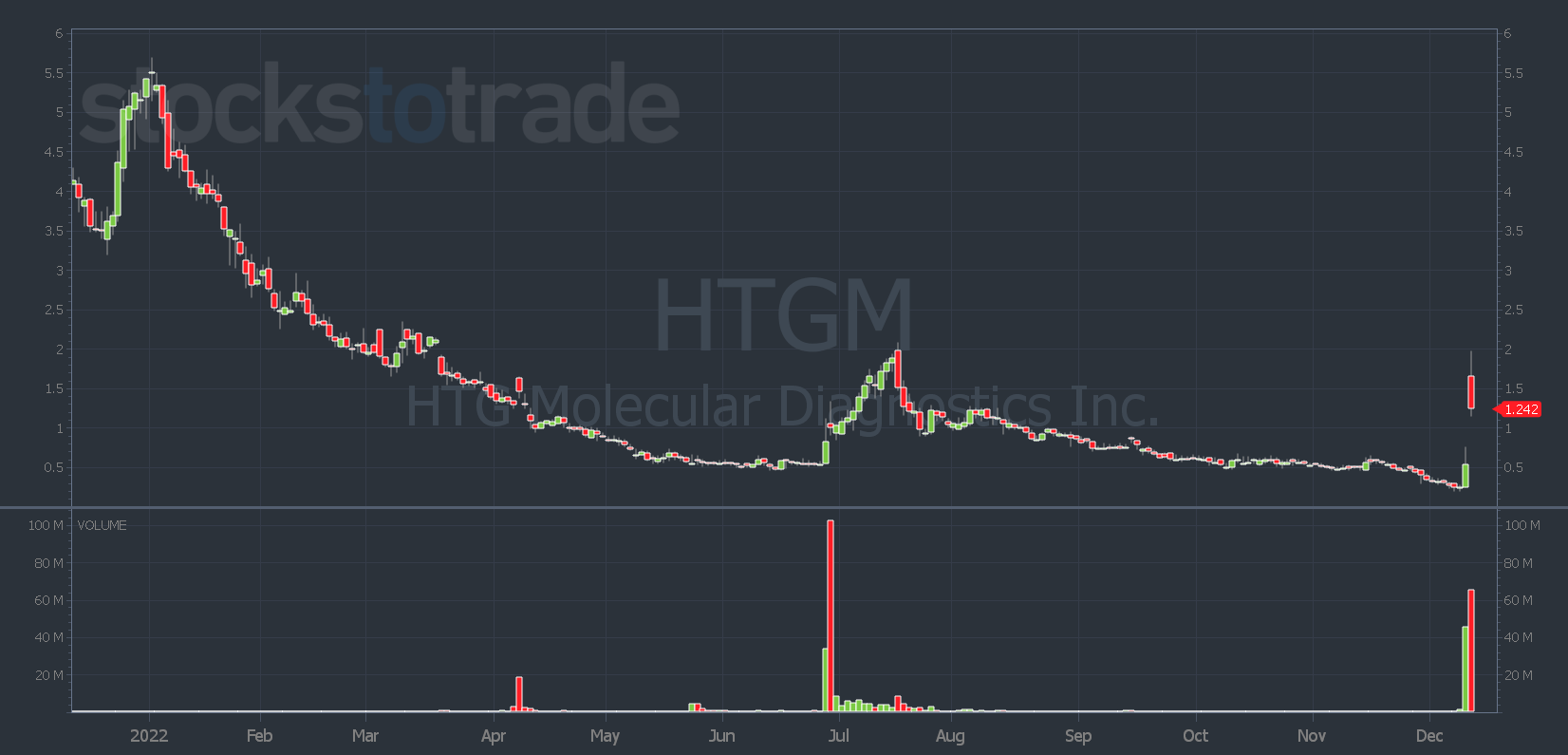

HTG Molecular Diagnostics, Inc. (NASDAQ: HTGM) was yesterday’s big gainer. I hate to say a stock is up too much. But HTGM had a big day Friday and a huge gap-up yesterday.

It was a watch for a dip and rip and an afternoon VWAP hold. It tried to make both moves, but in the morning it hit resistance at the multi-month area around $2.

Now that it pulled back and sucked in shorts, I’ll keep this on my radar for a breakout over that level.

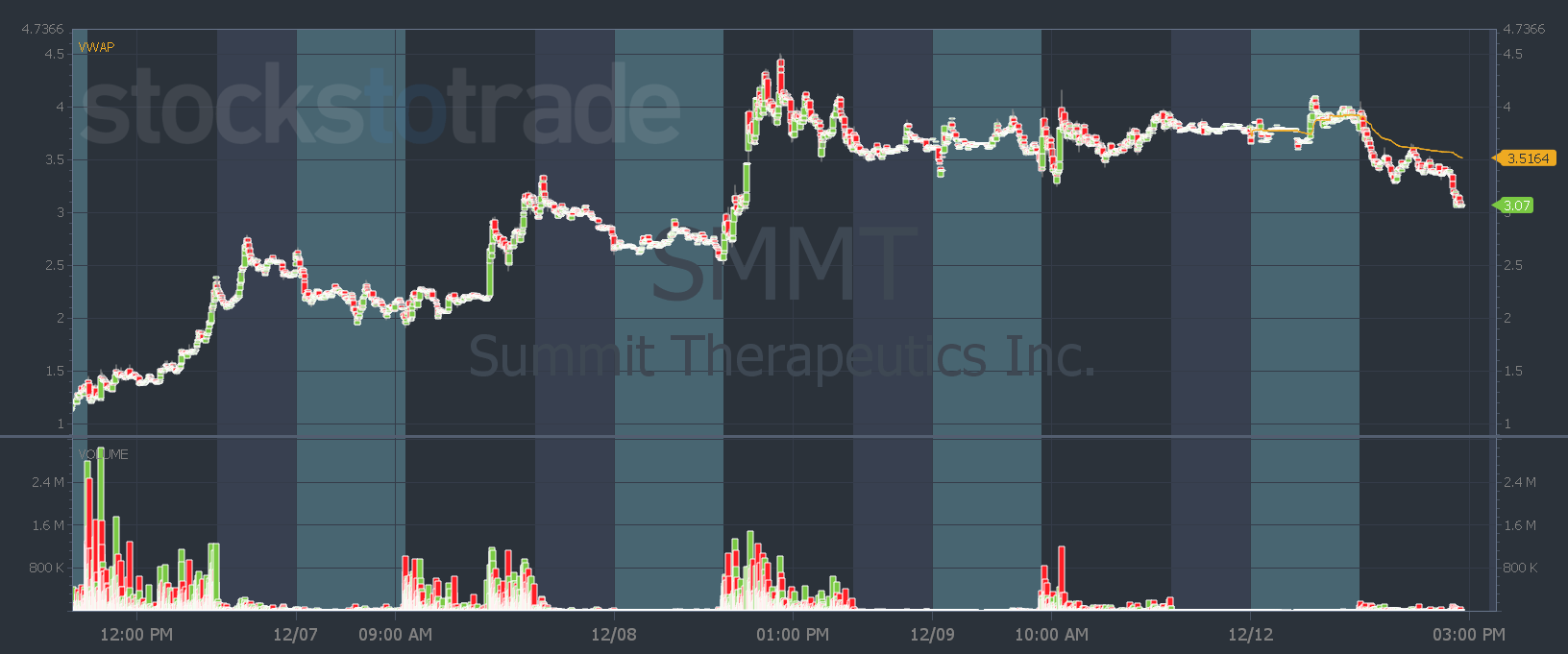

Last week’s big runner, Summit Therapeutics Inc. (NASDAQ: SMMT) continues to hang around. I was hoping for a weak open red-to-green move yesterday since it worked three times last week.

We didn’t get that move, but it’s still holding near its highs. I’ll watch it for a break above the $4.50 high.

Aptevo Therapeutics Inc. (NASDAQ: APVO) was my number-one watch yesterday. And even though I didn’t get the move I was looking for, I’ll still keep it on my radar…

It’s a low-float biotech with news that’s still up. So it stays on watch until volume dries up and it dies. That might be today … we’ll see…

And don’t forget about all the stocks and plans from my weekly watchlist.

But as we head into the rest of the week, there are some reasons to keep an eye on macro trends…

Even though penny stocks don’t necessarily follow the overall markets. Big themes can bring in volume, or suck it right out of the market entirely.

That’s why I’ll be watching…

Big News Dropping This Week

This morning all eyes will be on the consumer price index numbers. Some economists think it could increase by 7.3% from November a year ago.

But like earnings reports, the CPI report isn’t so much about the numbers — it’s about the market’s reaction to the numbers.

So be ready to adapt your plans and expectations to the market. Especially if the volume looks low and it’s a ‘quiet’ day.

And the macro news doesn’t stop there…

On Wednesday the Fed will likely announce another interest rate hike. Again, it doesn’t matter if the Fed raises rates by .5% or .75% — it’s about the market’s reaction to the news, not the actual news.

These two events are examples of how catalysts, themes, and even seasons can impact the market and its movements…

And that’s something my mentor Tim Sykes will be touching more on in his event this Wednesday night.

Sign up here and show up to see why he thinks we’re heading into a season that could see some of the largest and quickest trade opportunities of the decade.

Have a great day everyone. See you back here tomorrow.

Tim Bohen

Lead Trainer, StocksToTrade