It’s been long coming, but stock market robots have finally taken over. Once considered a niche sector, computerized systematic trading tools, aka trading robots or simply trading bots, are now extensively used by quantitative funds, or quant funds if you like. Quantitative trading are complex trades that encompass algorithmic trading, high frequency trading, and statistical arbitrage. Quantitative trading uses a combination of mathematical models, sophisticated statistical models, and computer models that utilize historical market data; are back-tested and optimized. They automate the process of monitoring, analyzing, and making trades without interference from emotions—whether fear or greed.

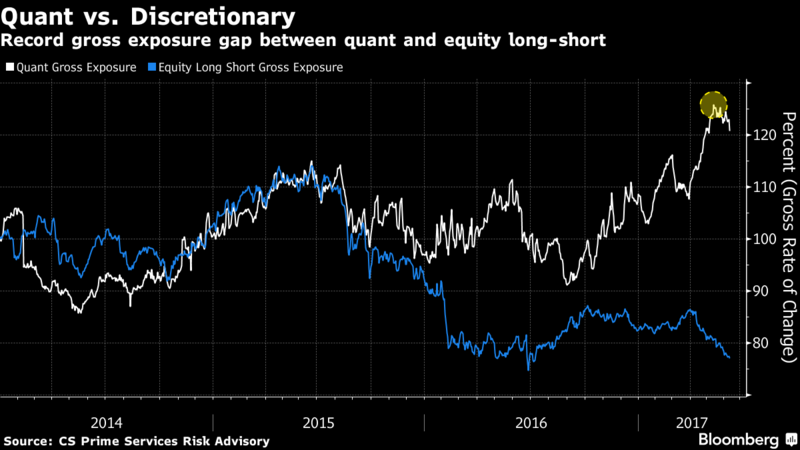

Quant funds now control 60% of all equity assets, having doubled their share from a decade ago. Human discretionary investment, on the other hand, accounts for a mere 10% of trading volume, while the rest is passive investments in the form of exchange-traded funds (ETFs) and index funds.

Download a PDF version of this post as PDF.

Blame the bots

From a casual glance, it would appear that the market gyrations that we have been witnessing are nothing more than good old volatility at play. But a deeper look reveals that there’s more to it than meets the eye—trading robots at work. Robot trading is unpredictable, and market fundamentals are frequently forced to take a backseat. These robots make it possible for large quant funds to make large volumes of highly leveraged, complex trades using exotic instruments. The end result is volatility that can sometimes defy logic.

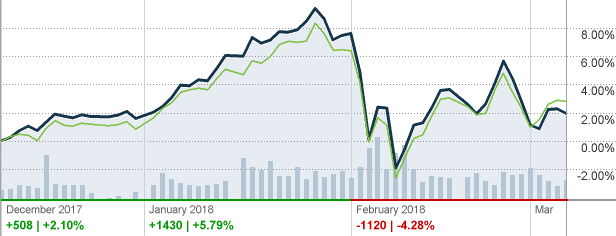

Case in point: in early February, the Dow Jones plunged more than 1,000 points over a three-day span, wiping out nearly $3 trillion in valuation for investors.

Dow Jones vs. S&P 500 3-month Returns

Forensic analysis of the massive selloff revealed that a certain trade had shorted VelocityShares Daily Inverse VIX Short-Term ETN (XIV), which in turn forced Credit Suisse (the sponsor of the ETF) to purchase large volumes of futures contracts to balance out the trade. This set off a vicious cycle of selling that triggered a broad-market selloff. Shortly afterwards, Credit Suisse stopped trading in the instrument, which suggests that even the powerful mutual fund was blindsided by the turn of events.

There are two basic problems here: using a bad hedging strategy and High Frequency Trading. The hedge using XIV ETF was an attempt to put all the market risk into one asset class, which is a dumb strategy. Instruments such as XIV are a relatively new class of ‘short-vol’ products that allow investors to bet against market volatility. They have been quite popular since the financial meltdown of 2008. But the end could now be looming for these exotic instruments, as institutions such as BlackRock Inc., the world’s biggest ETF provider, continue pushing for greater regulation of volatility products.

HFT now accounts for about 30% of all stock trading volume. HFT traders jump into the market, use their bots to make profits on millions of small trades, and cash out before the market closes. HFT traders have for years waged war to gain a significant trading edge by shaving milliseconds off trading times. Many automated trading firms already engage in arbitrage, a practice that basically involves betting that pricing gaps between two similar products will disappear. The use of high speed networks, including low-latency microwave networks, in trading is becoming increasingly widespread, though it tends to be shrouded in secrecy partly because they are controversial in some regions. In 2016, the South Korea Exchange moved to stop the use of microwave networks in derivative trading, terming the practice as ”unfair.” The South Korea derivative market has shrunk by close to 90% since 2011, and there are fears that microwave networks that confer a big advantage to bigger brokerages are to blame for this trend.

Although the market selloff this year stood out by its sheer enormity, it was by no means an isolated incidence. Between June 9 to June12, 2017, the tech sector sold off heavily and shaved off nearly $30 billion in what turned out to be a case of strategy changes by computerized trading systems. Some analysts even blame the infamous market crash of 1987 on early trading bots that were ahead of their time.

Trading bots in the ETF universe

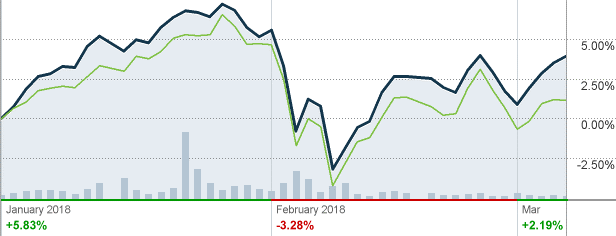

Traders and investors who are not comfortable with the idea of allowing a black box to run their trades can still savor the benefits of robot trading through a slightly different route. In Oct, 2018, cognitive computing company, EquBot, launched the first AI-powered exchange-traded fund (ETF), AI powered Equity ETF (AIEQ:US). The ETF uses supercomputing technology by IBM’s Watson to analyze millions of data points each day from 6,000 US-listed companies and create a portfolio of 30-70 stocks. AIEQ’s algorithms weigh its holdings in such a way that the ETF has a risk profile comparable to that by plain-vanilla stock ETFs such as the SPY.

Early results have been encouraging, with AIEQ showing an year-to-date return of 4.83% vs. 2.37% by the S&P 500. Longer timeframes of several years, though, will be required to test how the ETF performs under different market conditions.

AIEQ vs. S&P 500 YTD Returns

Ultimately, the success of robotic trading and quant funds is determined by the mathematical models that run them. One major weakness of quant trading is that it relies heavily on historical data and can sometimes be caught off guard by current developments. This happened to Long-Term Capital Management, one of the largest quant hedge funds, in 2000 after its model failed to foresee the serious repercussions that would beset the market after Russia defaulted on its debts. It’s therefore advisable to combine quant trading with traditional strategies in order to achieve proper diversification.