With true penny stocks being the hot market trend, I had to pick one as my number one watch yesterday.

Even though I don’t love them myself. You have to go where the opportunities are. And there were lots to choose from…

So how did I narrow down my pick?

And what criteria did I look at for potential trades?

Basically, it came down to one indicator that could’ve prevented a losing trade. Or helped you spot where to get in the right stock…

Read on to discover what indicated a potential trade and how it was all plotted out right on the chart.

When To Avoid a Stock And When To Get In

We had three big percent gainers yesterday that were all true penny stocks…

Mullen Automotive, Inc. (NASDAQ: MULN), Core Scientific, Inc. (NASDAQ: CORZ), and Scopus BioPharma Inc. (NASDAQ: SCPS).

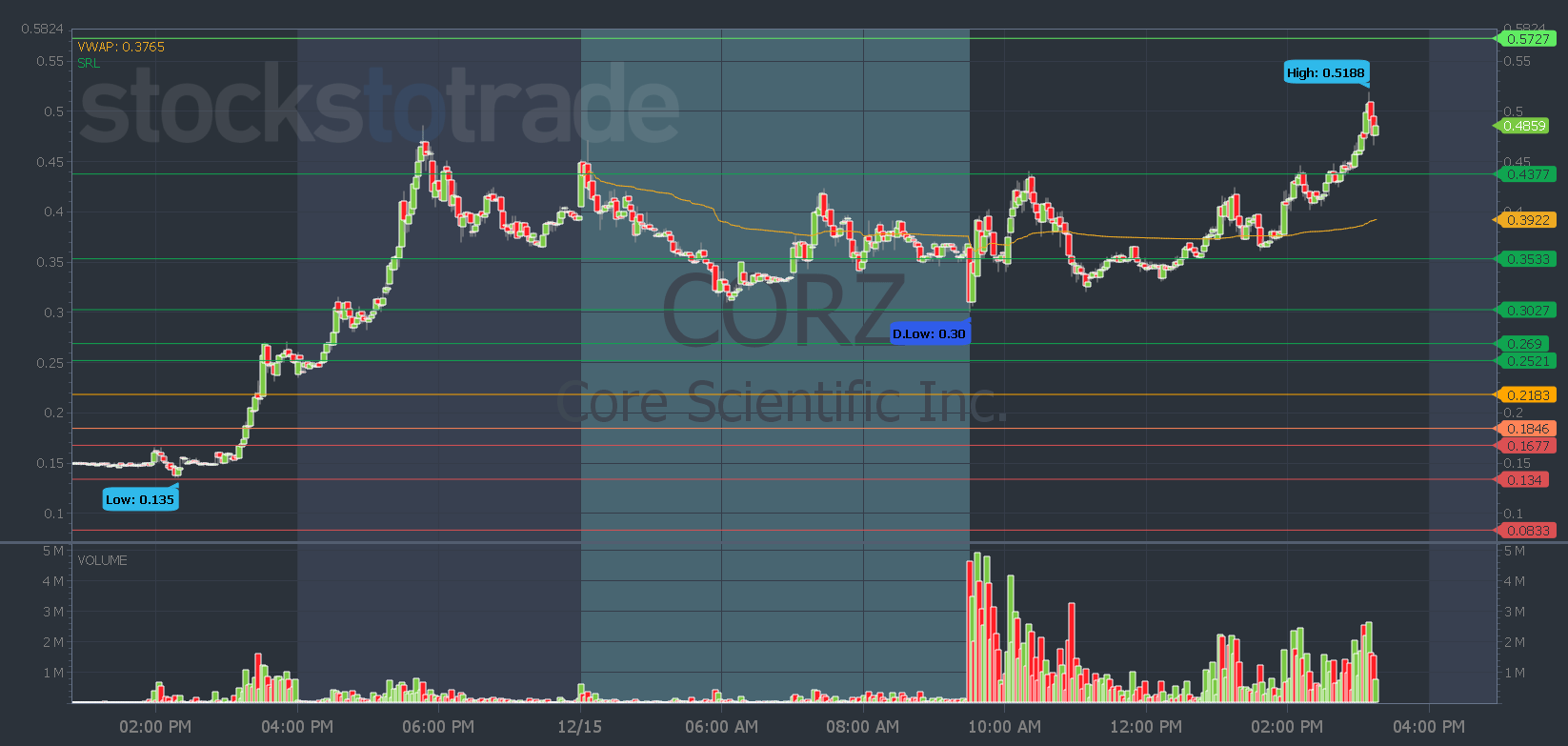

First, in Pre-Market Prep, I broke down CORZ in detail…

(Join Pre-Market Prep now before it goes exclusive and the price increases!)

It was a big gainer after hours on Wednesday but it has a high float. And the key level to watch was the level around Oracle’s 43-cent support and resistance level.

Why was it important?

It was near the high from the big after-hours move. It was the high from the 4 a.m. squeeze move, and the 7 a.m. spike couldn’t even touch it.

That’s why I thought if it could break above that, it could have the potential for a bigger move. Get ready for Friday squeezers here.

CORZ touched that level once in the morning but couldn’t break through convincingly. Then in the afternoon, we got the bigger move once it broke out…

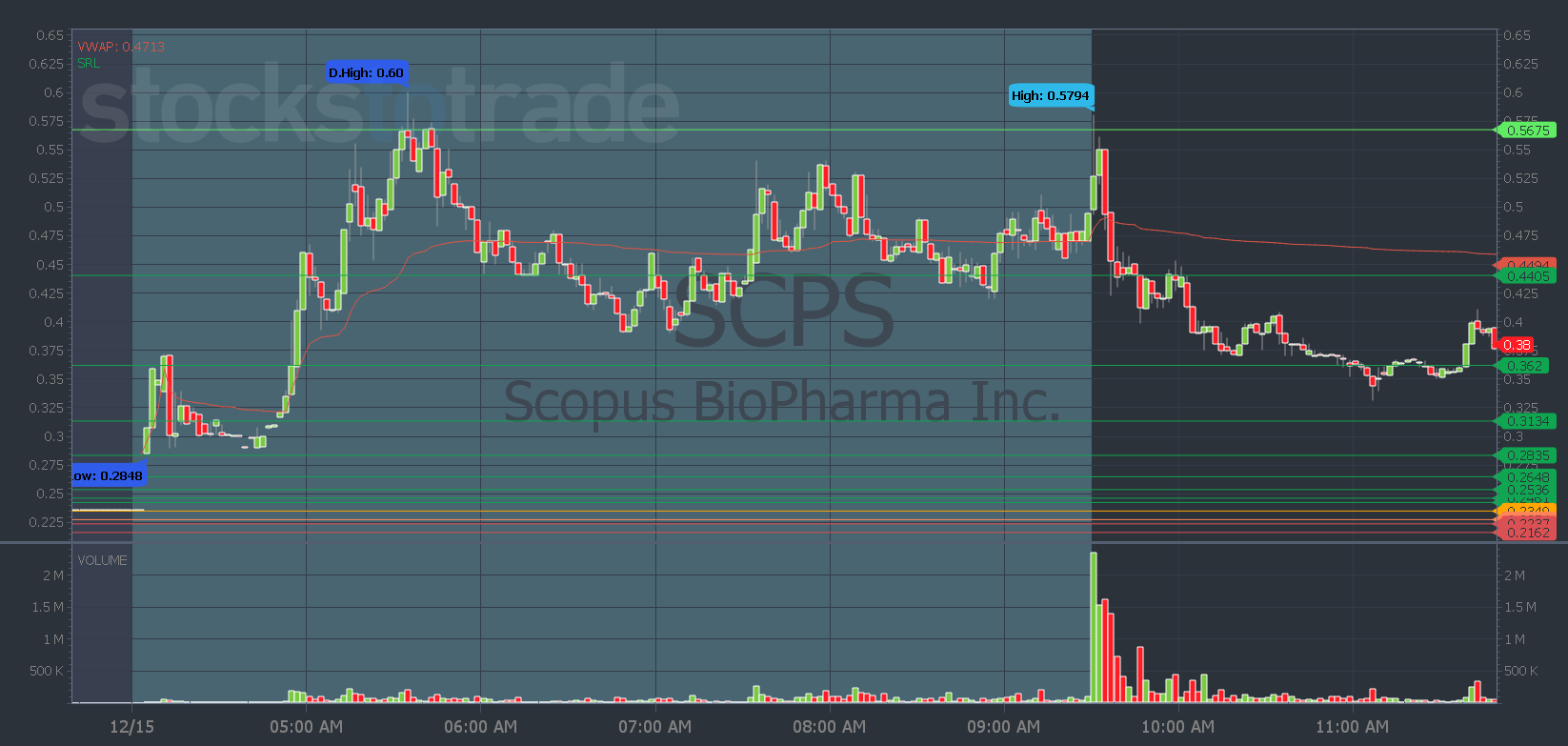

Next, during the webinar, someone brought up SCPS…

I did a quick search in the Breaking News Chat for news and didn’t find any. (Using control F in the Breaking News Chat to search for news can save you SO much time. It’s worth a year’s subscription just for that!)

I didn’t find any news on this gapper. And when a stock has no news, it’s a 9:45 am. or later dip and rip.

In the SteadyTrade Team, I went into more detail when we got closer to the open. And again I used Oracle to spot the key levels.

SCPS was trading right in a channel of two support and resistance lines. So it was easy to make a plan. If it breaks above the upper line it’s a go. If it breaks below the lower line it’s a no-go.

Look at the chart above … When SCPS broke below the lower support level it continued lower.

This is how we use Oracle’s levels to help us avoid buying stocks that fail.

Both of these stocks show you how the Oracle levels on true penny stocks are key to use in your trading plans.

Of course, they work on higher-priced stocks too…

So try it out for yourself. In this market, it’s more important than ever to have good entries and risk levels. And be able to spot when you should avoid a stock altogether.

Prevent losses and protect your capital as long as possible to give yourself the best chance to learn the nuances of the market.

If you want my help, get in my Pre-Market Prep webinars now before they go behind the curtain…

Have a great day everyone. See you back here tomorrow.

Tim Bohen

Lead Trainer, StocksToTrade

P.S. Tim Sykes’ first Winter Glitch alert was up 15% yesterday morning. If you missed his presentation or didn’t take action, you have a second chance here.