Trading can be exhilarating and action packed as well as loaded with rewards but also great potential risk. While often trading and especially penny stock trading is compared to gambling, your job as an aspiring day trader is to make your trades as little like a “random bet” as possible. By developing a process to write effective trade plans repeatedly and constantly you can minimize risk and set yourself up to maximize rewards. In this post I will go over the why as well as the how of writing trade plans. While not nearly as complicated or having as many moving parts you need to think of these as “battle plans”.

Here is a short PDF version of this post.

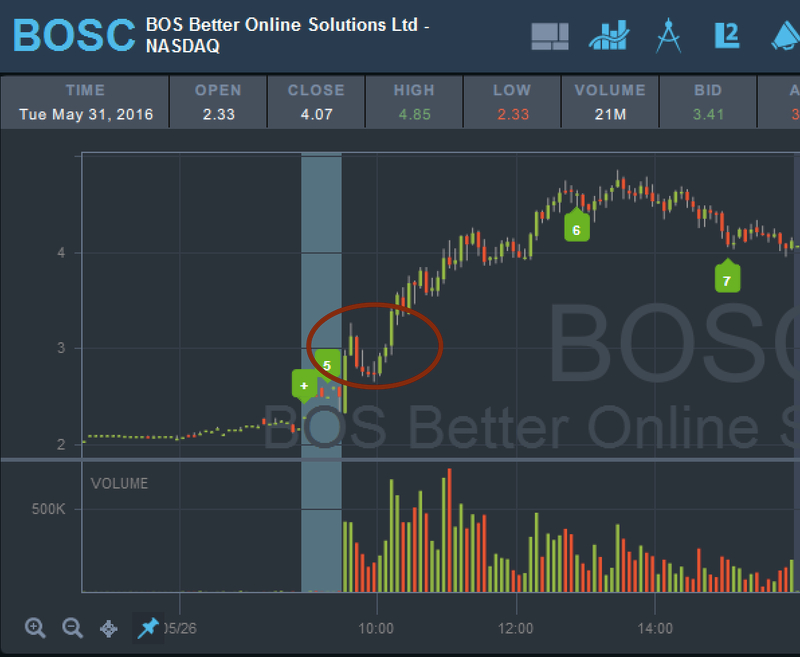

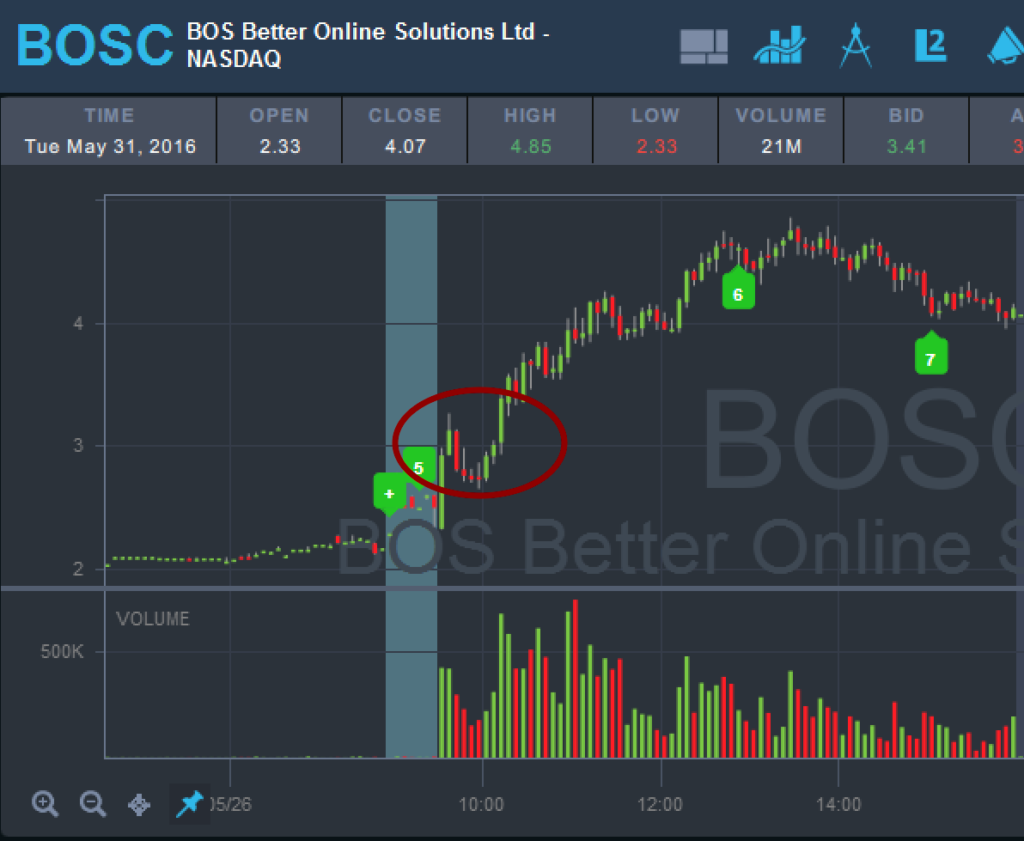

Your job is to put down in words on paper or digitally an “If/then” statement. You do not need to actually use programming logic, but your plan needs to detail what you will do and how you will execute depending on whether the trade does or does not work. One of the greatest attributes of day trading is the ease of entry and exit. Any online broker will allow you to enter a trade in seconds with almost no barriers to entry. Of course remember all brokers care only about commissions, they have no concerns over whether your trade is well thought out. But no barriers to entering any trade is one of the biggest double edged swords in this industry. So many traders pick up a random tip online, on TV or some other source and hit the buy button with doing little or no due diligence or planning. There is nothing at all wrong with considering “tips” or watch lists from other traders, but NEVER trade someone else’s plan. Take that ticker, do your due diligence, then take a moment or even longer to think about and plan your entry as well as exits for losses or profits. As an example I will detail a trade plan on a hot ticker from this week $BOSC. This was the biggest mover this week and was super hot on Twitter and elsewhere online. Most traders knew about this ticker right at the open. Many made money just hitting the buy button randomly. But so many others lost or minimized gains by entering impulsively and not writing down a trade plan. Refer to the chart below: For the sake of this illustration lets assume you missed the initial move at the open from $2.40 to over $3.00 per share. Many traders might buy and “hope” the trend will continue but then get shook out when the stock fails to continue and drops back to the mid $2.60’s. Now we settle back, fight the “Fear of missing out” and grab our index card or notepad and write a plan. “BOSC gapped up fast on huge volume out of the gate, topping at $3.20. If the stock reclaims $3.00 with solid volume I will buy. Very volatile stock, as long as higher lows hold I will stick with this trade and look to sell at $4+. If the momentum does not hold and the price drops back below $2.80 I will consider the trend broken and stop out.”  Of course keep in mind this is “hindsight trading” and it is always easy to document a plan after the fact, but the concept I want you to grasp is you ALWAYS have to think about the trade and what can happen. I have talked with so many traders through the years with BIG losses, often debilitating losses. And when I ask “Well what was your plan?”. Almost every time the response is, “You know it was such a fast mover, I just got in as fast as possible and figured I could plan on the fly. But it went against me so quickly I panicked and held way past what I ever would think was an acceptable stop loss. Then as I stared at a huge red number I just gave up and closed out.” While it still happens almost never do I talk about a trade with a trader that had a solid plan BEFORE entry and they detail huge losses. Sure halts, or random news events or bankruptcies etc happen and when they do almost no trade plan can be executed as detailed, but these events are so rare. You need to focus on preparing for the 99.9% of trades that do not involve these “black swans”. Keep in mind that this post is just a brief summary of why you need to have a plan. There is an entire section in StocksToTrade Pro explaining the development and step by step methods of writing trade plans in addition to several others. We also cover many tools from digital notebooks to analog items like whiteboards and index cards. You can also learn about advanced methods of using technical indicators like VWAP and MACD etc to lock in your plan as well as scaling in and out of positions based around technical indicators. The more ammunition that you have in your trading plan and by knowing which “weapon” to use the better shot you will have at reaching your target. Ultimately maximizing profits, minimizing losses while being efficient. In closing the number one takeaway from this post is to start practicing making trade plans. Build your watchlist (which is also covered extensively in StocksToTrade Pro), DO NOT do what most traders do and stop there. After your watchlist is built, step away, grab a cup of coffee and sit back down like true professional and write out a detailed trade plan, factoring in all potential scenarios. Then enter the market like a Navy Seal with an actionable plan and ONLY enter YOUR trades and take your stops and profits like a disciplined soldier, not some random button pushing gambler.

Of course keep in mind this is “hindsight trading” and it is always easy to document a plan after the fact, but the concept I want you to grasp is you ALWAYS have to think about the trade and what can happen. I have talked with so many traders through the years with BIG losses, often debilitating losses. And when I ask “Well what was your plan?”. Almost every time the response is, “You know it was such a fast mover, I just got in as fast as possible and figured I could plan on the fly. But it went against me so quickly I panicked and held way past what I ever would think was an acceptable stop loss. Then as I stared at a huge red number I just gave up and closed out.” While it still happens almost never do I talk about a trade with a trader that had a solid plan BEFORE entry and they detail huge losses. Sure halts, or random news events or bankruptcies etc happen and when they do almost no trade plan can be executed as detailed, but these events are so rare. You need to focus on preparing for the 99.9% of trades that do not involve these “black swans”. Keep in mind that this post is just a brief summary of why you need to have a plan. There is an entire section in StocksToTrade Pro explaining the development and step by step methods of writing trade plans in addition to several others. We also cover many tools from digital notebooks to analog items like whiteboards and index cards. You can also learn about advanced methods of using technical indicators like VWAP and MACD etc to lock in your plan as well as scaling in and out of positions based around technical indicators. The more ammunition that you have in your trading plan and by knowing which “weapon” to use the better shot you will have at reaching your target. Ultimately maximizing profits, minimizing losses while being efficient. In closing the number one takeaway from this post is to start practicing making trade plans. Build your watchlist (which is also covered extensively in StocksToTrade Pro), DO NOT do what most traders do and stop there. After your watchlist is built, step away, grab a cup of coffee and sit back down like true professional and write out a detailed trade plan, factoring in all potential scenarios. Then enter the market like a Navy Seal with an actionable plan and ONLY enter YOUR trades and take your stops and profits like a disciplined soldier, not some random button pushing gambler.