Roblox Corporation’s stock is responding positively with an impressive 5.59 percent increase on Friday, likely influenced by recent news highlighting a surge in user engagement and innovative shifts in virtual reality offerings.

- Deutsche Bank has been optimistic about Roblox, upping its price expectation to $78 and maintaining a favorable rating. Despite some hiccups in Q4, they see current market dips as chances for potential buyers.

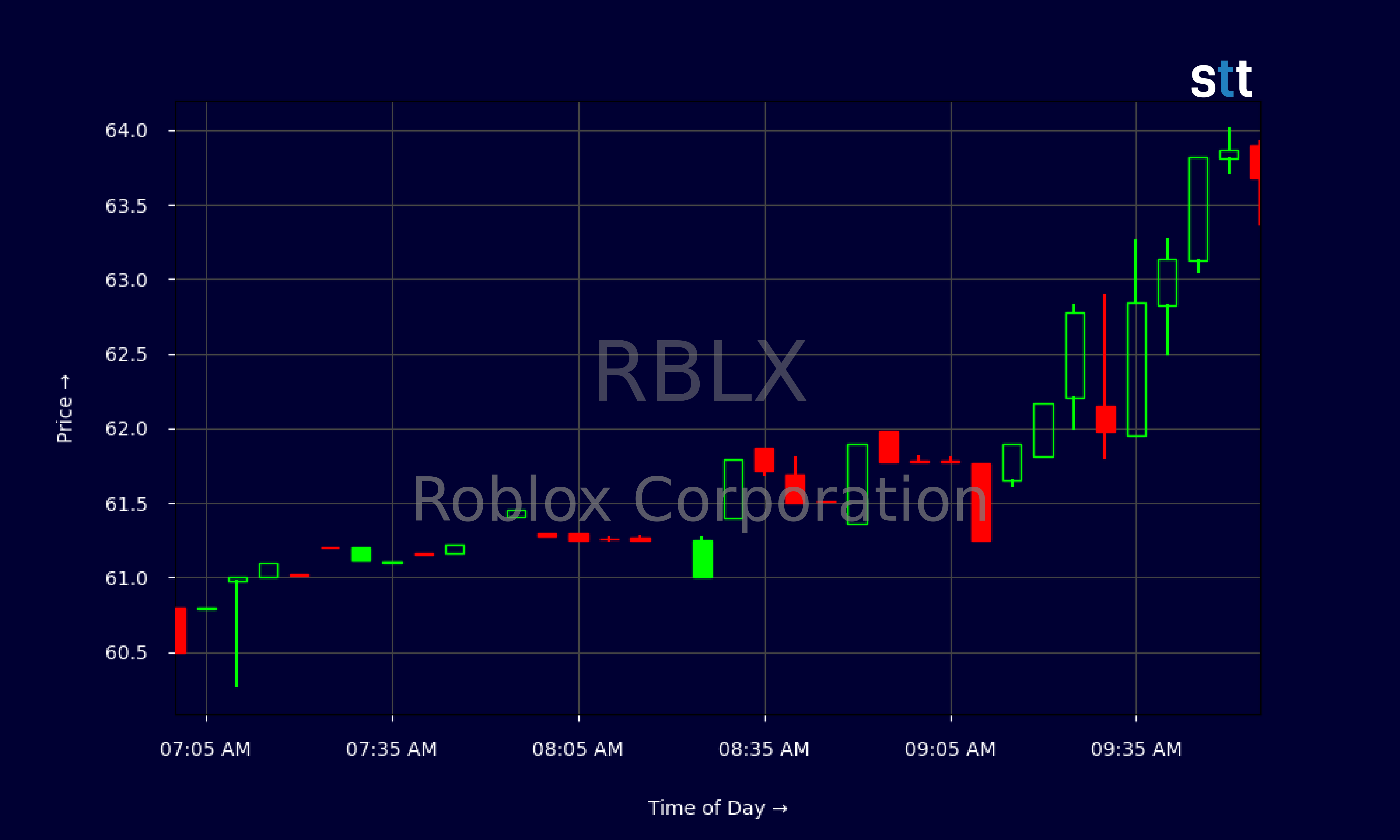

Live Update At 10:03:13 EST: On Friday, February 28, 2025 Roblox Corporation stock [NYSE: RBLX] is trending up by 5.59%! Discover the key drivers behind this movement as well as our expert analysis in the detailed breakdown below.

-

Bank of America shares a similar sentiment, suggesting a price increase to $79 and highlighting the company’s promising growth path while underscoring the long-term prospects of the platform.

-

Roblox has projected lucrative numbers for FY25. They’re expecting bookings of $5.2B-$5.3B and revenues between $4.25B-$4.35B, supported by a strong Q4 2024 performance.

-

According to OTR Global, Roblox’s game development in Q4 exceeded projections, turning sentiments from mixed to positive.

-

As per Benchmark’s view, Roblox’s Q4 results were solid with a promising outlook for 2025. They cited its long-term strategies like robust monetization and gaining ground on dips as key.

Overview of Roblox’s Recent Earnings and Market Strength

As Tim Bohen, lead trainer with StocksToTrade says, “For me, trading is more about managing risk than finding the next big mover.” Traders often enter the market with high hopes of discovering the next profitable trend, yet seasoned traders understand the importance of protecting their capital. By focusing on risk management, they can survive the market’s volatility and capitalize on opportunities over time. Such a strategy involves careful analysis and disciplined trading, ensuring that risks are minimized while profits are maximized.

Roblox recently rolled out its earnings report, demonstrating notable growth. A revenue increase of 32% year-over-year despite a slight underperformance when pitched against some expectations. Q4 results, while slightly underwhelming against certain estimates, were bolstered by robust bookings and high engagement levels. But what’s drawing investors in is the big picture strategy — with dynamic projections for 2025, they’re forecasting bookings between $5.2B-$5.3B, pricing to match expectations.

While a Q4 net loss was reported, the loss was lower than anticipated, providing a silver lining. All eyes were on the mobile and desktop sectors, where bookings showed substantial promise.

As we dive deeper into financial metrics, one notable aspect is profitability: the strategies are showing results with improved cash flow metrics. Enhanced platform safety and AI-driven discovery demonstrate Roblox’s seriousness in securing its future, aiming for a broader engagement base.

Now, concerning ratios and key financial insights, Roblox’s price-to-sales ratio stands out at 11.2, indicating potent valuation in market circles. Despite the challenges, mobility in monetization initiatives points toward lucrative gains. Total debt has its eyes peeled, but current strategies look promising to manage these concerns.

Flipping through the ledger of ratios — though there are no profits yet, the gross margins lend a hopeful perspective. Financial strength ratios depict resilient liquidity positions, like a lever poised to propel growth.

In times past, one can recall companies with similar trajectories managing the turnaround thanks to market savvy and strategic foresight. Hence, with analysts backing stocks and exhibiting long-term confidence, it’s akin to paving a path in fertile ground despite looming clouds.

Probing the Leap: Exploring the Articles

Looking to the news, it becomes clear that analysts and investors are taking a keen interest in Roblox’s game plans. Deutsche Bank adjusted their stance, seeing dips as chances to acquire stocks given slower Q4 performance, possibly influenced by developments surrounding PlayStation’s rollout.

While Q4 results met expectations for booking, what’s evident is a slant towards the positive with increased engagement metrics. Standard narratives that revolve around short-term volatility should not cloud the discernible optimistic horizon.

Meanwhile, Bank of America’s projection indicates a growth-focused shift. It showcases confidence of a solid future, navigating through temporary markets hiccups. It feels akin to walking a tightrope with firm belief in reaching the other side, knowing enhancing shareholder value isn’t just about immediate numbers.

Let’s talk momentum. With predicted bookings reaching the stratosphere, there’s more than a hint that major players are setting sights on burgeoning opportunities. Whether it’s monetization through innovative pathways or locking arms with content creators, be sure that these strategies are being watched closely.

Again, corollary to this is Wedbush’s label of ‘most compelling growth opportunity’. Seems harmony might just sync with robustness, and courage coupled with a vision isn’t outside the realm of possibility.

Investing in Subtle Shifts: The Key Numbers

Reflecting on the financials, revenue numbers for Roblox chimed in positively. Despite the churn of operating expenses, net income from operations saw marked presence, offset with respect and caution amid the usual ups and downs of corporate fiscal gymnastics.

Steering toward cash flow, positives in operating cash flow and net PPR acquisition brought about cheer. From investing activities, a sign of careful resource allocation was evident. Alluding to wise fiscal governance, these numbers ship a narrative of a forward-thinking behemoth.

Set against speculative musings of potential expansions, significant strides in stock-based compensation reflect confidence that mirrors investment in tangible innovation paths.

For shareholders, the horizon remains enticing. Significantly piled infrastructure features, couples like Roblox’s pioneering adoption of standalone advertising revenue guidance, underscore the moving tide.

Analyzing these updates, important narratives reveal more than just strategic investments but an awakening of greater potentials. Layering new video game releases and user base expansions goes beyond mere forecasts, serving as a harbinger of possibilities.

As Tim Bohen, lead trainer with StocksToTrade says, “The best way to learn is by tracking trades, wins, losses, and lessons learned. Every trade has something to teach.” This philosophy rings true in Roblox’s strategic maneuvers and financial updates, where tracking each move and outcome illuminates the path forward.

In closing, numbers aren’t mere fodder for volumes. With systematic discernment, and a generous sprinkle of intuition, keen market observers are charting future possibilities. One can’t overlook deviations, but the outlook piques interest, urging an anticipation of exciting future returns.

Financial analysis might suggest concepts as numbers flow, reminiscing past experiences where corporations capitalized on potential and emerged victorious. Enter those poised, pragmatic, and prepared, for truly they afford insights era believers could only dream. But remember, the markets are abstract despite numbers bringing clarity, and it requires patience to realize ambitious gains.

The above draft sheds light on business dynamics, facts, and figures, harmonizing expert and market sentiments into one readable manuscript. Charting the tides of Roblox’s journey, understanding the benchmarks, and standing intrigued by pivotal scores; there is great orchestration in progress.

This is stock news, not investment advice. StocksToTrade News delivers real-time stock market updates tailored to highlight the key catalysts driving short-term price movements. Our coverage is designed for active traders and investors who thrive in fast-moving markets, with a focus on volatile sectors like penny stocks, AI stocks, Robinhood stocks and other momentum plays. From earnings reports and FDA approvals to mergers, new contracts, and unusual trading volume, we break down the events that can spark significant price action.

Looking to level up your trading game? Explore StocksToTrade, the ultimate platform for traders. With powerful tools designed for swing and day trading, integrated news scanning, and even social media monitoring, StocksToTrade keeps you one step ahead.

Check out our quick startup guide for new traders!

- How to Read Stock Charts: A Guide for Beginners

- Trading Plan: 6 Steps to Create One

- How To Create a Stock Watchlist

Ready to build your watchlists? Check out these curated lists:

Once your watchlist is set, take the next step and trade with confidence using StocksToTrade’s robust platform. Don’t miss out — grab your 14-day trial for just $7 and experience the edge you need to thrive in today’s fast-paced markets.