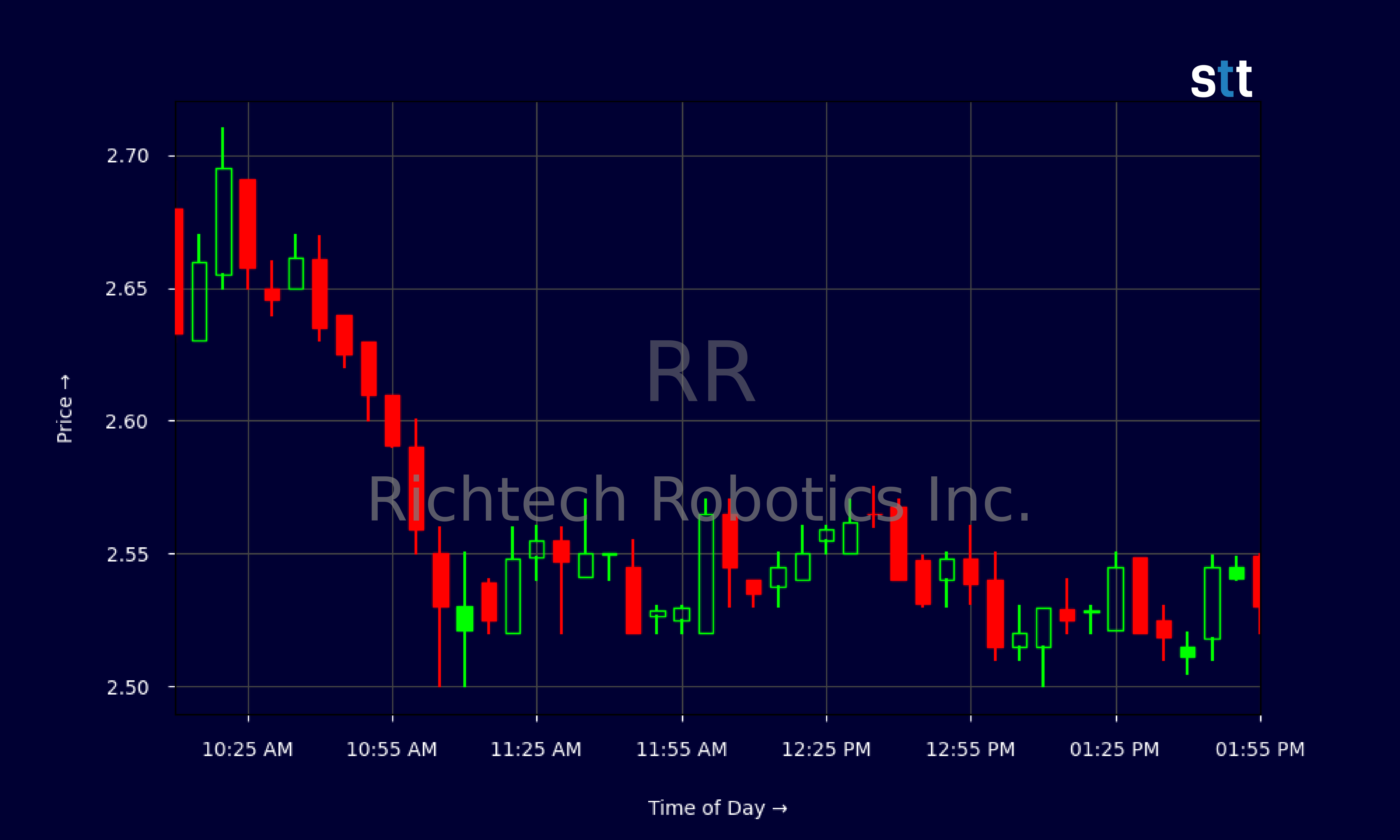

Richtech Robotics Inc. faces challenges, as reports surfaced about potential cybersecurity vulnerabilities in their new robotic systems, causing investor concern; on Wednesday, Richtech Robotics Inc.’s stocks have been trading down by -8.51 percent.

Impactful News Driving Stock Movements

- Collaboration with a major automotive company has boosted investor confidence in Richtech Robotics’ future growth potential, sparking interest and driving stock price upward.

Live Update At 14:02:00 EST: On Wednesday, January 29, 2025 Richtech Robotics Inc. stock [NASDAQ: RR] is trending down by -8.51%! Discover the key drivers behind this movement as well as our expert analysis in the detailed breakdown below.

-

Recent strategic acquisition of a leading AI firm has positioned Richtech Robotics as a strong contender in the emerging AI market, contributing to an optimistic outlook.

-

Positive reception of their latest product offerings at a global tech conference has generated buzz, attracting more attention to Richtech’s stock.

Richtech Robotics’ Financial Summary: Key Insights

“As Tim Bohen, lead trainer with StocksToTrade says, ‘For me, trading is more about managing risk than finding the next big mover.’ Many traders focus too heavily on predicting price movements and overlook the importance of employing strategies that minimize potential losses. By prioritizing risk management techniques, traders can ensure a more sustainable approach to navigating the volatile and unpredictable nature of the markets.”

Time for a deep dive into Richtech Robotics’ recent financial health as detailed in their earnings report, which presents a mixed bag. On the positive end, they’ve triumphantly infused $30M through fresh stock issuance. This cash injection indicates vigorous investor trust, despite the firm wrestling with not-so-glowing figures like an operating revenue of merely $526K against expenses peaking at $3.49M, hence, pushing them into the red with a daunting net income loss of nearly $3M.

From the balance sheet, Richtech’s total assets stand robustly at $42.65M, most of which are liquid or short-term assets, standing at about $30.51M. This suggests their capability to address short-term liabilities with the current profitability sheltered by their enriching cash pool. However, the profitability percentages suggest potential choppy waters ahead. EbitMargin, ebitdaMargin, and PretaxProfitMargin are all deeply entrenched in negative territory. These indicators not only reflect the cost-heavy operations but also hint at underestimated competitive and operational hurdles that might have clogged their profitability channels.

Tax implications? Not much of a liability here, with just $5,000 in income tax payable. This reflects either limited income under taxation or efficient tax management.

Another glaring but optimistic point dwells in their investment in intangibles—nearly $5.47M. This refers to their bets on future technologies or its innovation pipeline usually a tactic of growth companies looking to edge out competition through newbies patented under its belt.

More Breaking News

- Boeing’s Bright Horizon: Exploring Recent Gains

- Core Gaming’s AI COMIC Impresses with User Growth Amid Siyata Mobile Merger Talks

- Equinix Inc. Price Surge: Time to Act?

In conclusion, while Richtech Robotics continues to work toward propelling themselves upward amidst daunting operational expenses, their cash mechanisms and strategic deployments signal that there, indeed, lies potential within.

News Influence: What You Must Know

Their recent steps have made Richtech Robotics an eye-catcher in the tech market, fuelling stock price jumps. Spurring growth—Richtech has aligned itself with a crucial automotive force. This isn’t just ink on paper but could mean joint innovation in robotics and complete AI autonomy that reshapes smart vehicular landscaping. Investors have flocked back, believing this paves a path for revenue diversification, foiling the stagnancy trap many tech companies face.

Furthermore, purchasing an AI bigwig showcases Richtech’s stepping stone to branding themselves more as a tech innovator than merely a robotics producer.

What really pushed recent investor interest is the tech conference debut, where Richtech unveiled products that hint towards transforming AI integration. This showcases a marriage of cutting-edge innovations with consumer needs, an essential blend to captivate tech-pace investors.

Conclusion: Prediction and Potential Trends

Notably, it’s a cocktail of strategic partnerships and product breakthroughs that have propelled Richtech Robotics onto soaring stock trajectories. As trends predict AI-led growth avenues, Richtech’s assertive thrust into this arena positions them significant and anticipatory in future market hold.

Potential traders must weigh Richtech Robotics’ pivotal moment amid a tech-enthusiast market tide. The stocks are rippling from recent events, and keeping an eagle-eye vigil as trends play out is crucial. As Tim Bohen, lead trainer with StocksToTrade says, “If you’re still guessing at the end of your analysis, it’s probably not a trade worth taking.” To surmise, it’s hard to say with certainty if the current atmospherics harken instant profits. Still, this surge signifies that Richtech is striving for spotlight longevity. It’s this ambition that could spell prosperous returns for calculated risk-takers in the burgeoning tech frontier.

Disclaimer: This is stock news, not investment advice.

StocksToTrade News delivers real-time stock market updates tailored to highlight the key catalysts driving short-term price movements. Our coverage is designed for active traders and investors who thrive in fast-moving markets, with a focus on volatile sectors like penny stocks, AI stocks, Robinhood stocks and other momentum plays. From earnings reports and FDA approvals to mergers, new contracts, and unusual trading volume, we break down the events that can spark significant price action.

Whether you’re a day trader searching for the next breakout or an investor conducting due diligence, StocksToTrade News is your go-to source for actionable insights to make informed trading decisions.

Looking to level up your trading game? Explore StocksToTrade, the ultimate platform for traders. With powerful tools designed for swing and day trading, integrated news scanning, and even social media monitoring, StocksToTrade keeps you one step ahead.

Check out our quick startup guide for new traders!

- How to Read Stock Charts: A Guide for Beginners

- Trading Plan: 6 Steps to Create One

- How To Create a Stock Watchlist

Ready to build your watchlists? Check out these curated lists:

Once your watchlist is set, take the next step and trade with confidence using StocksToTrade’s robust platform. Don’t miss out — grab your 14-day trial for just $7 and experience the edge you need to thrive in today’s fast-paced markets.