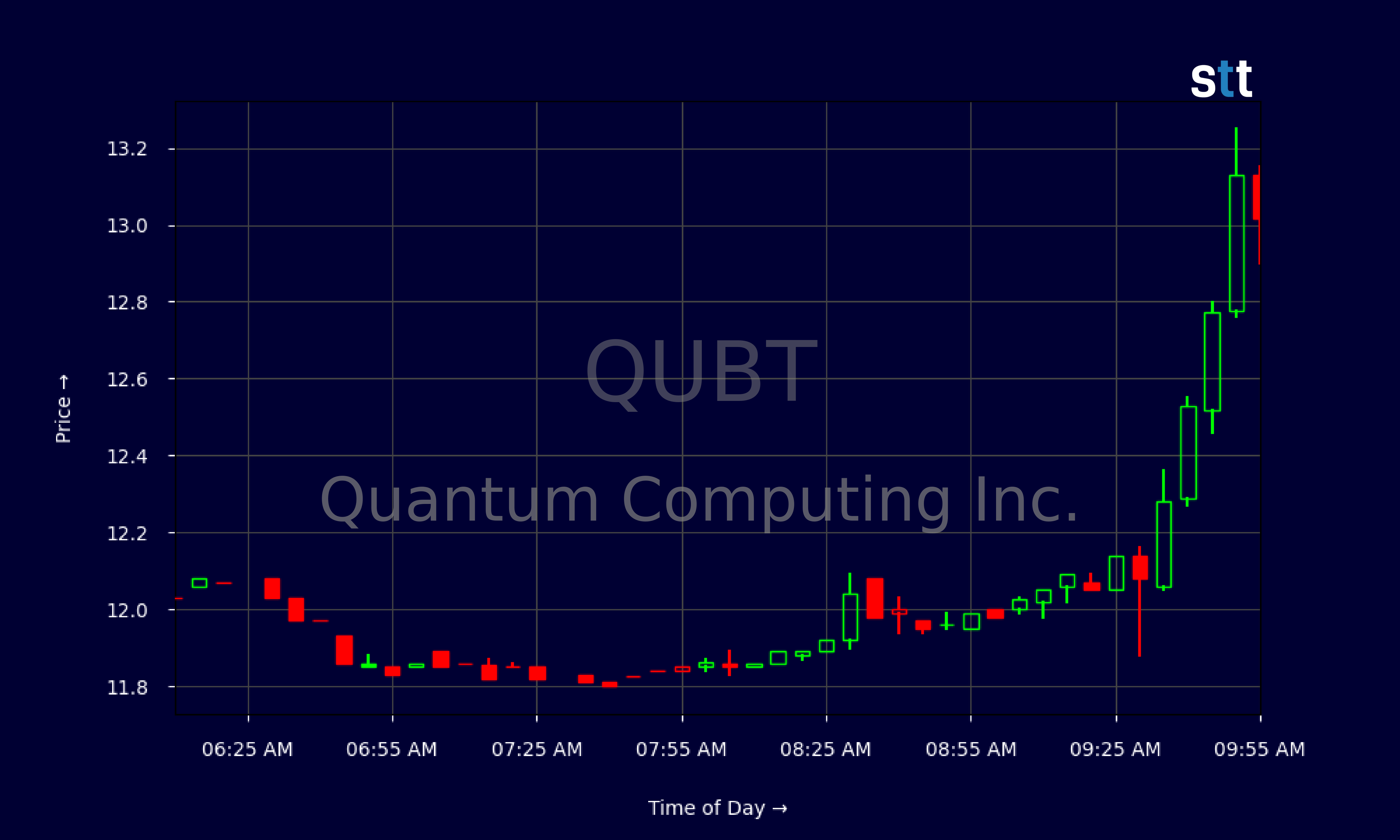

Quantum Computing Inc.’s stocks have been trading up by 10.23 percent following major breakthroughs in quantum technology adoption.

Company News Shaping Growth

- Milan Begliarbekov was promoted to COO and Pouya Dianat to Chief Revenue Officer at Quantum Computing. This move aims to support strategic growth and commercialization efforts.

-

In Q1 2025, the company reported earnings of $0.11 per share, bouncing back from last year’s loss of $0.08.

-

Quantum Computing will join the Russell 2000 and Russell 3000 indexes after the annual reconstitution on June 30, 2025.

-

A new quantum photonic chip foundry opened in Tempe, Arizona to accelerate commercialization of next-gen quantum machines.

-

Strong Q1 financial and operational results, bolstered by strategic advancements and increased market presence, were reported.

Live Update At 10:02:02 EST: On Friday, June 06, 2025 Quantum Computing Inc. stock [NASDAQ: QUBT] is trending up by 10.23%! Discover the key drivers behind this movement as well as our expert analysis in the detailed breakdown below.

Quick Overview of Earnings and Key Metrics

As Tim Bohen, lead trainer with StocksToTrade says, “For me, trading is more about managing risk than finding the next big mover.” In the fast-paced world of trading, it’s essential to prioritize risk management over the excitement of catching the latest trend. By focusing on managing risks effectively, traders can ensure longevity and sustainability in their trading journey, rather than getting carried away by the allure of quick profits from potential big movers.

Quantum Computing Inc.’s recent earnings report for Q1 2025 shows a notable positive shift. The leap from a loss of $0.08 per share last year to earnings of $0.11 is impressive. Revenue has increased to $39K, displaying growth potential in a niche market. Overall revenues amounted to $373K, though small, it marks progress from the previous $27K. The company’s key financial metrics suggest a remarkably steady stance. The profitability ratios, while negative, indicate the potential further down the road, given the new strategic directions and openings.

Understanding each number is like building a story from tiny bricks. The gross margin stands at 29.6%. It tells us that there’s some room for profit that can blossom with appropriate measures. The numbers reflecting their debt arrangement also paint a careful picture. With a zero total debt-to-equity ratio, they seem steady, suggesting potential for leveraged growth without looming, daunting liabilities.

On the flip side, key valuation metrics indicate challenges to be addressed. A price-to-sales ratio over 4,300 hints at inflated valuation risks, yet it displays optimism in future sales. For a fifth grader, it’s like believing your cake will taste much better because the cherries you put in are exotic, and very costly.

In contemplating market implications, it’s essential to look at recent achievements. Opening a new photonics chip foundry and entering the Russell indexes are strategic moves. They tell us stories of growth. Joining these indexes could bring increased investor interest, driving the market cap higher. The results, plus smart maneuvers like these, should resonate positively as strategic growth accelerators.

News narratives resonate well with improved metrics. Promotion of executives supports strengthening strategic dimensions. Financial reports showing improved cash flow with $87M from stock issuance add to the growth strategy.

More Breaking News

- Promis Neurosciences Shake the Market

- Aurora Innovation Preps for a Major Q2 Reveal in Autonomous Frontier

- SMR Stock Surge: Is It Time to Invest?

In summary, Quantum Computing Inc’s financial landscape might seem like a glass half full, or half empty depending on perspective, but trusted eyes see opportunities for a refill.

Key Developments and Market Dynamics

Quantum Computing’s rise in stock price is not just serendipitous. Instead, every upward movement appears to have a story behind it. When Milan Begliarbekov was given more responsibility, it was akin to a director settling into their role before a giant play begins. Similarly, Pouya Dianat stepping up as Chief Revenue Officer signals a focus on recalibrating sales engines and growth acceleration, much like tuning a fast car before a race.

The Russell 2000 and Russell 3000 inclusion is like receiving a recognition badge. For investors, it equates to a fresh stamp that ups credibility. Such increments in market recognition sow seeds for growth as portfolios looking for that dynamic element might now see Quantum Computing in a different light. Investors look for security and growth, much like a young player joining a sweet league. Such developments shape the landscape of investor perceptions.

Opening its new quantum photonic chip foundry in Tempe, Arizona, Quantum Computing is taking a bullish step. This facility doesn’t just stand tall, it signifies the readiness to embrace the increased demand for sophisticated tech.

Financially, increasing net revenue and conducting strategic partnerships can be seen as critical elements leading up to this point. It’s like climbing a building, step by step, and now viewing a broader horizon with better tools in hand. Recent results put them amidst financial progress, hinting at sustained operational efficiency.

Market Speculation and Stock Performance

For a moment, try pulling a market rabbit out of the hat, with Quantum Computing recently demonstrating remarkable earnings growth and strategic initiatives. With indexes showcasing a performance to look out for, bigger fish like venture capitalists sniff opportunities.

It’s not only the larger movements; smaller ripples are equally noteworthy. With their recent inclusion in significant indices, and moves to ever-better technology with their foundry efforts, it’s like they’ve mixed the right potion to chart an upward course.

Surely, with financial backing resulting from both meaningful earnings increments and targeted actions such as leveraging the Russell index inclusion, Quantum Computing is wrapping up a promise. Much like a person prepping for a career-defining role, they are scoping the horizon while tightening the laces. As Tim Bohen, lead trainer with StocksToTrade says, “A good trade setup checks all the boxes—volume, trend, catalyst. Don’t trade if you’re missing pieces of the puzzle.” This narrative lays the foundation for potential groundswell in stock metrics, just waiting for the next catalyst to propel it skyward.

In conclusion, as we perceive market reactions to the news articles and stock patterns, these aren’t isolated events. Instead, the journey of every stock price, every percentage rise or fall, tells its unique story that echoes through the halls of dynamics and data. While no narrative holds the crystal ball, those with their ear to the ground and an eye for detail can weave the strands of financial prose into land leading to prospective profits.

This is stock news, not investment advice. StocksToTrade News delivers real-time stock market updates tailored to highlight the key catalysts driving short-term price movements. Our coverage is designed for active traders and investors who thrive in fast-moving markets, with a focus on volatile sectors like penny stocks, AI stocks, Robinhood stocks and other momentum plays. From earnings reports and FDA approvals to mergers, new contracts, and unusual trading volume, we break down the events that can spark significant price action.

Looking to level up your trading game? Explore StocksToTrade, the ultimate platform for traders. With powerful tools designed for swing and day trading, integrated news scanning, and even social media monitoring, StocksToTrade keeps you one step ahead.

Check out our quick startup guide for new traders!

- How to Read Stock Charts: A Guide for Beginners

- Trading Plan: 6 Steps to Create One

- How To Create a Stock Watchlist

Ready to build your watchlists? Check out these curated lists:

Once your watchlist is set, take the next step and trade with confidence using StocksToTrade’s robust platform. Don’t miss out — grab your 14-day trial for just $7 and experience the edge you need to thrive in today’s fast-paced markets.