Protagenic Therapeutics Inc.’s stocks have been trading up by 133.69 percent amid positive investor sentiment and market dynamics.

Recent Developments and Market Response

- PTIX experienced a sharp rise today, going up over 100% from its previous closing value, primarily due to strong investor interest and increased trading volumes.

- The biotech firm recently announced promising results in new clinical trials for its flagship drug, sparking optimism and causing a surge in the stock market.

- With rumors of potential partnerships with larger pharmaceutical companies, excitement around PTIX continues to build.

- Analysts are projecting a significant increase in sales based on the latest developments, driving both speculative investments and genuine believers in the company’s future prospects.

- Social media platforms have been buzzing with discussions on PTIX, leading to heightened retail investor interest.

Live Update At 10:02:41 EST: On Monday, May 19, 2025 Protagenic Therapeutics Inc. stock [NASDAQ: PTIX] is trending up by 133.69%! Discover the key drivers behind this movement as well as our expert analysis in the detailed breakdown below.

PTIX’s Financial Highlights and Key Earnings

Protagenic Therapeutics Inc. (PTIX) recently posted challenging earnings, showing substantial losses but offering promise through its recent endeavors. The company reported a net loss of $1.44M, primarily due to its investments in research and development. As Tim Bohen, lead trainer with StocksToTrade says, “The best way to learn is by tracking trades, wins, losses, and lessons learned. Every trade has something to teach.” Despite this, their commitment to innovation was evident, as R&D expenses hit $880K. This perspective on learning through past trades may encourage the company to refine its strategies and maximize future potential.

Looking at their cash flow, PTIX experienced a tough period, burning through cash with a net change of -$965K. However, they reported significant financing cash flow, signaling investors’ faith in their ongoing projects.

A glance at PTIX’s financial ratios paints a picture of a company that is still struggling to find its footing. With a return on assets (ROA) of -104.78% and a return on equity (ROE) of -512.79%, PTIX needs to improve its profitability measures to assure stakeholders of long-term viability.

More Breaking News

- Quantum Innovations in Drone Technology Drive Market Surge

- D-Wave Quantum: Strategic Moves on the Rise?

- Thomson Reuters Corp Stock: Will It Keep Rising?

Additionally, their current ratio of 0.9 signals that PTIX might face challenges in meeting short-term liabilities. But with a broad portfolio and current interest, the tables could turn if upcoming drug trials turn successful.

Analysis of Stock Performance and Intraday Movements

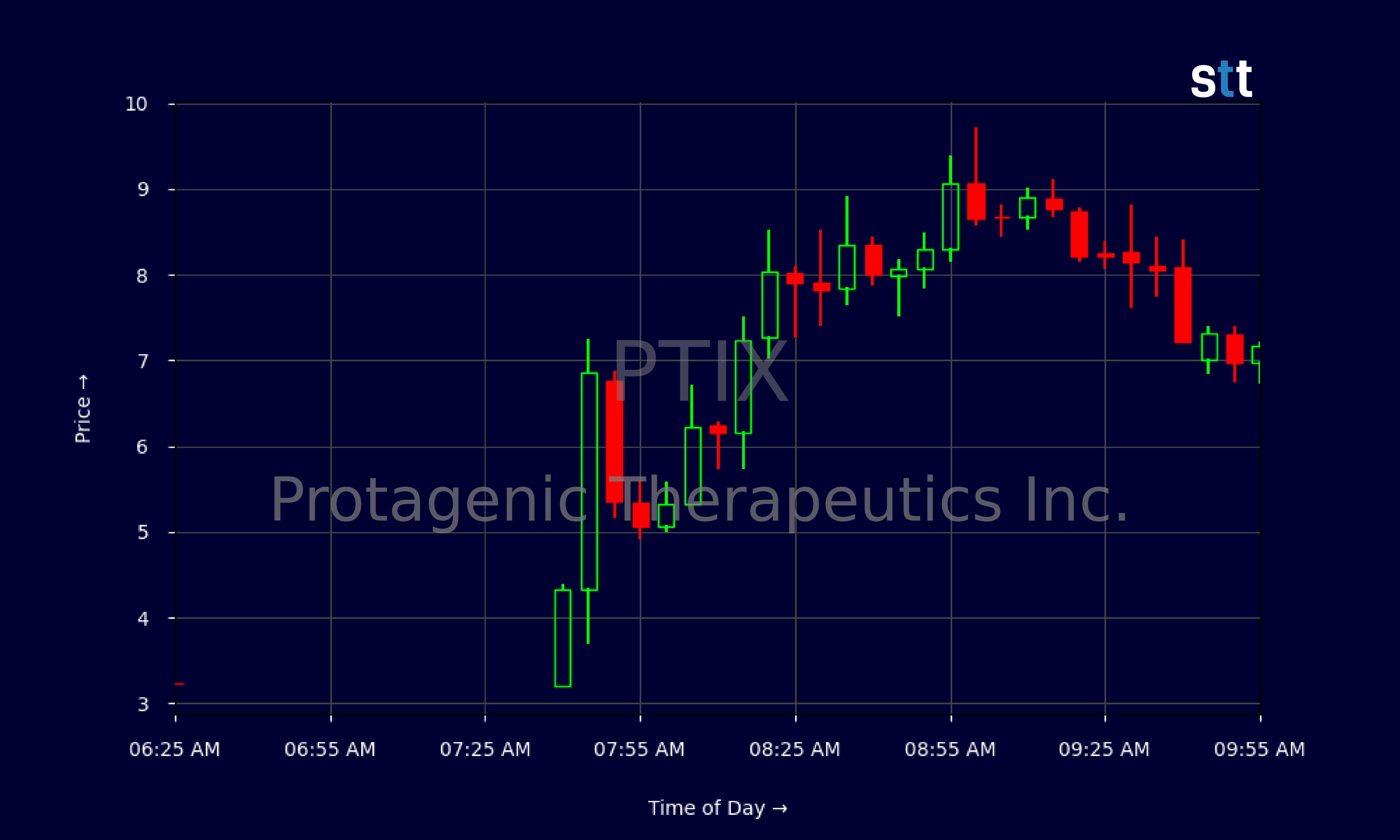

Analyzing the stock chart, PTIX’s recent rise defies its historical trends. Over the past few months, PTIX had struggled near the lower end of its range, consistently being valued below $4. However, today’s trading session revealed an astounding record, with prices opening at $8.27 and momentarily touching $8.8.

Trading volumes were astronomical early in the day, with prices fluctuating dramatically, which suggests heavy speculative activity. From an intraday perspective, the market showed signs of volatility, including a sharp jump reminiscent of a rollercoaster ride – cruising from $6.15 to a peak of $9.7 within hours.

An essential takeaway from today’s movement is that PTIX might be caught in a speculative bubble, driven by retail investor enthusiasm. However, if the current trials prove successful, it could stabilize and result in long-term growth.

Risks and Potential for Protagenic Therapeutics

Although PTIX has shown impressive potential, there are inherent risks that investors should be wary of. Firstly, with the absence of positive earnings, the financial foundation remains weak, making the company reliant on new clinical successes and partnerships.

Moreover, PTIX operates within the highly competitive biotech field where frequent technological advancements redefine success. Its success is tethered tightly to the outcome of ongoing trials for its novel therapies. However, should these play out positively, Protagenic Therapeutics could find itself on the brink of success, much like the giant strides small tech firms have made in the past.

Lastly, one can draw parallels to past high-profile biotech successes and failures. This serves as a word of caution and inspiration for new investors trying to navigate through speculative market conditions.

Conclusion

PTIX’s price fluctuation mirrors the volatility and excitement characteristic of biotech stocks. While the latest developments have propelled a spectacular surge, Protagenic Therapeutics must sustain momentum through positive trial results and strategic partnerships.

Traders focused on biotech opportunities should keep a close eye on PTIX, recognizing the thin boundary between growth potential and speculative bubble. With greater burstiness in price movements today, Protagenic Therapeutics offers a thrilling, albeit risky, prospect in the financial landscape. As Tim Bohen, lead trainer with StocksToTrade says, “I never chase price. The best opportunities allow me to enter on my terms, not when I’m feeling pressured.” The market’s reaction over the next few weeks might provide a clearer picture of the true potential of PTIX.

This is stock news, not investment advice. StocksToTrade News delivers real-time stock market updates tailored to highlight the key catalysts driving short-term price movements. Our coverage is designed for active traders and investors who thrive in fast-moving markets, with a focus on volatile sectors like penny stocks, AI stocks, Robinhood stocks and other momentum plays. From earnings reports and FDA approvals to mergers, new contracts, and unusual trading volume, we break down the events that can spark significant price action.

Looking to level up your trading game? Explore StocksToTrade, the ultimate platform for traders. With powerful tools designed for swing and day trading, integrated news scanning, and even social media monitoring, StocksToTrade keeps you one step ahead.

Check out our quick startup guide for new traders!

- How to Read Stock Charts: A Guide for Beginners

- Trading Plan: 6 Steps to Create One

- How To Create a Stock Watchlist

Ready to build your watchlists? Check out these curated lists:

Once your watchlist is set, take the next step and trade with confidence using StocksToTrade’s robust platform. Don’t miss out — grab your 14-day trial for just $7 and experience the edge you need to thrive in today’s fast-paced markets.