Pacific Biosciences of California Inc.’s stocks have been trading up by 8.77 percent, fueled by promising analysis and market optimism.

Recent Developments:

- Cathie Wood’s ARK Investment Management recently boosted its position in Pacific Biosciences by acquiring 899K shares, reflecting increased confidence in the company’s outlook.

- Scotiabank adjusted its price target for Pacific Biosciences from $6 to $2 due to disappointing financial results and potential setbacks in U.S. academic funding, while keeping an Outperform rating.

- Jim Gibson is set to become the new CFO at Pacific Biosciences, expected to take charge by March 31, a move signaling strategic leadership adjustments.

- Pacific Biosciences has rewarded its soon-to-be CFO, Jim Gibson, with a significant stock option, highlighting the company’s intent to align leadership incentives with organizational growth strategies.

Live Update At 11:03:40 EST: On Wednesday, April 09, 2025 Pacific Biosciences of California Inc. stock [NASDAQ: PACB] is trending up by 8.77%! Discover the key drivers behind this movement as well as our expert analysis in the detailed breakdown below.

Financial Overview:

When it comes to trading, many individuals focus solely on identifying lucrative opportunities, but the true challenge often lies in navigating uncertainty and minimizing potential losses. As Tim Bohen, lead trainer with StocksToTrade says, “For me, trading is more about managing risk than finding the next big mover.” This perspective underscores the importance of carefully assessing factors like market volatility and personal financial stability before making any trade. By prioritizing risk management, traders can maintain a sustainable approach that helps safeguard their assets.

Pacific Biosciences of California recently reported its financial results, revealing both challenges and opportunities. Revenue was $154M, marking a slower than anticipated growth rate due to hurdles like limited academic funding in the U.S. Though gross margin improved to 24.2%, profitability remains an issue, with operating losses largely influenced by high operational costs and R&D investments. The company’s assets turnover stands at a moderate 0.1, which indicates underutilization of assets to generate revenue. Meanwhile, a high current ratio of 7.5 suggests strong liquidity, but also potentially inefficient use of capital.

More Breaking News

- Fangdd Network Shows Resilient Growth Amid Market Headwinds

- Citi Boosts RH Price Target Amid Strong Earnings Expectations

- HKPD Nears Strategic Partnership with Prominent Pharmaceutical Firm

- SCAG Stock Reacts to Strategic Market Developments

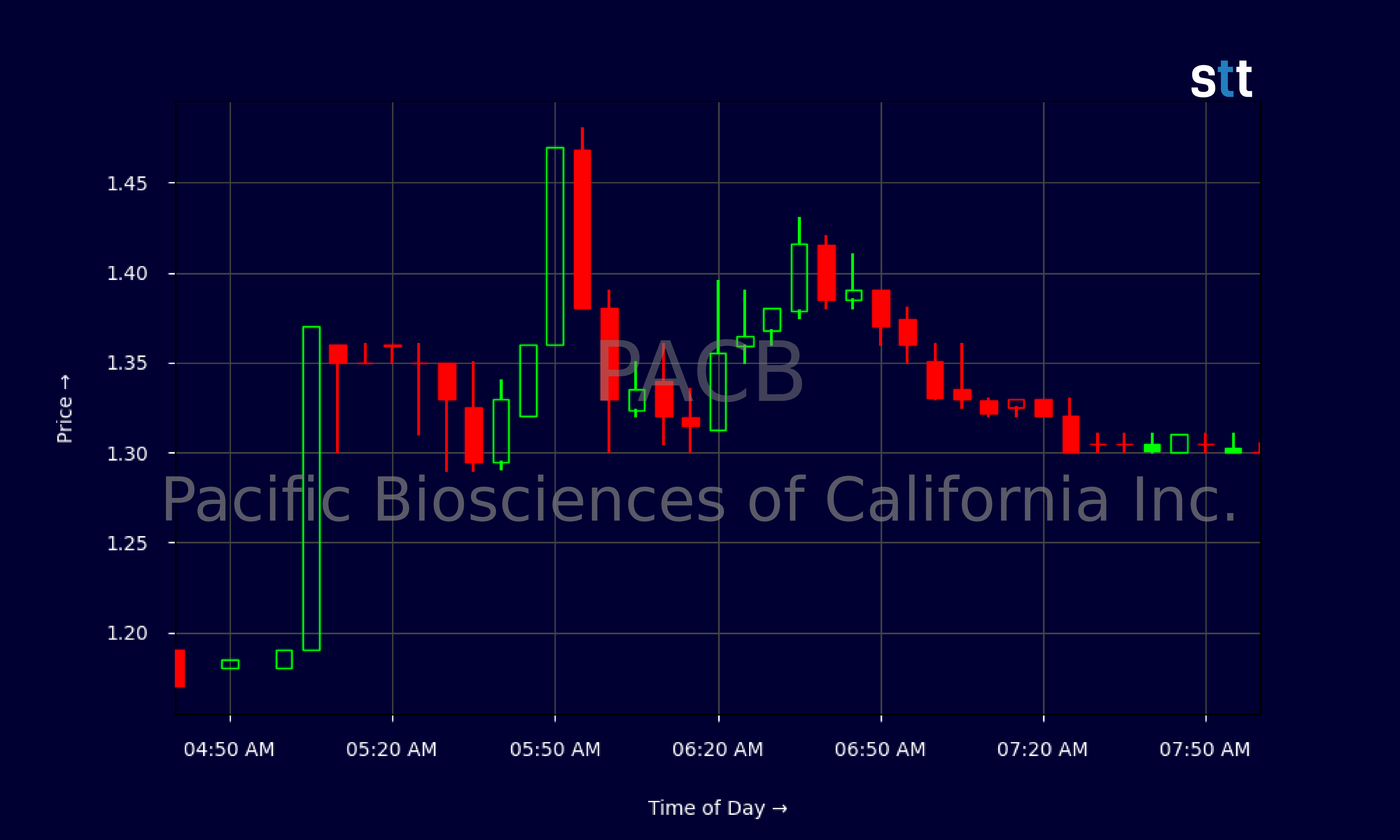

Reflecting on the market data, the stock price fluctuated sharply, starting the week at $1.35 and closing at $1.30 by April 9, 2025. This fluctuation indicates a mix of investor optimism and caution. Over the past few days, intra-day trading revealed significant highs driven by speculative buying, which could be tied to the announcement of ARK Investment’s heavy flirtation with PACB shares.

News Impact and Market Implications:

The strategic investment by Cathie Wood’s ARK Investment appears to be a strong vote of confidence, capturing investor attention and potentially creating a ripple effect through enhanced market sentiment and trading volumes. Large purchases like this can catalyze stock movements, often interpreted as insider confidence in future performance, regardless of the adjustments in price targets by analysts such as Scotiabank.

Scotiabank’s revised lower target reflects caution due to current operational struggles, but its Outperform rating suggests potential belief in Pacific Biosciences’ technology edge, particularly in next-generation sequencing. Despite the stock’s near-term financial hurdles, the underpinning technology could promise long-term gains.

Jim Gibson’s impending leadership is a critical component in redefining the financial trajectory of the company. His financial leadership from Sequoia should bring stability and possibly strategic refinements necessary for a company facing mixed sentiments. The significant equity incentive granted to him aligns his interests with shareholders, underpinning potential shifts in financial strategies or operational performance.

Conclusion:

While news surrounding Cathie Wood’s trading offers optimism, fundamental challenges portrayed by price target adjustments and financials present a complex picture of uncertainty. The newly appointed CFO, along with strategic incentives, could play a pivotal role in navigating Pacific Biosciences toward a brighter future. As Tim Bohen, lead trainer with StocksToTrade says, “I never chase price. The best opportunities allow me to enter on my terms, not when I’m feeling pressured.” This perspective perfectly illustrates the current dynamics as the immediate market performance shows promise, yet the broader picture rests on effective management of current challenges and capitalizing on tech advancements. The fusion of news and its resultant market impact remains a fascinating watch for industry observers and traders alike.

This is stock news, not investment advice. StocksToTrade News delivers real-time stock market updates tailored to highlight the key catalysts driving short-term price movements. Our coverage is designed for active traders and investors who thrive in fast-moving markets, with a focus on volatile sectors like penny stocks, AI stocks, Robinhood stocks and other momentum plays. From earnings reports and FDA approvals to mergers, new contracts, and unusual trading volume, we break down the events that can spark significant price action.

Looking to level up your trading game? Explore StocksToTrade, the ultimate platform for traders. With powerful tools designed for swing and day trading, integrated news scanning, and even social media monitoring, StocksToTrade keeps you one step ahead.

Check out our quick startup guide for new traders!

- How to Read Stock Charts: A Guide for Beginners

- Trading Plan: 6 Steps to Create One

- How To Create a Stock Watchlist

Ready to build your watchlists? Check out these curated lists:

Once your watchlist is set, take the next step and trade with confidence using StocksToTrade’s robust platform. Don’t miss out — grab your 14-day trial for just $7 and experience the edge you need to thrive in today’s fast-paced markets.