Organon & Co.’s stocks have been trading down by -24.32 percent amidst leadership shakeups and anticipated strategic pivots.

Key Market Developments:

- Morgan Stanley has revised down its price target for Organon, cutting it to $15 from $16, while keeping its Equal Weight rating. This reflects a cautious stance amid ongoing market uncertainties.

-

BofA Securities has also lowered its price target for Organon, from $15 to $11, reinforcing an Underperform rating. This news coincided with Organon’s stock trading at $10.70, a 3.82% drop, indicating investor skepticism.

-

CFRA has downgraded Organon & Co. to ‘Sell’ from ‘Hold’. Reduced price targets to $11 from $15 cite challenges such as anticipated revenue declines, generic competition, and liquidity concerns as potential hurdles ahead.

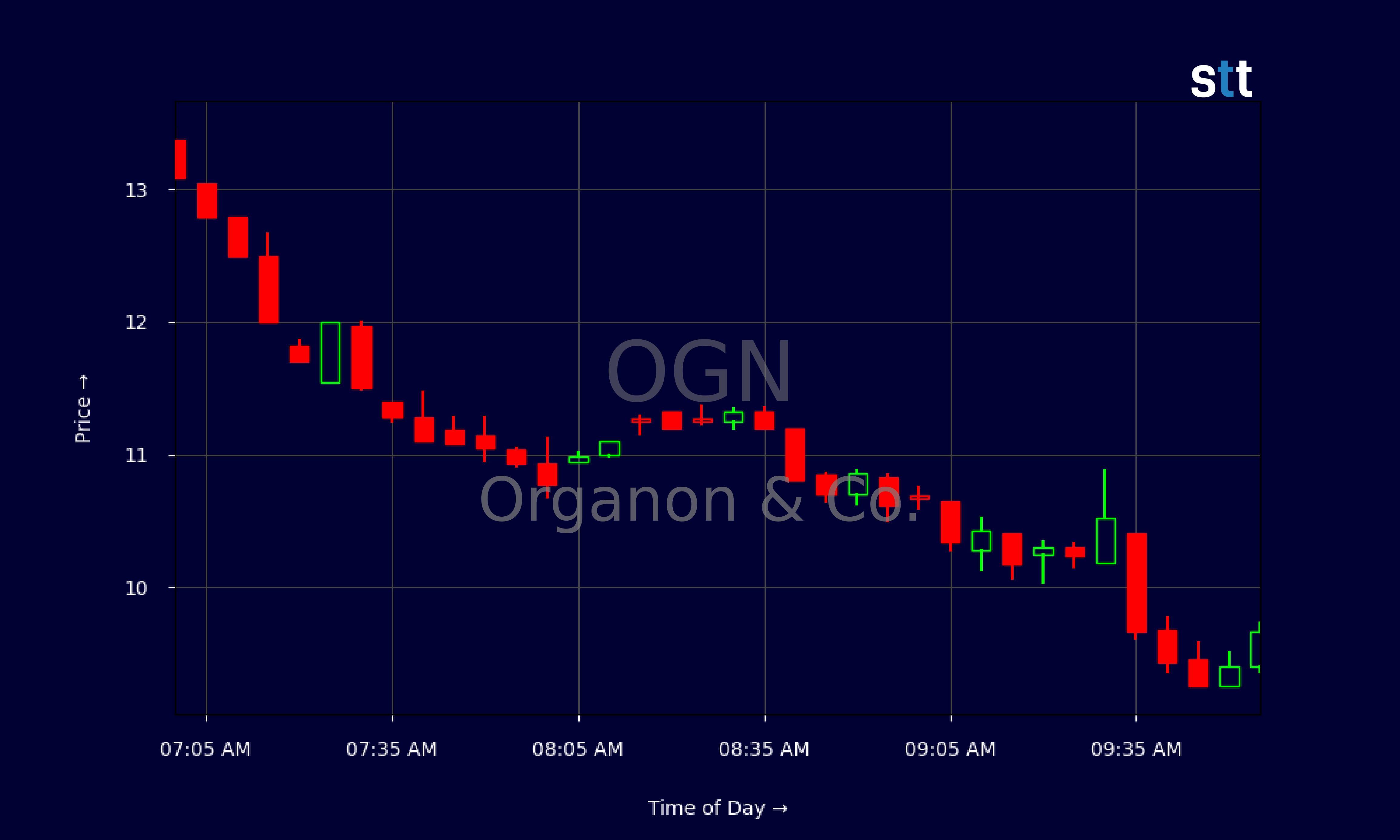

Live Update At 10:02:34 EST: On Thursday, May 01, 2025 Organon & Co. stock [NYSE: OGN] is trending down by -24.32%! Discover the key drivers behind this movement as well as our expert analysis in the detailed breakdown below.

Financial Snapshot and Implications:

In the dynamic world of trading, making strategic decisions that are both timely and informed is crucial for success. Seasoned traders often emphasize the importance of focusing on the present moment when analyzing market trends. As Tim Bohen, lead trainer with StocksToTrade says, “I focus on momentum that’s visible right now. Speculation on future moves is outside my playbook.” This approach helps traders to capitalize on current market movements while avoiding the pitfalls of over-speculation and guesswork about the future. By observing and acting on the current momentum, traders can better manage risks and enhance their ability to make profitable trades.

Organon & Co., a key player in the pharmaceutical industry, has recently showcased a mix of strengths and weaknesses through its financial reports and ratios. The company reported a revenue of $6.4B and maintained a gross margin of 58%, reflecting its robust revenue generation capability. However, its profitability margins have been met with challenges—the profit margin, clocking at around 13.49%, warrants a closer look into operational and back-end efficiencies.

Crucially, Organon’s total debt-to-equity ratio of 18.81 is indicative of significant leverage, arguably raising concerns among investors regarding debt management, particularly given the current macroeconomic climate. This foregrounds the necessity for strategic debt restructuring initiatives. The enterprise value of $11.6B, while substantial, signals market sentiments underscoring Organon’s equity holdings and balance sheet health.

Financially, Organon is categorized under low-pricing multiples, with a P/E ratio at 3.91 and a price-to-cash-flow ratio of 2.1. These benchmarks suggest undervaluation when compared to most peers, possibly opening avenues for investors seeking growth opportunities or value investing. Conversely, in the face of such appealing valuations, CFRA’s pessimistic forecast punctuates a cautious approach towards future buy-in.

Investors will likely weigh these metrics against Organon’s current strategic directives and market adaptability, especially with anticipated slowdowns. Asset turnover remains stable at 0.5, reflecting balanced operational throughput alongside the need for boosting asset efficiency.

Detailed Analysis of Market Sentiments:

Price Target Revisions:

The market pulse surrounding Organon & Co. has captured diverse analyst perspectives, particularly in terms of price target settings and stock valuations. The downgrades, such as those carried out by major entities like Morgan Stanley and BofA, have influenced market sentiment decisively. With adjusted price targets being pitched notably below initial expectations, investors may reassess their approaches towards holding or offloading equity positions in the pharmaceutical giant.

A factor warranting pertinent emphasis is the stock’s active trading dynamics amidst these target revisions. The fluctuations from $13.05 down to $9.865 in recent trading sessions mirror immediate reactions to expert analyses and commentaries, situating Organon & Co. within a broader spectrum of investor reevaluations and recalibrated market expectations.

Revenue & Competitive Landscape:

A core narrative impacting Organon’s market story revolves around its revenue management and the competitive challenges posed by generics. The forecasted 2.7% revenue decline and expected top-line sales reductions further underscore the wider strategic roadblocks ahead. As key profit centers—like Established Brands—project declines of over 5%, the onus lies on Organon to innovate or diversify its portfolio to sustain shareholder value and market relevance.

Considering Organon’s position and liquidity constraints, it becomes paramount to map investment strategies aligning with competitive strategies. The market will likely anticipate tactical pivots towards avenues that could leverage cash flows effectively while mitigating cost-related pressures.

More Breaking News

- BIT Mining Explodes: Time to Dive In?

- Sonnet BioTherapeutics Surge: What’s Fueling the Rise?

- RIG’s Unexpected Surge: Analyzing Market Movement

Investor Strategies and Market Predictions:

With substantial market skepticism underlining Organon’s present scenario, understanding the implications of key financial ratios and news narratives becomes crucial for making informed decisions. Traders are tasked with juxtaposing Organon’s apparent value potential against the looming specters of financial downturns as flagged by the current downgrades.

Despite poor short-term outlooks, long-term market trajectories might spotlight Organon as a trading ally once the tides of restructuring and strategic realignment efforts evidence concrete positive outcomes. As Tim Bohen, lead trainer with StocksToTrade says, “I never chase price. The best opportunities allow me to enter on my terms, not when I’m feeling pressured.” This mindset might guide traders to carefully parse through Organon’s strategic maneuverings, aligning risk appetites accordingly.

In conclusion, the evolving landscape that Organon & Co. navigates serves as an intricate puzzle for stakeholders. Balancing competitive pressures, financial metrics, and overarching market forces will delineate Organon’s pathway forward, for both tactical analysts and hopeful traders alike.

This is stock news, not investment advice. StocksToTrade News delivers real-time stock market updates tailored to highlight the key catalysts driving short-term price movements. Our coverage is designed for active traders and investors who thrive in fast-moving markets, with a focus on volatile sectors like penny stocks, AI stocks, Robinhood stocks and other momentum plays. From earnings reports and FDA approvals to mergers, new contracts, and unusual trading volume, we break down the events that can spark significant price action.

Looking to level up your trading game? Explore StocksToTrade, the ultimate platform for traders. With powerful tools designed for swing and day trading, integrated news scanning, and even social media monitoring, StocksToTrade keeps you one step ahead.

Check out our quick startup guide for new traders!

- How to Read Stock Charts: A Guide for Beginners

- Trading Plan: 6 Steps to Create One

- How To Create a Stock Watchlist

Ready to build your watchlists? Check out these curated lists:

Once your watchlist is set, take the next step and trade with confidence using StocksToTrade’s robust platform. Don’t miss out — grab your 14-day trial for just $7 and experience the edge you need to thrive in today’s fast-paced markets.