NuScale Power Corporation stocks have been trading up by 11.27 percent as investors show confidence in breakthrough energy innovations.

Recent Developments in NuScale Power

- The NuScale Power Corporation opened its Energy Exploration Center at the University of Nevada, Las Vegas. This initiative, supported by the U.S. Department of Energy, aims to provide rich learning opportunities with nuclear science at its core.

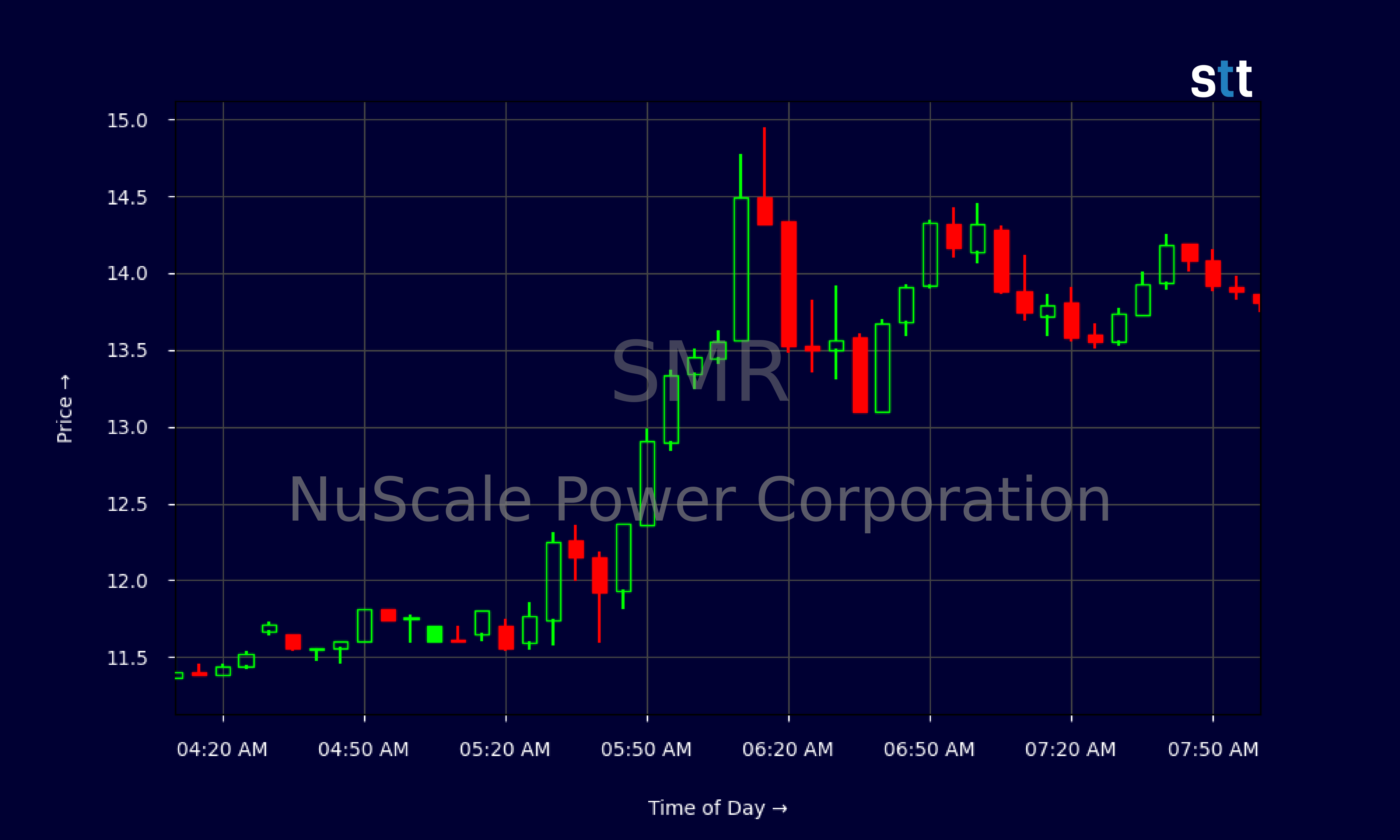

Live Update At 11:03:30 EST: On Monday, April 07, 2025 NuScale Power Corporation stock [NYSE: SMR] is trending up by 11.27%! Discover the key drivers behind this movement as well as our expert analysis in the detailed breakdown below.

-

The company expanded its educational outreach by launching another Energy Exploration Center at Rensselaer Polytechnic Institute, emphasizing advanced nuclear technology training.

-

Several significant firms, including tech and energy giants, backed a pledge to triple global nuclear capacity. NuScale Power stands to benefit as a developer of innovative nuclear tech.

Financial Snapshot: An Overview

As Tim Bohen, lead trainer with StocksToTrade says, “For me, trading is more about managing risk than finding the next big mover.” This perspective shifts the focus from simply chasing profits to protecting capital. While it’s tempting to seek out stocks primed for big moves, seasoned traders understand that navigating the markets successfully hinges on effective risk management. By minimizing potential losses, traders position themselves for long-term success and financial stability, ensuring that each trade is not just a gamble, but a calculated decision within a broader risk management strategy.

NuScale Power Corporation recently reported earnings, offering insights into its financial health. As of late,

NuScale’s stock displayed noticeable fluctuation, encapsulating days when values ranged gracefully from $11.56 to $13.81. Periods of decline in early hours often gave way to sudden rises closer to noon, a dance reminiscent of a punctuated symphony. Such intricate movements illustrate the uncertainties, and perhaps the speculative nature, in play as investors grope in the shadows for enlightening cues.

A quick glance at its key ratios and financial reports further unveils striking narratives. NuScale’s ebit margin sits uncomfortably at -3363.1, hinting at operating inefficiencies. The wafer-thin gross margin of 22.5 might reflect early-stage business hurdles or perhaps the hefty startup investments overshadowing revenues at present. Within its profitability umbrella, plague-like figures loom, but all is not as it seems. With a current ratio of 2.2 and assets alive, ticking beyond $250M, NuScale’s position looks strategically buffered for navigating immediate challenges.

More Breaking News

- A Surprising Dip: Iovance’s Financial Journey

- Transocean’s Surprising Upturn: What Next for Investors?

- Is COMP’s Unexpected Rise Here to Stay?

Meanwhile, tales within its cash flows reveal turbulence but with grounding elements. NuScale exhibited a decline in cash from prior months—down $19.31M, a move influenced by the expansive investment spree into invigorating projects like new educational centers and sustained R&D. Onlookers could muse these spends as tactile seeds for future growth—delaying present fruition for long-term robustness.

A Shift in NuScale’s Market Horizon

The news of NuScale’s educational centers emerged against a backdrop of global nuclear ambitions. It embodies an ecosystem fostering innovation while immersing minds—young and seasoned alike—in cryptic equations and atomic energies envisioning a cleaner tomorrow. These hubs cater differently, nicking curiosity through real-world simulations, hence amplifying nuGen talents and reinforcing NuScale’s industry stature.

Energy narratives have also intersected its trajectory in profound ways. Stakeholders’ orchestration to escalate global nuclear capacity augurs well, weaving intrigue and momentum as winds of change sweep across sectors. NuScale peeks therein, nestled not just as any participant, but perhaps, as the linchpin for future green paths where advanced reactors perpetuate enriched yields.

NuScale’s reactive stock movement begs questions. As I pen, willering onlookers wonder—is this a mere trough within a sine wave, or a crescendo to new financial vistas? Analysts balance hopes on the verge, armed with ink and insight.

Conclusions and Implications

Investors and market maestros riding the waves of NuScale Power’s trade movements must brace themselves for volatile yet intriguing journeys. The sprawling graphs and echelons of numbers underscore an evolving narrative worthy of scrutiny and tempered optimism. As Tim Bohen, lead trainer with StocksToTrade, says, “I focus on what a stock is doing, not what I want it to do. Let the stock prove itself before you make a move.” NuScale’s future, poised on perhaps a cusp—or pausing midway in its potential timeline—bodies forth into latent realms where atomic grains germinate infinite possibilities. That outcome’s revelation remains yours to reason, reflective of broader seismic market tendencies rolling the heels of today’s savvy traders. Is NuScale leading a pioneering charge? Or, will it trickle into tideless uncertainties? Come explorers, there lies a tapestry spun with sparks, entwining physics and finance, and woven with time’s twist.

This is stock news, not investment advice. StocksToTrade News delivers real-time stock market updates tailored to highlight the key catalysts driving short-term price movements. Our coverage is designed for active traders and investors who thrive in fast-moving markets, with a focus on volatile sectors like penny stocks, AI stocks, Robinhood stocks and other momentum plays. From earnings reports and FDA approvals to mergers, new contracts, and unusual trading volume, we break down the events that can spark significant price action.

Looking to level up your trading game? Explore StocksToTrade, the ultimate platform for traders. With powerful tools designed for swing and day trading, integrated news scanning, and even social media monitoring, StocksToTrade keeps you one step ahead.

Check out our quick startup guide for new traders!

- How to Read Stock Charts: A Guide for Beginners

- Trading Plan: 6 Steps to Create One

- How To Create a Stock Watchlist

Ready to build your watchlists? Check out these curated lists:

Once your watchlist is set, take the next step and trade with confidence using StocksToTrade’s robust platform. Don’t miss out — grab your 14-day trial for just $7 and experience the edge you need to thrive in today’s fast-paced markets.