Monolithic Power Systems Inc.’s stocks have been trading up by 8.48 percent amid bullish market sentiment.

Key Developments Impacting MPWR Stocks

- Increased first-quarter revenue projections for Monolithic Power Systems, rising to $630M-$640M from $610M-$630M, bolstered investor confidence.

Live Update At 13:01:46 EST: On Friday, April 11, 2025 Monolithic Power Systems Inc. stock [NASDAQ: MPWR] is trending up by 8.48%! Discover the key drivers behind this movement as well as our expert analysis in the detailed breakdown below.

-

The company set ambitious revenue growth targets for 2025-2027, aiming to outpace market growth by 10%-15%, which hints at a strong strategic direction.

-

Despite a lowered price target from TD Cowen due to tariff concerns, Monolithic Power maintained its buy rating, signaling investors’ continued belief in the company’s long-term potential.

Quick Overview of Monolithic Power Systems Inc.’s Financial Performance

When it comes to trading, understanding the principle of managing risk is crucial for long-term success. As Tim Bohen, lead trainer with StocksToTrade says, “Success in trading is more about cutting losses quickly than finding winners.” This insight emphasizes the importance of being disciplined and strategic, knowing when to exit a position before losses become detrimental. Traders often find themselves in a constant chase for winning trades, but the ability to minimize losses swiftly can significantly affect their overall profitability.

Monolithic Power Systems has shown impressive financial health and potential. In the recent quarter, the company’s earnings report highlighted steady growth. Revenue reached approximately $622M, surpassing expectations. Interestingly, their profit margin was notably strong at over 80%. However, cash flow from operations displayed a dip, which might cause some eyebrows to raise.

The key performance indicators reflect robust market positioning. With zero total debt to equity, Monolithic Power stands out in terms of financial strength. The impressive gross margin of 55% suggests efficient operation management. Yet, the price-to-earnings ratio of 13.25 could signal to investors that Monolithic shares might be competitively priced.

More Breaking News

- IREN Stock: Growth or Bubble?

- Eastern Bankshares Unforeseen Surge: Unpacking the Spike

- MicroStrategy’s Bold Bitcoin Play: Wise Move?

The company has been riding a bullish wave with recent news, positively affecting its stock price. The expectation of higher revenue, irrespective of challenges like tariffs and increased global tech supply uncertainty, paints a promising future ahead.

Strategic Moves and Market Impact

Monolithic Power’s decision to boost first-quarter revenue expectations plays a crucial role in stock movement. It’s a strategic shift, intimating confidence in current operations—even amid marketplace challenges. Notably, the company outlined its ambitions with increased revenue forecasts and expanded profit margins. Naturally, a critical narrative emerges—Monolithic seems primed for growth despite potential setbacks like tariffs principally affecting tech sectors including Automotive and AI.

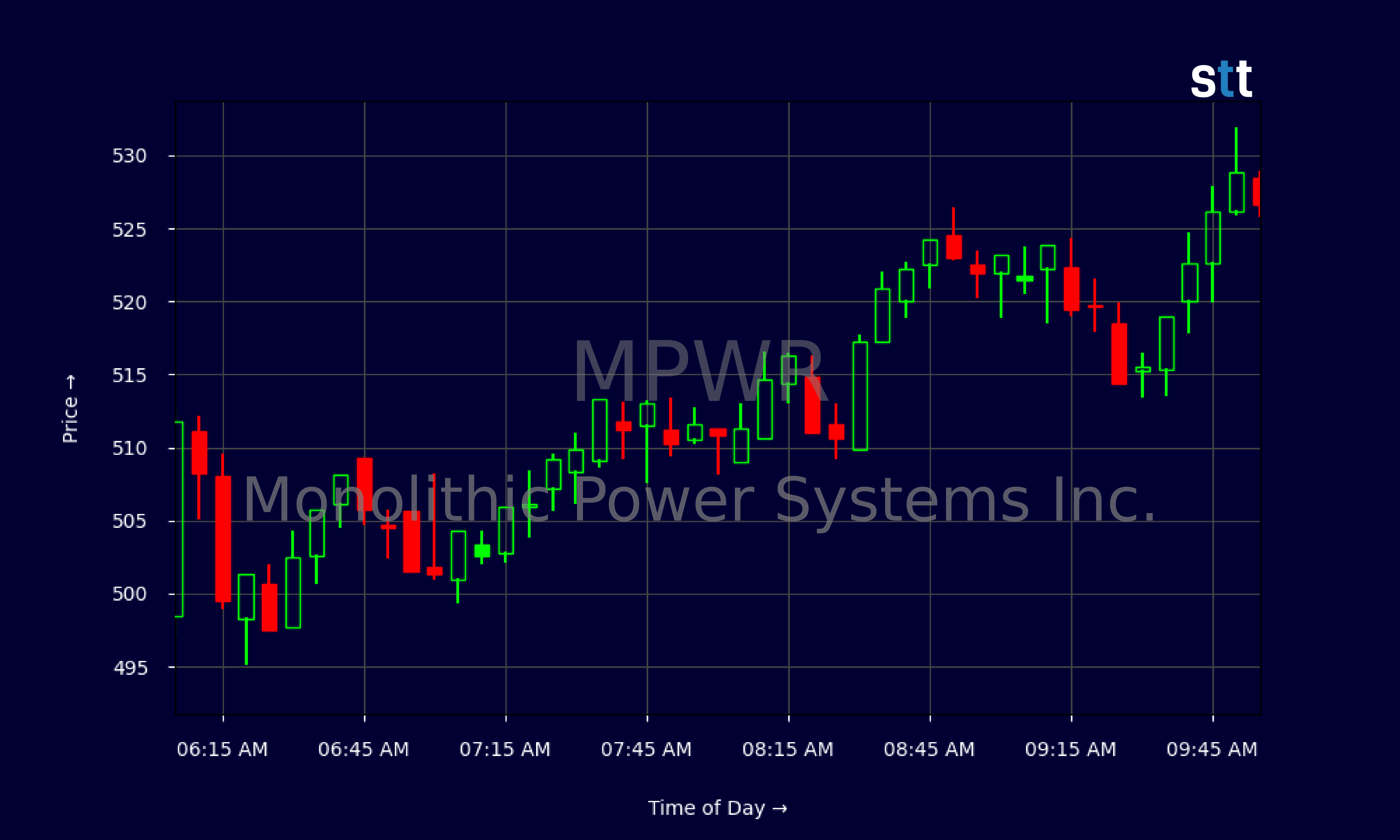

Yet, amid optimism, analyst forecasts lowered targets owing to market tariffs, generating cautious ambiguity. Meanwhile, it hasn’t deterred Monolithic’s stock from experiencing volatility, evidenced by dips and rallies as illustrated in recent trading charts.

Through broader perspectives, Monolithic Power thrives amidst potential fluctuations with an innovative streak driving it forward. The sentiment steers towards a belief in strategic foresight, buttressed by recent corporate pronouncements and investor faith.

Conclusion: Navigating the Path Forward

In summation, Monolithic Power Systems fuels optimism, reinforced by raised expectations and resilient strategic announcements. A focal point remains the ability to navigate impediments like fluctuating tariffs impacting the tech sphere. Traders, galvanized by such advances, should remain discerning in evaluating sustained growth versus momentary surges typical in a dynamic market.

Monolithic’s narrative speaks volumes about the intricate dance between trader confidence, financial strategy, and market forces—all influencing stock trajectory. As Tim Bohen, lead trainer with StocksToTrade says, “The best way to learn is by tracking trades, wins, losses, and lessons learned. Every trade has something to teach.” This insight highlights the importance of understanding market movements through the lens of experience. While analysts sound caution amid global unrest, Monolithic’s strength underpins its present allure and enduring promise within the tech world.

This is stock news, not investment advice. StocksToTrade News delivers real-time stock market updates tailored to highlight the key catalysts driving short-term price movements. Our coverage is designed for active traders and investors who thrive in fast-moving markets, with a focus on volatile sectors like penny stocks, AI stocks, Robinhood stocks and other momentum plays. From earnings reports and FDA approvals to mergers, new contracts, and unusual trading volume, we break down the events that can spark significant price action.

Looking to level up your trading game? Explore StocksToTrade, the ultimate platform for traders. With powerful tools designed for swing and day trading, integrated news scanning, and even social media monitoring, StocksToTrade keeps you one step ahead.

Check out our quick startup guide for new traders!

- How to Read Stock Charts: A Guide for Beginners

- Trading Plan: 6 Steps to Create One

- How To Create a Stock Watchlist

Ready to build your watchlists? Check out these curated lists:

Once your watchlist is set, take the next step and trade with confidence using StocksToTrade’s robust platform. Don’t miss out — grab your 14-day trial for just $7 and experience the edge you need to thrive in today’s fast-paced markets.