Kopin Corporation’s stock receives a significant boost following an upbeat earnings report that showcases strong financial performance and strategic initiatives driving market confidence. On Thursday, Kopin Corporation’s stocks have been trading up by 25.85 percent.

Recent Developments Shaping KOPN’s Market Trajectory

- Its revealing of DayVAS and DarkWAVE systems at SHOT Show 2025 is expected to boost its positioning in defense technology.

- Analysts see potential strategic moves with Kopin’s already strong market presence, pointing to possible acquisitions or becoming a target.

- An encouraging $2M production order for their microdisplays might signal robust market demand.

- A strong presence at the SPIE AR/VR/MR 2025 event highlights the firm’s dedication to futuristic tech design.

- New collaborations and presentations at pivotal industry events showcase confidence in Kopin’s growth strategy.

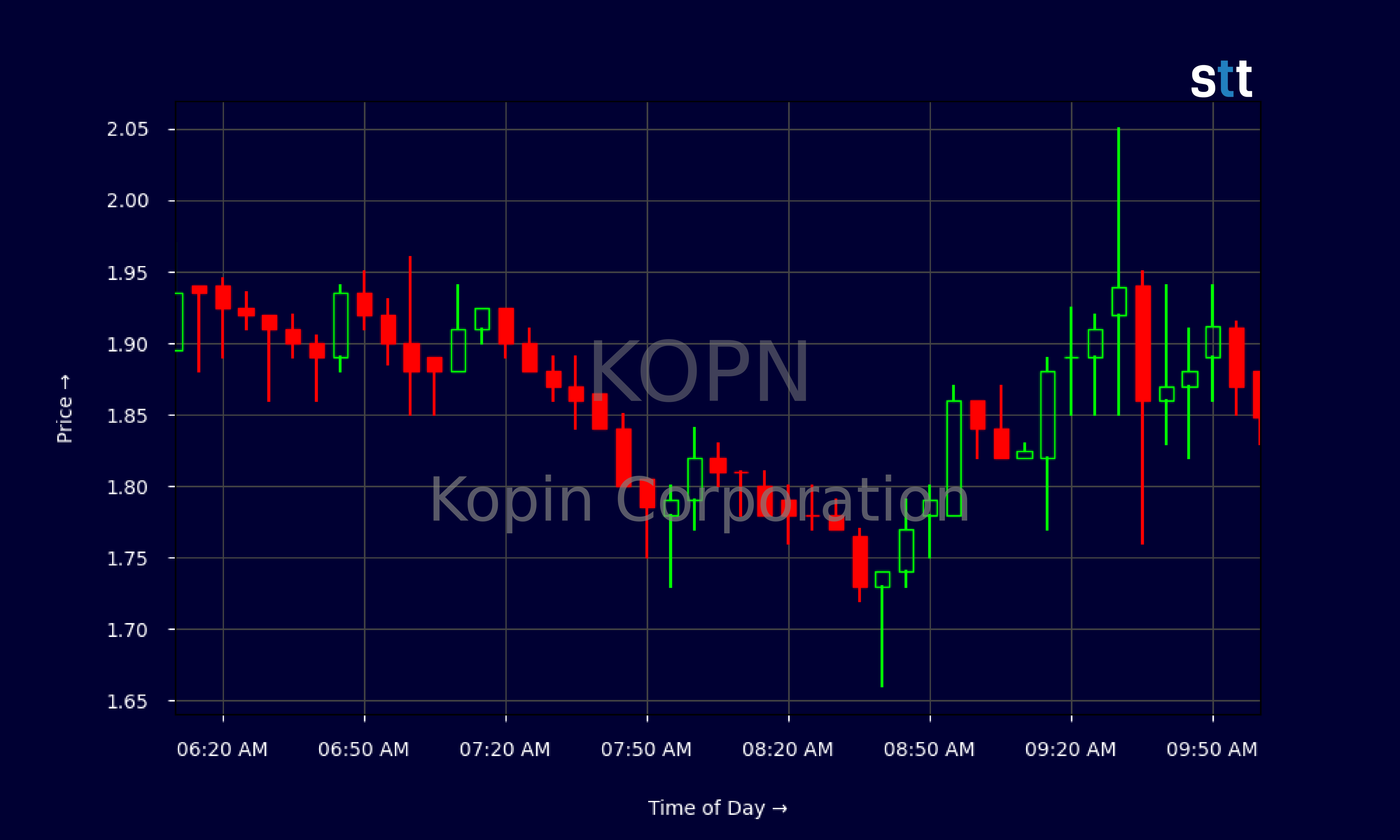

Live Update At 10:03:37 EST: On Thursday, January 23, 2025 Kopin Corporation stock [NASDAQ: KOPN] is trending up by 25.85%! Discover the key drivers behind this movement as well as our expert analysis in the detailed breakdown below.

Kopin Corporation’s Earnings and Financial Health

As Tim Bohen, lead trainer with StocksToTrade, says, “Preparation is half the trade. By the time the bell rings, my decisions are nearly made.” This is emphasized as crucial among traders who aim to execute their plans with precision and confidence. By gearing up adequately and having a strategy in place before the trading day starts, traders can better adapt to fast-moving markets and make informed decisions that align with their predefined goals.

Kopin Corporation, recognized as a leader in display solutions, has been making strategic maneuvers bolstering its standing. The firm’s latest earnings report has painted a dynamic picture. While some financial red flags catch attention, the diversified growth segments could spell potential.

A glance into recent earnings reveals challenges and opportunities. Despite a sizable revenue of around $40M this year, Kopin’s profit margins indicate stormy waters. With an EBIT margin standing at an eye-catching -109.8 and an untenable profit margin of -109.38, the firm seems to have little room for error. Yet, they benefit from a gross margin sitting comfortably at approximately 68.8%, hinting at efficient production processes.

The ongoing investment in research and infrastructure seems apparent in the balance sheets. With assets pushing above the $70M mark and liquidity ratios, such as a current ratio of 1.4 and a quick ratio standing at 1, there’s reassurance in the firm’s capability to meet financial obligations. Yet, one can’t overlook their leveraged position, with a leverage ratio reaching 3.1 and significant long-term debt representing potential burdens.

Kopin’s sales to asset turnover ratio, however, suggests they’re maximizing asset use even amidst challenges. A pivotal takeaway is their shift towards innovation-driven revenue streams. The recent high-profile collaborations and product reveals hint towards future revenue injections, especially if strategic acquisition discussions materialize. In terms of management efficiency, return on equity is negative, at -68.95, highlighting a low return against shareholder equity, ushering interest in future performance upgrades.

More Breaking News

- MARA Holdings Faces Market Turbulence: What’s Next?

- TSLA’s Remarkable Ride: Is the Surge Sustainable?

- Is It Time to Bet Big on Credo Technology?

- PDD Stock Flying High: Too Late to Buy?

These complex dynamics open an intriguing chapter in Kopin’s growth story. If they respond resourcefully to enhance margins and optimize their financial muscle, the anticipated market boom could very well unveil a rewarding future.

Capturing Market Opportunities through Cutting-edge Product Innovation

Embracing the spirit of innovation, Kopin has recently unveiled groundbreaking tech solutions at the SHOT Show 2025, introducing DayVAS and DarkWAVE. While the name might evoke sci-fi dreams, these reality-augmentations tools promise much for the military sector. The collaboration with Wilcox Industries signals mutual confidence in battlefield technology and suggests that capturing government contracts could be Kopin’s forte.

The strategic unveiling comes against the backdrop of increasing demands for sophisticated military tools. The genius in Kopin’s approach is blending novelty with functional necessity, potentially carving a niche in competitive arenas.

Partnering with influential manufacturers in events like the SPIE AR/VR/MR 2025 showcases Kopin’s broader ambition. It’s a stage not just to flaunt capabilities but attract future partnerships, opening doors to sectors looking to harness AR and VR technologies.

In a rapidly digitizing world, boasting a versatile portfolio spells advantage. The upcoming line of revolutionary displays gives Kopin a vital edge in grappling with evolving market needs.

Safer helmets with superior microdisplays? A dream made tangible as demonstrated by recent mega orders, the $2M production order being one early feather in Kopin’s cap. It’s here where the theoretical meets reality, where speculation morphs into tangible orders reflecting trust and demand in Kopin’s technological promise.

Financial Recap: Navigating Kopin’s Market Moves

A deeper dive into Kopin’s financial trajectory paints a narrative of anticipation blended with realism. Despite certain alarming signs in the profitability indexes, the potential pathways offered by their innovative strides should not be underestimated.

On paper, Kopin’s negative PE ratio raises eyebrows about immediate profitability, but innovation-driven ventures suggest longer-term gains. Noting an enterprise value nearly bursting past $199M, market enthusiasts perceive untapped value given the advancing tech leadership and strong demand.

Kopin’s balance sheet shows they’ve strengthened their financial footings against potential downswings. With assets tallied above $70M, the dynamics are intriguing as this asset strength intercepts impending fiscal hurdles, particularly with significant long-term liabilities on the horizon.

Focusing on forward motions, strategic presentations at events suggest that revenues could rise in tandem with amplified visibility. If these technological breakthroughs gain traction with clients, it could signal a revenue boost that brings volatility and flexible margins in stock trading arenas.

Summarizing, with seasoned analysts forecasting growth potentials coupled with tangible innovations, Kopin seems poised on the brink of lucrative leaps.

Strategic Vision and Potential Challenges

The path forward for Kopin isn’t void of challenges. The ride, hinted through analyst forecasts, will include mastering operational efficiency as a shield against fluctuating economic winds. For Kopin, honing stronger fiscal reinforcements and addressing the nuanced variables in product performance will be pivotal. Traders might keep a keen eye on these developments to gauge risk measure increments. As Tim Bohen, lead trainer with StocksToTrade says, “Success in trading is more about cutting losses quickly than finding winners.” This mindset could be particularly relevant for those tracking Kopin’s progress, emphasizing the importance of agile decision making amidst market shifts.

To distill the essence: Kopin’s position, both financially and technologically, remains compelling yet complex. So what do traders ponder? Will innovative leaps clear fiscal hurdles, setting the stage for robust growth? As Kopin charts its path forward, capturing market confidence will hinge on embracing adaptive financial strategies fueled by inventive tech landmarks. In conclusion, Kopin’s journey is worth attention as it navigates these shared challenges and opportunities, unfolding what could be an epoch of transformative market dynamics.

Disclaimer: This is stock news, not investment advice.

StocksToTrade News delivers real-time stock market updates tailored to highlight the key catalysts driving short-term price movements. Our coverage is designed for active traders and investors who thrive in fast-moving markets, with a focus on volatile sectors like penny stocks, AI stocks, Robinhood stocks and other momentum plays. From earnings reports and FDA approvals to mergers, new contracts, and unusual trading volume, we break down the events that can spark significant price action.

Whether you’re a day trader searching for the next breakout or an investor conducting due diligence, StocksToTrade News is your go-to source for actionable insights to make informed trading decisions.

Looking to level up your trading game? Explore StocksToTrade, the ultimate platform for traders. With powerful tools designed for swing and day trading, integrated news scanning, and even social media monitoring, StocksToTrade keeps you one step ahead.

Check out our quick startup guide for new traders!

- How to Read Stock Charts: A Guide for Beginners

- Trading Plan: 6 Steps to Create One

- How To Create a Stock Watchlist

Ready to build your watchlists? Check out these curated lists:

Once your watchlist is set, take the next step and trade with confidence using StocksToTrade’s robust platform. Don’t miss out — grab your 14-day trial for just $7 and experience the edge you need to thrive in today’s fast-paced markets.