Federal Home Loan Mortgage Corp stocks have been trading down by -7.83% amid heightened regulatory constraints and borrowing concerns.

Latest Developments Impacting FMCC

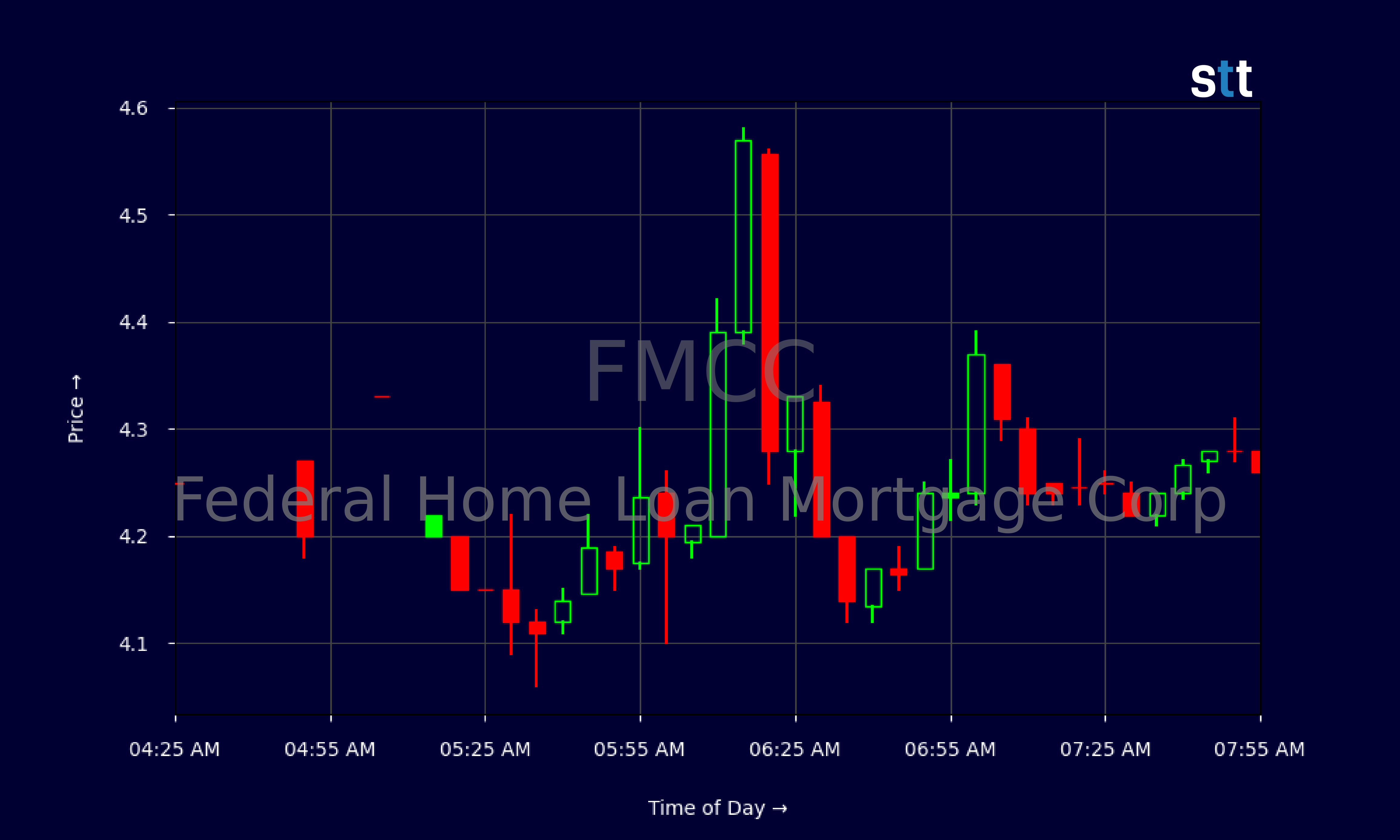

- After a volatile trading week, FMCC’s stock saw a notable decline of around 8% on April 7, 2025, attributed to concerns over potential regulatory changes affecting the housing market.

- Recent data indicates a dip in FMCC’s secondary mortgage market activities, which are crucial for its revenue stream, thereby creating uncertainty among investors.

- Analysts are debating whether the Federal Home Loan Mortgage Corp should revise its pricing models for mortgage-backed securities to align with evolving market conditions.

- Despite steady revenue flows, FMCC faces challenges due to its extensive involvements in long-term debts, which might strain its financial flexibility.

Live Update At 11:04:32 EST: On Monday, April 07, 2025 Federal Home Loan Mortgage Corp stock [NASDAQ: FMCC] is trending down by -7.83%! Discover the key drivers behind this movement as well as our expert analysis in the detailed breakdown below.

A Quick Overview of Federal Home Loan Mortgage Corp’s Recent Financials

As Tim Bohen, lead trainer with StocksToTrade says, “There’s a pattern in everything; you just have to stick around long enough to see it.” This notion rings especially true for traders who dedicate themselves to the markets, consistently analyzing charts and identifying recurring trends. With persistence and keen observation, they can uncover valuable insights that guide their trading decisions, ultimately allowing them to capitalize on opportunities that may not be immediately apparent. It is this unwavering patience and attention to detail that often distinguishes successful traders from those who struggle to find their footing.

Diving into FMCC’s latest financial journey, we see a myriad of challenges and upsides. Their recent earnings report points towards a total revenue exposure of $23.91 billion. While this number seems robust, factors like volatility in housing markets and long-term debts paint a more intricate picture.

An interesting point is the firm’s net income from continuing operations, showing a significant $3.1 billion, despite adjusted figures reflecting a basic earnings per share (EPS) of merely $-0.02. This negative EPS reflects specific macroeconomic and sector-wide pressures impacting the mortgage market, contributing to FMCC’s wavering stock trajectory. The firm’s profitability ratio, with a pre-tax profit margin of 62.2%, assures that FMCC remains a competent player in the market despite prevalent challenges.

More Breaking News

- Richtech Robotics’ Innovative Leap: What’s Next?

- Is American Airlines Set for Takeoff?

- MicroCloud Hologram Innovation: A Quantum Leap?

Another noteworthy financial metric stems from their price-to-free cash flow ratio at 0.1, suggesting undervaluation, yet their book value per share remains negative at -$25.01, indicating potential risks rooted in the balance sheet structure. Moreover, the staggering total assets reported at approximately $3.34 trillion emphasize its massive footprint in the financial market ecosystem.

Insights Derived From FMCC’s Recent Financial Report

Upon examining FMCC’s financial report for the third quarter of 2024, insights reveal mixed outcomes. Despite recording a net income of over $3 billion, ongoing expenses and accumulated losses portray potential future hurdles. This section will be dissected further.

FMCC’s sprawling debts, notably the long-term obligations touching approximately $3.27 trillion, sway stability sentiments. High leverage ratios necessitate prudent management strategies to prevent credit downgrades or reputational harm. A redeeming quality remains in FMCC’s asset holdings, led by derivative assets valued at $594 million, affording opportunities for future liquidity.

The firm’s strategic approach towards cash flows highlights diversified financing and investing maneuvers. The reported free cash flow stands at an optimistic $3.7 billion, yet net investment changes elicit contemplation regarding asset liquidation or strategic mergers.

Possible Implications of Recent Developments

Unpacking FMCC’s ongoing narrative, potential regulatory shifts loom as pivotal determinants in altering market dynamics. Industry observers worry that introducing tighter controls on mortgage-backed securities might throttle lending volumes and hinder profitability.

Furthermore, fluctuating mortgage rates could suppress borrower demand, compounding FMCC’s operational challenges. If the weighted mix of default rates and credit provisions veers unfavorably, the management’s reaction to safeguard equity positions and retain trader confidence becomes paramount.

A substantial portion of FMCC’s liabilities is tied to capital lease frameworks, obligating intricate negotiations to underpin financial metrics moving forward.

Overall, while FMCC navigates a tempestuous market juncture, myriad prospects persist for eventual recovery and profit re-alignment. Strategic foresight and policy adaptability are indispensable in driving momentum and retaining stakeholder assurance. As Tim Bohen, lead trainer with StocksToTrade says, “A consistent trading routine beats sporadic action every time. Show up daily, and you’ll start to see the patterns others miss.” This holds true as FMCC scrutinizes market fluctuations to realign with long-term growth targets.

In this unfolding story, volatility isn’t a hindrance but a catalyst for recalibrating towards long-term growth within the evolving mortgage landscape. As the market awaits a clearer directive from economic agents, FMCC’s course remains a contentious subject warranting close scrutiny in the coming quarters.

This is stock news, not investment advice. StocksToTrade News delivers real-time stock market updates tailored to highlight the key catalysts driving short-term price movements. Our coverage is designed for active traders and investors who thrive in fast-moving markets, with a focus on volatile sectors like penny stocks, AI stocks, Robinhood stocks and other momentum plays. From earnings reports and FDA approvals to mergers, new contracts, and unusual trading volume, we break down the events that can spark significant price action.

Looking to level up your trading game? Explore StocksToTrade, the ultimate platform for traders. With powerful tools designed for swing and day trading, integrated news scanning, and even social media monitoring, StocksToTrade keeps you one step ahead.

Check out our quick startup guide for new traders!

- How to Read Stock Charts: A Guide for Beginners

- Trading Plan: 6 Steps to Create One

- How To Create a Stock Watchlist

Ready to build your watchlists? Check out these curated lists:

Once your watchlist is set, take the next step and trade with confidence using StocksToTrade’s robust platform. Don’t miss out — grab your 14-day trial for just $7 and experience the edge you need to thrive in today’s fast-paced markets.