ConocoPhillips stocks have been trading up by 3.32 percent amidst positive sentiment following key energy market developments.

Key Market Shifts of COP

- UBS revises COP’s price target to $111 from $116, retaining a Buy rating, ahead of impending Q1 earnings.

- Jefferies decreases COP’s target price to $123, yet holds firm to a Buy rating, keeping optimism alive amid fluctuating oil prices.

- ConocoPhillips experiences a price target reduction to $120 from $133 by RBC Capital, while maintaining Outperform status, sparking investor deliberation.

- Wells Fargo lowers COP target to $116 from $131, despite continuing Overweight rating, resulting in skepticism among stockholders.

- Tudor Pickering Holt modifies COP target from $123 to $119, still maintaining a Buy rating, indicating potential value for investors.

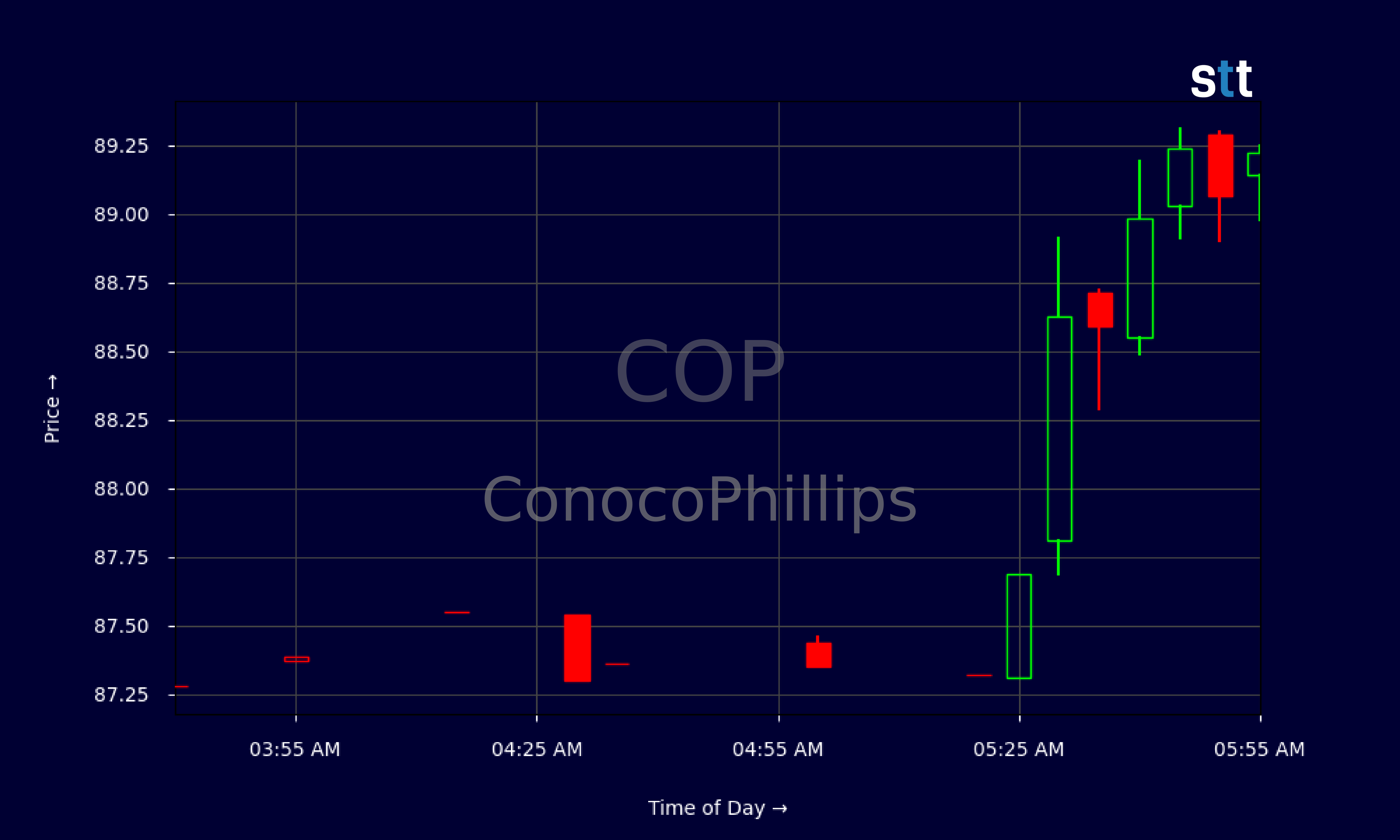

Live Update At 09:02:41 EST: On Thursday, April 17, 2025 ConocoPhillips stock [NYSE: COP] is trending up by 3.32%! Discover the key drivers behind this movement as well as our expert analysis in the detailed breakdown below.

Financial Metrics and Insights

As Tim Bohen, lead trainer with StocksToTrade says, “A good trade setup checks all the boxes—volume, trend, catalyst. Don’t trade if you’re missing pieces of the puzzle.” Traders should be diligent in their preparation. Successful trading often relies on having a thorough understanding of the market conditions and ensuring that all necessary criteria are met before executing a trade. By being meticulous and following a structured approach, traders increase their chances of making informed and profitable decisions.

Looking closer at ConocoPhillips’ quarterly report from 2024, its financial performance exhibits strong cash flow activities. The free cash flow stood robust at $4.46B, reflecting operational proficiency, even after a modest depreciation and amortization expense. The total revenue reached an impressive $54.75B, while its earnings per share (EPS) came in at 1.9. These figures outline ConocoPhillips’ enduring operational efficiency and profitability despite headwinds.

Analyzing key ratios, the profitability measures are notably healthy. The EBIT margin rested at 26.2% and the pretax profit margin at 25.2%. A good pretax margin implies consistent earnings generation before tax implications weigh in. Total debt to equity ratio holds at a reasonable 0.38, a testament to low leverage and prudent financial management.

Despite market upheavals, the P/E ratio of 11.06 suggests potential undervaluation, particularly when juxtaposed against industry norms. The price-to-cash flow ratio sits at 6.2, underscoring ConocoPhillips’ ability to generate cash relative to its stock price. This bodes well for investors seeking stable returns.

COP also shines through strong asset and management effectiveness ratios. Return on equity at 29.3% indicates efficient equity utilization. Return on assets, a definitive 14.93%, vouches for superior asset deployment in revenue generation. The cash flow from operations at $4.457 billion underscores significant liquidity support, crucial for navigating uncertain market conditions.

The company’s current ratio of 1.3, along with a quick ratio of 1, implies stable liquidity, critical for meeting short-term obligations. These financial strengths position ConocoPhillips to possibly weather volatility and create opportunities for strategic investment initiatives.

More Breaking News

- HOLO’s Recent Stock Surge: What’s Driving It?

- Quantum Computing Stock Plunge: What’s Next?

- TAL Education Group’s Stock Rise: Should You Care?

ConocoPhillips’ trailblazing momentum and its thriving energy production set the stage for potential sustainable growth. The firm’s strategies and market adaptations, though mixed with uncertainties due to global economic pressures, remain keenly watched by analysts and stakeholders. Its operational prowess and adaptability hold the firm in good stead as geopolitical and environmental dynamics continue to unfold.

Why Market Adjustments Matter

In the wake of fluctuation, ConocoPhillips is navigating investment communities’ shifting sands, leaving a rich trail of analytical discourse in its path. UBS embarking on a price target revision, while neutralizing economy-driven unpredictabilities, keeps investors on alert. This strategic revision, albeit conservative, still suggests untapped potential, especially in anticipating constrained global oil supplies.

Jefferies’ revised outlook is yet another beat in this financial chorus. This adjustment has steered sentiments, from cautious to optimistic, in anticipation of feasible value-based opportunities. Oil demand trailing towards recovery, even amidst shadows of global economic ambiguities, brings a fresh perspective into Jefferies-themed stock positivity.

As RBC Capital and Wells Fargo weigh in with modifications of their own, darting in on tailored price targets, the overarching sense of resilience in ConocoPhillips’ market performance emerges through. Their persistence with Outperform and Overweight ratings hints at a shielded optimism, revamping potential speculation.

The storyline continues, where Tudor Pickering Holt joins this symphony of fluctuating targets. They bolster the Buy rating while readjusting the target levels, suggesting firm adherence to foundational trust bolstered by ConocoPhillips’ strong posture amidst market volatility.

The investment community’s cautious but positive readjustments amplify the tug between market volatility and prospective returns. This dynamic paints the very mosaic that keeps ConocoPhillips’ market standing through relentless adaptability, strategic foresight, and resilient operations.

Conclusion: ConocoPhillips’ Long Game

Unpacking the various financial maneuvers and market reactions offers a deeper dive into ConocoPhillips’ story—a narrative of grit and dexterity against the market’s tide. The incline in operation-generated resources and conservatively defined debt positions underscores an alignment towards both stability and strategic growth.

For traders seeking opportunities within oil and energy realms, ConocoPhillips illuminates a path with strategic financial stewardship, notwithstanding analytical recalibrations. As Tim Bohen, lead trainer with StocksToTrade says, “For me, trading is more about managing risk than finding the next big mover.” In times of evolving macroeconomic wake, individuals reflecting on ConocoPhillips’ toolkit of adaptability and resource efficiency may find this performance journey worth considering.

Overall, with its financial metrics displaying resilience, COP presents an intriguing consideration for future trading trajectories.

This is stock news, not investment advice. StocksToTrade News delivers real-time stock market updates tailored to highlight the key catalysts driving short-term price movements. Our coverage is designed for active traders and investors who thrive in fast-moving markets, with a focus on volatile sectors like penny stocks, AI stocks, Robinhood stocks and other momentum plays. From earnings reports and FDA approvals to mergers, new contracts, and unusual trading volume, we break down the events that can spark significant price action.

Looking to level up your trading game? Explore StocksToTrade, the ultimate platform for traders. With powerful tools designed for swing and day trading, integrated news scanning, and even social media monitoring, StocksToTrade keeps you one step ahead.

Check out our quick startup guide for new traders!

- How to Read Stock Charts: A Guide for Beginners

- Trading Plan: 6 Steps to Create One

- How To Create a Stock Watchlist

Ready to build your watchlists? Check out these curated lists:

Once your watchlist is set, take the next step and trade with confidence using StocksToTrade’s robust platform. Don’t miss out — grab your 14-day trial for just $7 and experience the edge you need to thrive in today’s fast-paced markets.