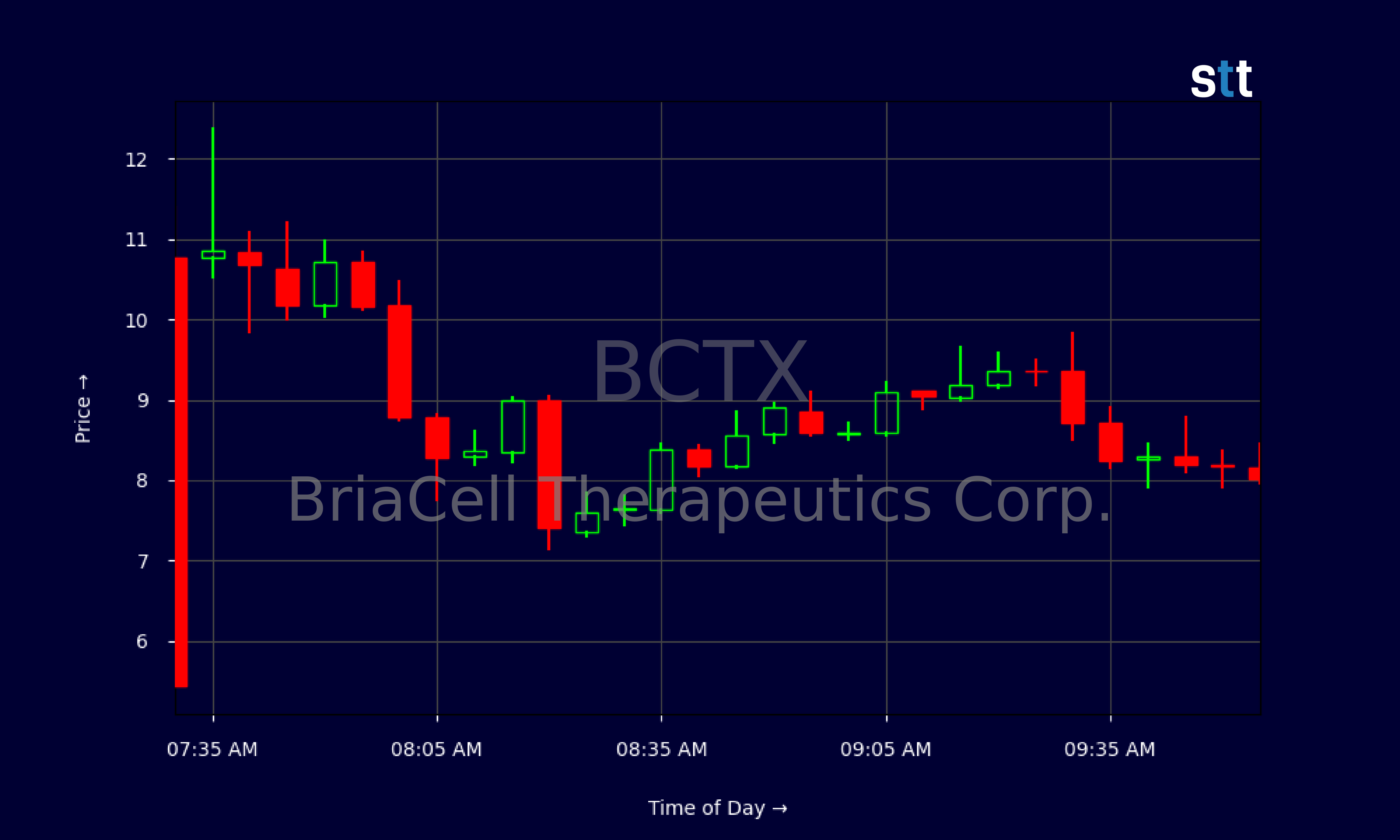

BriaCell Therapeutics Corp.’s stocks have been trading up by 49.17 percent after promising treatment results bolstered market confidence.

Highlighting the Crucial Market Moments

- The shares of BriaCell Therapeutics jumped over 31% following favorable outcomes from a Phase 2 study involving its Bria-IMT treatment.

- New results underscore the beneficial effects of the Bria-IMT in combination with checkpoint inhibitors, showing improved patient survival across diverse breast cancer types.

- These findings place BriaCell’s treatments ahead in comparison to competitors, pushing an interest growth in their therapeutic options.

- The company is further catalyzing interest by announcing advancements in its B7-H3 antibody that might open further revenue-generating opportunities alongside existing lines.

- With the enrolment into Phase 3 nearing completion, they could provide promising top-line data showcasing their growing prowess soon.

Live Update At 10:02:35 EST: On Thursday, April 24, 2025 BriaCell Therapeutics Corp. stock [NASDAQ: BCTX] is trending up by 49.17%! Discover the key drivers behind this movement as well as our expert analysis in the detailed breakdown below.

Financial Reflection on BriaCell Therapeutics Corp.

As Tim Bohen, lead trainer with StocksToTrade says, “For me, trading is more about managing risk than finding the next big mover.” This perspective is vital for those navigating the financial markets. By focusing more on risk management, traders can safeguard their portfolios against unexpected market shifts. It emphasizes the importance of developing strategies that prioritize capital preservation over chasing high volatility trades, allowing traders to maintain a more stable trajectory in their trading endeavors.

BriaCell Therapeutics presently finds itself at an exciting juncture. The company, with its promising treatments in metastatic breast cancer care, has showcased growth potential and is redefining its space in the pharmaceutical market. However, the financial sheets reveal some challenges. Operating losses remain significant, and although they have Issued capital to raise funds, their stretched cash flow indicates an avenue of concern. The cash flow statement reflected a substantial reduction in ending cash during the last reported quarter, a reflection of their increased investments and operating expenses, primarily in research and development.

Key financial metrics depict a low debt-to-equity ratio, which might appeal to potential investors. However, profitability measures like negative earnings before interest and taxes (EBIT) highlight hurdles that the company needs to overcome to stabilize their cost-effectiveness.

More Breaking News

- SGBX Stock Rebound: What’s Fueling the Growth?

- Moomoo Expands Horizons with Major Competitions and Educational Initiatives

- ProPetro Holds Steady Amid Positive Price Target and Earnings Update

- Rekor Systems Surges on Positive Earnings and Major Contracts

The recent stock movement seems to be driven significantly by their promising Phase 2 study results, outperforming established counterparts like the ADC drugs. Positive study findings stir the market, but careful consideration of financial health remains cardinal.

Assessing Market Reaction to News and Possible Outcomes

BriaCell’s climb in share price reflects a vibrant response from investors. Surge in results from their studies acts as a significant catalyst amid broader market trends. Investors should eye the timely advancements in their clinical pipeline closely, which could translate into substantial revenue streams in the future.

Their recent unveiling of the B7-H3 antibody indicates a pathway for expansion beyond existing markets, alluring for stakeholders looking for growth avenues. This context positions BriaCell not only as a contender in the treatment space but as a potential leader with ongoing strategic advancements.

Initial stages of Phase 3 continuation and nearing closing, wield opportunities for patients and investors alike. Market optimism, while tangible, needs backing by sustainable growth and continued positive outcomes in efficacy and safety markers. Upcoming data from the studies will provide further clarity on the stock’s trajectory.

Wrapping up the Narrative: Stock Price Implications

In light of these key updates, BriaCell’s stock emergence and ongoing studies speak volumes about their pursuit of excellence. Traders should remain attentive to upcoming clinical data and patient enrolment numbers which could dictate future market valuation alignment.

Balancing news-driven optimism with cautious optimism on financial stability is vital. Traders may feel enticed by progress in treatment efficacy, while simultaneously needing awareness of the ongoing challenges outlined in financial reviews. It sets a stage where news can influence volatile stocks, and real stories from their trials reinforce trader opinions and decisions. As Tim Bohen, lead trainer with StocksToTrade says, “I focus on what a stock is doing, not what I want it to do. Let the stock prove itself before you make a move.” This trading perspective aligns with the current scenario, encouraging traders to evaluate BriaCell based on its real-time stock performance rather than expectations.

Trading in BriaCell remains high-risk but simultaneously holds high reward if continued clinical progress translates to commercialization prospects. As these stories unfold, market perceptions evolve, contributing to the dynamic biotech trading landscapes.

This is stock news, not investment advice. StocksToTrade News delivers real-time stock market updates tailored to highlight the key catalysts driving short-term price movements. Our coverage is designed for active traders and investors who thrive in fast-moving markets, with a focus on volatile sectors like penny stocks, AI stocks, Robinhood stocks and other momentum plays. From earnings reports and FDA approvals to mergers, new contracts, and unusual trading volume, we break down the events that can spark significant price action.

Looking to level up your trading game? Explore StocksToTrade, the ultimate platform for traders. With powerful tools designed for swing and day trading, integrated news scanning, and even social media monitoring, StocksToTrade keeps you one step ahead.

Check out our quick startup guide for new traders!

- How to Read Stock Charts: A Guide for Beginners

- Trading Plan: 6 Steps to Create One

- How To Create a Stock Watchlist

Ready to build your watchlists? Check out these curated lists:

Once your watchlist is set, take the next step and trade with confidence using StocksToTrade’s robust platform. Don’t miss out — grab your 14-day trial for just $7 and experience the edge you need to thrive in today’s fast-paced markets.