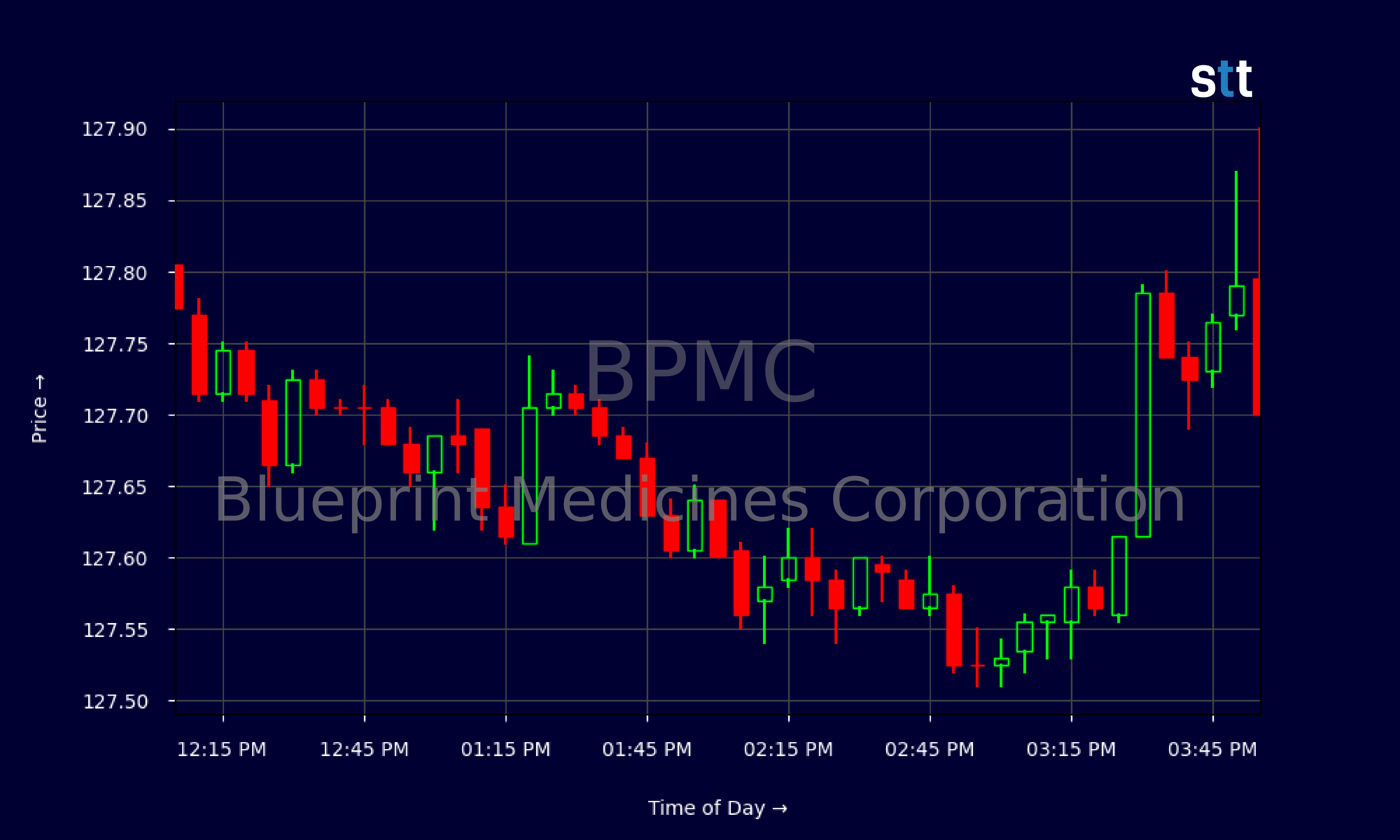

Blueprint Medicines Corporation’s stocks have been trading up by 26.06 percent following promising FDA designations and encouraging trial results.

Current Market Movement: What’s Driving Blueprint Medicines?

- Recent developments have nudged Blueprint Medicines upwards with a jump of over 9%, catching the eye of keen market observers. Their strategic advancements in drug development have attained crucial milestones, sparking positivity among investors.

-

A wave of optimism has swept the pharma sector as Blueprint’s treatment breakthroughs have become the talk of the town. Analysts are buzzing about the potential of these innovations to transform sector norms.

-

The company has basked in attention following smashing successful trial outcomes for its cancer treatments, fueling investor confidence and elevating stock prices.

-

Their innovation prowess, coupled with strategic partnerships, is pushing stock values upward swiftly, and many wonder if this velocity has a grip on the market’s future.

-

Traction gained from continuous scientific development and a robust pipeline seems to reassure investors, welcoming a prediction of sustained growth.

Live Update At 16:02:41 EST: On Monday, June 02, 2025 Blueprint Medicines Corporation stock [NASDAQ: BPMC] is trending up by 26.06%! Discover the key drivers behind this movement as well as our expert analysis in the detailed breakdown below.

Recent Earnings Report and Financial Overview

As Tim Bohen, lead trainer with StocksToTrade says, “I never chase price. The best opportunities allow me to enter on my terms, not when I’m feeling pressured.” This principle is crucial for traders who want to make informed and strategic decisions rather than impulsive ones driven by market pressure. By focusing on finding the right entry points that align with their trading strategy rather than reacting to external pressures, traders can maximize their chances of success in the market.

Blueprint Medicines shows promising signs with their recent earnings reports. Their revenue has climbed to $508.82M, yet key ratios reveal a mixed picture. Gross margin stands impressively high at 96.5%, but profit margins are underwater with a concerning negative at -27.7%. Such outcomes paint a complicated picture, as investments and research extensively drain cash reserves but enrich intellectual property and foundational assets.

Operating expenses are hefty, mainly due to their constant innovation and drug development endeavors. Notably, a continuously negative EBIT margin highlights challenges in operational profitability. A high debt-to-equity ratio of 2.08 suggests a leveraged position, hinting at reliance on external financing to deliver on agenda.

Yet, the company’s strategy is clear: remain on the cutting edge of medical innovation while navigating cash flow challenges with effective research manoeuvres. They sit on a cash pyramid of $122.25M, positioning them to fund upcoming developmental phases and therapies. A beacon of potential lies within: Revenue growth rates in the past three and five years report impressive percentages of 36.46% and 50.86%, respectively.

Blueprint’s quick ratio of 2.6 indicates healthy asset liquidity against liabilities, allowing resilience against potential economic downscales. Challenging ratios like a return on equity at -40.29% exhibit struggles toward profitability, but Blueprint’s transformative vision seems persistent and undeterred.

More Breaking News

- K Wave Media’s Unexpected Surge Explained

- Denison Mines Corp Strikes Major Deal Amid Competitive Uranium Arena

- Guidewire Software’s Financial Leap: An Unexpected Surge

Looking Beyond: Impact of Current Developments

The market rejoiced at Blueprint’s breakthroughs, showing strong support for the pharma giant. Key innovations have become not just alternatives but possibly the golden standard. Analysts expect number-crunching and promising data to power long-term price appreciation, yet risks tied to clinical outcomes and regulatory approval linger as always. As Tim Bohen, lead trainer with StocksToTrade says, “A consistent trading routine beats sporadic action every time. Show up daily, and you’ll start to see the patterns others miss.” This is especially true for traders keeping a close eye on Blueprint’s developments.

The stock’s strong bullish waveform, shaped by recent success stories, seems invincible. Yet traders are reminded to weigh in constant innovation costs and potential economic storms that shake pharma prospects and valuations. A recent climb in stock prices seems aligned with powerful sectorial transformation and fortified confidence in the company’s trajectory.

Breakthrough developments that blueprint shields are charting territory previously unseen, heralding uncharted waters of potential market domination. Their effervescent exploration invites attention, although patient navigation around financial metrics and competitive landscapes will tell the tale for Blueprint Medicines.

This is stock news, not investment advice. StocksToTrade News delivers real-time stock market updates tailored to highlight the key catalysts driving short-term price movements. Our coverage is designed for active traders and investors who thrive in fast-moving markets, with a focus on volatile sectors like penny stocks, AI stocks, Robinhood stocks and other momentum plays. From earnings reports and FDA approvals to mergers, new contracts, and unusual trading volume, we break down the events that can spark significant price action.

Looking to level up your trading game? Explore StocksToTrade, the ultimate platform for traders. With powerful tools designed for swing and day trading, integrated news scanning, and even social media monitoring, StocksToTrade keeps you one step ahead.

Check out our quick startup guide for new traders!

- How to Read Stock Charts: A Guide for Beginners

- Trading Plan: 6 Steps to Create One

- How To Create a Stock Watchlist

Ready to build your watchlists? Check out these curated lists:

Once your watchlist is set, take the next step and trade with confidence using StocksToTrade’s robust platform. Don’t miss out — grab your 14-day trial for just $7 and experience the edge you need to thrive in today’s fast-paced markets.