Bitfarms Ltd.’s stocks face pressure amid new regulations and market skepticism surrounding cryptocurrency mining practices. On Tuesday, Bitfarms Ltd.’s stocks have been trading down by -4.65 percent.

Investigation Sparks Concern

- An investigation into potential securities fraud involving Bitfarms has been launched by the Rosen Law Firm. Allegations suggest misleading business information has triggered a review of the company’s financials for the past two years.

- Twain of lawsuits looms large as the Portnoy Law Firm also initiates a probe into Bitfarms’ financial misstatements, directly impacting stakeholders’ confidence and causing a noticeable dip in stock price.

- Bitcoin’s recent 5% drop has rippled through the cryptocurrency market, affecting companies like Bitfarms, whose fortunes are closely tied to Bitcoin’s performance.

- The broader cryptocurrency market is experiencing heightened volatility, as Bitcoin’s price decrease challenges related stocks, testing investors’ nerves and decision-making.

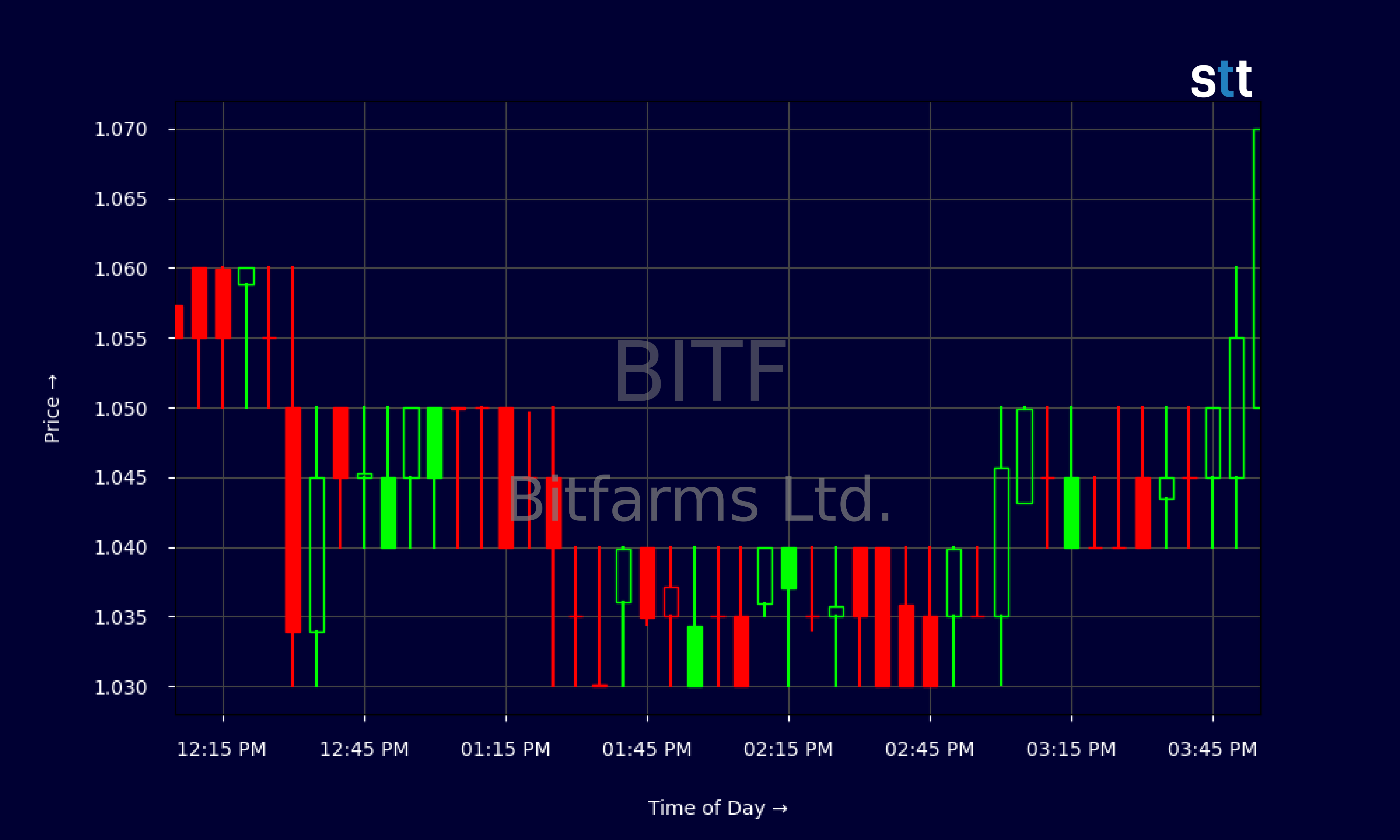

Live Update At 16:02:20 EST: On Tuesday, March 25, 2025 Bitfarms Ltd. stock [NASDAQ: BITF] is trending down by -4.65%! Discover the key drivers behind this movement as well as our expert analysis in the detailed breakdown below.

Earnings and Key Metrics Overview

As Tim Bohen, lead trainer with StocksToTrade says, “Time and experience have taught me that missed opportunities are part of the game. There’s always another setup around the corner.” In the fast-paced world of trading, every moment counts, and sometimes, opportunities slip through our fingers. The key is not to dwell on these missed chances but to remain vigilant and patient. In trading, as in any skill, there’s always a new opportunity ready to present itself. Staying informed, maintaining discipline, and learning from past experiences are crucial for any trader navigating the ever-changing market landscape.

Bitfarms’ recent financial performance presents a complex tapestry. The company recorded a staggering gross margin of -17.5%, indicating it spends more money producing its goods than it earns from them. In terms of profitability, Bitfarms is facing significant challenges; its EBIT margin of -66.9% and net profit margins reveal a company struggling to transform revenue into profit.

The revenue figure of $146.37M for the year shows ambition but offers little solace when scrutinized alongside negative profit margins. Revenue growth over the last five years was 47.13%, signaling expansion but failing to translate into a solid bottom line. Despite this apparent growth, the high price-to-sales ratio (2.86) adds a layer of caution for potential investors.

More Breaking News

- TeraWulf’s Rising Trajectory: Time to Invest?

- StubHub Stock Stumbles as Trading Continues to Intensify

- Centrus Energy Pioneers Uranium Market Expansion with Strategic MOU

- SoundHound: Is It On The Upswing?

Moreover, financial strength metrics such as a current ratio of 3.7 suggest that Bitfarms has enough liquid assets to cover its short-term liabilities comfortably. Still, the leverage ratio at 1.2 indicates dependency on debt, which adds another layer of risk.

Market Implications of Recent News

Amidst the financial turmoil, news of investigations and a significant restatement of the financials have stirred the waters. This increased scrutiny has shaken investor confidence, reflected in the stock’s recent performance. The result is a volatile market response, with Bitfarms’ share price dropping by 6%.

As news of financial missteps support class-action lawsuits, the specter of court proceedings looms, potentially casting a long shadow over the company’s future. Legal battles, though commonplace in high-stakes financial environments, often lead to reputational damage, which can weigh heavily on stock prices if left unchecked.

Adding to Bitfarms’ woes is the fluctuating Bitcoin market. With Bitcoin demonstrating its notorious volatility by losing 5% in value, the ripple effect is unmistakable. Bitfarms, being inherently linked to the cryptocurrency, finds itself riding the waves of Bitcoin’s choppy performance.

Strategy Moving Forward

For traders eyeing Bitfarms, the takeaway from the current scenario involves exercising caution. The equation of legal wrangles, volatile revenue performance, and dependency on an unsteady Bitcoin landscape casts doubt on short-term profitability prospects.

Clouded by ongoing investigations and potential court battles, the company’s ability to emerge unscathed without affecting its stock price growth is uncertain. The prudent trader will monitor these developments closely, considering the scrutiny over Bitfarms’ financial disclosures and the broader cryptocurrency market conditions. As Tim Bohen, lead trainer with StocksToTrade says, “I focus on what a stock is doing, not what I want it to do. Let the stock prove itself before you make a move.”

With the company’s main challenge centered around restoring market confidence, success depends not just on financial realignment but also strategic prowess in navigating legal waters. As legal firms dig deeper into Bitfarms’ financial conduct, shareholders are left to ponder the road ahead — whether it leads to redemption or further decline.

In summary, while Bitfarms may face tumultuous short-term conditions, its future hangs in the balance. The confluence of legal, financial, and market dynamics creates a precarious position where the path to stabilization appears fraught with hurdles. Traders should remain vigilant, keeping a keen eye on fluctuating news cycles and emerging market trends.

This is stock news, not investment advice. StocksToTrade News delivers real-time stock market updates tailored to highlight the key catalysts driving short-term price movements. Our coverage is designed for active traders and investors who thrive in fast-moving markets, with a focus on volatile sectors like penny stocks, AI stocks, Robinhood stocks and other momentum plays. From earnings reports and FDA approvals to mergers, new contracts, and unusual trading volume, we break down the events that can spark significant price action.

Looking to level up your trading game? Explore StocksToTrade, the ultimate platform for traders. With powerful tools designed for swing and day trading, integrated news scanning, and even social media monitoring, StocksToTrade keeps you one step ahead.

Check out our quick startup guide for new traders!

- How to Read Stock Charts: A Guide for Beginners

- Trading Plan: 6 Steps to Create One

- How To Create a Stock Watchlist

Ready to build your watchlists? Check out these curated lists:

Once your watchlist is set, take the next step and trade with confidence using StocksToTrade’s robust platform. Don’t miss out — grab your 14-day trial for just $7 and experience the edge you need to thrive in today’s fast-paced markets.