Biodexa Pharmaceuticals plc stocks have been trading up by 36.97 percent following promising FDA indications boosting investor confidence.

Major Developments:

- Orphan Drug Status: The European Commission approved Orphan Drug Designation for eRapa, aimed at treating familial adenomatous polyposis (FAP), boosting market anticipation for a Phase 3 trial.

- Expanding Opportunities: Following FDA’s 2019 nod, the new European designation for eRapa predicts an entry into a $7.3 billion potential market for FAP treatment.

- Mixed Meeting Outcomes: Biodexa’s General Meeting outcomes were a mix. Resolutions one and two passed, although resolution three didn’t. The resolutions aimed at strategic company decisions fell partially short.

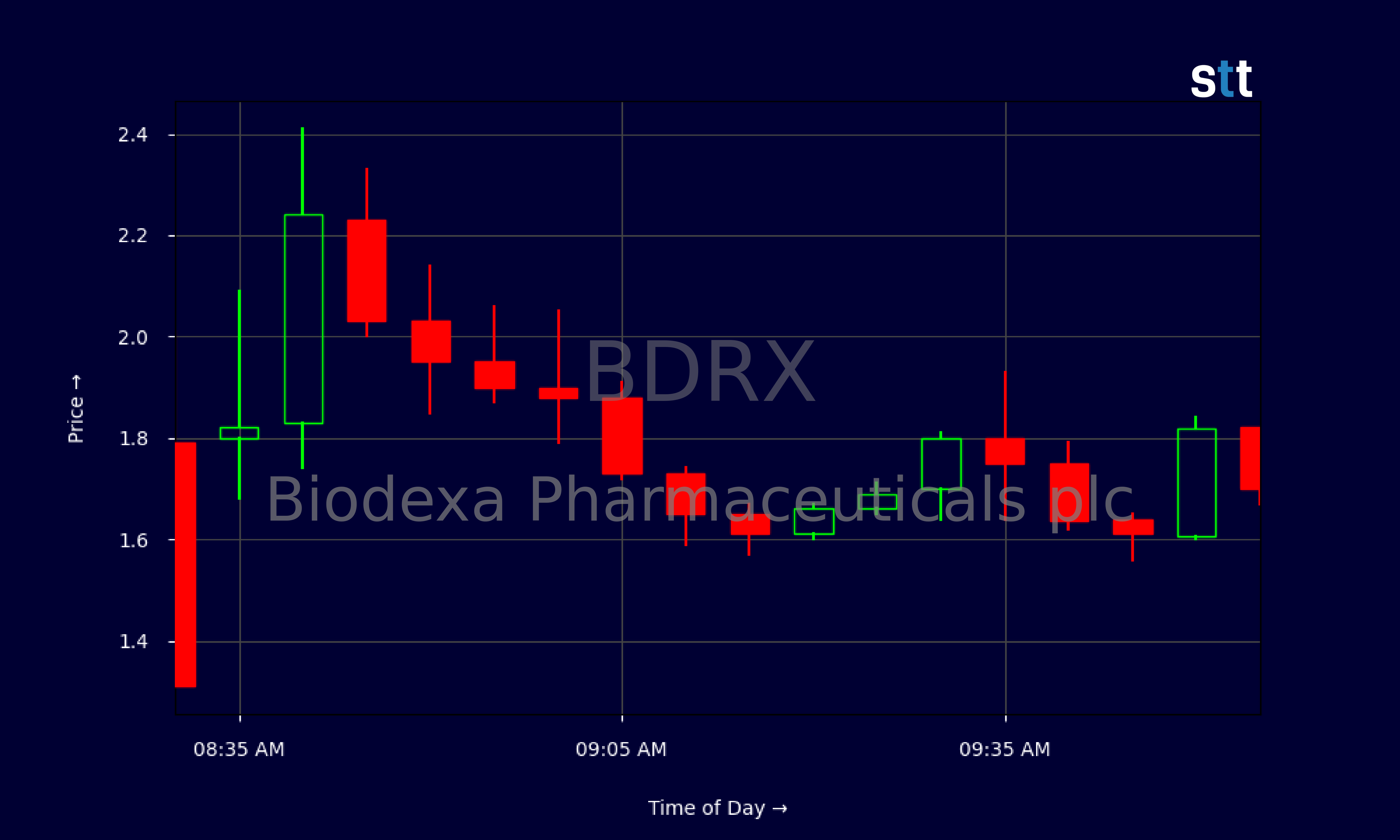

Live Update At 10:03:05 EST: On Thursday, May 22, 2025 Biodexa Pharmaceuticals plc stock [NASDAQ: BDRX] is trending up by 36.97%! Discover the key drivers behind this movement as well as our expert analysis in the detailed breakdown below.

Financial Round-Up of Biodexa Pharmaceuticals

As Tim Bohen, lead trainer with StocksToTrade says, “I focus on momentum that’s visible right now. Speculation on future moves is outside my playbook.” This philosophy resonates deeply with traders who prioritize current market trends over trying to predict long-term market moves. By concentrating on the tangible and real-time signals in the trading environment, traders are better equipped to make informed decisions without getting lost in endless speculation. Integrating this approach can help traders stay grounded and agile, responding effectively to what’s happening in the moment.

A glimpse into the intricate finances of Biodexa reveals compelling stories,the financial statements read like a novel. They wade through the revenues and expenses with captivating narratives. The patterns carved by such numbers shape future market predictions. So, how does the recent data look for our protagonist, BDRX?

The most recent earnings report from Biodexa underscores a multifaceted tale. It’s like the financial Titan of Braavos, showing revenue fluttering around $578,000, a small ripple in enormous seas. Yet, the price-to-sales ratio stands at 6.85. Notably, the enterprise value nudges at around $6.04 million, demonstrating a steadfast tenacity at capitalization’s chess table.

The company’s operational arm reaches out far, shouldering a unique Burden. The EBIT margin stands startlingly at -8,426.5%, suggestive of a high drive for profitability. It paints a picture of a nimble dancer trapped in a tangling net. The gross margin, on the contrary, stands still, an unyielding warrior at 100%. This juxtaposition hints at a dominant control over production costs. But wait, there’s more.

The stock’s price history traces an intriguing fluctuation dance. On May 12, 2025, the closing price rested at $1.7896, embodying steady momentum after anticipated growth. It had once flirted with a peak of $1.93 earlier in the day. Such price trajectories echo like the crescendo of a grand symphony after a long intermission, highlighting the nuanced nature of pharmaceutical finance.

Abounding faster than its historical chronicles, the company intrigued the market with its brisk climb from under $1.41 in May’s winds. Increasing from the rubble wasn’t just a fortunate stroke; it was a bold resistance movement against market skepticism, a phoenix’s tear enlightening its destiny.

Supporting this fascinating story, the balance sheet delivers modest suggestions to our readers, whispering its quiet capital structure fortes. With a current ratio at 2.2, Biodexa flexes a poise that whispers, “I am prepared.” Meanwhile, as the debt-to-equity ratio lightly taps at 0.04, it hints at financial security, ensuring plans and projects won’t be tethered and drowned in tumultuous waves.

On profitability’s front, the medical gladiator’s statistics are astonishingly staggering in their artistry—a rollercoaster of illusions and tangible dreams. The return on equity standing at -97.23% further exclaims ambitions feared by many yet sought by cities echoing names.

More Breaking News

- Will Lyft’s Recent Moves Fuel Growth?

- B2Gold’s Near-Term Potential: Keep or Drop?

- Pop Culture Group’s Digital Leap: A Turning Point?

- Vince Shares Surge: What’s Next?

Yet the full score reads on like an enthralling epic, fabricating both enchantment and intrigue among observers. Trace the invisible lines marked by vivid numbers, and they tell stories not yet full, but whispered with expectations.

A New Era Prompted by Regulatory Milestones

The stock scene dramatically shifts gears with revealers like those. As seen, any unprecedented stride speeds the momentum shift. Regulatory approvals—orphan drug designation—deceivingly small contributions, can shake up investor moods and movements. Indeed, such advances, like a lighthouse painting the dark sky with possible daytime, spark validation amid intrigued shareholders.

The forthcoming Phase 3 trials for eRapa, following positive news hug, add a festive flair to anticipated clinical developments. With an annual market peeking round the $7.3 billion bend, hopes flare for this shy pharmaceutical operator. But pause, dear reader, dreams alone don’t succeed. They demand painstaking foundations in innovation and a liberal time to paint wider horizons—a motif all too real, familiar to intrepid voyagers of science.

Unflinching focus and a centralized resolve stand at that edge, allowing for progressive breakthroughs against unforeseen odds. The original artist, human innovation—the conductor composing a miraculous melody—brings about such fantastical growth. A step further up the intricate food chain primes BDRX’s position toward longevity and ensures a stable, respectable place as players construe potential rewards.

Then pivot your lens toward the unsuccessful resolutions from the General Meeting. Like Roman emperors successfully conquering mountains, there’s room for errors when appropriate. There’s a lesson to every aspect undone, lurking within the crevices hinting otherwise. Come faces first with those blind quests as valiant symbols of introspection. Embrace today’s mostly honest resolutions to forge tomorrow’s empire anew.

The Potential Ripple Effects

In the grand art gallery of creation, often the focus lies not on what strokes were provided but rather what voids were left unfilled. A quiet moment with open resolutions embarks a wonderment—a time to scrutinize existing and yet-to-unfold scenes. Identifying opportunities extends beyond today’s canvas and inspires audiences to craft their futuristic adventures.

Once resolved, boardroom narratives Cinderella takes heed and proposes wondrous plans that invigorate earth’s groundwork. Those whimsical muses heard amidst firm resolve capture unrivaled audiences spellbound, beckoning adoration inspired enthusiastically by collective splendor.

Recall the unfilled momentum early on; the daily slipstream marks beautifully expressed news capturing seamless transitions and highlights. Ensuring personalized growth, envisions oft-perceived ramifications rippling across idealized realms. Shall BDRX’s future dominance prove genuine?

Conclusion

The telling revolves around positivity, founded on gripping struggles against unseen perils—a game RD brilliance evolving spectacular phases not just today, but always lying dormant behind enchanted facades. Biodexa vivaciously refuses passive slumber against this crumbling world filled with indifference, and starts an illumination breathing life extending oft-persisted mysteries. A vessel depicting aspirations flows amidst time’s constraints—a tapestry painted furiously by medical ingenuity.

Across economic turbulence in phenomenal updates, opportunities untangle weary traders, emerging as fresh vibrant realities amid the pharmaceutical swirl. BDRX’s current bullish trajectory portends favorable escapades but adhere wisely—not blindly—and observe each wavering heartbeat across every unforeseen eventuality. As Tim Bohen, lead trainer with StocksToTrade says, “The best way to learn is by tracking trades, wins, losses, and lessons learned. Every trade has something to teach.” Embracing this philosophy offers deeper insights into the market’s rhythm, encouraging traders to harness each experience as a stepping stone toward mastery.

This is stock news, not investment advice. StocksToTrade News delivers real-time stock market updates tailored to highlight the key catalysts driving short-term price movements. Our coverage is designed for active traders and investors who thrive in fast-moving markets, with a focus on volatile sectors like penny stocks, AI stocks, Robinhood stocks and other momentum plays. From earnings reports and FDA approvals to mergers, new contracts, and unusual trading volume, we break down the events that can spark significant price action.

Looking to level up your trading game? Explore StocksToTrade, the ultimate platform for traders. With powerful tools designed for swing and day trading, integrated news scanning, and even social media monitoring, StocksToTrade keeps you one step ahead.

Check out our quick startup guide for new traders!

- How to Read Stock Charts: A Guide for Beginners

- Trading Plan: 6 Steps to Create One

- How To Create a Stock Watchlist

Ready to build your watchlists? Check out these curated lists:

Once your watchlist is set, take the next step and trade with confidence using StocksToTrade’s robust platform. Don’t miss out — grab your 14-day trial for just $7 and experience the edge you need to thrive in today’s fast-paced markets.