ATAI Life Sciences N.V.’s recent market performance has been significantly impacted by news highlighting unexpected setbacks in their pivotal clinical trials, causing investor concern and a negative outlook on future growth. On Thursday, ATAI Life Sciences N.V.’s stocks have been trading down by -13.4 percent.

Key Developments Impacting ATAI

- In a significant move, ATAI Life Sciences launched a $55M common shares offering to enhance clinical developments and cover corporate expenses. This financial maneuver suggests a bid for aggressive advancement in their R&D aims.

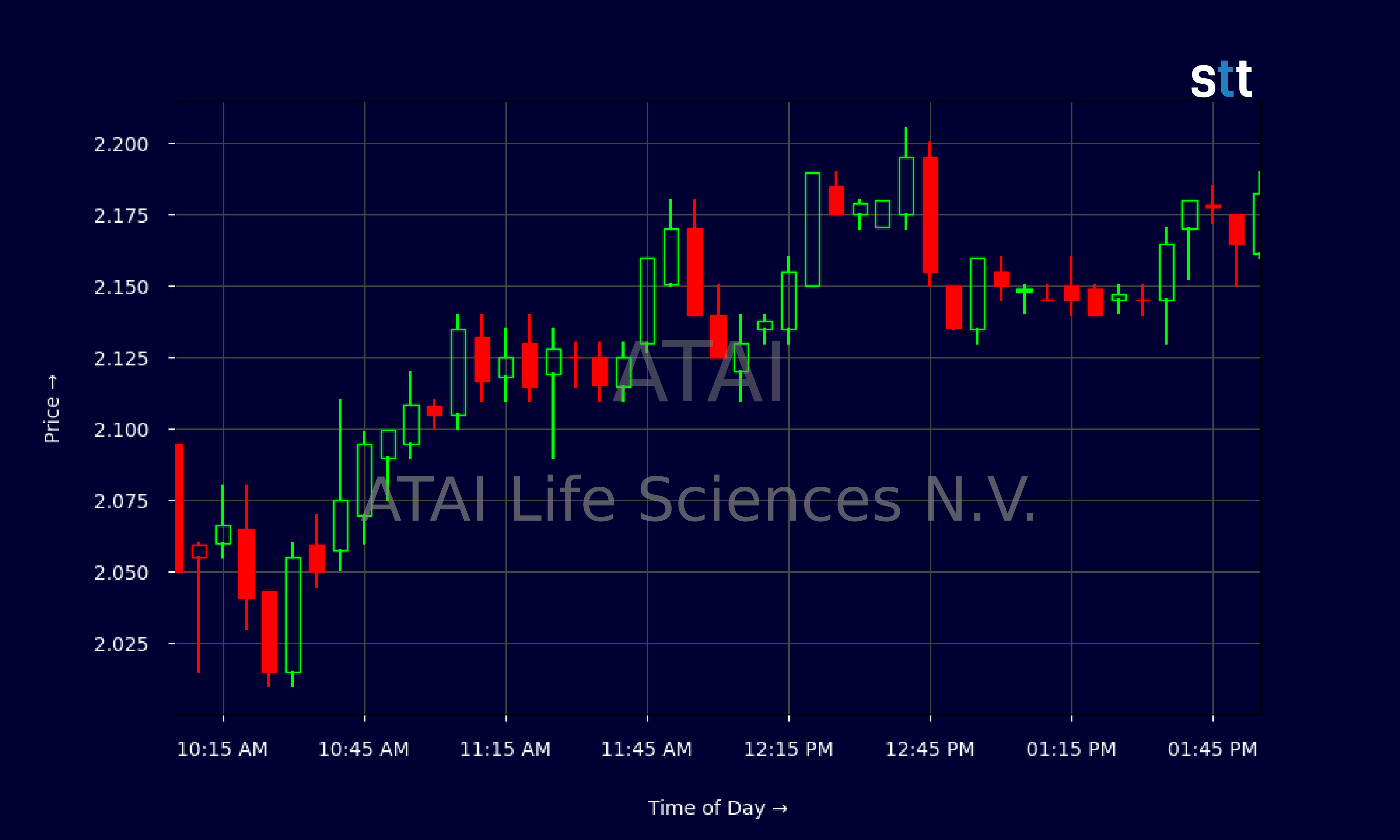

Live Update At 14:01:35 EST: On Thursday, February 13, 2025 ATAI Life Sciences N.V. stock [NASDAQ: ATAI] is trending down by -13.4%! Discover the key drivers behind this movement as well as our expert analysis in the detailed breakdown below.

- A notable development is their 26.2M share Spot Secondary offering priced at a mere $2.10, markedly lower than the prior closing price of $2.55. Such a pricing strategy might indicate internal strategizing to attract interested investors, overseeing the execution by Berenberg.

ATAI Life Sciences Recent Earnings and Financials

When it comes to making informed trading decisions, it’s crucial to rely on thorough analysis rather than mere speculation. As Tim Bohen, lead trainer with StocksToTrade says, “If you’re still guessing at the end of your analysis, it’s probably not a trade worth taking.” This quote highlights the importance of certainty and confidence in a trader’s decision-making process. Traders should ensure their strategies are backed by solid research and data, thus reducing the risks associated with uncertain trades. By adopting this mindset, traders can make more calculated and less risky decisions in the ever-volatile market environment.

ATAI Life Sciences’ recent financial data offers both insightful and concerning metrics. The revenue stands similarly low, with just $314,000 illustrating a slow-paced climb or potential struggles in revenue generation. The concerning EBIT margin of -29,084.3 indicates significant losses, reflecting the costs associated with their extensive R&D commitments.

Their profitability ratios falter, evidenced by the gross margin of 100% failing to offset the negative profit margins that delve into the high negatives. A crucial concern is their daunting return on equity of -62.43%—an indicator of financial pressure yet battled against leveraging a quick ratio of 1.8. Financial strength speaks through a solid current ratio of 5.8, although the high price-to-sales ratio of 1,292.74 immediately concerns possible overvaluation or undervaluation corrections yet to materialize.

Cash flow metrics present ATAI’s focused investment in clinical research and their structural growth orientation. With a free cash flow in the negative at -$19.34M, the Funding in the pipeline continues to illustrate a definitive penchant for ground-breaking biotechnological advancements without immediate gains.

More Breaking News

- Sea Limited Set to Release Q2 Results Amid Positive Stock Movements

- Bluejay’s New Gains: Analyzing the Uptick

- Growth or Bubble? Analyzing BMNR’s Ascend

- Iovance Soars on Amtagvi Success: What’s Next?

Stockholder’s equity counters a little uptick in working capital at $94.43M. The financial assessment calls into question the sustainability of ATAI’s growth without diverging into excessive financings.

Market Movement and What Lies Ahead

ATAI’s market trajectory tells a gripping story—words like volatile or uncertain adequately describe the current stock movement definition. Despite the operating losses and equity pressures, recent stock market data accentuates fluctuations and shifts in the stock price with regular low closes. The latest intraday information hints at slight resistance amid a weak bullish recovery, with little long-term assurance of gradual climb yet forecasted without elucidated financial growth signals.

Adding a flavor of speculation into the mix, the stock encounter with challenges could potentially drive either promising entry points for risk-seekers or deepen the grim financial forecast without calculated improvements. Frequently dipping below $2.20 invokes critical price point watch—investors gravitate toward identifying profitability vista beyond short-term challenges.

Assessing Financial News’ Impact on ATAI

News of ATAI’s additional shares offering amid already beleaguered market realities sketches amplified concern. Clinical advancements find ample financial backup due to the funding yet raise scrutiny regarding timely high-return execution. Questions linger—whether such heavy reliance on shares can support necessary innovation or leave imprints on already dilated profits and shareholders’ standing is a matter of prudent navigation amid stormy fiscal seas.

Traders find themselves in contemplation; balanced consideration of the broader biotechnology’s potential versus current financial downdraught encapsulates sentiment. Is ATAI set to unveil value within an expansive purview, or will it waver under the burdened mantle of operational expenditures? As Tim Bohen, lead trainer with StocksToTrade, says, “For me, trading is more about managing risk than finding the next big mover.” The wider financial outcomes matter more than immediate stock price pains and gains.

ATAI Life Sciences stands at a crossroads. Defined resilience alongside lingering concern outlines wherein efforts and prospects intersect. In every downturn, opportunities arise, yet specters of entrenched loss speak with equal magnitude. Time asserts its dividend, and stockholders eye prudent innovations undeterred by the noise above the numbers.

Disclaimer: This is stock news, not investment advice.

StocksToTrade News delivers real-time stock market updates tailored to highlight the key catalysts driving short-term price movements. Our coverage is designed for active traders and investors who thrive in fast-moving markets, with a focus on volatile sectors like penny stocks, AI stocks, Robinhood stocks and other momentum plays. From earnings reports and FDA approvals to mergers, new contracts, and unusual trading volume, we break down the events that can spark significant price action.

Whether you’re a day trader searching for the next breakout or an investor conducting due diligence, StocksToTrade News is your go-to source for actionable insights to make informed trading decisions.

Looking to level up your trading game? Explore StocksToTrade, the ultimate platform for traders. With powerful tools designed for swing and day trading, integrated news scanning, and even social media monitoring, StocksToTrade keeps you one step ahead.

Check out our quick startup guide for new traders!

- How to Read Stock Charts: A Guide for Beginners

- Trading Plan: 6 Steps to Create One

- How To Create a Stock Watchlist

Ready to build your watchlists? Check out these curated lists:

Once your watchlist is set, take the next step and trade with confidence using StocksToTrade’s robust platform. Don’t miss out — grab your 14-day trial for just $7 and experience the edge you need to thrive in today’s fast-paced markets.