Did you open your weekly watchlist email on Sunday?

If you did, you probably caught at least one great trade opportunity yesterday…

But we didn’t just have one — we had THREE winning trades from the watchlist!

My watchlist gives you the basic ideas for a potential trade.

But I broke down each trade idea in detail in my morning SteadyTrade Team webinar…

Today I’ll share what details you missed, and what I saw in premarket before any of these stocks made their move…

Plus, what I liked about each one, and which one became my number one watch…

Table of Contents

Money Monday Trading Action

In my Monday morning Pre-Market Prep session, I said all the stocks from last week are still in play with the same ideas.

But if you want more in-depth analysis, you need to be in my morning SteadyTrade Team webinars.

That’s where I went into more detail on these three big runners…

Avenue Therapeutics, Inc. (NASDAQ: ATXI)

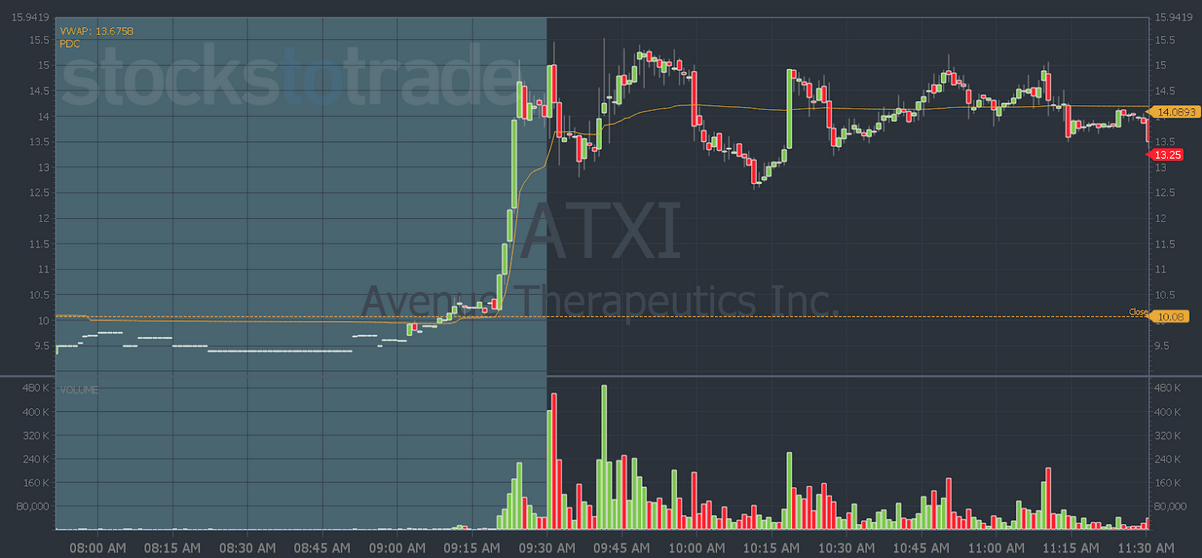

ATXI was one of the biggest runners last week. On the weekly watchlist, I said to watch for breaks above $12, and/or a weak open red to green move.

Yesterday morning I explained why…

I wanted to see ATXI trickle lower to lure in the short sellers looking for the first red day … Then I wanted it to go green in the afternoon and smoke ‘em.

But I explained in the webinar that there are multiple ways you could’ve played ATXI — buy a break above the premarket high of $11.15, a break of $12 like I said in the watchlist, or whole dollar, half dollars all the way up.

That means you can enter at breaks above those levels because short sellers panic at those levels.

I didn’t get the dip I was hoping for…

Because a few minutes after I talked about ATXI, the Breaking News Chat team alerted the chat guy was in it.

And ATXI blew through all the whole dollar and half dollar levels until it hit $15.

Ready to catch moves like that in premarket? Click here to see how you can maximize premarket trading hours.

FingerMotion, Inc. (NASDAQ: FNGR)

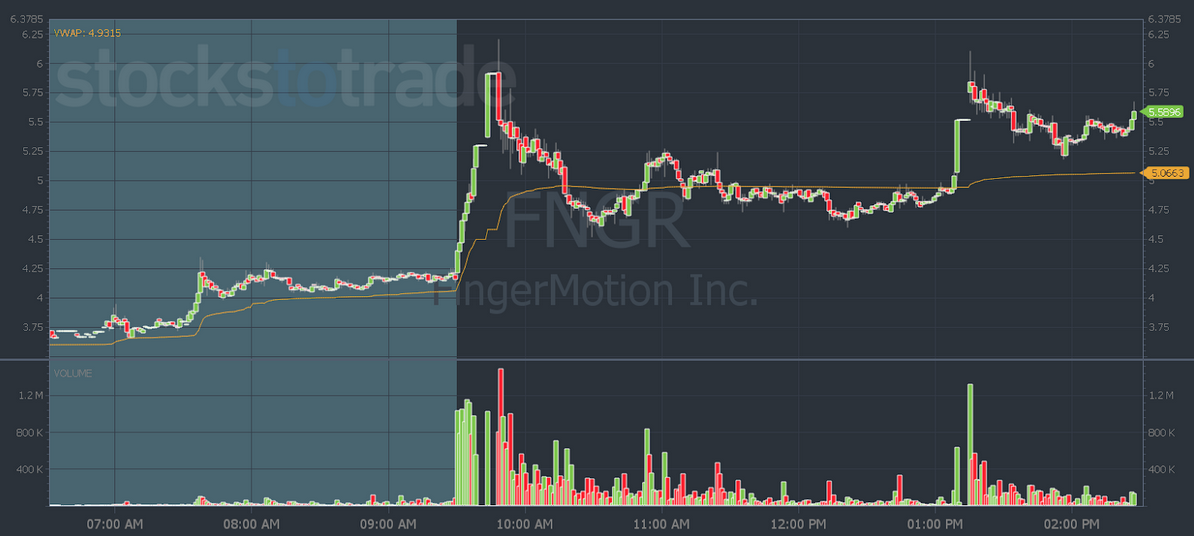

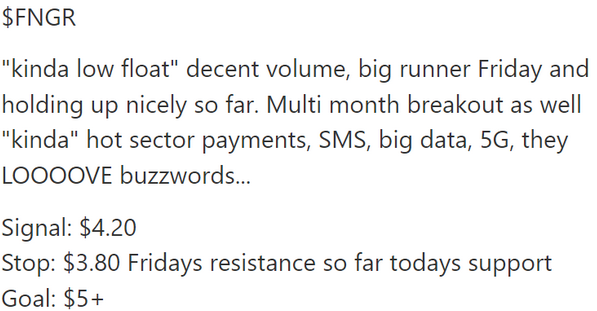

FNGR was one of Friday’s best runners. On Monday morning I wasn’t as excited about it as I was for ATXI last week… (800,000 FLOAT!)

But it checked some of the boxes…

- It’s a cool technology.

- They have a lot of buzzwords on their website.

- It had a nice multi-month breakout.

But I wish it had a lower float and more volume. And I would’ve liked more of a ‘why.’ Like a 9 a.m. press release.

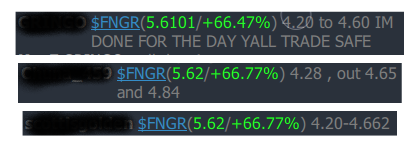

But I still liked it enough to make it my number one watch. Here’s the game plan SteadyTrade Team members and Daily Market Profit subscribers received in premarket…

You had to be fast to get filled right near the open. But the stock went straight up from my target entry price and offered up to a 40%+ gain for traders who took it…

Global Tech Industries Group, Inc. (OTCQB: GTII)

GTII is an OTC that had six green days in a row. When you see that kind of action in an OTC, you know it has to fail eventually.

And there were three potential ways to trade this one…

First, if you bought on Friday to sell into a gap on Monday — stick to your plan and sell into the gap at the open.

The next options are what I outlined on the watchlist … Look for a morning panic dip buy or an OTCswizzle in the afternoon.

For a morning panic, I like to see a 20-40% panic. Then the first green candle on a five-minute chart, take an entry and risk the low of the day.

GTII didn’t play out a morning panic like we typically see right at the open. Instead, it squeezed higher before falling off a cliff…

You can see how my morning panic trade idea worked on the five-minute chart above.

If you took an entry after the first five-minute green candle following the panic, you could’ve made up to $1 per share on the bounce.

What Can You Learn From These Three Trades?

The lesson from these three trades is this…

The best penny stocks of the day are often the best penny stocks from the previous day.

The highest probability chart patterns and best trades 90% of the time are day two, day three, or day four runners.

Multi-day setups and breakouts are where you should focus.

ATXI shows you why when you’ve got an 800,000 float stock that’s still up a week later — it needs to be top of your list.

But if you missed any of these plays, it’s okay. There will always be another one…

Make sure you open your weekly watchlist email every week.

And get in my SteadyTrade webinars for twice-daily breakdowns of all the top stocks in play.

Have a great day everyone. See you back here tomorrow.

Tim Bohen

Lead Trainer, StocksToTrade