The latest multi-day runner created almost daily plays for Pre-Market Prep and SteadyTrade Team members…

I even sent alerts for a couple of trades, right to subscribers’ inboxes.

If you missed the plays, it’s OK. I’m going to break them down in detail for you here…

That way the next time there’s a day one spiker, you can keep your eyes on it for moves like these…

But before I give you the trade details, it’s important to understand why these stocks move the way they do.

So let’s dig in, there are a lot of lessons and trade breakdowns to learn from…

Table of Contents

Why REV Ran

When we trade low float spikers, a lot of traders know to look for patterns. But they don’t know what makes the patterns work, or why a stock moves the way it does.

So let’s start with the basics before we break down trade ideas…

Revlon, Inc. (NYSE: REV) has roughly 54 million outstanding shares. But only about five to seven million shares are actively traded. Others are locked up by insiders or institutions.

And after REV announced it could file for bankruptcy, shorts were eager to get in thinking this thing was going to $0…

They loaded up. And soon almost half of REV’s float was short. That makes it ripe for a squeeze.

Because when longs want to take advantage of a stock breaking above key levels, there are even fewer shares available for them to buy.

And when the squeeze gets started, the buying frenzy from longs — and shorts trying to get out — creates moves like we witnessed in REV…

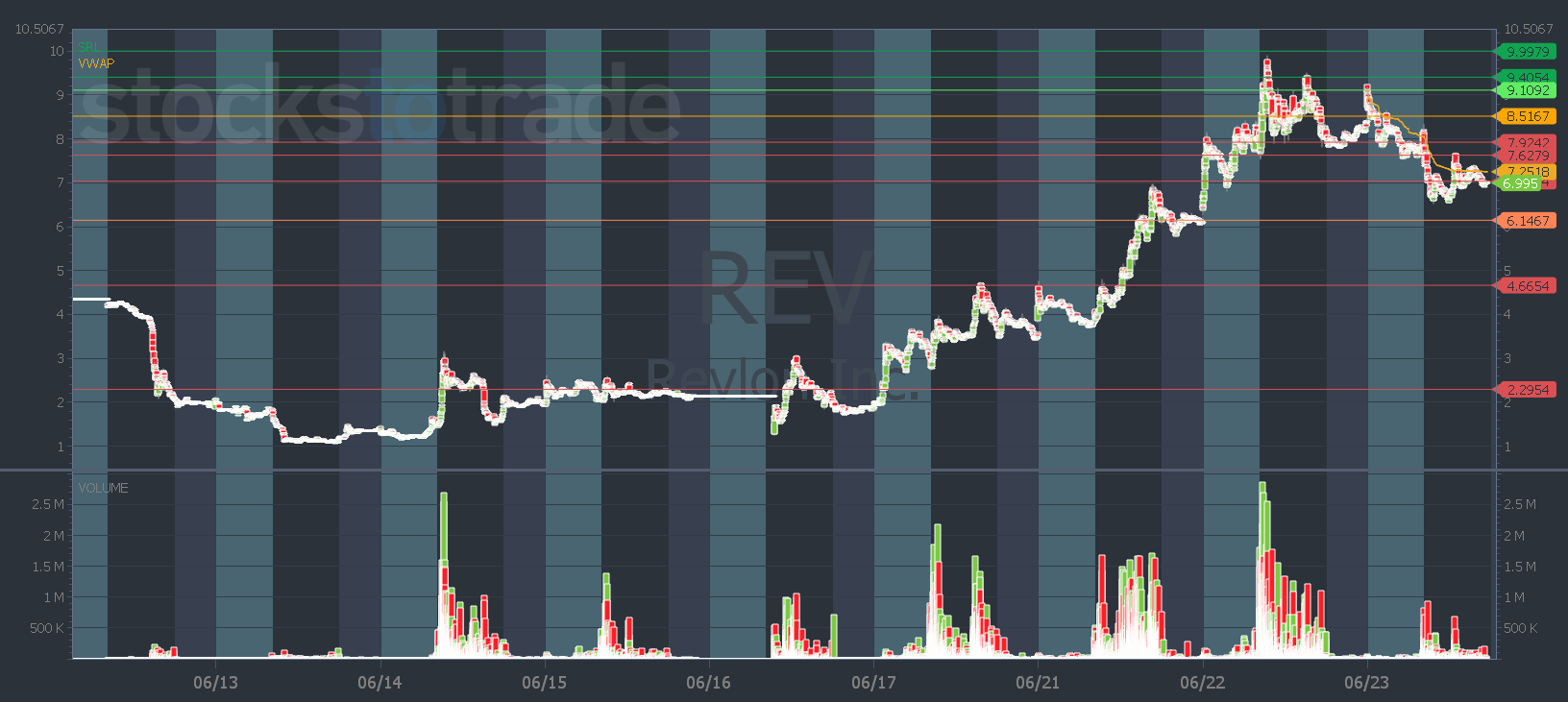

It all started after REV had a big selloff. It started to grind back up…

It hit resistance at around $3 and shorts were all trying to guess the top.

Personally, I hated REV last Wednesday and Thursday. I didn’t like the news.

But everything changed last Friday…

The Afternoon VWAP Hold High-of-Day Break

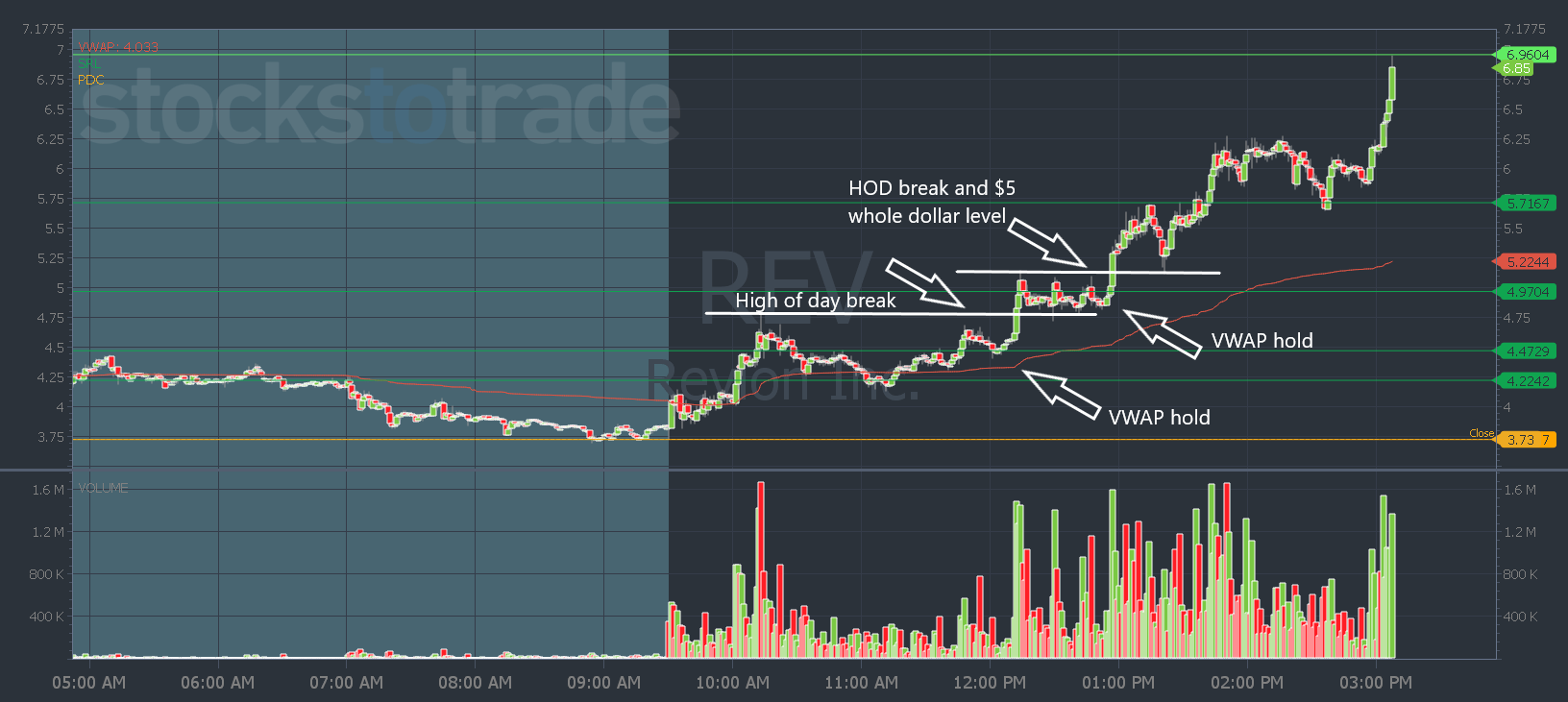

On June 17, REV had a morning spike above the $3 whole dollar high from Tuesday and Thursday — that’s when it got my attention.

And after the morning spike, it consolidated above VWAP, then had a beautiful break above the high of the day in the afternoon. I alerted ABCD subscribers before the move. If you missed it, sign up here.

Check out the move…

And it wasn’t over for REV…

The Break of Previous Days High

The markets were closed last Monday, so on Tuesday, June 21 all eyes were on REV after its Friday afternoon squeeze.

In Pre-Market Prep that morning, I said to watch for a break above the previous day’s high. The high was around $4.75, but we don’t nit-pick over pennies…

I was more interested in a break above $5.

That was both the Oracle level and a whole dollar level. Shorts tend to panic more above whole dollar levels.

It was also a key level that aligned on multiple time frames — it’s the previous day’s high, the premarket high, the 10 a.m. high, and the high of the day.

Whether you play the $4.75 or $5 break, the pattern is the same…

The Dip and Rip

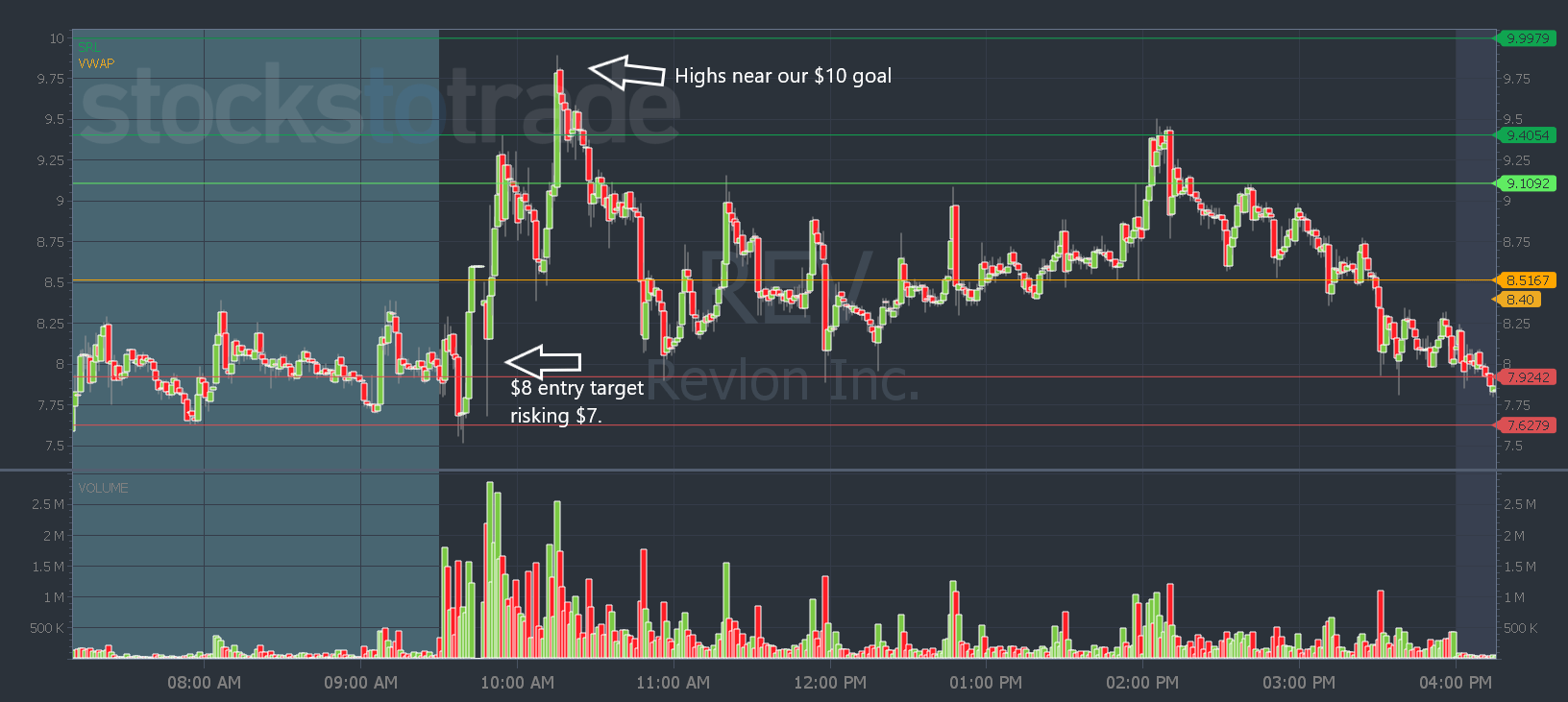

On Wednesday, it was my number one watch, and my Daily Market Profit alert — check it out here. And I said in the SteadyTrade Team webinar, that it’s a dip and rip all day…

$REV

As usual, we love the repeat names!!!! This is in total squeeze mode. Love $8 reclaims.

Target: $8 or any “whole dollar/half dollar” all the way up.

Stop: $7

Goal: $10+

REV was choppier as it traded higher…

Wednesday morning it traded massive volume as the last of the shorts got blown up, and more shorts tried to guess the top. It even had a volatility halt around 9:40 a.m.

But the plan worked.

Of course, nothing is guaranteed, but REV was a great example of what we look for in multi-day runners. We want to see them prove themselves and break key levels. That can indicate there’s more potential upside.

But we don’t just buy and hold. Especially a stock like REV that’s a sketchy bankruptcy play…

I think you’re crazy to hold a stock like that overnight. Bad news could come out anytime and it can get ugly.

That’s why I teach traders how to day trade based on specific patterns…

If you buy at $5 and sell at $5.50 are you going to get rich? No.

But can you potentially make a couple of hundred bucks? Yes.

Then you rinse and repeat that over time.

The goal, in the beginning, is to learn the patterns and start with a small size. Then size up when you have more experience.

Eventually, it won’t end well for REV. But in the meantime, it could hang around for a few weeks and offer more trading opportunities.

That’s why I’m in SteadyTrade Team webinars every morning and afternoon. So if there’s a potential trade, we’ll be ready!

Have a great day everyone. See you back here tomorrow.

Tim Bohen

Lead Trainer, StocksToTrade

P.S. If you’re wondering what the colored lines on my charts are, they’re Oracle support and resistance levels. Get the indicator available only on StockToTrade here.