We had another winning Breaking News Chat alert yesterday. But this was different from some of the shady penny stock news we usually talk about…

The news hit a real stock. And near a perfect point on the chart…

So you didn’t have to blindly buy the stock based on news.

You can put the whole puzzle together — news, a pattern, and rules to keep you safe.

I’ll show you how and break it all down for you below…

Did you hear the news? My next free webinar has moved to Monday afternoon — see all the details and sign up here.

What Makes This News Different?

Yesterday’s Coinbase Global, Inc. (NASDAQ: COIN) Breaking News Chat alert wasn’t like the usual penny stock PR we deal with daily…

COIN had news with BlackRock, Inc. (NYSE: BLK) — one of the world’s largest asset management companies.

BLK manages roughly $10 trillion in assets…

That means the partnership exposes Coinbase to institutional investors with fat wallets…

And that can mean more potential revenue for COIN.

And if you had StocksToTrade’s Breaking News Chat, you got the news FAST!

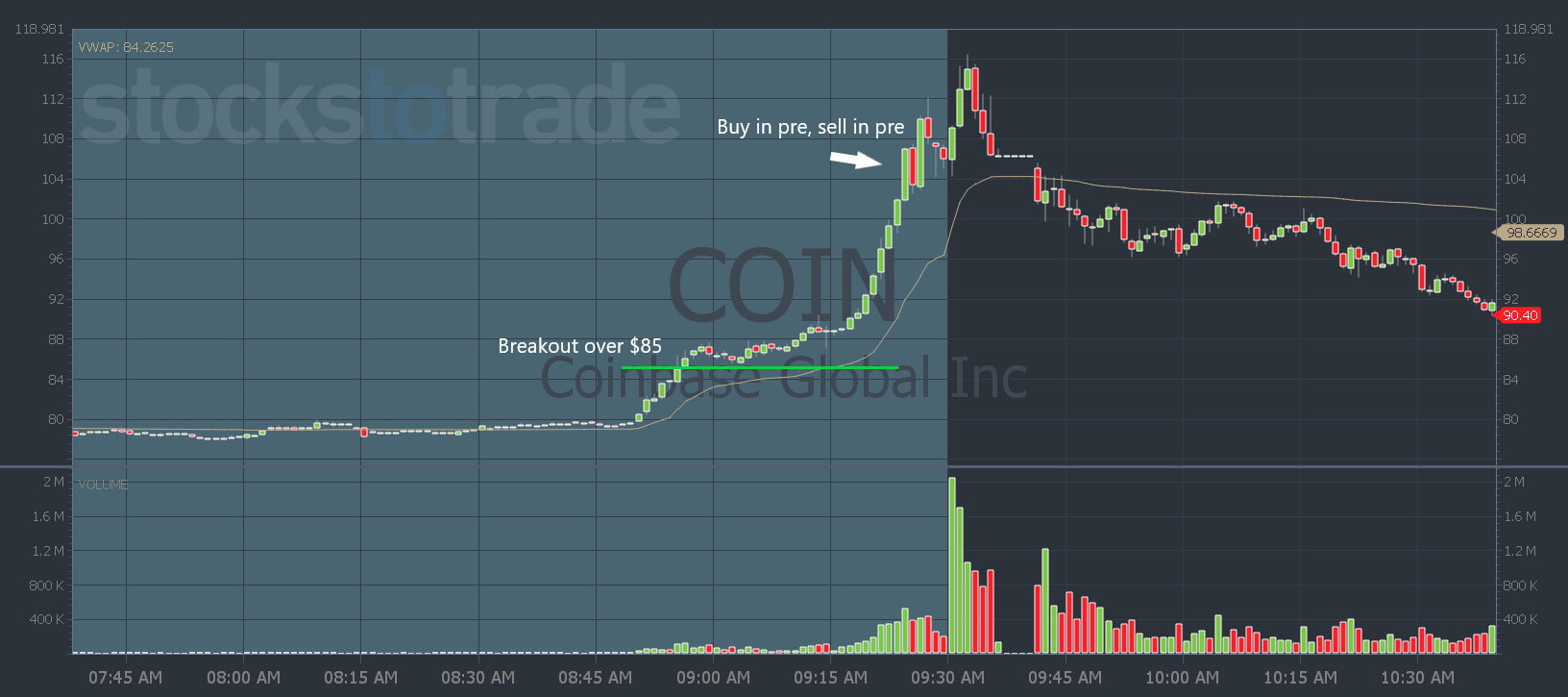

Check out the premarket move you could’ve caught in COIN…

So the news was a pretty big deal. But you know I never encourage traders to blindly buy stocks because they have news…

COIN had other things going for it that added to its big move.

It’s a beaten-down stock and it was heavily shorted…

Because just a couple of weeks before the partnership announcement, the SEC accused Coinbase executives of insider trading.

So part of the move could’ve been shorts exiting their positions. But the chart was also set up for a perfect pattern…

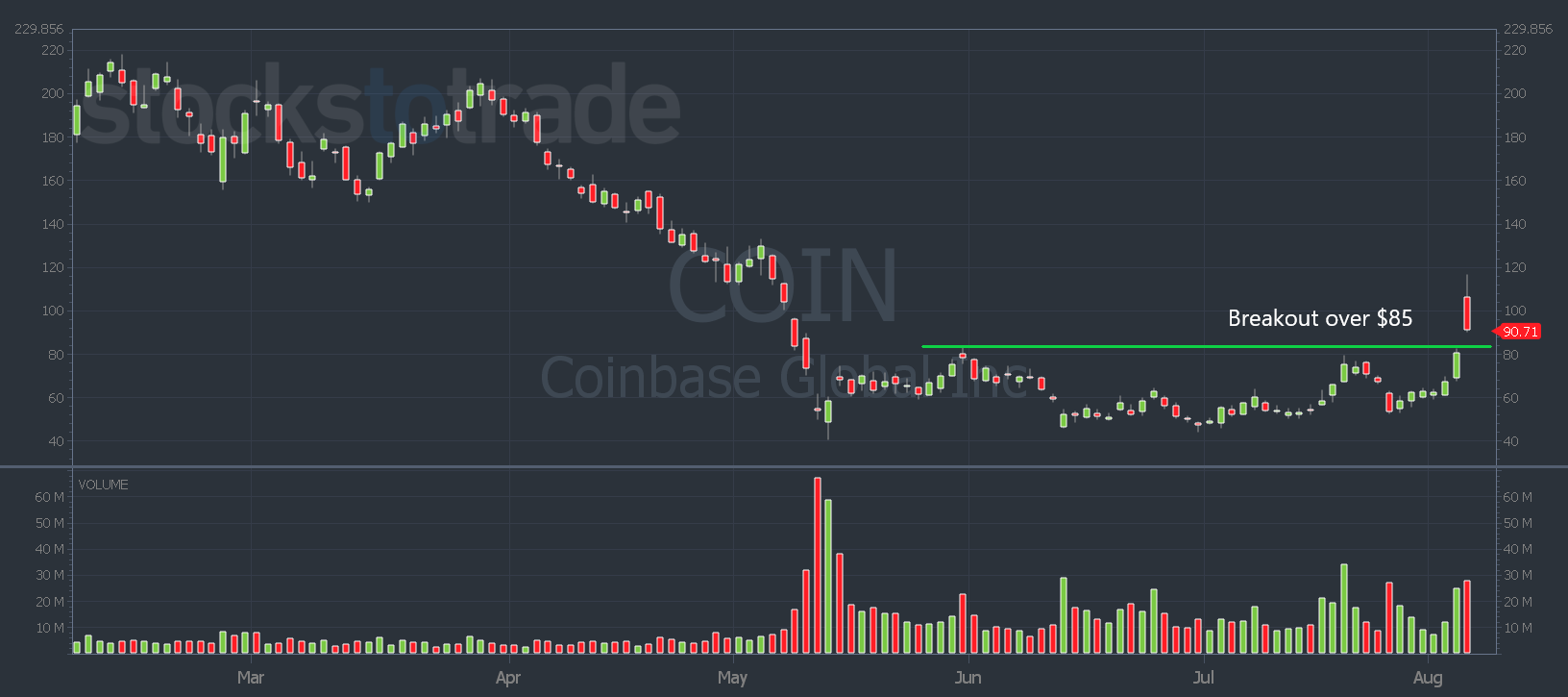

To see that, we have to zoom out to the daily chart…

You can see COIN had a beautiful multi-month breakout above roughly $85.

If you saw the news in premarket, a good entry would’ve been to wait for the break over $85…

If you missed the initial breakout, there was a nice area of consolidation where you could’ve entered, using the breakout level as your risk.

Once the stock broke out of consolidation and ripped higher, you could’ve exited any time before the market opened for a profit using my “buy in pre, sell in pre” rule.

This is how you can put breaking news alerts, patterns, and rules together to execute a trading plan.

Knowing what news matters is something you can learn with experience. The more you see which breaking news moves stocks, the more you’ll learn how to recognize them.

But the Breaking News Chat team does a lot of that work for you…

Our analysts sift through tons of news sources to bring you the headlines that have the most potential to move stocks.

See for yourself the difference it can make in your trading.

Have a great day everyone. I’ll see you back here tomorrow.

Tim Bohen

Lead Trainer, StocksToTrade