Everyone in Pre-Market Prep yesterday morning was excited about Bed Bath & Beyond Inc.’s (NASDAQ: BBBY) gap up…

Even my girl Oracle liked it.

But she doesn’t know what I know…

There are a ton of bagholders stuck in BBBY because they believed it was going to $100.

And now they’re desperate to get out for minimal losses or break even…

That means the stock will struggle to climb higher as the bag holders sell.

So I didn’t have high hopes that it would be a big day for BBBY … Plus, I’d prefer if it slowly grinds higher until Friday to blow up shorts.

In the meantime, there was a better play out there yesterday.

If you missed the initial move, you even had a second chance to get in…

This is why you can’t afford to miss news … And why pattern recognition is key…

Two Patterns = Two Profit Opportunities

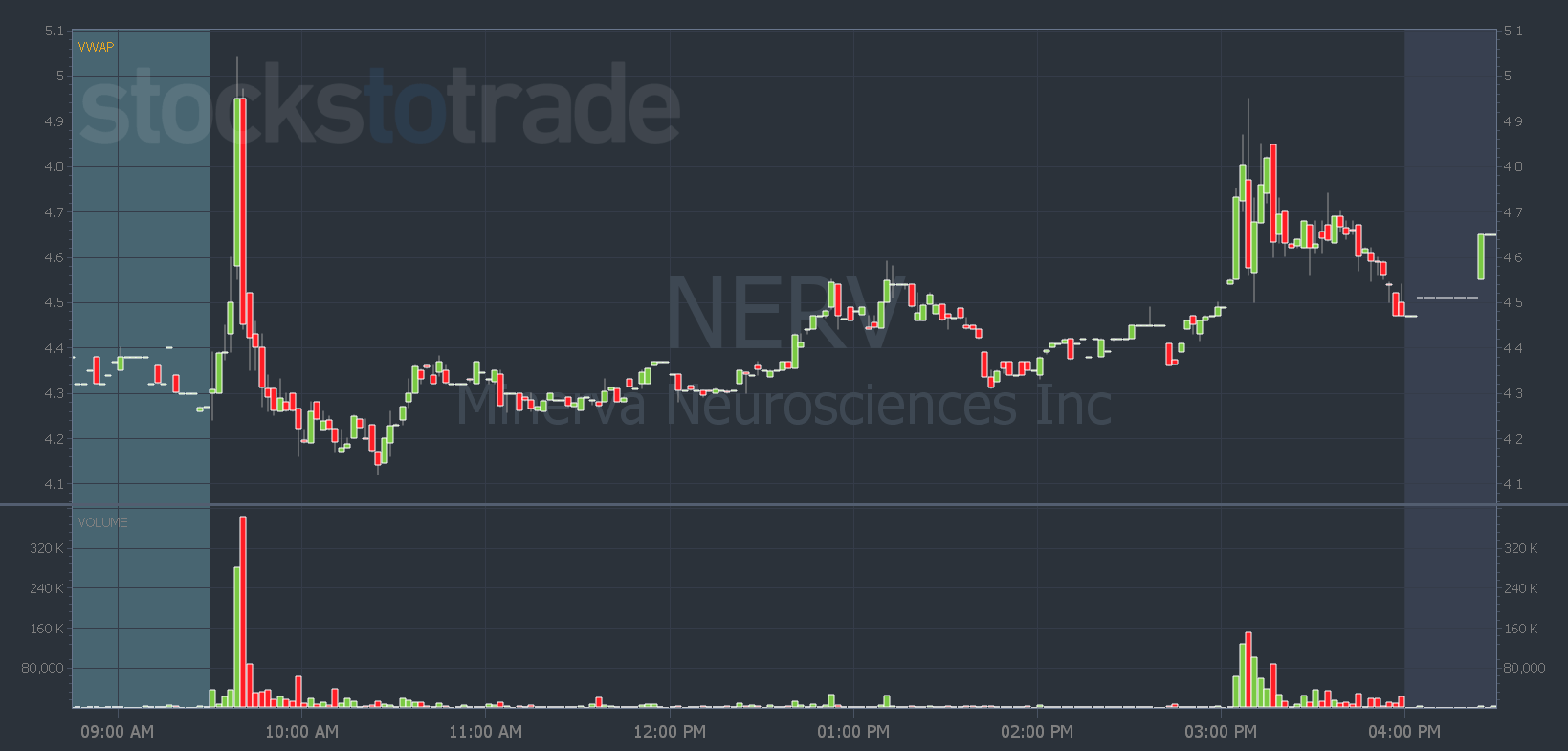

On Tuesday, Minerva Neurosciences, Inc. (NASDAQ: NERV) announced it submitted a new drug application to the FDA for a potential schizophrenia treatment.

But as you can see, it didn’t really react to the news…

It had one big spike near the open but it traded on low volume and immediately failed.

Then yesterday it spiked over 80%!

Was it a late reaction to the news? Or was something else going on…?

If you had StocksToTrade’s Breaking News Chat you would know why it was moving…

And you won’t find this news on your news wires…

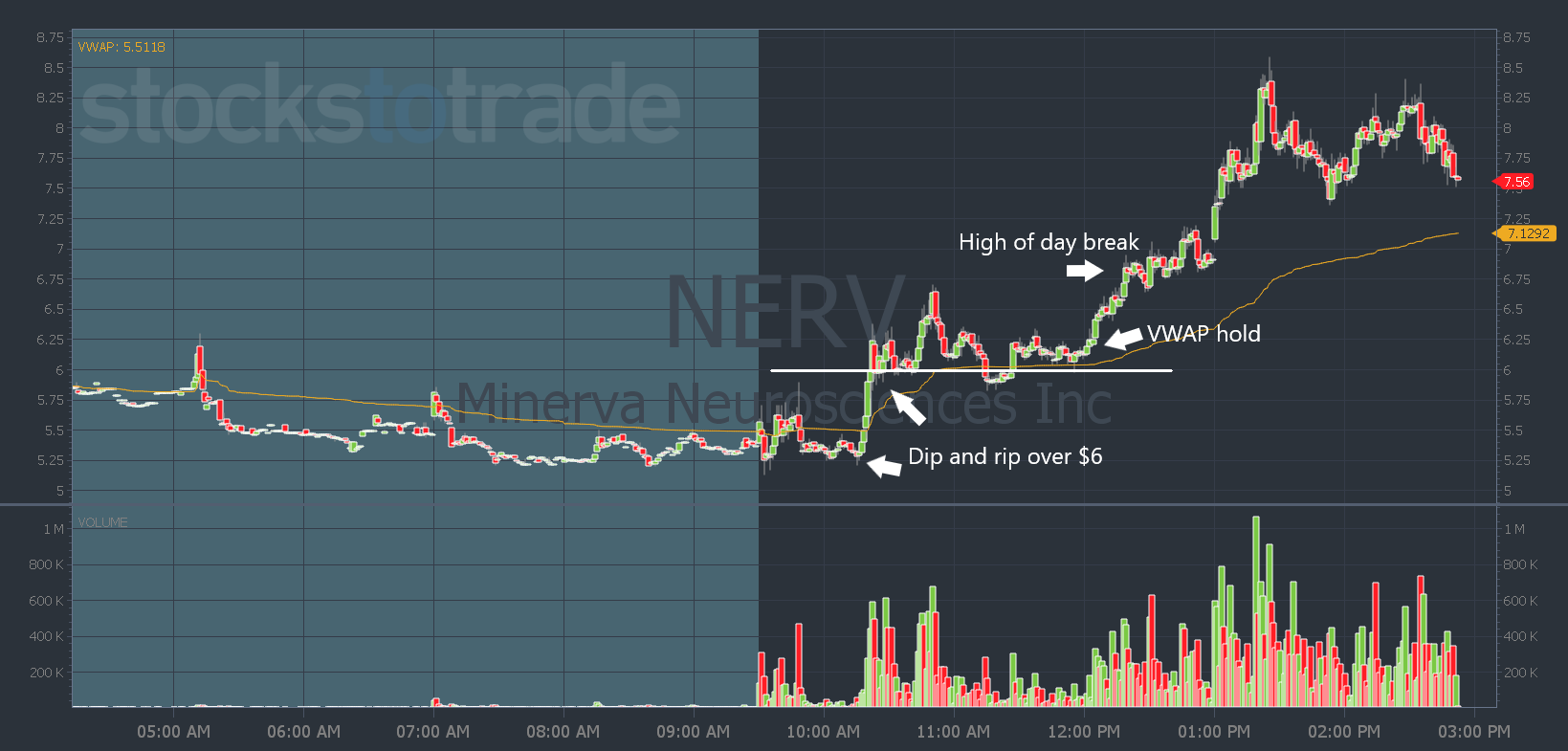

Yesterday in premarket, the Breaking News Chat team alerted that a hedge fund took an 8.8% passive stake in the company…

I said in Pre-Market Prep it was a watch for a dip and rip over $6.

But that wasn’t it for NERV. You could’ve traded it again in the afternoon when it had a VWAP hold high-of-day break around noon…

The stock made a high of $8.50. That means you had the chance to catch a $2.50 per share move from my entry target.

But before you can capitalize on these big movers, you need to know what the ‘smart money’ is doing…

The Breaking News Chat makes that possible.

A ‘smart money’ investment is also what created the buzz around BBBY when it recently ran…

That’s why you can’t afford to miss these news alerts.

Just don’t be a believer and make the same mistakes too many traders made in BBBY…

Avoid becoming a bag holder by sticking to the process and the patterns that repeat.

That’s how you can grow your account over time…

Have a great day everyone. I’ll see you back here tomorrow.

Tim Bohen

Lead Trainer, StocksToTrade