Market themes and hot sectors come and go…

It’s your job as a trader to stay on top of what’s hot and cold.

Then adapt your focus and watchlists to what’s working…

In this nasty overall market, that means looking for trades that are disconnected from the macro headlines and environment.

Stocks with their own stories, headlines, and catalysts…

Whether that’s focusing on a hot theme, sector, or chat pump.

Recently we had hot IPOs … Then traders moved on to lithium stocks for a few days … Now stocks seem to be moving on government contract news since SOBR Safe, Inc. (NASDAQ: SOBR) went nuts last week.

But yesterday we had another new surprise runner…

We’ll see if this can add more juice to these catalysts in the future…

A New Trading Trend?

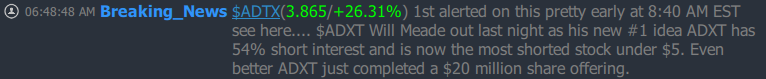

Yesterday morning the Breaking News Chat team alerted Aditxt, Inc. (NASDAQ: ADTX)…

It was the latest Twitter pump touted as a low float, high short interest stock. And the most shorted stock trading under $5.

Yesterday the company also announced it regained compliance with the Nasdaq exchange.

It also recently completed a reverse stock split and an offering. So there was less chance of dilution into any potential spike…

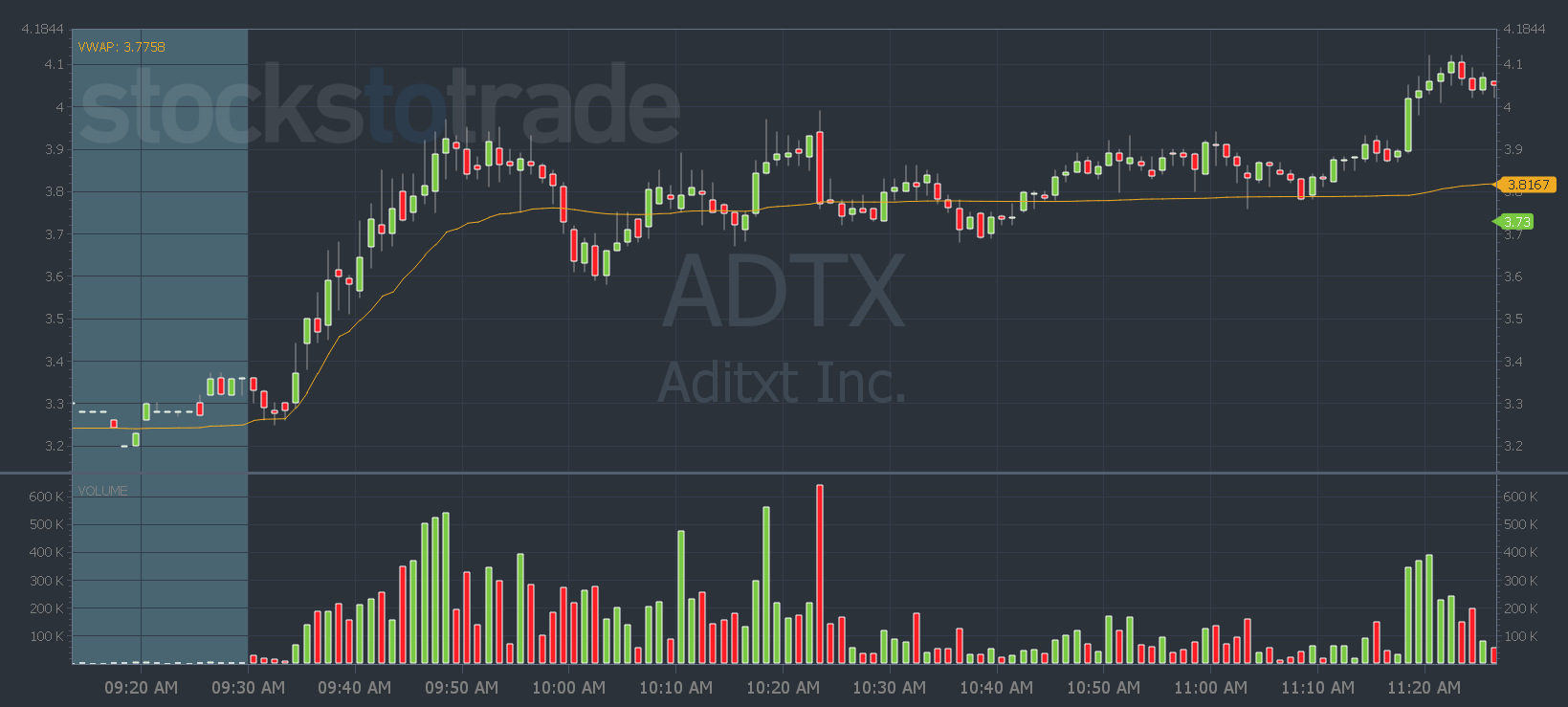

And a spike is what we got…

ADTX ripped higher a few minutes after the open and continued to climb — even as the overall markets hit new daily lows.

It gained 34% on the day.

So what does that mean for traders looking for trades in this ugly market?

You have to follow the trends…

I’ve said for a while that Twitter pumpers have lost their juice. But now that we’ve had a big runner on an exceptionally ugly market day…

I’ll be watching pumped stocks more closely.

That means keeping an eye on Breaking News Chat for alerts.

And implementing the 9:45 a.m. rule to keep me safe from the 9 out of 10 that fail.

Adapting is key if you want to survive this market…

The Breaking News Chat helps by keeping you up to speed on all things happening in the market — whether it’s in the macro environment or in small caps.

Try it today and see how it can change your trading game.

Have a great day everyone. See you back here tomorrow.

Tim Bohen

Lead Trainer, StocksToTrade