Table of Contents

High-frequency traders have, for years, waged war to gain a significant trading edge by shaving milliseconds off trading times. Many automated trading firms already engage in arbitrage, a practice that basically involves betting that pricing gaps between two similar products will disappear. For example, merger arbitrage is all the rage right now, under the new Trump administration, which is seen as favoring mergers as opposed to the outgoing Democrat-led government, which tended to stifle them. Such arbitrage opportunities already exist in the markets in the U.S. and Japan.

And now, traders are about to be gifted with a new supercharged trading network that will facilitate faster trades between Chicago and Tokyo. The new network, dubbed Go West, will be built under a joint venture comprised of six trading firms. The network will encompass existing microwave towers, fiber-optic lines and undersea cables, which will help to will shorten transmission times for trade data between the two markets. Trading firms outside the original consortium will be able to access the new network, starting as early as 2017.

Download a PDF version of this post as PDF.

Do You Have A Need? A Need For Speed?

Microwave Towers Satisfy Traders’ Need for Speed

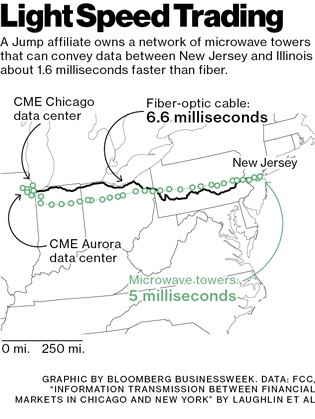

Microwave networks are beloved by high-frequency traders, simply because they are able to lower network latencies, compared to conventional communication technologies such as fiber-optics. In fact, microwave networks can be twice as fast as the conventional internet.

Real-world examples prove that microwaves are indeed superior to fiber optics, as far as latencies go. London and Frankfurt (396 miles apart as the crow flies) are connected via a microwave network as well as fiber optics and the difference is startling. Whereas the fiber network shows a latency of 17 milliseconds, the microwave network has a latency of just 4.2 milliseconds, about four times faster. The large latency gain happens mainly because fiber networks are hamstrung by geographical challenges where the cable has to follow the most feasible route, not to mention the fact that the speed of light slows down to 200,000 km/second when traveling through glass, compared to 299,700 km/second when traveling in air.

But, microwave networks are actually more old-hat than many traders know. Back in 1949, New York and Chicago (712 miles apart) were connected by a total of 34-hop line-of-sight microwave towers that were operated by AT&T. In the U.K., the country’s trunk communication was fashioned out of microwave radio networks that carried everything from TV to telephone to national defense data from the mid-1950s to the 1980s.

The main reason why fiber has largely superseded microwave networks lies in the latter’s physical limitations. Microwave networks use high-frequency signals in the 6GHz-30GHz range, which are highly directional and require a clear line of sight between transmitting stations.

High-frequency signals tend to suffer from severe attenuation (loss of intensity) when traveling through obstacles such as clouds, rain and other weather elements. This phenomenon is known as ”rain fade,” and was pretty common with satellite TV. To mitigate rain fade, telecom companies boost the transmission power and use larger dishes and hydrophobic coatings.

But, most companies prefer replacing or augmenting microwave networks with fiber-optic lines, due to their higher reliability and higher bandwidth capacity. Up until a few years ago, most cell towers were backed up using microwave. But, the higher throughput of modern LTE cells has forced many companies to fully replace them with fiber.

Still, the clear benefits offered by microwave networks means that they will continue to be useful in private networks, including trading networks, due to their lower latencies and higher security. Fiber does well enough over short stretches but starts suffering serious lags over longer distances.

Currently, about 6-10 microwave networks that support high-speed trading exist between data centers in Chicago and New Jersey, where U.S. stock trading takes place. But, Go West will mark the first time that such a network connects one side of the globe to another.

The London-Frankfurt microwave route mentioned above was built by Colt Technologies and commissioned in 2012. Jump Affiliate, one of the six companies building the Chicago-Tokyo network, has leveraged a private microwave network over the past 15 years to become one of the most active and successful high-frequency firms in CME. Insiders estimate that Jump has made billions of dollars in profits, thanks to its supercharged microwave networks.

More high-speed trading networks

There could even be more high-speed trading networks lurking in other places around the world, but many tend to be shrouded in secrecy. This is well evidenced by 2013 research, carried out in California, that found that there was a 2.5-millisecond drop in latency between New York and Chicago in 2011-2013, a 33% latency reduction compared to the previous 7.5 milliseconds. The research team correlated these findings with trade data from the FCC and concluded that the latency drop had been the result of several microwave networks coming online.

The fact that the true extent of the use of microwave networks in trading is not well understood can partly be chalked up to their esoteric nature and also partly because they are controversial in some regions.

For example, there is a move by the South Korea Exchange to stop the use of microwave networks in derivative trading, terming the practice as ”unfair.” The South Korea derivative market has shrunk by close to 90%, since 2011 and there are fears that microwave networks that confer a big advantage to bigger brokerages are to blame for this trend.

Unfolding of a ‘Knightmare’

Despite their benefits in high-frequency trading, high-speed networks come with their fair share of challenges.

Slicing a few milliseconds off the physical latency of a high-speed trade might sound impressive, but is actually meaningless if the trader lacks software that can cope with that kind of speed.

High-frequency traders use software that comprises computer algorithms that ingest stock market data in real-time and quickly take positions (buy-sell, long-short) before other traders can act.

The first trading algorithms arguably had an easier time than modern versions, since they mostly battled human beings. But, modern high-frequency is an algorithm slugfest, since nearly all traders employ them in their trades.

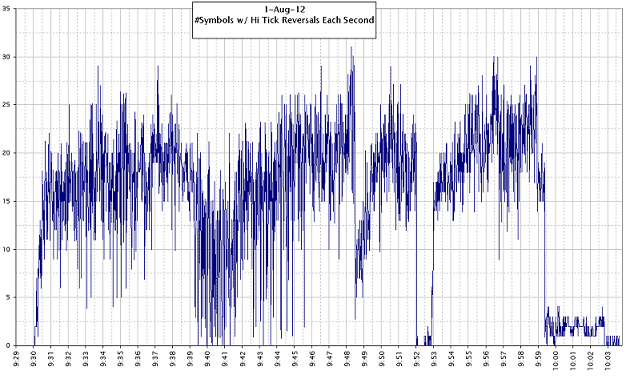

Algorithmic trading can go awfully wrong at times. One well-documented case is an incident that has been dubbed ”the Knightmare,” after Knights Capital, a top HFT and the maker of the infamous 2012 software that turned algorithmic trading on its head. Knights Capital released new trading software that went live on the morning of Aug.1, 2012. At around 9.30 am, the new software started acting up, randomly buying and selling shares worth $7 billion in the space of just 45 minutes.

Although the firm was later forced to unwind those trades at a huge cost of $460 million to the bottom-line, or about half of its market cap at the time, it clearly demonstrated the frailties of HFT.

Erratic behavior of 2012 Knight Capital algorithmic trading software. The software was fixed around 10 am before kicking in yet again.

A few proposals have been advanced to prevent HFT from wandering too deep into ethically grey areas. One such proposal is block-chain technology which, if implemented, would mean slower, block-chain transactions. Of course, that would also mean that front-running, a popular trading strategy that involves sneaking into trades a few milliseconds early, gets killed.

The Next Big Thing for Private Trading Networks

As mentioned above, microwave networks will continue being used widely in private trading networks where they will be augmented with fiber optics. However, replacing microwave technology with even faster technologies might take longer.

Companies have been experimenting with laser technology, in a bid to replace microwaves in point-to-point links. But, the results have not been encouraging, so far. The current crop of laser-based communication networks are not much faster than microwaves and suffer from severe attenuation during inclement weather. Although this drawback can be mitigated by using adaptive optics, a fail-over technology, in the form of microwave, fiber or millimeter waves, would still be required to guard against times of bad weather.

AOptix, a company that has been developing ground-to-aircraft laser networks for the U.S. military and whose gear has been used to build links between stock exchanges in the U.S. and Europe, closed shop in February of this year.

High-frequency traders will, therefore, have to be content with microwave technology, for now.