Day trading is one of my favorite ways to trade.

And I love to trade low-float, low- to lower-priced stocks.

Most times those are the types of names I share with you.

The Oracle system is my secret weapon. I use it every day to determine how and when to trade these types of names.

It scans the entire stock market every morning, looks at price patterns and trends, and then applies its algorithm to generate a list of stocks it believes will be big winners for that day.

Click here to learn more about the system I cannot trade without.

Last Sunday, I shared with my subscribers some stocks I’m watching that are not low float, and are certainly not low-priced….

So why the heck did I choose for my watchlist Amazon.com Inc. (NASDAQ: AMZN), Microsoft Corporation (NASDAQ: MSFT), and Alphabet Inc. (NASDAQ: GOOG)?

Don’t worry, there was a method to my madness.

I did, in fact, have a solid investment thesis for each of them and saw potential big wins.

I shared these stocks in my Weekly List of the Best Stocks to Watch.

This completely free service includes the following:

- An email every Sunday with the five hottest stocks that our system flagged as potential winners for that week.

- A detailed analysis of each of those stocks and why I chose them.

- “Lookbacks” that show you what we got right (and what we got wrong) so you can sharpen your trading skills.

If you’re interested in being part of Best Stocks to Watch, sign up here.

But what if you want to get in on the action of these big names but can’t or don’t want to buy stocks in the $100 to $300 range?

I have the solution for you!

So, let’s talk about a trading strategy that’s brand new to a lot of you: options trading!

Before you say, “No! That sounds complicated!” Read what I have to say…

I’m going to make it a lot less complicated.

Best of all, this type of trading is accessible to people with smaller account sizes.

First, a quick explanation:

Instead of directly trading shares, you’re staking a claim on shares at a specific price, without being obligated to complete the purchase.

Think of options as calling dibs on something. They give you the right to buy or sell an asset at a set price before or by a certain date.

Remember, the key word here is “option.” You have the choice to buy or sell…

Or you can do neither of those things.

The two types of options are calls and puts.

A call option is a bullish play and gives you the right to buy an asset at a specific price (known as the strike price) on before the option expires

With a call option, you’re betting the asset’s price will go up.

For example, if a stock is trading at $50 and you think it will rise to $60, you could buy a call option with a strike price of $55.

By the way, the strike price is the predetermined price in the contract at which you will purchase the stock if you choose to.

So, if the stock goes up to $60, you can still buy it at $55, and profit from the difference. Even if it goes up to $100, you can buy it at $55 and you just made $45!

Now, you do have to pay a price to buy the contract itself. That’s what’s called the premium.

Therefore, If you don’t use, or exercise, the option, you’re out the premium.

Put options are bearish trades…

This type of option gives you the right to sell an asset at a specific price on or before the option expires.

With a put option, you’re betting the price of the stock is going to go down.

In this case, if a stock is trading at $50 and you think it will drop to $40, you could buy a put option with a strike price of $45. If the stock falls to $40, you can still sell it at $45, again profiting from the difference.

Again, you have to pay a premium to own the put contract, so you will always have that much less in your pocket no matter what you do.

Options vocabulary:

I defined some of these terms above but here are some others that you need to know.

Strike Price: The price at which the option can be exercised.

Expiration Date: The date on which the option expires.

Premium: The price you pay for the option.

In-the-Money: The difference between the stock’s current price and the strike price.

For a call, the stock price is greater than the strike price; for a put, the stock price is less than the strike price.

Out-of-the-Money: In this case, for a call, the stock price is less than the strike price; for a put, the stock price is greater than the strike price.

In other words, if you’re currently “in-the-money” on your options, you are making a profit.

If you’re currently “out-of-the-money”, they’re trading at a loss, or a negative profit.

At-the-Money: The difference between the stock current price and the stock price is $0.

Intrinsic Value: The difference between the asset’s current price and the strike price (for in-the-money options).

Extrinsic Value: The portion of the option’s price that exceeds its intrinsic value. This often depends on time to expiration and volatility of the underlying stock.

Why should you trade options?

Options offer you several advantages:

Leverage: They allow you to control a larger position with a smaller amount of capital, which is great for traders with smaller accounts.

This means you can be involved in all the action for names like MSFT, AMZN and GOOGL without having to actually purchase the underlying stock. . This

It also means you can potentially make huge profits from relatively small movements in the underlying asset’s price.

Flexibility: You can use options to hedge against potential losses in your portfolio, to generate income, or to speculate on the direction of a market move.

Limited Risk: When you buy an option, your risk is limited to the premium you paid for it.

When you own the actual stock, your downside risk is greater and your losses can be much bigger.

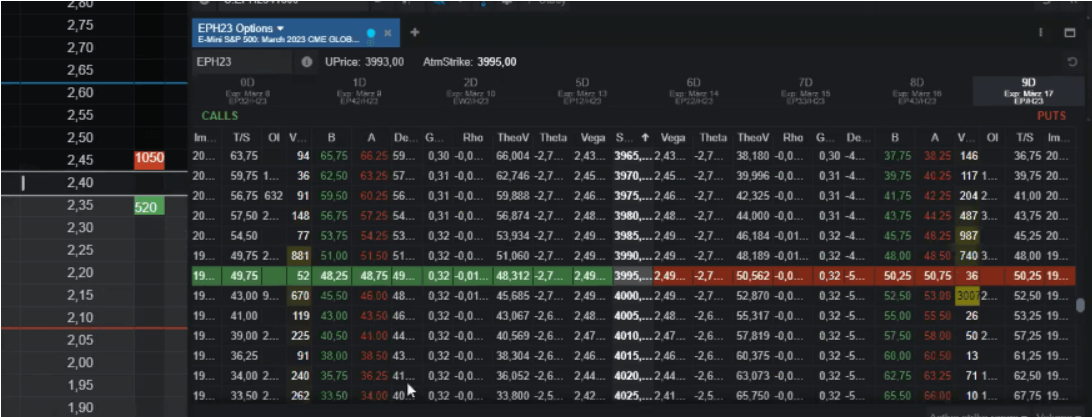

How to read an options table:

Options tables can be confusing, but here’s a quick guide:

- OpSym: The option symbol, showing the ticker, contract expiration date, strike price, and whether it’s a call or put option.

- Last: The option’s current trading price.

- Net Change: The price change since the last trading day’s close.

- Bid: The current price offered to buy the option.

- Ask: The current price offered to sell the option.

- Extrinsic Ask: The time premium that is built into the current option price.

- IV Bid/Ask: Implied Volatility Bid/Ask, indicating potential future volatility.

- Volume: The number of contracts changing hands.

- Open Interest (OI): The number of open contracts not yet cashed in or sold.

- Delta: The exposure of the underlying asset to price shifts.

- Gamma: The rate at which delta changes.

- Vega: How much the option’s price reacts to changes in implied volatility.

- Theta: Tracks the decreasing value of options as expiration approaches.

- Strike: The price set to buy or sell the security.

Common options trading strategies:

Here are a few basic options trading strategies to get you started:

Long Call

Buy a call option if you believe the asset’s price will rise.

Long Put

Buy a put option if you believe the asset’s price will fall.

Covered Call

Sell a call option on an asset you already own. This strategy can give you some extra cash in your account equal to the amount of the premium you received.

However, it limits your upside potential if the asset’s price rises significantly.

Protective Put

Buy a put option on an asset you own to protect your account value against a decline in its price. This is like buying insurance on your stock position.

What are the risks of trading options?

As with any trading, there is always risk.

The primary risk is losing the premium paid for the option if the stock doesn’t move the way you expected it to.

Additionally, options can expire worthless if they’re trading out-of-the -money or at-the-money. You should exit your option position before expiration if that’s the case.

With options trading, and all trading, you should have a clear understanding of the market and a solid trading plan.

Do you have a trading plan? It’s the first step you should take before you start any kind of trading.

If you don’t, read my article on how to create a good one. Never trade without a plan!

My final thoughts:

Is options trading right for you?

If you understand the basics, like the ones I described above, you’ll be better equipped to navigate the options market. Remember, education is key. Take the time to learn and practice, and you’ll be well on your way to mastering options trading.

If you think you’re ready to trade options and want to learn more, you should subscribe to our IRIS system.

As part of the program, we provide options training, trade ideas, and everything else you need so you can feel comfortable doing it on your own.

Learn more about IRIS, our proprietary AI-powered trading system, right here.

Have a great day everyone. See you back here tomorrow.

Tim Bohen

Lead Trainer, StocksToTrade