The Tim Sykes conference continues in Miami today with another round of millionaire presenters…

This morning Rob Booker filled in for me with live market insights at the open. He shared his favorite pattern for morning trading which I’ll show you later…

Then we had Tim Sykes’ millionaire student and Trading Challenge moderator Tim Lento share his top lesson from his $1 million loss shorting AMTD Digital Inc. (NYSE: HKD).

And before lunch, Mariana shared her tips for how you can find who you are as a trader. And how you can break down your journey to avoid becoming overwhelmed.

Read on for all these amazing lessons. And remember, today is the last day to get exclusive access to my highest conviction trade idea— get it now before time runs out !

A New Morning Pattern

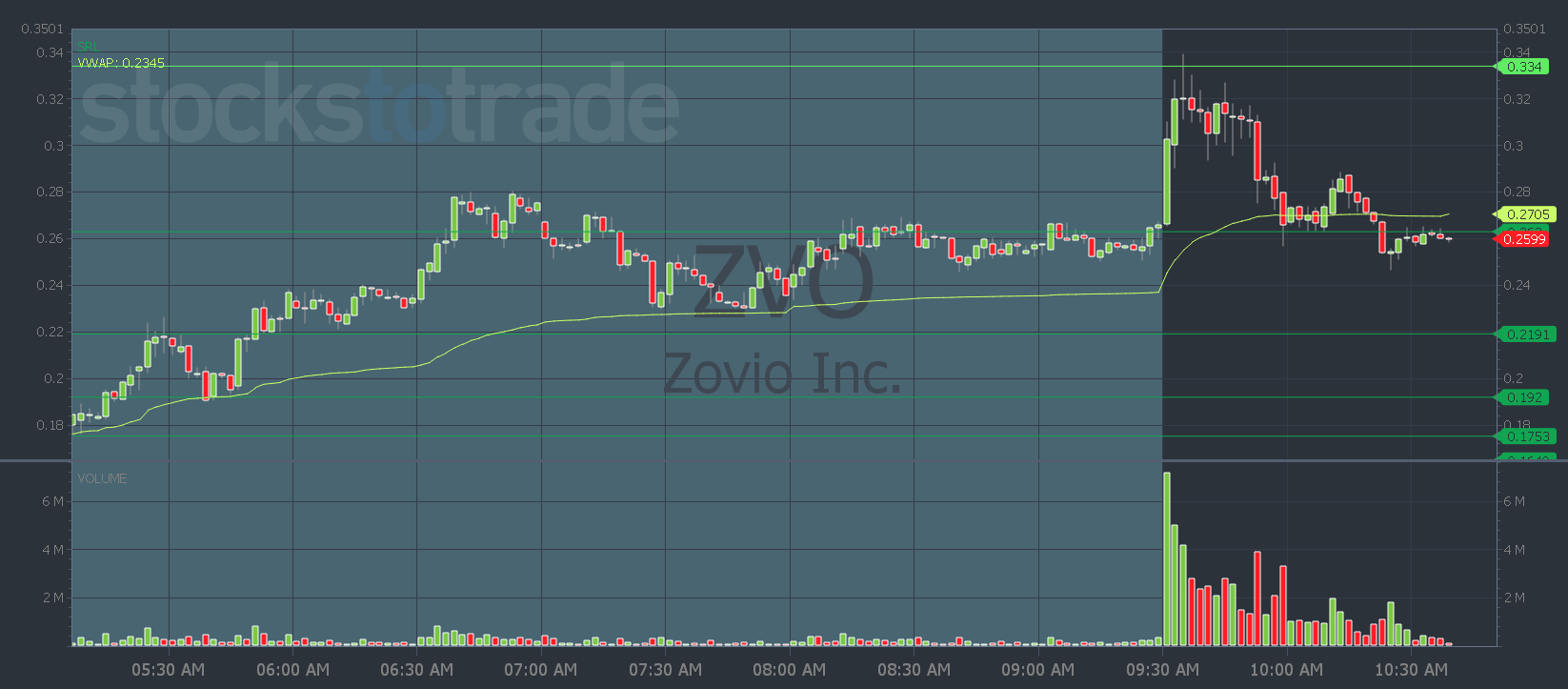

This morning traders at the conference were looking at Avenue Therapeutics, Inc. (NASDAQ: ATXI) and Zovio Inc (NASDAQ: ZVO).

Both of them were on Oracle.

ATXI ended up failing. But ZVO hit Oracle’s signal and the next resistance level for an almost perfect trade.

Rob Booker likes the same kind of stocks I like — low float with high volume.

Float is a stock’s supply. Volume is the demand.

Rob likes stocks with fewer than 10 million shares.

For his favorite morning pattern, Rob looks for stocks that spike and pull back in premarket. Or stocks that spike and consolidate.

Then he’s watching for it to break above the premarket high or consolidation area. Just like ZVO did this morning.

When exiting a trade, Rob looks for Oracle resistance areas and he likes to be out of his trades by 10 a.m. Eastern.

He believes most stocks slow down after that time. Then he comes back in the afternoon to look for more opportunities to trade the same stock.

Tim Lento’s Lesson From a $1 Million Loss

Tim majored in finance in college and became an accountant.

In school, he had learned about stocks and investing and tried the buy-and-hold strategy. But he didn’t make much money.

He found Tim Sykes from his appearance on the show “Wall Street Warriors” and started following his blog.

That’s when Sykes was shorting penny stock pumps when they’d eventually fail. And it’s still what Tim Lento does today.

He blew up a few accounts learning to trade. And admits he has horrible risk management.

But that wasn’t the reason for his $1 million loss…

He says there are three reasons he took such a big loss:

- He got lazy.

- Stopped recording and tracking his trades.

- He traded something outside his core strategy.

The reason Lento has been so successful without good risk management is that he’s so specialized in his strategy.

He shorts scams. HKD wasn’t the same underwriter he typically looks for behind Chinese IPOs. And the stock wasn’t promoted.

He took his usual short position, then he was traveling when his friend texted him about HKD’s move.

Lento’s broker ended up closing out his position at around $760. But it could’ve been worse since the stock went to $2,500.

Lento says the two ways to make it as a trader is to have discipline and stick to what you know.

How to Find Yourself As a Trader

Mariana is Tim Sykes’ first female millionaire student. And she definitely inspired other women traders at the conference.

Trading is difficult and Mari knows firsthand how tough it is in the beginning. You have a lot of doubts. And plenty of negative emotions to deal with when you make mistakes and take losses.

Mari says the three key traits every trader needs are to stay positive, patient, and persistent.

You have to encourage and motivate yourself … One of the things people like about trading is not having a boss. But without anyone there to keep you accountable — you have to do it for yourself.

That’s why you need to know who you are as a person and trader. Ask yourself:

- What’s your routine?

- What’s your lifestyle?

- What are your personality traits?

You have to understand yourself, so you know where you are, where you want to be, and what personality traits will hold you back.

When you know what you struggle with, you can figure out how to overcome the barriers.

All the millionaire traders at the conference were once where you are. They went through the struggles — and they still do.

Nobody is perfect. Trading’s a lifelong learning journey.

So meet friends and other traders you can connect with either online or in person.

Join me in live webinars every morning here.

Have a great day everyone. See you back here tomorrow.

Tim Bohen

Lead Trainer, StocksToTrade